This post explains how to implement the sign constrained lasso with ridge, and linear regression model. The restrictions of expected sign is of great importance in the case when building an econometric model with meaningful interpretation. We can easily incorporate sign restrictions to the above regression models using glmnet R package.

It is a stylized fact that the default risk decreases in GDP growth rate, but increase in GDP growth volatility. This relationship is empirical and theoretical guideline for the model selection. Therefore, all explanatory variables should be consistent to its own expected signs.

The lasso, ridge, and linear regression model is the unrestricted model as default setting. But The sign restrictions need to be included as additional constraints in optimization problem. Implementing this optimization problem is not easy but we can sidestep this difficulty by using glmnet R package.

Since the following R code have a self-contained structure, it is easy to understand. In this code, The expected signs of each coefficients are given by user as following rule.

- 1 : expected sign is plus(+)

- -1 : expected sign is mimus(-)

- 0 : expected sign is indeterminate

#===================================================================#

# Financial Econometrics & Derivatives, ML/DL, R,Python,Tensorflow

# by Sang-Heon Lee

#

# https://kiandlee.blogspot.com

#-------------------------------------------------------------------#

# Sign constrained Lasso, Ridge, Stnadard Linear Regression

#===================================================================#

library(glmnet)

graphics.off() # clear all graphs

rm(list = ls()) # remove all files

N = 500 # number of observations

p = 20 # number of variables

#--------------------------------------------

# X variable

#--------------------------------------------

X = matrix(rnorm(N*p), ncol=p)

# before standardization

colMeans(X) # mean

apply(X,2,sd) # standard deviation

# scale : mean = 0, std=1

X = scale(X)

# after standardization

colMeans(X) # mean

apply(X,2,sd) # standard deviation

#--------------------------------------------

# Y variable

#--------------------------------------------

beta = c( 0.15, -0.33, 0.25, -0.25, 0.05,

rep(0, p/2-5), -0.25, 0.12, -0.125,

rep(0, p/2-3))

# Y variable, standardized Y

y = X%*%beta + rnorm(N, sd=0.5)

y = scale(y)

#--------------------------------------------

# Model without Sign Restrictions

#--------------------------------------------

# linear regression without intercept( using -1)

li.eq <- lm(y ~ X-1)

# linear regression using glmnet

li.gn <- glmnet(X, y, lambda=0, family="gaussian",

intercept = F, alpha=0)

# lasso

la.eq <- glmnet(X, y, lambda=0.05, family="gaussian",

intercept = F, alpha=1)

# Ridge

ri.eq <- glmnet(X, y, lambda=0.05, family="gaussian",

intercept = F, alpha=0)

#--------------------------------------------

# Model with Sign Restrictions

#--------------------------------------------

# Assign Expected sign as arguments of glmnet

v.sign <- sample(c(1,0,-1),p,replace=TRUE)

vl <- rep(-Inf,p); vu <- rep(Inf,p)

for (i in 1:p) {

if (v.sign[i] == 1) vl[i] <- 0

else if (v.sign[i] == -1) vu[i] <- 0

}

# linear regression using glmnet with sign restrictions

li.gn.sign <- glmnet(X, y, lambda=0, family="gaussian",

intercept = F, alpha=1,

lower.limits = vl, upper.limits = vu)

# lasso with sign restrictions

la.eq.sign <- glmnet(X, y, lambda=0.05, family="gaussian",

intercept = F, alpha=1,

lower.limits = vl, upper.limits = vu)

# Ridge with sign restrictions

ri.eq.sign <- glmnet(X, y, lambda=0.05, family="gaussian",

intercept = F, alpha=0,

lower.limits = vl, upper.limits = vu)

#--------------------------------------------

# Results

#--------------------------------------------

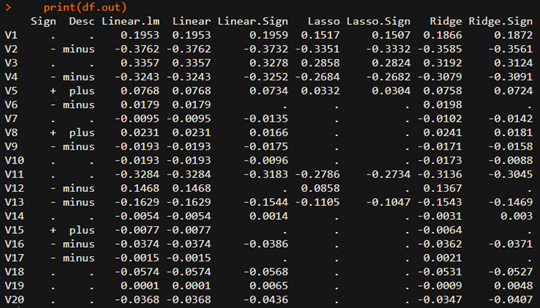

df.out <- as.data.frame(as.matrix(round(

cbind(li.eq$coefficients,

li.gn$beta, li.gn.sign$beta,

la.eq$beta, la.eq.sign$beta,

ri.eq$beta, ri.eq.sign$beta),4)))

# for clarity

df.out[df.out==0] <- "."

df.out <- cbind(

ifelse(v.sign==1,"+",ifelse(v.sign==-1,"-",".")),

ifelse(v.sign==1,"plus",ifelse(v.sign==-1,"minus",".")),

df.out)

# always important to use appropriate column names

colnames(df.out) <- c("Sign", "Desc", "Linear.lm",

"Linear", "Linear.Sign","Lasso", "Lasso.Sign",

"Ridge", "Ridge.Sign")

print(df.out)

From the above estimation results, we can find that estimated coefficients are consistent with each expected sign. When estimated sing conflicts with the expected one, its coefficients is set to zero and is discarded. Therefore we can understand that the sign restrictions is another form of variable selection process which reduce more the range of selected variables.

Generally speaking, it is not easy to impose the expected sign restrictions but we can do it with powerful glmnet R package.

For additional insight on this topic and to download the R script, visit the SH Fintech Modeling Blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SHLee AI Financial Model and is being posted with its permission. The views expressed in this material are solely those of the author and/or SHLee AI Financial Model and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.