Mat Cashman, Principal of Investor Education at OCC joins IBKRs Senior Trading Education Specialist Jeff Praissman to discuss the history of options, the role of the Options Clearing Corporations plays in the industry, and recent volume trends.

Sponsor Contact Information: For more free options education from The Options Industry Council (OIC), an industry resource provided by OCC, visit OptionsEducation.org.

Have an options-related question? Contact the OCC Investor Education team at options@theocc.com or via live chat on OptionsEducation.org.

Connect with OIC Instructor, Mat Cashman.

Summary – IBKR Podcasts Ep. 61

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Jeff Praissman

Hi everyone, welcome to IBKR podcasts. I’m your host Jeff Praissman, Interactive Brokers Senior Trading Education Specialist. It’s my pleasure to welcome to the IBKR Podcast studio, Mat Cashman, Principal of Investor Education at the Options Clearing Corporation or OCC. Hey Mat, welcome to the show. Thank you for joining us and congratulations on the OCC being named one of Built In’s top places to work for the second year in a row.

Mat Cashman

Hi Jeff, it’s a pleasure to be here. Thanks for having me.

Jeff Praissman

Yeah, I mean, you’ve been a frequent webinar contributor for us, so I’m really excited to get you in the studio for podcast. Could you give our listeners just a brief overview of your background in the industry?

Mat Cashman

Yeah, absolutely. I have done probably one webinar a month for the last year or so and I’ve enjoyed them a lot, so it’s really nice to be here for a podcast. My background is really in options trading almost exclusively. I’ve been a trader since about 1997-1998. I started on the floor of the CBOE trading single stock options and pretty quickly after that I moved over to trading commodity options, traded soybean options, and corn and wheat and things like that and the agricultural complex. After I did that at the CBOT for a while, I moved to London with a pretty large Chicago options trading company and started an options book over there that I traded bund, Bundesanleihe options which are German bond options. So, I’ve done a little bit of everything. After that I moved back to the United States and the bulk of my career was probably a 10-year stint from I don’t know, ‘05 to 2015 where I started and ran a group called Toro Trading which was an index options market making business that started on the CBOE, again on the floor of the CBOE we traded index options across all of the different suite of index products on the CBOE. And we wound that down in 2015, and since then I’ve been doing some brokerage stuff and then most recently I landed at the OCC at the OIC where I’m Principal of Investor Education and I teach people how options work, So, I’ve really just leveraged all of the experiences that I’ve had in trading and I utilize all of that to really drive the message home as to how options work both mathematically behind the scenes, but also how they work in a real world environment so that people can understand how to trade them in their own accounts.

Jeff Praissman

And as a former PHLX guy myself, I can definitely relate to your floor history as well with options. But what exactly are those, you know, OCC and OIC? And why are they so important to the option industry?

Mat Cashman

Yeah, that’s a great question and one I don’t necessarily think it’s asked enough to be honest. It’s a really vital part of a of a healthy functioning ecosystem as far as the options are concerned, and the larger idea behind it is that the OCC, the Options Clearing Corporation, is the largest centralized clearing corporation of its kind. Essentially what OCC does is they’re centralized clearing corporation so when you trade, let’s say Jeff, you and I were trading and let’s say I had come to visit the PHLX, and I was on the floor of the PHLX and we were trading. You decided you want to sell calls and I decided I wanted to buy calls. You would sell them to me, and I would buy them from you but what would really happen is that our exchange of risk would take place behind the scenes through the OCC. The OCC is the buyer to every seller and the seller to every buyer. And in the situation where that transference of risk is centralized, what that means is that you and I, even though we made the trade with each other, don’t necessarily have any counterparty risk directly with each other. Our counterparty risk is essentially taken on by that centralized clearing facility, the OCC. So, the OCC is this buyer to every seller the seller, to every buyer and then after that process happens there’s all kinds of other things that they do. They work in the process of settling the options, process of exercise and assignment, which is an entirely different process, but happens in a very centralized way, similar to the way that they centralized the actual transference of risk. And then the OIC where I technically work, the Options Industry Council, is the educational arm of our parent company the Options Clearing Corporation. So like I said, the OCC is the largest clearing corporation of equity and index exchange traded options in the world. OIC started as a collective in 1992 with the aim to better educate the public as to the risks and benefits of exchange traded options. Currently we continue to pursue that goal through. Utilization of our website mainly, optionseducation.org. You can find all kinds of online courses, webinars, videos, podcasts like the one you’re listening to now. At OIC, we’re actually able to provide these services free of charge to the public, because we are actually fully funded by our parent company, the OCC. That’s really kind of the overview of how that whole system works.

Jeff Praissman

So, to really summarize it, the OCC is really what keeps the system working and keeping it safe for everyone. So in other words, if I’m buying an option from you if I’m closing out the position and I sell it you’re not necessarily needing to buy it back. Someone else is buying it back. I don’t need to worry about risk for my counterparty because the OCC basically vetted everyone making sure that everything is going to be above board and that it’s going to be a run as an efficient system where everything is going to be safely processed.

Mat Cashman

Yeah, exactly, and what it really does from a from a real world like where the rubber meets the road perspective is that it removes that counterparty risk between you and I. If you and I are trading, theoretically we don’t have any actual counterparty risk. You can see how that could potentially be an issue, right? If the OCC didn’t exist within that centralized clearing facility, the counterparty risk between two people would be significant, and additionally that counterparty risk still exists in other markets that don’t have a centralized clearing facility like this, right? So swaps markets, places like that where you have a direct relationship with the person that you’re trading with or for instance, other marketplaces that have that kind of setup, you actually have full counterparty risk with the person that you’re on the phone with or trading with electronically, and that is your actual risk. That’s your headline risk. You are in a centralized clearing facility marketplace that risk is kind of nullified by that centralized clearing.

Jeff Praissman

How have options changed throughout the years? What’s kind of the history of options?

Mat Cashman

There’s a lot of history there. It’s a pretty interesting story most people know the history of the options, basically from the 70s onward in the United States, right? That’s when the CBOE came about, right? I think it was founded in 1973 as an offshoot of the CBOT. The CBOE is the Chicago Board of Options Exchange. The CBOT is obviously the Chicago Board of Trade, and most people understand the options history from that perspective. You can go back a little bit farther than that and options history … I would say the earliest — a lot of people think the earliest recorded example of options was probably the 4th century by Aristotle who wrote down the fact that there was someone named Thales of Miletus, who had profited from an oil harvest, right? That had happened before. And this guy Thales had a really good idea about the fact that there was going to be a massive oil harvest and what he did which is essentially kind of creating the first option is he went out and bought the rights to all of the olive presses before this actual harvest came. He thought it was going to be a massive harvest because of all of these different agricultural and weather features. So, what ended up happening is it ended up being a massive harvest. He owned all the rights to the olive presses. And if you own all the rights to the olive presses, and people have a bunch of olives that have just been harvested, but they have no way to press them into olive oil, you can imagine what happens to the price of the olive presses, or the use of the olive presses. People are willing to pay a lot more for them. Well, this guy Thales owns them all so what did he do? He bought them for a specific amount for a set amount and then he sold those rights to other people or a variable amount that continued to go up as the demand for those olive presses took off, and so he essentially created the first call option. That’s what people really think about as the very beginning history of it but if you want to talk about the modern history of it, it’s really since 1973 when the CBOE kind of standardized, how options were traded in the United States.

Jeff Praissman

And I think there’s probably a lot of our listeners that don’t realize that originally puts were something that were added later. It wasn’t always calls and puts now with items traded in decimals or pennies versus what used to be fractions far as multi-listing and all these things have come in to really take away the spread and really make them, I’d say much easier to trade.

Mat Cashman

Yes, much easier to trade and better to trade from the end user’s perspective and you narrow the spread for the end user. It makes it a much easier product to use and it just requires less capital and less slippage, right? You don’t have to cross a giant bid-ask spread and it makes it more liquid.

Jeff Praissman

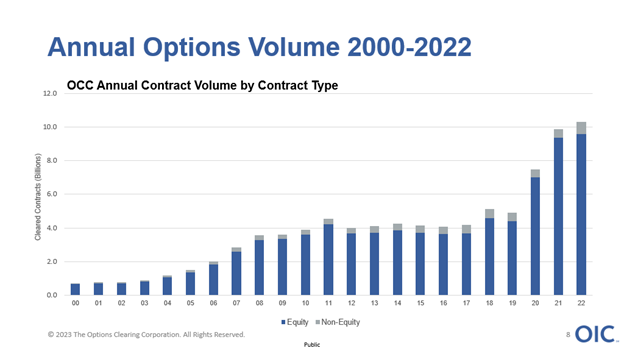

You’ve been kind enough to supply us with the chart, and this will be in the study notes for everyone listening. But looking at the volume over the last 22 years or so, it’s pretty interesting trends and sort of want your take on, say, the last five years, but then also the last 10 years and sort of what you think is behind the volume changes.

Mat Cashman

There’s a lot there to unpack really. Like from 2000 until 2022 and this is a slide that you’ll see in the in the notes. This is a slide that I use almost exclusively and a lot of the OIC instructors use this when presenting about options. What it tells you is that, generally speaking, over the last 22 years options volume has absolutely exploded. Now, with most of that being centered around the last two years from 2020 to 2022, you’re going to see that once the pandemic hit in 2020, there’s a massive spike in options volume. It went from probably like 5 billion contracts that OCC cleared in 2019 to last year we had a record year where we cleared 10.3 billion contract. So, in three years the option volume overall, the full option volume for the entire marketplace of exchange traded options has theoretically doubled.

Previous to that I remember being in the SPX pit on the floor of the CBOE in 2008 and seeing the end of year volume number come across the tape, it’s somewhere close to 4 billion contracts. I think it was like 3.7 billion contracts in 2008 and thinking that I would never ever see something like that ever again. Because I had gone through 2008, traded through this crazy period of time and seen volume numbers that I had never seen before and thought that there’s no possible way we will ever recreate that amount of volume well I was thousand times wrong in that regard. And what happened is 3 years later, in 2011, the sovereign debt crisis hit and OCC cleared close to 5 billion contracts that year, so it’s kind of been a steady rise up until 2020, really. And then you see this giant spike in 2020 when the pandemic hit. There was a period, probably between 2011 and 2019 where things volume wise were very plateaued. Kind of stagnated at a relatively elevated 4 billion-ish contracts a year and then they really took off in 2020. Most people will look back on that data and say the reason why the volume took off is people were home, they were on their couches, they had easy access to zero cost brokerage accounts, and if you take all of those things, they also were getting stimulus checks from the government right, which a lot of people would surmise people have dumped that into options trading or trading in general. And so there’s a lot of those factors that people put together as the reason why this volume has exploded in the way that it has, and I think there’s a lot of truth to that, but I also think that there are many of the things that you discussed, that we just discussed earlier which is giving people better access to a marketplace and educating them as to how that marketplace works are really key factors in pushing volume numbers to the point where they are, because people tend to trade things more actively and in a much more educated way when they have a good basis of understanding of it.

Jeff Praissman

Education is such an important part of this as well, and obviously where you work, the OIC, your goal is to educate consumers on the benefits and risks of options and as well as Interactive Brokers, we have a strong trading education department where we produce videos and not just on our platform but also in general economic and market areas. So, education is so key as far as keeping the marketplace healthy as well, because you obviously want investors in there that are making intelligent decisions.

Mat Cashman

And the last thing that we want is for someone to walk into an options marketplace, not have the educational tools and understanding for what they’re about to do, hit a bunch of buttons., buy or sell a bunch of options, lose a bunch of money and then walk out and say the whole thing’s rigged right? Like that’s the last thing we want because first and foremost, it’s just not true. And then secondarily, that person isn’t going to be using options on a long-term basis for what they’re intended for, which is you can use them for a lot of different reasons. You can generate income with them. You can mitigate risk with them. You can speculate with them. You can do all kinds of things with options, and they’re in a sense , infinitely customizable in the way that you can use them, but it’s important that you understand how they work and what they can do and what they can’t do before you start pressing all those buttons right? And that’s something that when I every time that I’ve ever worked with IBKR, one thing that I always talk about is that you guys dump a lot of resources into the educational aspect of this, and it’s something that is really wonderful to see from my seat because what I do is exclusively educational, right? Like that’s exactly what I do. You guys obviously have an entire business that’s behind it, that’s doing other things, but it’s really refreshing to see a company that utilizes the resources that they have in order to educate their customers as to how these things work.

Jeff Praissman

Right, exactly and to your point earlier we want our investors to benefit and understand the risks before getting into it as well. We want them to stay and they do well, we all do well right? That sort of the thing. It’s interesting that you brought up that 2020 kind of exploded with the pandemic and one possible reason … very likely reason is people are home. They’re trading, but you know people are back to work for the most part now, and it seems like the volume you mentioned was a record year last year, 10.3 billion contracts. What are some of the ways that the option industry — this volume has stayed sticky, in other words, because obviously those meme stocks have gone away to some degree right now. Like GameStop and AMC, you don’t really hear too many headlines about them. And what changes have kind of come across in the last couple of years? How has it evolved to keep this record setting volume going?

Mat Cashman

That’s a really good question, and I really like the idea of using the word sticky as far as the explanation for those volume numbers because those volume numbers are high enough that you could look back and see them as a possible blip on the radar screen and that they were a volume squeeze or something that had happened and that was going to go away. But what we’re really seeing is that those customers that showed up in 2020 are still there and trading, they’re just trading in different ways. And what you’ll see is that you’re seeing the same amount of volume come through but the volume is starting to, in a sense, rotate from product to product or product sector to product sector. And so, what you mentioned earlier was the meme stocks and we all know what happened around that point in time. There was obviously an explosion of options, business and volume in very specific single stock equities and sometimes in very specific strikes within months within those single stock equities, right? We all kind of remember a day when one strike on GameStop was trading more than the S&P, right? Like things like that. Like that isn’t happening anymore. Just like you mentioned, people have kind of pulled back from those kinds of trades but what has happened is 6 months after the meme craze happened what we saw was a big dip in that kind of volume and single stock equity options and a massive increase in, for instance, ETF volume. We would see a year over year increase of 65% in ETF volume. And so we’re seeing the same amount of volume come through, but we’re seeing people move things around in different sectors as far as the options are concerned, and so, whereas they used to trade maybe meme stocks and then they moved to ETFs in between. What we’re also seeing now is there’s a huge move into things like shorter dated options in, for instance the indexes. So the volume is staying sticky where it was, right? We’re expecting another 10 billion contracts, but we don’t know exactly where the next rotation is going to be as far as the volume is concerned. So that’s kind of … I hope that gives you an explanation of where those volume numbers are now as opposed to where they were.

Jeff Praissman

Seems that it almost kind of shows a maturation of the investors wealth to kind of go from these headline news stocks to ETFs or indices ETFs. For our listeners, they act as indices they basically replicate them. And you mentioned the daily options, we both remember a time when there were only monthly expirations and then it went to weekly and then now for these ETFs and some indices there’s daily expirations. Where do you think the industry is headed in the future? What do you think is maybe the next innovation to keep the stickiness as well as you know, obviously there’s a sort of a supply and demand where coming up with the supply that is going to help keep the investors in demand I guess.

Mat Cashman

I agree, I think what we’ve seen recently is such a massive shift into the shorter dated options. And I’ve had many, many conversations with lots of people that are involved in the business and this is a very in vogue thing to talk about and part of the reason why is because we’re seeing incredible amounts of volume that are really focused in these 0DTE options, days to expiration options. For those who don’t understand, 0DTE option is an option that is listed, traded and expired all on the same day essentially. And what that means is on Friday they might list the Friday option that will expire on Friday and so you get one price iteration as far as settlement is concerned for that option. Now what that really is that trading it has a completely different risk profile than trading a 365-day option or a 225-day option, right? It’s a very, very specific risk transference vehicle, and the amount of volume that we’re seeing pushing into those options is really kind of changing the landscape especially in the index as to where the volume is, and if you’re a market maker and you’re making markets and index options, you have to respond to volume numbers that are like this, right? If everyone wants to trade the front of the curve and you’re a market maker, you have to start trading the front of the curve because if you don’t, you’re just standing there twiddling your thumbs waiting for someone to come buy the year-long options or sell the year-long options. That’s not really a recipe for success from a trading perspective.

But I would say really on the whole, if you zoom out a little bit as far as the industry is concerned, that really what we’re going to probably see, and this is my personal [opinion] is that the exchanges are and they’re kind of already doing this — you’ll see this. They’re going to have to be constant innovations as far as options contracts are concerned that are going to meet those investors where they are and give them what they’re looking for in order to actually be able to cover their risk in the way that they want. And so the exchanges that are best and most nimble at doing those things and innovating in those products are going to be the exchanges that end up with the lion’s share of the volume going forward and I think you’ll probably see a lot of dynamic movements of where that volume is as those products get kind of innovative and rolled out to the public and there can be a big difference between whether or not a product is successful based on how it’s marketed, right? Like that matters. You know some products launch and don’t do very well, and part of the reason why is maybe the targeted marketing effort wasn’t quite as targeted as it should have been, right? It doesn’t mean it’s a bad product, it just means that maybe the message didn’t get across to the people that it should have gotten across to say they wanted it in the first place. But generally speaking, I think what we’re going to see is as that volume rotates back in and forth around different products that the exchanges are going to have to respond to that and be able to be the engine of innovation for where those new products come from that are going to drive that ball.

Jeff Praissman

And you know, at the end of the day options are called derivatives for reason. They really add that extra layer to your portfolio. So in my opinion, the more choices there are out there for investors, and the more the exchanges innovate really the better off the industry is because like you said, some will be popular, some won’t. But if they’re filling a need, that’s usually a good thing as far as you know, having the investors have different options on options.

Mat Cashman

Yeah, I would agree. I would agree with that. I think it’s really interesting when you think about it from an exchange perspective because they would in a sense, love to roll out options on everything, right? Like they want to give you as much “optionality” as they can, but they are left with a decision and a balancing act. They only have so many resources that they can throw at this whole thing, right? And listing options and then making sure that they’re settled correctly and that the prices are disseminated correctly and that et cetera, et cetera, et cetera, it takes a certain amount of resources from either a digital perspective or a manpower perspective, or just the people that that write the code that that underlies this entire thing. Exchanges don’t want to list options that aren’t going to trade because remember exchanges make money when the options actually change hands when they trade. And so listing an option from an exchange perspective that doesn’t trade is a losing business proposition, right? And they have to evaluate that on a kind of case by case basis as to where they think the best utilization of their resources are as far as that is concerned and so you have to think about it from that perspective as well. There’s lots of different layers of how this works.

Jeff Praissman

Now I mean this has been a great conversation, Mat, I want to thank you for coming by and joining our podcast. And you know, for our listeners, for more from Mat and the OCC please go to our website under education and to view the previous OCC webinars as well as keeping an eye out for any upcoming live events. I also want to remind everyone that you can find all our podcast on our website under Education, scroll down to IBKR Podcasts, or on Spotify, Apple Music, Amazon Music, Pod Beam, Google Podcasts and Audible. Thank you for listening, until next time I’m Jeff Praissman with Interactive Brokers.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.