See the first installment of this series here.

Macroeconomic factors

As we have said before, macroeconomics looks at the big picture, i.e. how is the economy performing? To help us answer this question, macroeconomists have come up with certain factors which are as follows:

Gross domestic product (GDP)

In simple terms, GDP gives us the monetary value of how much the country produces in a year. Think of a family which comprises 2 sons and 2 daughters. The sisters produce electric bicycles which cost them $1 million. While the brothers built customised bike engines which cost them $1 million. Thus, you will say that the family’s GDP was $2 million in a year.

In a similar manner, you will calculate the monetary value of all the products which are made in a country.

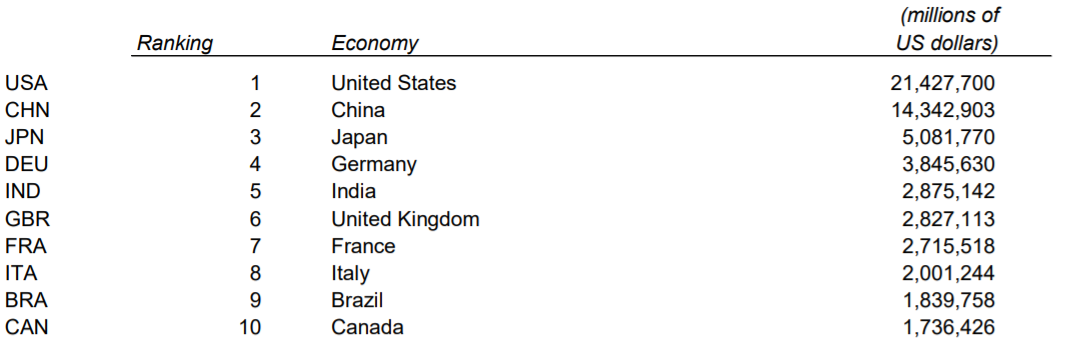

To give you an idea, here are some GDP figures for the year 2019:

(Source: Gross domestic product 2019)

Yes, you are right in wondering how you get these figures, considering a country has so many different sectors and private as well as public enterprises. Usually, the country has a dedicated governmental agency which collects and calculates the country’s GDP figures.

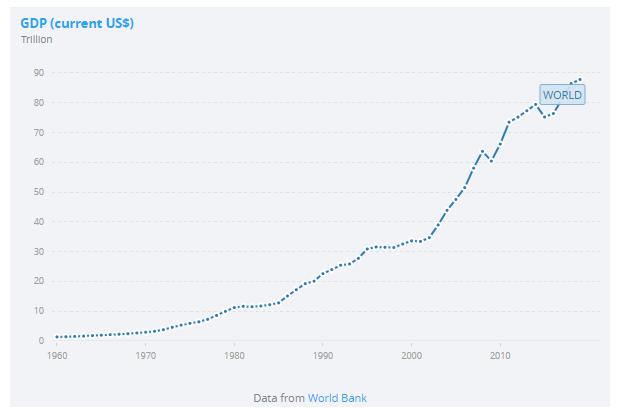

In fact, you can also see the world GP over the years, as given below:

Note: Visit QuantInsti to see an interactive version of this chart.

How do you calculate the GDP?

Broadly speaking, there are three ways to calculate the GDP, which should give you the same figure. Let’s see what these are:

A. Output (or production) method – In this method, you calculate the final value of all the goods produced, but subtract the value of any intermediate goods consumed in the process. Taking the family’s example, if one electric cycle is valued at $1000, but the steel and material used is worth $700. Then the final value will be $300.

B. Expenditure method – This method is a bit opposite to the earlier method, where we calculate the spending in the country. A simple formula for the expenditure approach is as follows:

GDP = C + G + I + NX

Here, C refers to consumption by mostly individual or private companies.

G refers to Government spending,

I represents an investment in capital goods

NX = Exports – Imports

In simple terms, it is assumed that any spending will occur in either of the four terms and thus, if add them all up, we will get the value of total spending or expenditure, which is called the GDP.

C. Income approach – As the name implies, the income approach simply tells us to add up all the wages, rents, interests or profits earned. This will tell us how much the country earned and is the GDP.

This was an oversimplification of the approach to calculating the GDP. In the real world, we also have to take into account the inclusion (or exclusion in some cases) of taxes, subsidies and rebates, which could distort the real number.

Stay tuned for the next installment in which Rekhit will review inflation.

Visit QuantInsti for additional insight on this tutorial:

https://blog.quantinsti.com/macroeconomics/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)