See Part I for an overview of price action trading and the different types of charts and Part II to get insight on the concept of support and resistance.

Identifying support and resistance using Python

The first step in our approach is to import necessary libraries and get the asset data.

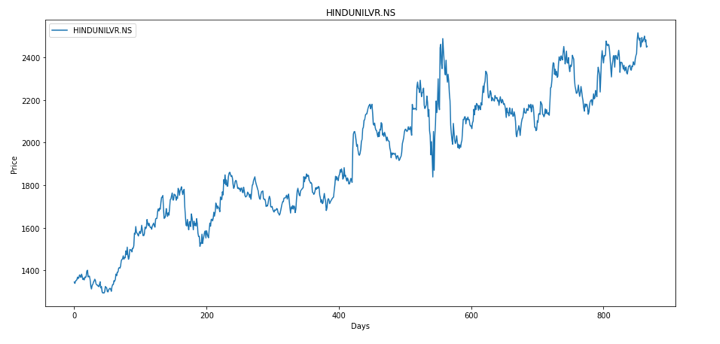

We will be focusing on the close price data of HINDUNILVR.NS for performing the support and resistance analysis. We fetch the asset’s OHLCV data from Yahoo! Finance and store it in a dataframe as shown below.

# Import Libraries

import numpy as np

import pandas as pd

import yfinance as yf

from math import sqrt

import matplotlib.pyplot as plt

# Set the start and end date

start = '2018-01-01°

end = ‘2021-07-12

# Set the ticker

symbol = "HINDUNTLVR.NS*

# Get the data from Yahoo! Finance

df = yf.dounload(symbol, start, end)

# Disply the data

df.tail()Fetch data.py hosted with ❤ by GitHubThe last 5 rows of our data can be displayed using the df.tail() command.

Output:

| Date | Open | High | Low | Close | Adj Close | Volume |

| 2021-07-05 | 2499.000000 | 2513.399902 | 2485.050049 | 2499.050049 | 2499.050049 | 761700 |

| 2021-07-06 | 2490.000000 | 2497.949951 | 2469.000000 | 2472.500000 | 2472.500000 | 461782 |

| 2021-07-07 | 2458.000000 | 2490.800049 | 2445.850098 | 2481.649902 | 2481.649902 | 623145 |

| 2021-07-08 | 2462.199951 | 2469.750000 | 2438.449951 | 2447.550049 | 2447.550049 | 1114426 |

| 2021-07-09 | 2440.000000 | 2464.500000 | 2438.449951 | 2451.449951 | 2451.449951 | 538094 |

To get a visual representation of the close price data, we will use various functions of the matplotlib library.

# Plot the close price data

series = df[‘Close’]

series. index = np.arange(series.shape[@])

plt. figure(figsize=(15, 7))

plt.title(symbol)

plt.xlabel ("Days")

plt.ylabel("Price’)

plt.plot(series, label-symbol)

plt.legend()

plt.show()Plot.py hosted with ❤ by GitHubHere’s the graph highlighting the close price of the asset:

Close price

Now since we have all our data in place, the next step is to identify the swing highs and the swing lows in the above price graph. An easier way to do this is to identify the local minima and local maxima points.

To identify the local minima and maxima points, we will first need to smoothen the price graph. This can be achieved using the savgol.filter function from the scipy.signal library. To learn more about this function, you can visit the documentation page here.

# Create smooth graph of close price data

from scipy.signal import savgol_filter

# To find amount of data in months

month_diff = series.shape[0] // 30

# We need value to be greater than 0

if month_diff == 0:

month_diff = 1

# Algo to determine smoothness

smooth = int(2 * month diff + 3)

# Smooth price data

points = savgol_filter(series, smooth, 7)

# Plot the smooth price graph over default price graph

plt. figure(figsize=(15,7))

plt.title(symbol)

plt.xlabel ("Days")

plt.ylabel("Price’)

# Close price data

plt.plot(series, label-symbol)

# Smooth close price data

plt.plot(points, label=f'Smooth {symbol}")

plt.legend()

plt.show()Smooth graph.py hosted with ❤ by GitHubStay tuned for the next installment of this series to learn how to plot and compare the normal close price graph with the smoothened close price graph

For additional insight on this topic visit QuantInsti blog: https://blog.quantinsti.com/price-action-trading/.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Displaying Symbols on Video

Any stock, options or futures symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)