The post “Factor Investing: Is a Human Capital Factor on the Horizon?” first appeared on Alpha Architect Blog.

Excerpt

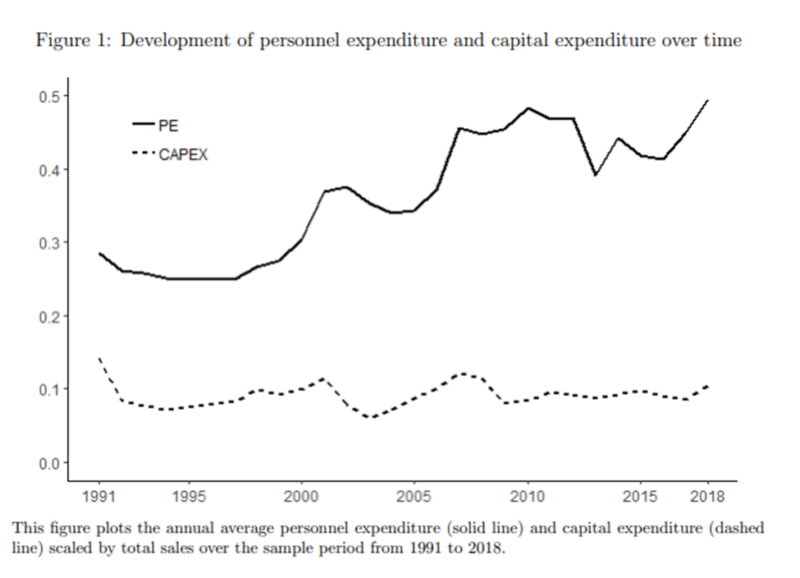

From 1991 to 2018, capital expenditures as a percentage of total sales remained relatively flat, at about 10 percent. On the other hand, personnel expenses almost doubled during that time. In fact, by 2018 personnel expenses (the costs for hiring, wages, salaries, and bonuses; social security and insurance costs; costs for employee training and development; perquisites like catering and workwear; and post-termination benefits) consumed approximately half of all of the average firm’s revenues of publicly traded European firms reporting under International Financial Reporting Standards (IFRS). Reflecting this trend, many CEOs have stated that “employees are our greatest asset.” However, due to accounting rules requiring that most expenditures related to employees be treated as costs and expensed as incurred, the value of employees is an intangible asset that does not appear on any balance sheet. That raises the question: If employees are a firm’s greatest asset and yet, as an intangible asset (as are research and development and advertising expenses), their value doesn’t appear on any balance sheet, does the market properly value the asset?

Recent research, including the 2020 studies “Explaining the Recent Failure of Value Investing,” “Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?” and “Equity Investing in the Age of Intangibles,” has investigated the impact on equity valuations and returns resulting from the dramatic increase in the relative importance of intangible assets compared to physical assets. The findings have been consistent that the increasing importance of intangibles, at least for highly intangible industries, is playing an important role in the cross-section of returns and thus should be addressed in portfolio construction. This lack of having a hard accounting measure for intangibles could be one thing impacting the underperformance of the value factor. But the lack of a strong measurement for intangibles affects not just value metrics but other measures, such as profitability, which often scale by the book value of total assets, both of which are affected by intangibles—and investors recognize at least some of their value.

Human Capital as Intangible Asset

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Matthias Regier and Ethan Rouen contribute to the literature on intangible capital with their October 2020 paper, “The Stock Market Valuation of Human Capital Creation.”

They began by noting:

“Accounting rules require that most expenditures related to employees be treated as costs and expensed as incurred. The reason for this treatment is that unlike with assets, firms do not have control over their employees (i.e., employees are not forced to remain employed by the firm). Still, costs related to employees likely consist of two components, the immediate expense that ensures that employees contribute to maintaining current business operations, and the investment that encourages employees to improve in their roles and grow the firm.”

Unfortunately, they noted:

“While IFRS requires firms to disclose PE [personnel expenses], under U.S. Generally Accepted Accounting Principles (GAAP), firms are required to disclose only the total number of employees and, since 2018, the salary of the median employee, a measure that lacks relation to future performance. Given these limited disclosures, investors face informational challenges when attempting to recognize the variation in firms’ abilities to effectively invest in intangible assets broadly and generate human capital specifically.”

To address this problem, they developed measures of firm-level human capital creation from publicly disclosed personnel expenditures (PE)—a line item that firms are required to disclose under International Financial Reporting Standards—and examined the stock market valuation of these characteristics, allowing them to capture cross-industry and cross-firm variation in the ability to create future value from PE. They then analyzed whether and when the stock market realizes the future value created by PE.

Personnel Expenses and Value Creation

Regier and Rouen explained:

“While a portion of PE is consumed contemporaneously to ensure the continuation of current operations of a firm, PE also contains personnel investments to attract and retain talent, and train workers to improve operations in the future. Given the growing importance of human capital to firms’ operations, markets should realize at least some of the human capital quality when it is created.”

They added:

“While PE is expensed as incurred, a component of the expenditure can be thought of as similar to buying a machine that will continue to produce value during its useful life. Therefore, firms that invest heavily in building human capital understate their earnings. If the market fixates on reported earnings, these firms will be undervalued in the current period and generate abnormal returns in subsequent periods. … At the same time, firms with high PE may be riskier on average. Opportunities to grow the firm’s human capital do not necessarily reflect the efficacy of those investments, creating greater uncertainty about the firm’s expected future income. PE may also be difficult or costly to adjust in the short run, leading to high labor leverage, which results in firms’ operating profits being more sensitive to shocks and which is positively associated with firms’ equity risk. This could lead markets to demand a risk premium.”

Their data sample covered firms listed on an EU-regulated market because they must disclose, according to IFRS, their PE. Their sample included the current 27 members of the EU as well as the United Kingdom, which left the EU in early 2020. They added Norway and Switzerland, for a total of 30 countries and almost 12,000 firms for the period 1990-2018.

They began their analysis by calculating from PE the variation in firms’ efficacy in creating human capital by identifying the relation between prior period PE and current firm performance.

The authors explained:

“Specifically, for a large sample of firms across 30 European countries, we begin by regressing at the industry level current operating income on several years of lagged PE to identify the optimal lag structure for each industry. In some industries, as many as three or four years of lagged PE are significantly positively associated with current operating income (e.g., manufacturing) while in other industries, prior PE has no relation to current performance (e.g., chemicals). Next, we rerun these regressions at the firm-year level using the industry-determined lag structure. Summing the coefficients on prior PE from these regressions provides a firm-year estimate of the PE future value, or PEFV. We view total PE scaled by total assets as a proxy for a firm’s opportunity to create human capital, while PEFV represents a proxy for the efficacy of that investment.”

Their analysis sorted firms into portfolios three ways:

- On the efficacy of the firm to generate future values from PE (PEFV).

- Based on current PE, scaled by total assets (PE/TA) as a proxy for firms’ opportunities to develop human capital.

- Based on the interaction of efficacy and opportunity (PEFV*PE/TA).

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)