See the Part I to learn about ChatGPT.

ChatGPT for market research

ChatGPT and other language models can be used for market research. The ability of these models to process and analyse large amounts of unstructured data, such as news articles, social media posts, and analyst reports, makes them well-suited for gaining insights into financial markets.

For example, ChatGPT or a similar model could be used to perform sentiment analysis on news articles related to a particular stock or market and generate a sentiment score that reflects the overall positive or negative sentiment of the articles. This information could then be used for making trading decisions or market analysis.

Another use case for ChatGPT in market research is natural language processing (NLP). The model could be used to extract key phrases, named entities, and other relevant information from large volumes of financial news and reports. This information could then be used to track market trends, identify potential investment opportunities, or monitor changes in company performance.

Overall, while ChatGPT and other language models have the potential to be valuable tools for market research, it’s crucial to thoroughly validate and evaluate their performance before using them to inform any investment decisions. Additionally, these models should be used in conjunction with other methods and techniques to gain a more comprehensive understanding of financial markets.

Prompt: Perform sentiment analysis on news articles related to a particular stock or market. Please give me an example with python code

ChatGPT:

Here is an example of how you could use ChatGPT to perform sentiment analysis on news articles related to a particular stock or market using Python:

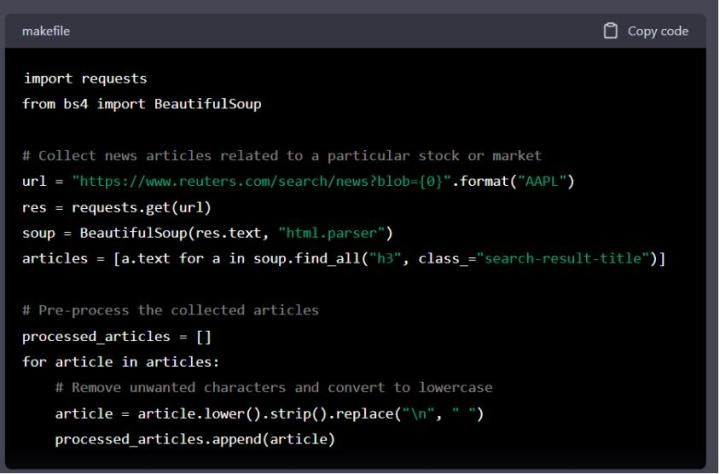

Data collection and pre-processing:

Model fine-tuning:

Assuming you have a pre-trained language model, you would fine-tune the model on the processed articles to adapt it for sentiment analysis. This may involve training the model on a labelled dataset of positive and negative examples or using transfer learning to fine-tune the model on task-specific data.

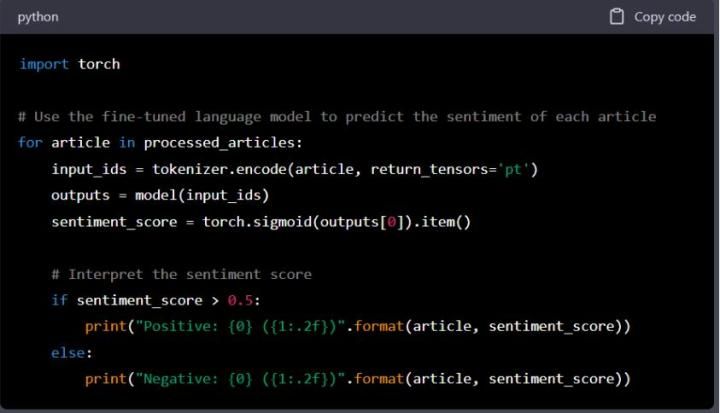

Sentiment analysis:

Stay tuned for Pat III to learn about backtesting a trading strategy.

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)