Employee Stock options (ESOs) are often used for recruiting and retaining employees. For decades, stock options have become an integral component of compensation in the US.

Typically, ESOs are early-exercisable long-dated call options written on the company stock. To maintain the incentive effect, the firm usually imposes a vesting period that prohibits the employee from exercising the option. During the vesting period, the employee’s departure from the firm will result in forfeiture of the option. After the vesting period, when the employee leaves the firm, the ESO will expire though the employee can choose to exercise if the option is in the money. Among the S&P 500 companies, the average vesting period has been consistently close to 2 years, while the average maturity has decreased from 9–10 years to 8 years over a decade.

Due to the extensive use of ESOs, the Financial Accounting Standards Board (FASB) has become concerned about the cost of these options to shareholders. In the past decade, the expensing of these options has changed from optional to mandatory. In 2004, under Statement of Financial Accounting Standards №123 (revised), FASB required firms to estimate and report “the grant-date fair value” of the ESOs issued. Opponents of expensing ESOs often argue that calculating the fair values at the time they are granted is very difficult. This gives rise to the need to design a sound valuation method.

In order to determine the cost of ESOs to the firm, it is important to understand the characteristics of ESOs and distinguish them from market-traded options.

Once endowed with an ESO, the employee cannot sell it, or directly hedge against the position by short selling the company stock. According to Section 16(c) of the U.S. Securities Exchange Act, executives are precluded from short-selling the shares of their employer.

Also, the FASB statement 123R indicates that “many public entities have established share trading policies that effectively extend that prohibition to other employees.” Nevertheless the employee can partially hedge by trading other securities, for example, the S&P 500 index.

The sale and hedging restrictions may incentivize the employee to exercise the ESO early and invest the option proceeds elsewhere. The employee’s risk preference and his available investment opportunities directly affect his exercise behavior.

Another vital feature for ESO valuation is the possibility that the employee will leave the firm before the ESO matures. At any time, an employee could be fired by the employer, or leave the firm voluntarily for various reasons, such as retirement. If the departure happens during the vesting period, then the option is forfeited, and the ESO costs the firm nothing in this case. If the ESO holder leaves after the vesting period, then, at the time of departure, the holder may exercise the option, and the firm pays the proceeds, if any.

All these features — vesting, sale and hedging restrictions, the employee’s exercise behavior and the risk of sudden job termination — have significant bearing on the fair value of ESOs.

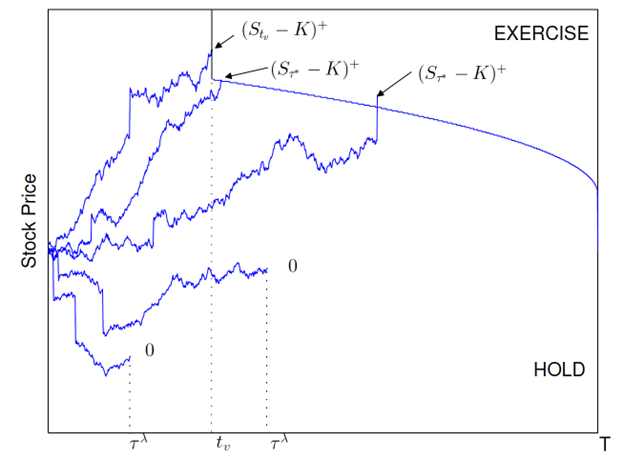

ESO payoff structure. From bottom to top: (i) The employee leaves the firm during the vesting period, resulting in forfeiture of the ESO. (ii) The employee is forced to exercise the vested ESO early due to job termination. (iii) The stock price path jumps across the exercise boundary after vesting, so the employee exercises the ESO immediately. (iv) The stock price reaches the exercise boundary (without jump) after vesting, and the option is exercised there. (v) The employee exercises the ESO at the end of vesting. Along each stock price path, the vertical line segments depict jumps in the stock price.

Source: Leung (2021).

Hence, FASB requires valuation models to capture the unique characteristics of ESOs. Apart from the firm’s perspective, how do these characteristics influence the employee’s exercise behavior and associated incentive effect?

In a series of papers (see references below), we provide stochastic models that incorporate all these characteristics, capture the employee’s exercise timing, and determine the cost of ESOs to the firm. Among our findings, it is clear that the option holder’s risk aversion can have a very profound effect on the timing of exercises. This in turn will lead to a significant cost impact to the firm and explain why ESOs should be worth much less than exchange-traded options.

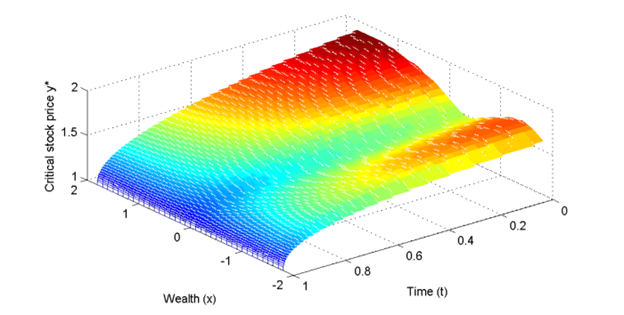

When accounting for the ESO holder’s risk aversion, the optimal exercise policy can be characterized by the critical stock price surface y*(x,t) as a function of wealth x and time t. It varies with wealth and decreases as time approaches maturity.

Source: Leung (2021)

References

T. Leung (2021), Employee Stock Options: Exercise Timing, Hedging, and Valuation, World Scientific Publishing Co.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Computational Finance & Risk Management, University of Washington and is being posted with its permission. The views expressed in this material are solely those of the author and/or Computational Finance & Risk Management, University of Washington and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)