The post “An Introduction to Investing in Carbon Markets” first appeared on Alpha Architect Blog.

Carbon Markets Overview

Carbon markets are quickly making their way to the forefront of Environmental, Social, and Governance (ESG) investing, as well as the finance community as a whole. The Kraneshares Global Carbon ETF, (Ticker: KRBN) (whose holdings I’ll dive into shortly) was one of the top 5 performing ETFs in 2021 on a % return basis (1). However, it doesn’t appear that 2021 was a one-hit-wonder for Carbon Markets, but instead, the beginning of a new and very real trend.

Whether we’re analyzing the private sector or the most powerful governments in the world, it’s safe to say that the push for “net-zero emissions” and carbon-friendly policies is one that will continue to crescendo into the latter half of the decade and beyond.

In the private sector, some of the largest companies in the most carbon-intensive industries (from a greenhouse gas emissions perspective) have already publicly declared their net-zero targets. These industries include Oil and Gas (e.g., Shell, BP, Total, Chevron), Utilities (e.g., Engie), Steel (Nippon Steel), Cement / Construction Materials (Holcim, Boral), Automotive (e.g., Ford, General Motors, Volkswagen), and Beverage (e.g., Coca-Cola) (2).

The private sector is not in this endeavor alone. There continues to be a substantial push from the public sector with the most powerful world leaders driving their economies towards net-zero emission targets and/or carbon tax policies. Countries with policies already in place include the United States, China, Canada, the UK, the Eurozone, Argentina, Mexico, Columbia, Chile, South Africa, and Kazakhstan.

Given the incredible collaboration between the private and public sectors to drive these new industry standards and policies, there are three subsequent questions a skeptical investor might ask:

- Are carbon markets capable of solving the issue of greenhouse gas emissions?

- What is the forecast / outlook for carbon markets?

- How can retail investors allocate capital to carbon markets?

The Acid Rain Case Study

Let’s tackle the first question – Are carbon markets capable of solving the issue of greenhouse gas emissions? – using the famous acid rain case study(3).

The acid rain program began in 1995 in the United States and was developed for the purpose of removing Sulfur Dioxide (SO2) and Nitrogen Oxides (NOX) from the atmosphere. SO2 and NOX are the two primary pollutants that drive acid rain. The initiative called for a ten million-ton reduction in SO2 emissions, and a one million-ton reduction in NOX emissions by the year 2020, using the 1980 emission levels as a starting baseline.

Similar to the carbon emission markets of the present day, the SO2 and NOX markets leveraged a strategy that combined government policy with drastic changes to private sector operations. More specifically, there were two major components to this strategy, which resulted in the SO2 and NOX markets coming to fruition. The first component of this strategy was the emission reduction targets previously mentioned. These emission reduction targets were set by the United States government in collaboration with the Environmental Protection Agency (EPA). The second component of the strategy was the creation of the SO2 and NOX Cap and Trade Program. The Cap and Trade program laid the groundwork for establishing a market exchange that facilitated free-market pricing of SO2 and NOX(4).

The SO2 and NOX Cap and Trade program has been wildly successful. In short, the program resulted in a 93% reduction in SO2, and an 87% reduction in NOX as of the year 2020, all but wiping out the acid rain issue throughout the entire United States. If the SO2 and NOX cap and trade program can be replicated for carbon, it would appear that markets do have the ability to resolve the carbon emission problem domestically, if not globally.

Compliance Carbon Markets: The Carbon Cap and Trade Program

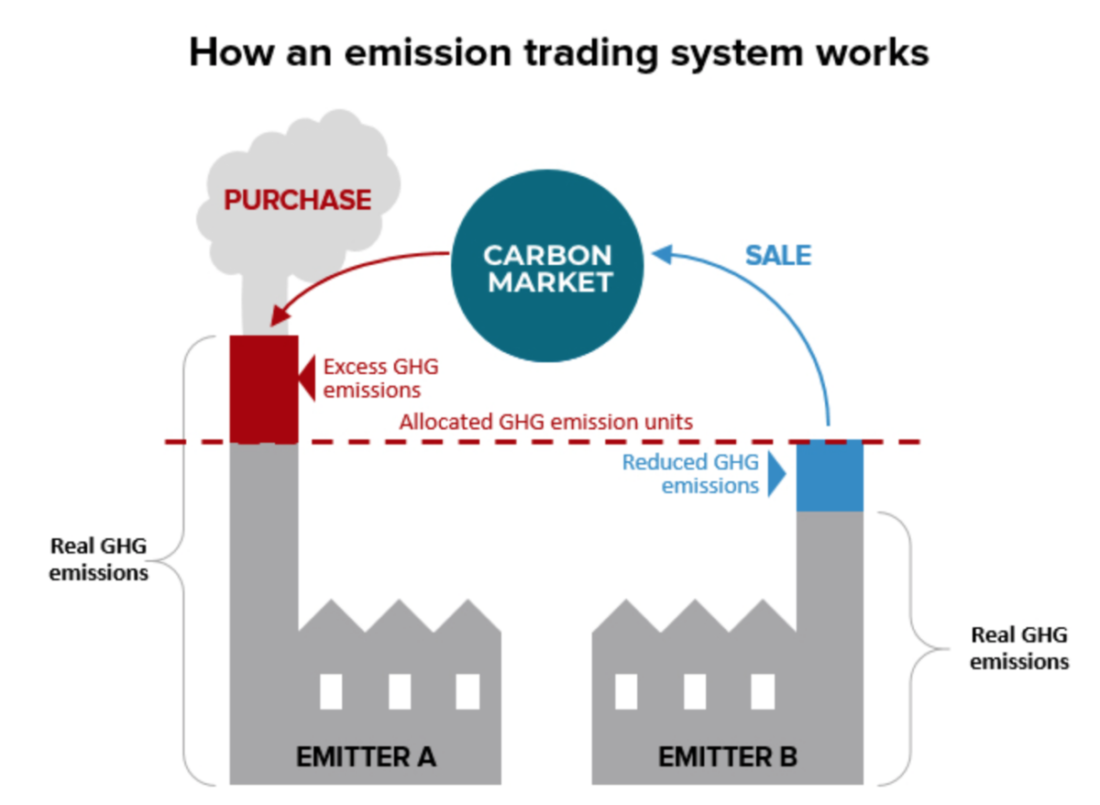

The carbon cap and trade market for trading carbon allowance credits (futures) is effectively identical to the SO2 and NOX cap and trade markets which successfully combated the acid rain issues across the United States. A visual of how this market functions for Carbon can be viewed in Figure 1 (Carbon Streaming Corporation, Compliance credits).

Local, state, or federal policy will dictate maximum emission limits (otherwise known as emission caps). For example, the California carbon allowance allocation for the year 2021 was just over 164 million metric tons (California Air Resources Board). A full breakdown of the various allocations that make up the 164 million metric tons can be viewed in Figure 2. From there, carbon emitters have the ability to buy or sell carbon allowance credits (futures) based on how many metric tons of carbon their operation emits into the atmosphere. Operations that emit more than the cap amount would look to buy carbon allowance credits from an organization that emits less than the cap amount (cough, cough Tesla). Operations that emit less than the cap amount would look to sell their carbon allowance credits to an organization that is emitting more than the cap limit. This market system incentivizes carbon-emitting operations to reduce their carbon footprint. If they are unable to reduce their carbon footprint, they’ll be forced to pay for carbon allowance credits from organizations whose carbon emissions are below the government-mandated cap. Additionally, there are various penalties (in the form of fines) that would be enforced if an organization does not meet the net cap limit, either organically through decreasing their carbon footprint via operations, or inorganically through purchasing carbon allowance credits.

Figure 1: Carbon Cap and Trade Diagram (Carbon Streaming Corporation, Compliance credits)

Figure 1: Carbon Cap and Trade Diagram (Carbon Streaming Corporation, Compliance credits)

Figure 2: California Carbon Allowance Allocation (measured in metric tons) (California Air Resources Board)

Figure 2: California Carbon Allowance Allocation (measured in metric tons) (California Air Resources Board)

Voluntary Carbon Markets

The second portion of the modern-day carbon market is known as the Voluntary Carbon Market (or voluntary carbon offset credits). Voluntary carbon offsets are a new innovation to Carbon markets that were not part of the acid rain SO2 and NOX cap and trade program.

Voluntary carbon offsets can be generated by voluntarily financing /executing projects that reduce greenhouse gas emissions beyond an operation’s business as usual setup/jurisdiction. Carbon offset credits generated by such projects can be broken out into two categories (Carbon Streaming Corp, Voluntary credits).

The first project category is avoidance/reduction, such as forest conservation or greenhouse gas emission capture. The second project category is removal/sequestration, such as reforestation, wetland restoration, or direct air capture technology(5).

Carbon offset credits can be purchased by governments, public/private entities, or individual investors via some market or exchange. However, once a carbon offset credit is used to reduce the net greenhouse gas emissions of the operation to which it is being applied, those credits can no longer be traded (bought or sold) or applied again elsewhere to a different entity/operation. This holds true for both compliance carbon credits and voluntary carbon credits. There are registries run by independent organizations that (i) verify voluntary carbon offset credits generated through “green” projects, and (ii) track the application of these carbon offset credits against an operation’s greenhouse gas emission levels such that offset credits cannot be re-used. The first organization of its kind to carry out this mission is the American Carbon Registry(6). Another highly reputable organization that carries out the same function is Verra(7).

Visit Alpha Architect to read the full article: https://alphaarchitect.com/2022/03/10/an-introduction-to-investing-in-carbon-markets/.

References

| 1 | Ferringer, Best performing ETFs of the Year – etf.com |

|---|---|

| 2 | Geck, Seven major companies that committed to net-zero emissions in 2021), (Murray, Which major oil companies have set net-zero emissions targets? 2020), (Our net zero climate pledge 2021), (Huebach, Auto industry’s push for net-zero emissions 2021) |

| 3 | EPA, Acid Rain Program |

| 4 | a detailed explanation of how Cap and Trade markets function can be found in the following sections |

| 5 | Carbon Streaming Corp, Voluntary credits |

| 6 | American Carbon Registry, Our mission |

| 7 | Verra 2022 |

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.