Earnings Seasons are often exciting times for investors. In the market session following a scheduled announcement, the opening stock price may move quite drastically depending on the earnings report. Empirical studies suggest that the variance of stock price returns on the earnings announcement date can be several times greater than those on other dates.

In addition to the immediate price impact, earnings releases may also affect the drift of the stock price after the announcement over a longer horizon. This empirical observation is commonly referred to as the post-earnings-announcement drift.

Since many public companies also have options written on their stock prices, this motivates us to investigate the problem of pricing equity options prior to an earnings announcement (EA). As options are intrinsically forward-looking contracts, their prices should account for the uncertain stock price impact of an upcoming earnings release.

A natural question is how to extract information on such an impact from observed options prices, especially a few days before the announcement. Since traders often quote or study the implied volatility (IV) for each option, it is of practical importance to examine the behavior of the pre-earnings announcement implied volatility (PEAIV).

Pre-earnings announcement implied volatility tends to rise until the announcement date.

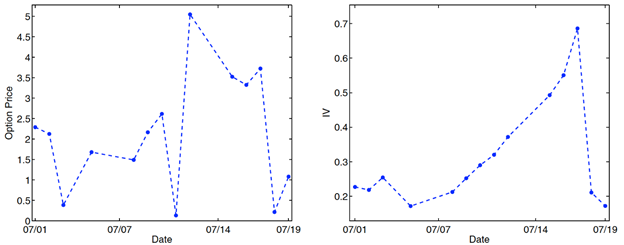

One main feature of the PEAIV is that it tends to rise, often rather drastically, up until the announcement date. In Figure 1, we show the price and IV of the front month (i.e. with the nearest maturity date) at-the-money (ATM) call option written on IBM. Following an earnings announcement, the option expires on the Friday in the same week. As we can see on the right panel, the IV increases rapidly from 30% to over 70% as time approaches the earnings announcement, and then drops significantly to close to 20% after the earnings report is released. At the same time, the ATM call price stays well above zero even though the time to maturity is very short (Figure 1 (left)). Moreover, we observe that the IV reaches a maximum just before an earnings event.

Fig. 1. The price and implied volatility of the front month ATM option on IBM with expiration date 19 July. The earnings announcement date is 17 July. The implied volatility falls sharply after the announcement. Source: T. Leung and M. Santoli, Accounting for Earnings Announcements in the Pricing of Equity Options, Journal of Financial Engineering, vol. 1, issue 4, 2014

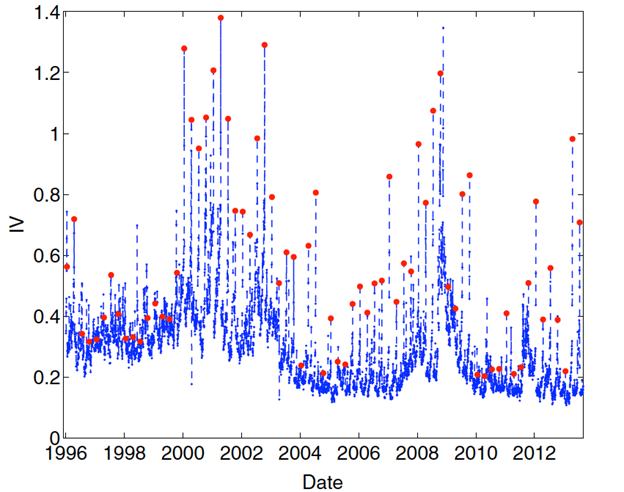

To illustrate that the increasing PEAIV is more than a coincidence, in Fig. 2 we plot the time series of the IV of the ATM call option for IBM from January1996 to August 2013. In the same figure, we mark in red the IV values on days during which EAs were made. As we can see, spikes in volatility most often coincide with the earnings release dates.

Fig.2: The time series of the implied volatility (IV) of the front month ATM call on IBM. The red dots mark the value of the IV on EA dates. Source: T. Leung and M. Santoli, Accounting for Earnings Announcements in the Pricing of Equity Options, Journal of Financial Engineering, vol. 1, issue 4, 2014

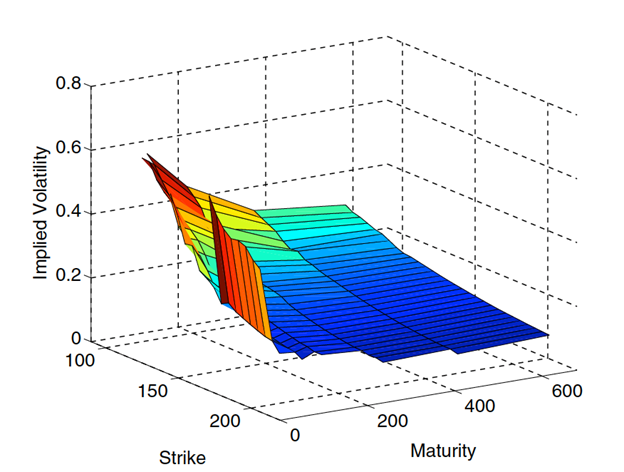

We can also gain some insight from the shape of the implied volatility surface. In Fig. 3, we show the IV surface of IBM on 15 July, two days before an earnings release. It is also clear that the front month options, which have 1 day to expiration, have very high volatility. The implied volatility is significantly lower for longer-term options, suggesting a less pronounced effect of the upcoming EA.

The IV surface of IBM at the market close on 15 July, two days before an EA. Source: T. Leung and M. Santoli, Accounting for Earnings Announcements in the Pricing of Equity Options, Journal of Financial Engineering, vol. 1, issue 4, 2014

These market observations call for a pricing framework that explicitly incorporates the jump to be realized on the EA date. In this paper, a new option pricing framework is introduced to capture the price impact of an EA, with emphasis on the behavior of the implied volatility prior to the event. Specifically, a random-sized jump scheduled on the EA date is incorporated to represent the shock to the company stock price. Analytic bounds and asymptotics for extreme strikes are available for the IV under a general class of stock price models with an EA jump. In the bounds, we observe the explicit dependence on EA jump parameters and a common time-dependence of the PEAIV across these models.

References

T. Leung and M. Santoli, Accounting for Earnings Announcements in the Pricing of Equity Options [pdf;link],Journal of Financial Engineering, vol. 1, issue 4, p.1450031, 2014

Google Scholar // Linkedin Page // Homepage

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Computational Finance & Risk Management, University of Washington and is being posted with its permission. The views expressed in this material are solely those of the author and/or Computational Finance & Risk Management, University of Washington and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)