The post “Board Diversity and Innovation: International Evidence” first appeared on Alpha Architect.

Board Gender Diversity and Corporate Innovation: International Evidence

- Dale Griffin , Kai Li , and Ting Xu

- Journal of Financial and Quantitative Analysis

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

The link between corporate innovation and firm value is well documented in the academic literature (Pakes, 1985; Austin, 1993; Hall et al, 2005; Kogan et al, 2017). (although some research questions its replicability). This study extends the literature on innovation and relates it to the current debate on board gender diversity and the consequent impact, if any, on firm value.

Specifically, does the prevalence of women on corporate boards influence the degree and scope of corporate innovation?

Using a unique dataset consisting of 12,244 firms, observed over 45 countries, and the period 2001-2014, the authors seek to answer gender diversities impact on innovation and firm value. Although innovation is typically measured by R&D expenditures, in this study the authors use measures of firm-level patents, either citation-weighted patent count standardized by R&D capital or the scope of citations.

- Does board gender diversity produce more innovation when innovation is measured by patent count?

- Does board gender diversity produce more innovation when it is measured by the scope of firm patents?

- What are the channels or mechanisms that board gender diversity affects innovation?

What are the Academic Insights?

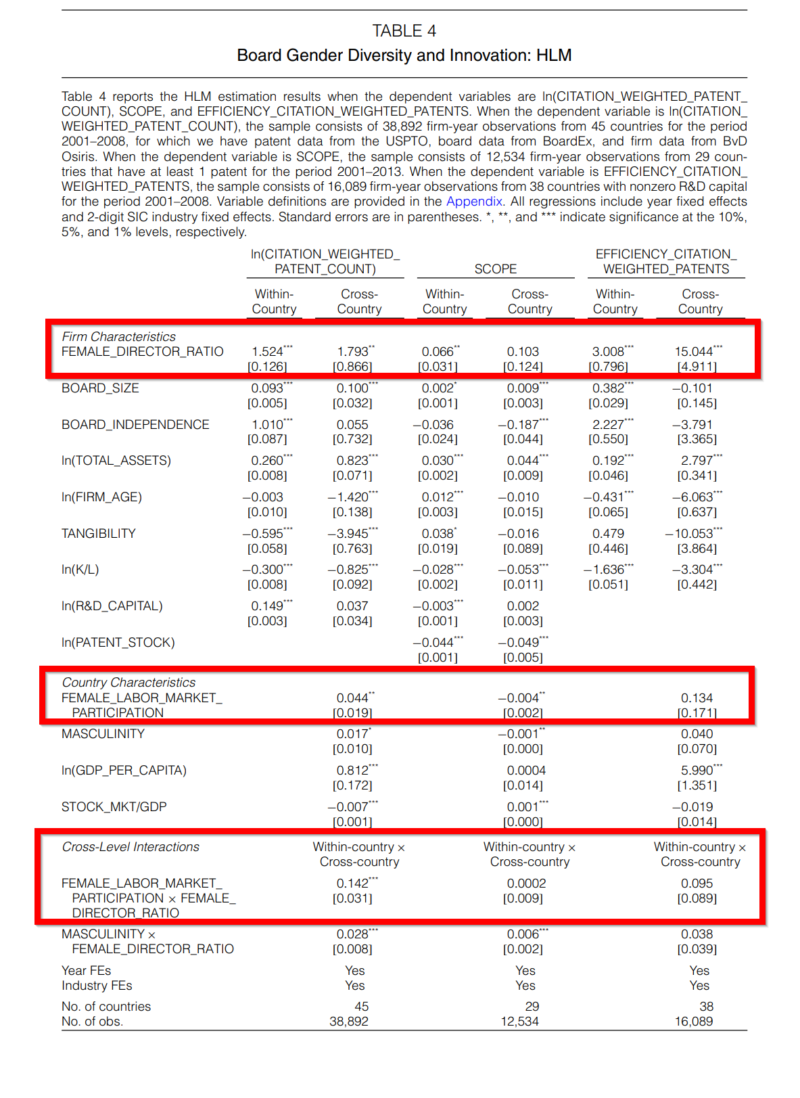

- YES. When innovation is measured by citation-weighted patent count: there is a positive and significant relationship between the female director ratio (See chart below) and the patent count. This was documented both within countries and across countries. Characteristics of firms with higher patent counts include size (larger firms), larger independent boards, lower asset tangibility, lower capital-to-labor ratios and higher R&D. Specifically, a one standard deviation increase in board gender diversity increases the patent count by 16.4% or 5.8% standard deviations. A one standard deviation in board size results in a 10.3% standard deviation in patent count, the same increase in firm size results in a change of 22.8% standard deviations.

- YES. When innovation is measured by the scope of citations associated with patents: again there is a positive and significant relationship between the female director ratio and the scope of the patent count. This was documented both within countries and across countries. Characteristics of firms with a greater scope of patent count include larger boards, larger market cap and older firms, more tangible assets, lower capital-to-labor, lower R&D, and lower patent stock. . Specifically, a one standard deviation increase in board gender diversity increases the scope by 2.2% standard deviations. A one standard deviation increase in board size results in an increase of 2% standard deviations in scope, while a one standard deviation increase in firm size increases scope by 23.3% standard deviations.

- The authors consider and analyze 3 channels or mechanisms whereby board gender diversity may affect the rate of corporate innovation:

- CEO employment and compensation contracts. Female directors are associated with compensation contracts that encourage innovation, with lower CEO turnover and with lower performance sensitivity as measured by ROA and stock returns. That is, more gender diverse boards appear to offer more downside protection and tolerance when the innovative efforts made by CEOs stumble or fail. Gender diversity is also associated with compensation schemes that are longer term in nature, generally forms of noncash compensation and long-term incentive plans.

- Corporate culture. Using data from transcripts of earnings calls and machine learning techniques, gender diverse boards were found to be positively associated with the Corporate culture value of innovation, a framework of cultural framework developed by Guiso (2015) and Li (2020). The framework includes measure of 5 corporate values including innovation, integrity, quality, respect and teamwork.

- Level of diversity among inventors. Using inventor-level data, boards with more female directors were found to be positively related to the number of female inventors as well as the ethnic diversity of inventors.

The use of alternative measures of patents, samples, adding nonlinear effects, and focusing on specific industries produced no change in the conclusions.

Why does it matter?

The debate on gender diversity in the corporate boardroom is intense and controversial. This research contributes to the deliberations regulators, governments and the media should be having with respect to whether or not women in the boardroom are value-enhancing. The evidence presented here bolsters the arguments for corporations to encourage diverse boardrooms for innovation and value enhancement.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Using a novel database of firm patents and board characteristics across 45 countries, we examine both within- and cross-country determinants of board gender diversity and its relation to corporate innovation. Boards are more likely to include women in countries with narrower gender gaps, higher female labor market participation, and less masculine cultures. Firms with gender diverse boards have more patents and novel patents, and a higher innovative efficiency. Further analyses suggest that gender diverse boards are associated with more failure-tolerant and long-term chief executive officer (CEO) incentives, more innovative corporate cultures, and more diverse inventors, characteristics that are conducive to an improved innovative performance.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.