The article “ESG Ratings how do they Compare Across Data Providers?” first appeared on Alpha Architect Blog.

ESG Ratings Divergence: Beauty in the Eye of the Beholder

- Linda Zhang

- Journal of Index Investing, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Globally, ESG ETFs have grown substantially in recent years, with AUM of about $320 billion as of June 30, 2021, according to Bloomberg. The vast majority of ESG ETFs are tracking ESG indexes published by a few leading rating firms, which control the ESGness of corporations ( and their inclusion in indexes) as well as ETF investors’ investment outcomes and their contribution (or lack thereof) to issues surrounding a clean environment and a just society through their investments. The academic literature has recently documented the issue of the divergence of ESG ratings among the different rating firms (Berg et al., 2020; La Bella et al., 2019; Li et al., 2020). This is an issue because it causes confusion to both investors and asset managers.

This article attempts at contributing to the rating divergence issues from the perspective of the impact on the ETF industry. It asks:

- Where and by how much do convergence and vast divergence happen across key rating firms?

What are the Academic Insights?

The study analyzes the three most influential ESG research and rating firms ( MSCI, S&P Global, and Morningstar/Sustainalytics). While MSCI uses a letter rating, similar to a bond rating scheme, the other

two use 1-to-100 numerical schemes. Hence, it focuses on comparisons involving quantitative analysis that are primarily between the latter two firms.

The study finds the following:

- Rating firms tend to give low ESG ratings to companies that do not report much data. This often punishes smaller firms or companies that have recently gone public, as they tend to report fewer ESG data. For example, while MSCI assigns Tesla a rating of A, the third-best rating group, the other two give Tesla a bottom quintile rating.

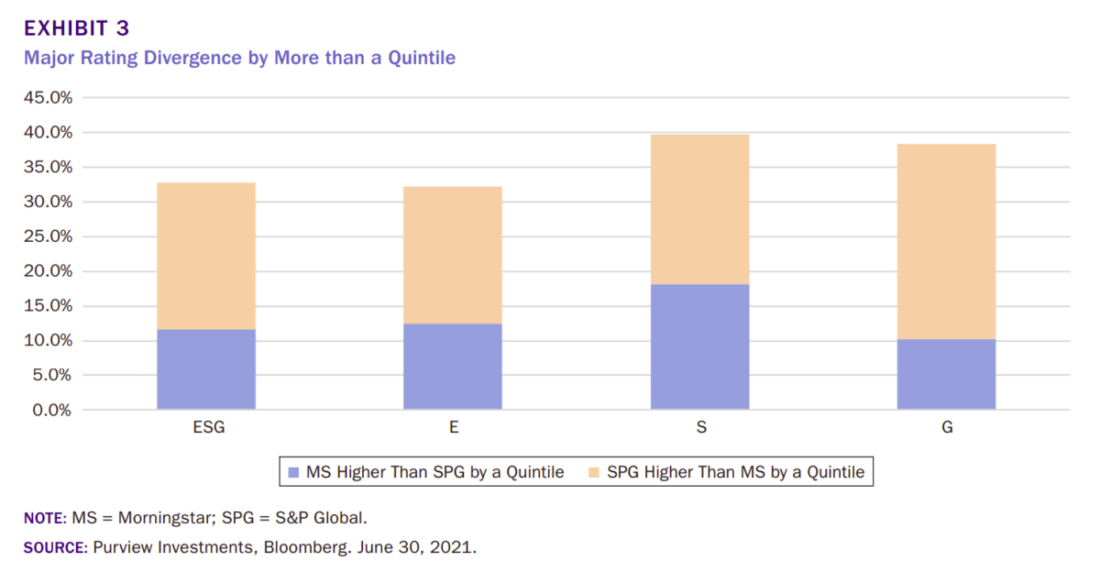

- There is more convergence in opinions on the environment (E) component of the ratings while disagreement becomes larger in social (S) and governance ratings (G), as indicated by lower Pearson correlations. This is related to the fact that E components are more quantifiable while the choices of the social and governance attributes are often more qualitative and debatable.

- The degree of rating divergence is observed to vary substantially across economic sectors. Specifically, the consumer staples sector contains the highest percentage of firms with a rating divergence of more than a quintile. The least disagreement lies in the information technology and communication services sectors, relatively speaking.

- As far as single components and sectors, on the environment front, the most disagreement between the two firms involves utilities, energy, materials, and real estate. On social issues, besides consumer staples, the two rating firms show the highest disagreement in the utilities and industrial sectors. On social issues, besides consumer staples, the two rating firms show the highest disagreement in the utilities and industrial sectors.

The article also includes a case study on how to evaluate an ESG product.

Why does it matter?

This article is important because it sheds light on the issue of rating divergence among different data providers. As more investors search for investments aligned with their values, it is paramount that the industry improves the rating process by making it easier, transparent, and objective.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Investments aligned with environmental, social, and governance (ESG) principles are rapidly growing globally. In the exchange traded fund (ETF) industry, this gives rise to the power of ESG rating firms that have the influence to direct capital flows into ETFs tracking the indexes. This article examines the issues of substantial ESG rating divergence across rating firms, the impact on investors’ choices, and the influence on the ETF industry. The divergence appears to be the greatest in social and governance components, and is often qualitative in nature. The author found that certain economic sectors are more prone to ESG rating divergence than others. She presents a case study about two ESG ETFs that are viewed

quite differently under various rating lenses, and offers suggestions to investors, advisors,

and analysts on how to research ESG ETFs, given the major rating divergence. The article

concludes with ways the ETF industry could improve its practices collectively to better serve

investors with clarity and to sustain the growth of ESG impact investments

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155