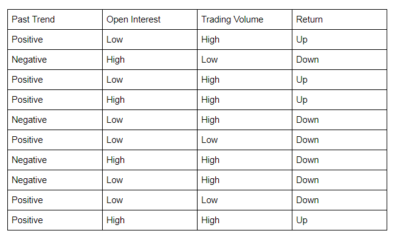

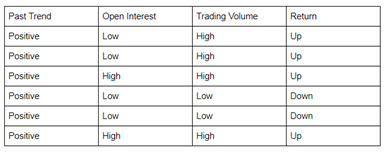

Let’s understand how the Gini Index works by looking at this simple example.

Let’s start by calculating the Gini Index for ‘Past Trend’.

P(Past Trend=Positive): 6/10

P(Past Trend=Negative): 4/10

If (Past Trend = Positive & Return = Up), probability = 4/6

If (Past Trend = Positive & Return = Down), probability = 2/6

Gini index = 1 – ((4/6)^2 + (2/6)^2) = 0.45

If (Past Trend = Negative & Return = Up), probability = 0

If (Past Trend = Negative & Return = Down), probability = 4/4

Gini index = 1 – ((0)^2 + (4/4)^2) = 0

Weighted sum of the Gini Indices can be calculated as follows:

Gini Index for Past Trend = (6/10)*0.45 + (4/10)*0 = 0.27

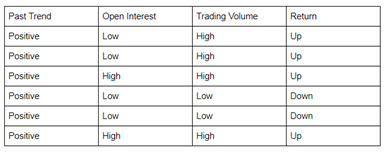

Calculation of Gini Index for Open Interest

P(Open Interest=High): 4/10

P(Open Interest=Low): 6/10

If (Open Interest = High & Return = Up), probability = 2/4

If (Open Interest = High & Return = Down), probability = 2/4

Gini index = 1 – ((2/4)^2 + (2/4)^2) = 0.5

If (Open Interest = Low & Return = Up), probability = 2/6

If (Open Interest = Low & Return = Down), probability = 4/6

Gini index = 1 – ((2/6)^2 + (4/6)^2) = 0.45

Weighted sum of the Gini Indices can be calculated as follows:

Gini Index for Open Interest = (4/10)*0.5 + (6/10)*0.45 = 0.47

Calculation of Gini Index for Trading Volume

P(Trading Volume=High): 7/10

P(Trading Volume=Low): 3/10

If (Trading Volume = High & Return = Up), probability = 4/7

If (Trading Volume = High & Return = Down), probability = 3/7

Gini index = 1 – ((4/7)^2 + (3/7)^2) = 0.49

If (Trading Volume = Low & Return = Up), probability = 0

If (Trading Volume = Low & Return = Down), probability = 3/3

Gini index = 1 – ((0)^2 + (1)^2) = 0

Weighted sum of the Gini Indices can be calculated as follows:

Gini Index for Trading Volume = (7/10)*0.49 + (3/10)*0 = 0.34

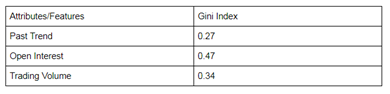

From the above table, we observe that ‘Past Trend’ has the lowest Gini Index and hence it will be chosen as the root node for the decision tree.

We will repeat the same procedure to determine the sub-nodes or branches of the decision tree.

We will calculate the Gini Index for the ‘Positive’ branch of Past Trend as follows:

Stay tuned for the next installment in this series, in which Shagufta will continue discussing Calculations of Gini Index for Trading Volume!

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.