Excerpt

Indisputably, we are witnesses of an ETF mega boom. From passive to active ETFs, their numbers seem to be ever-increasing. Since these exchange-traded funds can be excellent (accessible, transparent, liquid) instruments, it is a great necessity to examine their possible usage in active and systematic trading or investing. Therefore, the short research critically assesses the possibility of using ETFs in the Skewness Trading Strategy.

Introduction

Lottery tickets have meager prices relative to the highest potential payoff; they have low negative expected returns; their payoffs are very risky (i.e., the prize distribution has high variance); and, most importantly, they have a tiny probability of a huge reward (i.e., they have positively skewed payoffs). Overall, for a low cost, lottery tickets offer a slight chance of a huge reward and a significant probability of a little loss, where the probabilities of winning and losing are fixed and known in advance. Even though any particular asset is not likely to possess the extreme characteristics of lotteries, mainly the considerable reward to cost ratio, some assets share these features qualitatively. To identify these assets that can be perceived as lotteries, one can consider asset-specific skewness as a measure. Agents, in general, are likely to deem the assets with high asset-specific skewness more attractive. Kumar (2009) proposed that the investors perceive low-priced stocks with high idiosyncratic volatility and high idiosyncratic skewness as lotteries. The study suggests that investors are likely to pay for a small probability to win an enormous payoff.

The skewness effect has been identified across multiple asset classes before – namely commodities, currencies, or equities. Amaya et al. (2015) analyzed intraday equity returns and found that the skewness is a negative predictor of the following week’s return. Fernandez-Perez et al. (2018) have identified a similar effect in commodity futures, where skewness is also a negative predictor. Skewness as a negative predictor was also identified by Zaremba and Nowak (2015) in an extensive sample of 78 country indices. Vojtko and Lievaj (2020), who analyzed currencies, equities (country indices), and bonds, also provide skewness-related findings. While bonds and currencies seem to relate to the sizeable skewness effect consistent with the other literature, the investment universe of equities is much smaller than that of Zaremba and Nowak (2015), and the effect seems insignificant.

Our motivation for research stems from the fact that the anomalies in the financial market tend to repeat in multiple assets classes. Hence the lottery-like payoff resulting from the skewness effect could be present in exchange-traded funds as well. For example, commodity ETFs track the underlying commodities, and if the skewness effect is present in individual commodities, the effect should also exist in commodity ETFs.

Furthermore, according to the previous research, investors should be the “lottery ticket issuer” instead of playing the lottery. In other words, if the skewness effect holds, they should prefer going long on ETFs without lottery-like characteristics (ETFs with low skewness) and short on ETFs with lottery-like characteristics (ETFs with high skewness). The critical question is whether this lottery effect also holds in ETFs. We examine the skewness effect across various categories: country ETFs, commodity ETFs and global or US sector ETFs. The skewness anomaly is examined for two lookback periods – shorter one-month skewness and long 12-months skewness. The 12-months skewness coincides with the skewness in commodity futures of Fernandez-Perez et al. (2018). The one-month skewness is more dynamic and can be compared to another common lottery effect – the MAX effect of Bali et al. (2009), calculated as the maximal daily return over the previous month. Although the MAX effect was originally found in individual stocks, there is a possibility that it can also be found in ETFs.

Methodology

The analysis of the skewness effect is performed through portfolio sorts. Each month, skewness is calculated from daily returns over the past month for the short one-month or over the past twelve months for the long twelve-month skewness. As a next step, we sort ETFs into quintiles (quartiles). To conclude our analysis, we examine the strategy of going long on the quintiles (quartiles) of ETFs with the lowest skewness and going short on the quintiles (quartiles) of ETFs with the highest skewness. The portfolios are rebalanced each month and equally weighted.

Analysis – one-month skewness

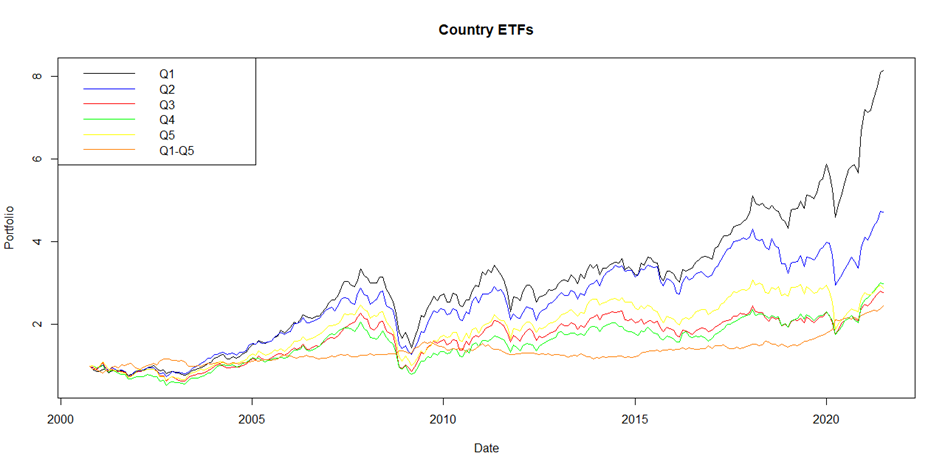

Country Exchange-traded Funds

The investment universe consists of 19 exchange-traded funds: SPY, EWL, EWQ, EWU, EWD, EWG, EWN, EWI, EWO, EWK, EWJ, EWW, EWM, EWH, EWS, EWA, EWZ, EWT, and EWY. The backtesting period spans from 01.8.2000 to 31.07.2021.

For the Country ETFs, we have identified similar results as Zaremba and Nowak (2015). The lowest skewness assets outperform the highest skewness assets, and the anomaly seems to be alive even if the ETFs are used as trading instruments. Additionally, the skewness effect appears to be economically significant and has reasonably low volatility (under 10%).

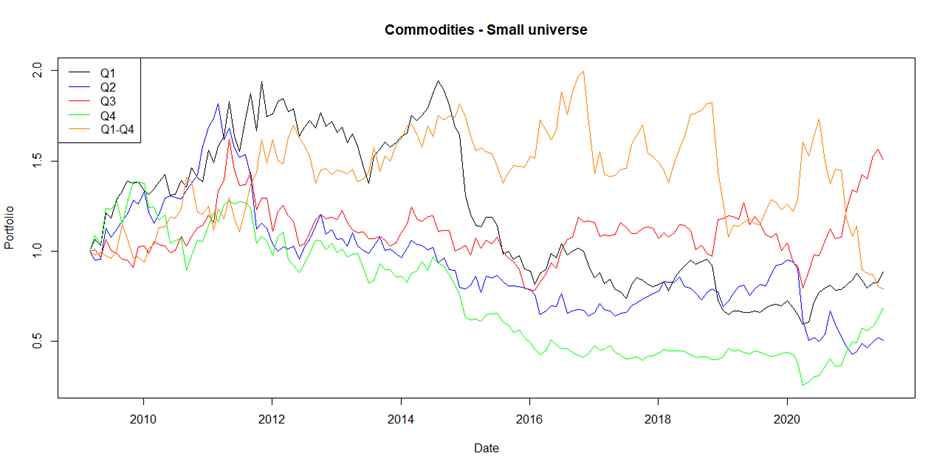

Commodity Exchange-traded Funds

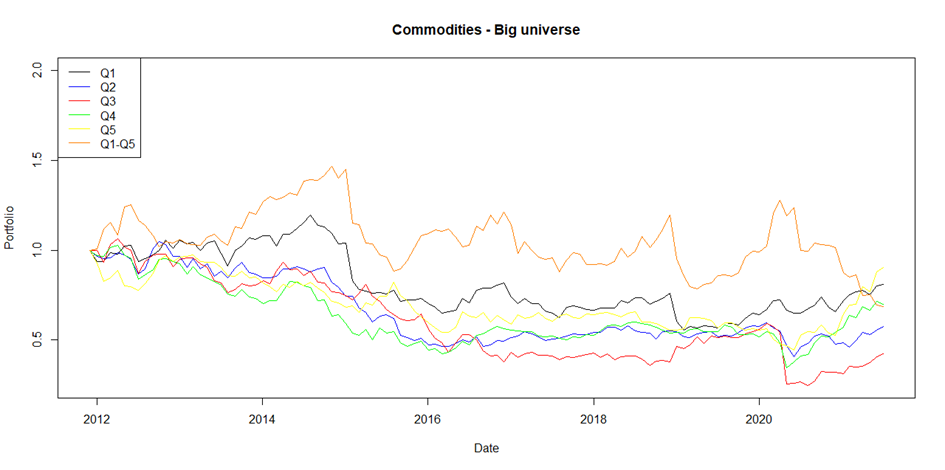

For commodities, we analyze two investment universes. The first universe is smaller but offers a more extended sample. The second is more extensive regarding the number of instruments, but due to inception dates, the sample is shorter.

The first universe consists of 8 commodities ETFs: gold, silver, oil, natural gas, base metals, agriculture, cocoa, and gasoline (GLD, SLV, USO, UNG, DBB, DBA, NIB, UGA). The backtesting period spans from 01.07.2008 to 31.07.2021.

The second one consists of 14 commodities ETFs, namely gold, silver, oil, brent, natural gas, platinum, palladium, gasoline, base metals, corn, cane, soybean, wheat, and cocoa (GLD, SLV, USO, BNO, UNG, PPLT, PALL, UGA, DBB, CORN, CANE, SOYB, WEAT, NIB). The backtesting period spans from 01.10.2011 to 31.07.2021.

Commodities are widely recognized to follow long bull or bear runs, which is the main reason why a passive holding of commodities is rarely advised. Instead, the commodities are commonly used in active strategies, but the commodity ETFs do not seem to be the best investment universe for the skewness effect.

Both samples primarily include a major commodity bear run, and although the lowest skewness ETFs tend to decrease the least, the highest skewness ETFs can bounce back strongly and erode the returns. Overall, both strategies are unprofitable and volatile. There certainly are periods where the skewness effect in commodities can benefit the investor, but undoubtedly it is not an all-weather strategy.

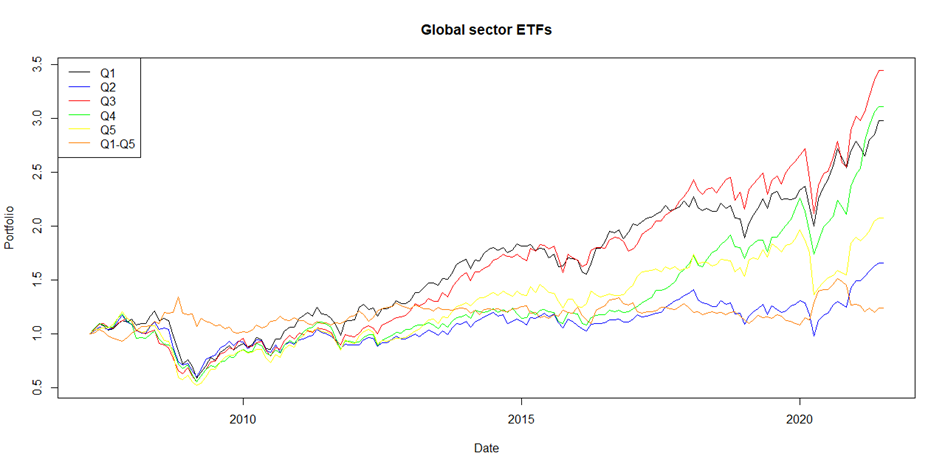

Global Sector Exchange-traded Funds

The investment universe consists of 10 exchange-traded funds: IXN, IXP, IXJ, RXI, MXI, EXI, KXI, JXI, IXG, IXC. The backtesting period spans from 01.02.2007 to 31.07.2021.

Although the skewness spread portfolio (Q1-Q5) appears to be slightly profitable, the skewness effect seems to be relatively weak. On average, the highest skewness quintile has the lowest returns, but the difference is minor. Moreover, the lowest skewness quintile is almost on par with the middle quintile. On the contrary to expectations about significant anomaly, the performance does not continuously decrease from the lowest to the highest quintile.

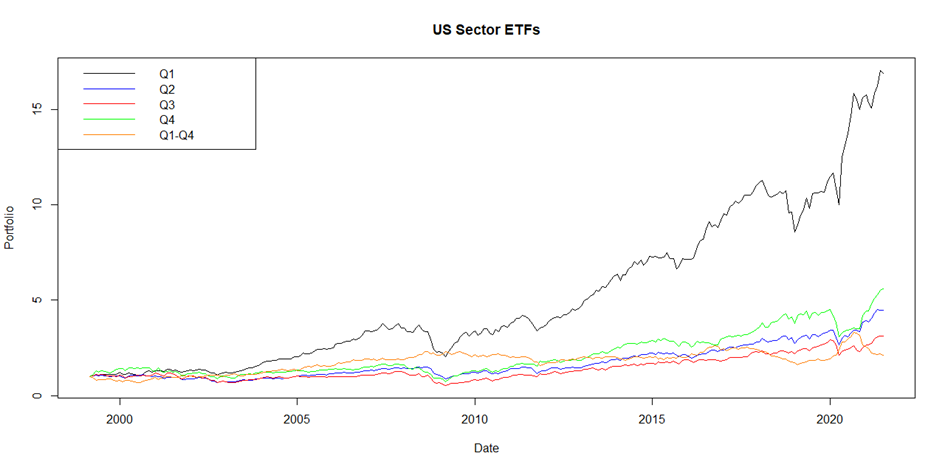

The US Sector Exchange-traded Funds

The investment universe consists of 9 exchange-traded funds: XLK, XLY, XLV, XLB, XLP, XLI, XLU, XLF, XLE. The backtesting period spans from 1.1.1999 to 31.07.2021.

Based on the sample, we can conclude that US sector ETFs are similar to the Country ETFs. The evidence shows that the least skewed ETFs consistently outperform more skewed ones.

Author: Viktoria Komornikova (Edited by Matus Padysak)

Visit Quantpedia to find insight on twelve-months skewness and to read the full article: https://quantpedia.com/lottery-effect-in-etfs-across-several-asset-classes/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)