The article “yfinance Library – A Complete Guide” first appeared on AlgoTrading101 Blog.

Excerpt

What is yfinance?

yfinance is a popular open source library developed by Ran Aroussi as a means to access the financial data available on Yahoo Finance.

Yahoo Finance offers an excellent range of market data on stocks, bonds, currencies and cryptocurrencies. It also offers market news, reports and analysis and additionally options and fundamentals data- setting it apart from some of it’s competitors.

Yahoo Finance used to have their own official API, but this was decommissioned on May 15th 2017, following wide-spread misuse of data.

These days a range of unofficial APIs and libraries exist to access the same data, including of course yfinance.

Note you might know of yfinance under it’s old name- fix-yahoo-finance, since it was re-named on May 26th 2019 at the same time that it went over a large overhaul to fix some usability issues.

To ensure backwards compatibility, fix-yahoo-finance now imports and uses yfinance anyway, but Ran Aroussi still recommends to install and use yfinance directly.

In this article we will focus mainly on the yfinance library, but we discuss the overall range of options and other alternative providers in more depth in our parent article, Yahoo Finance API – A Complete Guide.

Is the yfinance library free?

Yes, yfinance is completely open source and free. You can find the documentation here.

Why should I use the yfinance library?

- Free

- Quick and easy to set yourself up

- Simple

- High granularity of data (1min/2min/5min data)

- Returns data directly in pandas dataframes/series

As we have just mentioned yfinance is completely open source and free. There are other ways to access the Yahoo Finance data, some free and some paid, and there are certain benefits to some of the options that require paying, like being ensured a degree of maintenance to the solution, but everybody loves free!

Installation couldn’t be quicker or easier. yfinance has just 4 dependencies, all of which come with Anaconda anyway, and installs fully in a single line of code. No account creation required, or signing up for and using API keys!

Its simple. yfinance is highly Pythonic in it’s design and incredibly streamlined. It’s as easy as creating a ticker object for a particular ticker/list of tickers and then just calling all the methods on this object. Like this:

import yfinance as yf

apple= yf.Ticker("aapl")

# show actions (dividends, splits)

apple.actions

# show dividends

apple.dividends

# show splits

apple.splits

# + other methods etc.

Don’t worry, we’ll break down that code further in a bit!

Furthermore, the documentation is concise- fitting on a single page, and the method names are very self explanatory.

High granularity of data. One cool feature of yfinance is that you can get highly refined data, all the way down to 5 minute, 3 minute and even 1 minute data! The full range of intervals available are:

1m, 2m, 5m, 15m, 30m, 60m, 90m, 1h, 1d, 5d, 1wk, 1mo, 3mo

However it is important to note that the 1m data is only retrievable for the last 7 days, and anything intraday (interval <1d) only for the last 60 days.

yfinance also handily returns data directly in padas dataframes or series. This is on contrast to some other options to access Yahoo Finance’s data where you will get lengthy JSONs you need parse for the specific information you want, and will have to manually convert to data-frames yourself.

» Here are some alternative (mostly) free data sources and guides:

Why shouldn’t I use the yfinance library?

- Lacks specialised features

- Some methods are fragile

- Unofficial / not necessarily maintained

- Can get yourself rate limited/blacklisted

Lacks specialised features. Despite the fact you can use it to get a good range of core data, including options and fundamentals data, yfinance doesn’t provide a method to scrape any of the news reports/analysis that are available on Yahoo Finance.

This obviously isn’t ideal if you want to build model that relies in part on sentiment analysis, so if you want that sort of data, you might want to check out RapidAPI (which will talk about more shortly) that does offer such data.

Also, other market data alternatives often include interesting extras. For example Alpha Vantage provides modules that calculate various technical analysis indicators for you- obviously an enormous effort save if you want to build an algorithm utilising any of them! yfinance just provides the basics.

Some methods are fragile. yfinance mainly makes API calls to Yahoo Finance to gather it’s data, but it does occasionally employ HTML scraping and pandas tables scraping to unofficially gather the information off the Yahoo Finance website for some of it’s methods. As such, the functionality of some of it’s methods is at the mercy of Yahoo not changing the layout or design of some of their pages. In fact, yfinance is widely known to already have a few issues.

As a quick aside, data scraping works by simply downloading the HTML code of a web page, and searching through all the HTML tags to find the specific elements of a page you want.

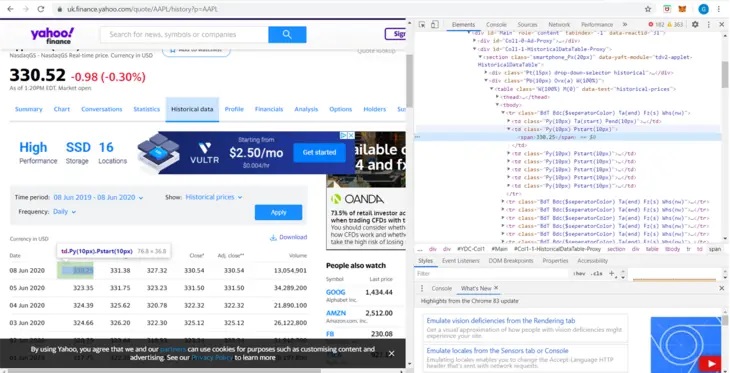

For instance below is the Yahoo Finance Apple (‘AAPL’) historical data page:

If the method to get the historical data HTML scraped, it would be searching the various div, class and tr tags etc. for various IDs to pick out the data that should be returned.

For instance the class ID “Py(10px) Pstart(10px)” refers to the historical prices populating the table. If in this case Yahoo Finance was to change the class ID pointing to this value, the method might return completely incorrect data, or even nothing at all. Again, this sort of vulnerability doesn’t apply to all of yfinance’s methods- most of them do in fact make direct API calls- but it does affect a few.

It’s an unofficial solution. Again, because yfinance is simply the result of one man’s hard work and not in any way affiliated with Yahoo Finance, there’s no guarantee if it breaks it will be maintained.

As we already mentioned it did have a big update to fix issues on May 26th 2019 on the same day it was renamed, but that’s no guarantee problems will be fixed in the future. Are you sure you want to build a trading algorithm on-top of data that might one day suddenly and without warning be wrong? There are already a few known issues with yfinance, which we will highlight later on in this article.

You can get yourself rate limited/blacklisted. Again because yfinance scrapes data for a few of it’s functions, you sometimes run the risk of getting rate limited or blacklisted for too many scraping attempts.

This is a risk that’s always present when trying to scrape websites, but when you’re building applications trading real money on-top of infrastructure that might be making a lot of data requests, the risk:reward changes.

Conclusion

Overall yfinance an incredibly beginner friendly option. You’ll be able to dive right in and test out ideas without wasting time puzzling over complex documentation whilst still having access to a good range of data!

That said, the risk of getting faulty data or being blocked from getting any data at all when employing algorithms trading real money is absolutely unacceptable.

We think yfinance is great for prototyping, or if you are beginner, or just want to download a bunch of historic data.

But if you want complete confidence that a serious trading system is going to function with total reliability, we’d absolutely recommend going with a official and alternative market data provider- preferably one claiming to provide low latency data directly from exchanges.

Polygon and IEX might make good bets.

Visit AlgoTrading101 to read the full article.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from AlgoTrading101 and is being posted with its permission. The views expressed in this material are solely those of the author and/or AlgoTrading101 and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.