The possibilities for quantifying risk in portfolio analytics seems to be limited only by the imagination of researchers. Indeed, you can find dictionaries that wade through an ever-lengthening list of indicators. But any short list of robust metrics surely deserves to include drawdown, which offers a powerful combination of relevance and simplicity. A new research paper reminds, however, that drawdown comes in several flavors and so investors need to think carefully when deploying this metric in the quest to identify genuinely skillful portfolio results.

“Over the years, a diverse range of drawdown measures has evolved to guide asset management,” advise the authors of “Drawdown Measures: Are They All the Same?” , a recent working paper by Olaf Korn (University of Goettingen) and two co-authors. They go on to advise in the study’s abstract:

Conceptual differences between drawdown measures translate into different rankings of portfolios, which we document in a simulation study. Our research also shows that all drawdown measures can (to some degree) discriminate between skillful and unskillful portfolio managers, but differ in terms of accuracy. However, the ability to detect skill does not easily improve performance ratios where drawdown measures serve as the denominator. In conclusion, our study shows that the choice of an adequate drawdown measure is vital to the assessment of investments because different measures emphasize different aspects of risk.

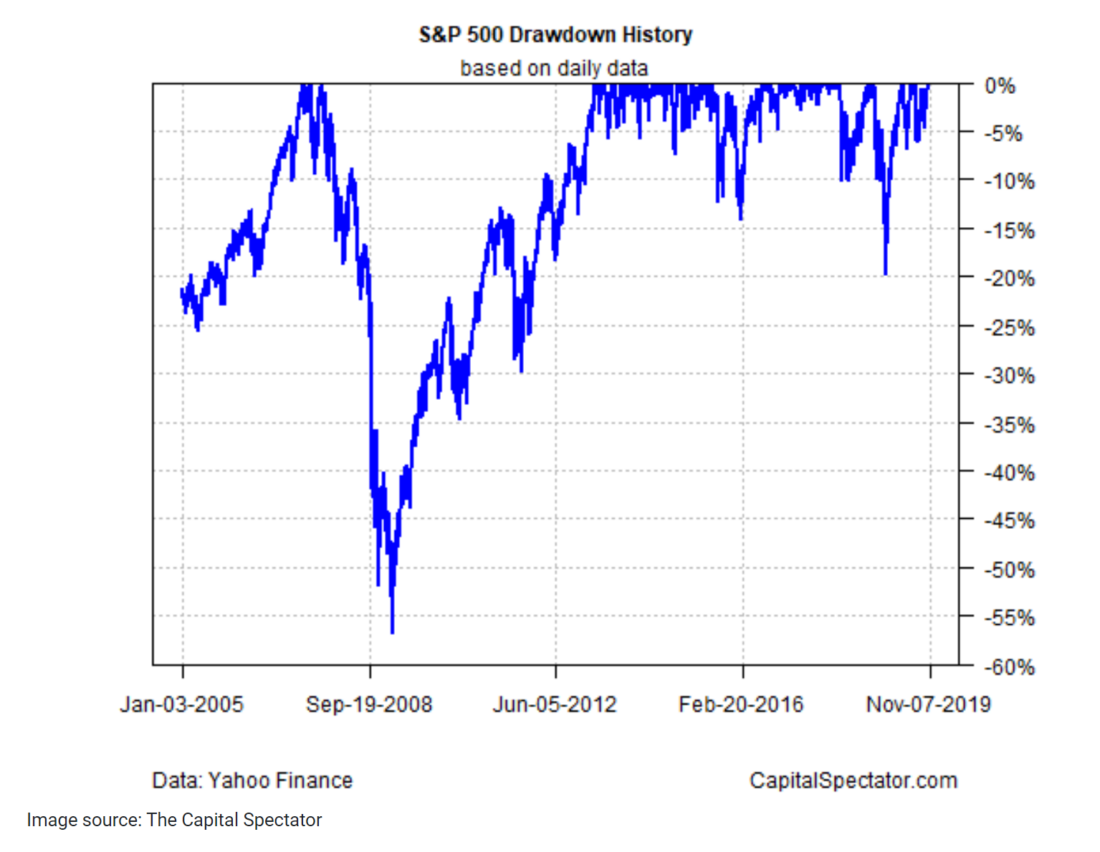

For the casual investor, the notion that there’s more than one measure of drawdown may be surprising. After all, drawdown is often described as a simple peak-to-trough calculation. For example, here’s how the US stock market’s drawdown history stacks up since 2005 via the S&P 500.

Visit The Capital Spectator to read the full article and download supplemental code:

http://www.capitalspectator.com/whats-the-best-methodology-for-measuring-drawdown-risk/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Capital Spectator and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Capital Spectator and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.