Sean McGovern, vice president of research at McAlinden Research Partners, returns to our series on agricultural commodities for a deep look into wheat futures and how the ongoing Russo-Ukrainian War has been affecting prices. Will Russia extend the upcoming deadline for the Black Sea Grain Initiative? And how will shipment pressures affect the likes of ADM, Bunge, and other companies in the grain industry ecosystem? Join us for a full rundown, complete with IBKR’s Jeff Praissman’s and Cassidy Clement’s stories of higher consumer costs, whether GMO wheat will disrupt traditional business, and … whatever happened to the restaurants’ bottomless bread basket?

Note: Any performance figures mentioned in this podcast are as of the date of recording (February 16, 2023).

Summary – IBKR Podcasts Ep. 63

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Steven Levine

Hello, and welcome to IBKR Podcasts. I’m Steven Levine, senior market analyst at Interactive Brokers. I’m your host for today’s program. We’re joined, again, by Sean McGovern, vice president of research at McAlinden Research Partners – this time to talk to us about the current state of wheat futures. This is part of our series on agricultural commodities and what you might expect your next breakfast bill might cost you.

Welcome back with us, Sean! Really great to have you here. Thanks so much.

Sean McGovern

Absolutely. Good to be back.

Steven Levine

It’s great to have you here. We had a coffee break, right? Now we’re on a roll. This is great. For those of you who haven’t had a chance, Sean gave us some really great insights on coffee and coffee futures on our podcast called ‘Time for a Coffee Break?’. That’s streaming now on IBKR Podcasts. And also back with us from that podcast is Jeff Praissman, IBKR’s senior trading education specialist. Welcome, Jeff.

Jeff Praissman

Thank you.

Steven Levine

Along with Cassidy Clement, IBKR’s senior manager of SEO and content. This is her first time here with us. I believe SEO is ‘search engine optimization’ is that right?

Cassidy Clement

You got it right. Exactly what it is.

Doling Out More Dough

Steven Levine

We’re not going to get too far into that or what that means exactly. But we will hear some of what Cassidy and Jeff are spending on wheat products at their local markets like bread, bagels, cereal, things like that.

So, everybody, really great to have you here. It’s like a party, again. And this time, we’re going to talk about wheat. It’s one of the staple ingredients in many people’s diets. A lot of references to wheat in popular culture…. You might not know it, but there are. I think John Denver had a song in the mid-70s that said ‘gold is just a windy Kansas wheat field’ … and that’s so nice. In fact, according to the Kansas Department of Agriculture, that state is apparently the world’s best source for hard red winter wheat. I looked that up. So, there’s a hard red winter wheat, as well as hard white varieties, and we’ll talk about that a bit later, along with how some wheat-related companies may be affected by swings in the prices of wheat futures like ADM, Bunge, and food companies like General Mills and Kellogg’s.

So, great to have all your perspectives, providing some insights into what wheat futures prices are doing – why – and how much some of us are paying for their wheat products at local markets. So, that brings us to Cassidy and Jeff.

Cassidy. Let’s start with you. You consume certain wheat products for breakfast, right?

Cassidy Clement

Yes.

Steven Levine

Okay. So, can you tell us what that is, what your brand of choice is, how much you say that costs you, and is it more or less than, say, what you paid last year?

Cassidy Clement

Sure. So, growing up in the. Northeast, classic breakfast item is bagels, and being that we’re here in the HQ in Greenwich, Connecticut, we’re pretty close to New York City. So, the bagels here are known to be very good. That’s usually what I will go for for bread. Probably last year, I was looking at maybe like $3.99-$4.99 for a bag of bagels.

Steven Levine

Wow, that’s cheap now.

Cassidy Clement

Yeah. Well, now it’s $6.99-$7.99 at a local grocery store. I’m not really a ‘loaf of bread’-type person, but that’s usually my temperature gauge on wheat in my daily…

Steven Levine

That’s like twice the amount that you paid last year.

Cassidy Clement

Exactly. I’m a little more understandable if I were to go to a mom-and-pop bakery … to understand the various costs that have come into play, whether it’s from inflation, or a few years out of COVID with issues with business, but when it comes to large-scale brands, I’m not the only customer, so it’s really wild to see that.

Steven Levine

Bagels. I haven’t had bagels in a long time. They usually make me pretty tired. We had coffee that…. That was something that gets me up in the morning, but bagels seem to drag me a bit down; but it used to be something that I used to love. I’m glad I’m not spending that much money on bagels. It’s crazy.

Jeff, what’s your breakfast like in the morning with respect to wheat-related products?

Jeff Praissman

I have two breakfast go-to’s, and both involve Martin’s whole wheat potato bread. If I have a little more time, I’ll usually have a couple of sunny-side-up eggs with a couple of slices of toast and dip the toast in the yolk and kind of enjoy my breakfast. If I’m rushing out the door, I’ll just make a couple slices of toast and throw some peanut butter on it. And in both cases, like I said, the Martins whole wheat potato bread is really what we like in my household.

Steven Levine

Yeah, that sounds really, really great. What was the brand of bagels you bought?

Cassidy Clement

Steven Levine

Thomas’ bagels. Wow. Okay, so, I can tell you that I typically have two slices of wheat toast in the morning. I get a 24-ounce bag of multigrain bread from a company called Alvarado Street Bakery. It’s based out of California. Packaging tells me it’s from organic sprouted wheat. I don’t know what that is, but it costs me about $6.99 at my local supermarket. I don’t know what sprouted wheat is or what the difference is, but … sounds good … sounds healthy. So, I’m kind of a sucker for healthy things like that. But I’d like to learn more about what these differences in wheat are, and if we’re spending reasonable amounts of money on our wheat products. I mean $6.99 from $3.99 from a year ago sounds like a lot for bagels, I don’t know. But I’d like to hear from you, Sean. When you’re looking at this bigger picture of global commodity availability, demand, supply chains … all these other influences that may affect wheat prices, we’ll talk about all that later, but would you say it’s reasonable? I know I asked you this question about coffee – if it’s reasonable that what we’re paying for these items is reasonable. And I know for coffee you said it was something of a luxury, but I don’t know if that’s the same with wheat? Is it? I mean, maybe it’s a healthy thing or … I don’t know. What are your thoughts there?

Sean McGovern

I think I’m going to essentially echo a lot of the same sentiment I had about coffee, but I’ll put it more simply this time.

Steven Levine

OK.

Sean McGovern

I like Wonder Bread Texas Toast … all that. You know, just as much as the next guy. But I’m not going to tell you that swapping out the fancy sprouted grain bread for them is the secret to becoming the next billionaire or something like that. But really, though, there Is a marked difference out there between different kinds of bread. In fact, you notice bread tracks with things like culture, and so many places you can tell a nation by its bread as much as it’s language sometimes. We definitely shouldn’t be missing out on that variety in our lives. So, feel free, please. You have my endorsement. Go out … ignore the finances a little when it comes to good bread, I think.

Wheat Varieties – From Kansas to Chicago

Steven Levine

Okay, okay. Well, what are these differences exactly between, like what Kansas is producing in terms of hard red winter wheat or hard white wheat or sprouted wheat versus whole wheat? And what are we buying on the futures exchange when we buy wheat futures?

Sean McGovern

For our purposes, that’s going to be the soft red wheat. ‘Chicago SRW’ is more specifically what they call it. That’s what we’re talking about when we reference wheat futures here; those are the most liquid contracts trading on the CME – the Chicago Mercantile Exchange, and they form the benchmark even though there are also winter wheat futures [KC HRW] out there as well. These are, as I said, going to be the most liquid – the Chicago SRW. The hard versus soft differentiation really has to do with the gluten content of the bread, how malleable it is, how it’s going to form when it’s baked. Hard wheat is typically what you’re going to be using for breads. Soft wheat is going to go into a cake or some kind of baked good that’s more crumbly than it is stretchy. The color descriptions of the wheat – white versus red –those do relate to the tanness of the bread, with red being more so than white, but it also delineates flavor and protein content. So, red wheat is going to be more bitter and have a greater amount of protein content. You did mention the sprouted bread, so I’ll tell you a little about that.

Steven Levine

I’m scared now. I don’t know if I want to know … but go ahead.

Sean McGovern

I used to eat Ezekiel bread a few years back – that’s also sprouted grain bread, but you typically see it in the freezer at the grocery store. You have to freeze it at home, too, because it has no preservatives at all in it. My mom always put all bread in the freezer anyway, no matter what it was. So, that’s par for the course for me, but what the sprouted grains actually is – it just means the grains …. they’ve been allowed to sprout, right? Germination. Those sprouts that come out of these whole grains release enzymes that make them sort of lower on the glycemic index, and in short, that just means it’s easier to digest the proteins and things like that are going to be more bioavailable, if you believe in that.

Steven Levine

So, everybody on this can feel rest assured that if you’re eating sprouted wheat … and if you’re not, maybe you should consider them … because it sounds like they’re healthier.

Sean McGovern

They may be.

Steven Levine

We’ll go with that.

Sean McGovern

I’m not a nutritional expert. That’s not my place of expertise.

Wheat Futures & The Russo-Ukrainian War

Steven Levine

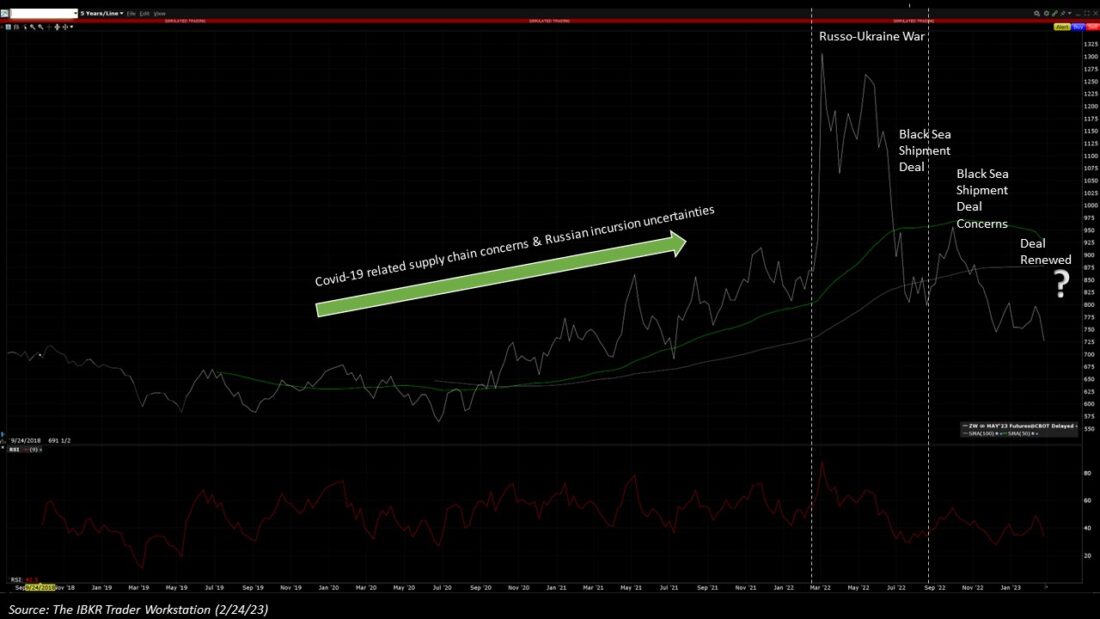

I was just hoping to get some validation from it, but we’re all good. So, let’s talk a little bit about wheat futures. And we’ll get into other things later in the podcast, I know people will be interested in, including genetically modified wheat … and that’s something else on the sort of nutritional side that we’ll get to. But I really want to understand what’s happening with wheat futures, because I’ve seen a huge spike when the war between Russia and Ukraine started, or around the time it started. I think at the end of February last year they had hit a fairly astronomical height. I think it was something on the order of over $1,300. I think it was like $1,306 ½ at the end of February [2022]. It’s now at around $780 ¼ the last time I looked. So, the war keeps going on, but futures prices of wheat have dropped significantly from the end of February last year. So, I guess my questions are … a lot, right? How much of the global supply is coming from Ukraine? How much of the price swings that we’re seeing is due to really the contentions that this war has brought about?

Sean McGovern

We’ll go through that kind of point by point, because the Russo-Ukrainian War is the number one catalyst we are watching … we have been watching … in our research about grains, wheat specifically. So, traditionally, the region encompassing Ukraine, as well as the western portion of Russia, has been known as the bread basket of Europe. In more recent times, that’s been more like the bread basket of the world due to the massive reach of these countries’ grain exports. As far as total supply of wheat goes for the whole world, Russia is around 8.5%, Ukraine is producing roughly 3.1%. Those kind of sound like small shares when you first hear them, but each of those countries are always among the top 10 producers for any given year; and combined, you can kind of look at that [as] every one out of every 10 bushels of wheat is coming out of this region. Russia is having a huge surge in their domestic wheat harvest over the last year that jumped above 104 million tons in 2022. That was up 37% year-over-year, and NASA’s Harvest program has used satellite data to determine that farmers in Ukraine harvested about 26.6 million tons of wheat for 2022. That’s several million tons greater than some of the more pessimistic forecasts from earlier in the year, but it’s still about 20% below the previous year’s harvest. Now, we talked more specifically about the exporting capacity of these grains. Russia is typically the global leader, and Ukraine is not very far behind. This grain deal is really what is going to define grain prices going forward from here. That’s our belief. That’s something we’ve been watching. We’re about a year into this stage of the conflict … that it’ll be exactly a year on February 24th, but obviously this war has been going on much longer than that, and grain prices were already on the rise well before the Russian military units had formally crossed into Ukraine. Right now, we’re specifically monitoring the fate of that Black Sea Grain Initiative, which is sort of a trade deal Turkey and the UN brokered with each country – Russia and Ukraine – to end Russia’s naval blockade of Ukrainian ports back during the summer. That agreement created a neutral path through the Black Sea and into Turkey’s Bosphorus Strait for merchant ships. From there, ships passed through the Mediterranean … move freely. The deal sets up a system where observers from all four parties monitor the loading of the grain and get to inspect the ships. That’s been facilitating the shipment of a significant amount of Russian grain, Ukrainian wheat, which has gone on for several months. That’s why you’ve seen the prices fall like they have, but here’s the thing that we need to watch out for: That agreement was initiated in July and was renewed for 120 days in November. But with the escalation of this conflict beginning to ramp up, it remains a mystery whether Russia will sign on to another extension before the upcoming deadline, which is March 17th. They did suspend their involvement in the deal once, back in October. That breakdown only lasted for a few days, but it does show how tenuous this all is.

Steven Levine

I saw prices start to rise, I think, at about that same time that that deal became compromised. So, really, you’re looking at more supply coming out of Russia, and a fairly fluid export in the Black Sea at this point. That’s keeping prices where they are, but that could reverse.

Sean McGovern

That’s exactly right. And that’s starting to slow down, though, and this is why we’re concerned.

Russia is getting pretty complacent about the number of ship inspections that they’re doing, because all of the parties have to inspect these ships before they go out. If you go back to September, the inspections were running at a pretty good pace of about 10.4 per day. They peaked at 10.6 in October. It’s been all downhill from there. That fell to 7.3 ships in November. 6.5 in December, and then only 5.3 by January, so only 85 ships actually got to pass through the Bosphorus carrying grain for the entire month of January. That was the lowest level since August, and due to that, we’re now looking at a backlog of more than 100 ships idling, waiting to pass through the straight as of late January. So, that’s a twofold problem: One, because it simply means less grain is getting through in the short-term, but moreover, it seems Russia might be souring on this deal, and this is kind of their way of quiet quitting, right? It’s important to note that the grain trade is a significant source of revenue for Russia, which it needs to pay for the war. But if they see bailing out of the deal as a way to renew their blockade in the Black Sea and kind of use economic warfare against Ukraine, that would put the rest of the world back to square one as far as grain shipments out of this key region go. And obviously that situation could quickly begin pushing wheat prices upward again.

Steven Levine

I think I’ve read in your research, as well – McAlinden [Research Partners] puts out amazing research…. This piece that I had read was really insightful about the possibilities of this resurgence in prices of wheat futures. And that was an area in Ukraine that has come under further duress during this war, and that’s Zaporizhzhia, I understand. And, so, are we looking at more supply that could be taken offline because of the devastation that’s being wrought in that region, which I understand is fairly wheat-rich?

Sean McGovern

Yes, that is exactly one of the things we’ve been focusing on. We break this down by region. So, Russia controls, or they claim control, of five regions, and to some degree they do occupy each of those five regions, which we call ‘oblasts’. Oblasts are the equivalent of what we would know as a state. So, you have Crimea, Kherson, Zaporizhzhia, Donetsk, and Luhansk. Those are the oblasts that are home to about one-third of the total planted area for Ukraine’s winter wheat. That’s the crop we’re focused on during this time of year. That leaves two-thirds of the country’s planting area, and what we would consider mostly secure territory for now. Also, consider that not all of the crop under occupation is going to waste, as plenty of reporting has shown, Russia is taking advantage of the Ukrainian fields they have under their occupation and shipping off that grain as their own and bolstering global supply. But everyone in the world is sort of talking about a renewed offensive by Russia. That was something we were looking at a couple of months ago. We thought it would start sooner, perhaps, but every think tank … every kind of intelligence agency … is now speaking about this. We’re waiting on it. It’s very unpredictable. The situation is fluid, but an increase in the fighting would suggest more sanctions on Russia, maybe more non-compliance by Russia with this deal … and getting out of this Black Sea grain deal. So, the conflict … watching the updates on what’s happening on the ground … is going to kind of give us signs about what to expect with any kind of diplomacy that’s going on right now.

U.S. Supply & Exports

Steven Levine

What are the other countries that are responsible for the global supply of wheat, and how is, say, weather a factor for these countries? I know we talked about coffee in Brazil last time. I’d also like to know about U.S. production, because we seem to have a lot of wheat fields here, don’t we? I mean, we just talked about Kansas. And, so, how much does the U.S. account for wheat production? I talked to Jeff about this earlier today. We can’t imagine, really, that we would be importing wheat from anywhere, so let’s maybe talk about that.

Sean McGovern

Yes, the U.S. is a huge exporter of grains … wheat specifically … wheat, corn, any kind of agricultural commodity, the United States is a big player, and, as with any agricultural commodity, weather is going to play a huge role in the actual planting and harvest process, along with influencing traders’ expectations. Favorable, mild temperatures this winter, particularly across North America, have been yet another contributing factor to recent softness in wheat pricing. The United States and Canada continue to play large roles in grain markets, and a lot of those developments in the North American market more closely than most other regions. Last month, Reuters reported that farmers expanded their plantings of winter wheat this year by 11%, and that put us at an eight-year high, which is undoubtedly influencing price fluctuations. There are some concerns about how much crop will be grown as the drought monitor is showing some exceptionally dry conditions across Nebraska, Kansas, and Oklahoma, as well as at least moderate drought conditions across most of the High Plains regions. But those seem to be offset by otherwise calm, temperate weather. What we see today is also significant: significantly less dryness than what we had witnessed in a lot of 2021 and 2022. About 9.7% of the U.S. is currently experiencing what would be categorized as extreme, or exceptional, drought, but more than 13% of the country actually fell under those categories at this time last year. If we go back even further … back to 2021 … almost 21.2% of the U.S. would have been suffering from those levels of drought at that time. So, relatively speaking, mid-February moisture has improved significantly versus those two past years.

Steven Levine

It sounds like it’s, on average, pretty good news for production in the U.S. in terms of wheat.

Sean McGovern

Yes, that’s exactly right. That’s what it seems like.

Inflationary Pressures & WASDE

Steven Levine

So, that now kind of transitions this whole discussion towards the prices that we’re paying at our retailer. I mean, as Cassidy said … How much is it now? $6.99?

Cassidy Clement

I’d say probably $6.99.

Steven Levine

$6.99. And Jeff was yours higher, lower than last year?

Jeff Praissman

It’s definitely going up. I don’t think it’s significant as Cassidy’s bagels, but I want to say it was probably like $4.25-$4.50 last year, and it’s probably around $5.00 a loaf at the local supermarket. So, I mean, it’s still going up 10%, or more than 10%.

Steven Levine

The direction is going higher. So, I want to put this out there, because this is very scary to me, along with the nutritional value of my bread…. But Breakfast Index, according to Bloomberg, is up, and this is a report that came out today, I understand from the UK’s National Statistics Office or Office for National Statistics. Food inflation: The average cost of breakfast, it seems, in the UK has gone up the most since the index began. So, the price of milk has gone up 50%. Eggs and butter up almost 30%. Bread – up over 20% since last year. So, this is fairly scary. I don’t know the dynamics exactly of where the UK sits in terms of the economy of wheat, but what is the U.S. looking at in terms of, say, wheat in in the CPI [Consumer Price Index] or in producer prices [PPI, Producer Price Index]?

Sean McGovern

Believe it or not, the Consumer Price Index has a component for cereals and bakery products. That’s one of the biggest ways we measure that. It’s still soaring. It’s up 15.6% year-over-year as of January. That price growth may have already peaked, considering that’s actually down from over 16% last August. We can’t be certain whether that downward trajectory will hold considering there really is so many factors in play in grain markets right now. But if we don’t see a major shift in weather or the geopolitical realm, disinflation and wheat products may play a role in dragging down broader food inflation, which appears to be following the same pattern. For some goods on the producer side, though, it’s a totally different story. For instance, we’ve seen producer price growth for goods like wheat and wheat flour falling rapidly. The annual change in the Producer Price Index for wheat actually just turned negative for the first time since 2020 in December. That’s the most recent PPI we’ve gotten as of today. Those goods appear to be following wheat futures lower, but producer prices for cereals haven’t rolled over nearly as much, even though they, too, appear to be past peak.

One thing I will point out as sort of an anecdote: Does anyone remember when we got free refills of the bread basket at a restaurant without having to ask? I feel like that’s totally gone now.

Jeff Praissman

Yes, absolutely.

Sean McGovern

Most places, they won’t give you a hard time if you ask for it politely, but I feel that kind of element of hospitality … the endless bread basket … that’s something that might have been lost as a casualty of inflation.

Jeff Praissman

I would almost go a step further, and I feel like it’s not being offered as much – even the initial bread basket. I feel like you almost have to ask for some bread sometimes versus before, [when] it would just automatically appear on the table.

Steven Levine

Yeah, this is the Oliver Twist story, isn’t it? It’s like the ‘Please, Sir, may I have some more?’ This is terrible. That’s a sort of version of shrinkflation, I suppose, or like the diner coffee that we talked about before, right? I mean, it’s like, okay, let’s skimp on how much we actually put in this water. And, so, it just tastes like coffee-burned water. It’s very sad. Well, I guess, too much bread is not good for you anyway, right? I’m not a nutritionist either, but I’m going to just put that out there. Too much of anything is not good. Don’t keep eating the bread. You won’t have room for dessert. I think that that’s the way it goes.

So, you talked a lot about weather conditions in North America. And the World Agricultural Supply and Demand Estimates, or WASDE … it comes out monthly, right? The World Agricultural Outlook Board puts it out. It gives us an annual outlook for supply and how the use of domestic and global wheat is panning out, among other things, like rice and oil seeds and cotton. So, what is the latest WASDE, Sean? What can that tell us about the outlook for wheat and how might that be a factor when considering the commodity in terms of inflation?

Sean McGovern

Yes, we just got the most recent WASDE report on February 8th. And what we’re seeing is a rise in U.S. wheat stocks for the 2022 to 2023 period and mostly flat exports. World wheat production was up slightly and so were inventories. That would suggest continued moderation in prices ahead, which is what it seems speculators are betting on as well, according to the net short positioning on Chicago wheat we’re seeing. Toward the end of January, we actually saw speculators establish their most bearish stance in Chicago wheat since May of 2019. Weaker commodity prices certainly contribute to some knock-on deflation, but we can’t forget that the impact of so many other factors … wages, transport costs…. All of that is associated with getting wheat from the ground to the finished product on a store shelf, where the consumer will be paying for it. So, it’s a factor, but it’s not everything.

Knock-on Effects

Steven Levine

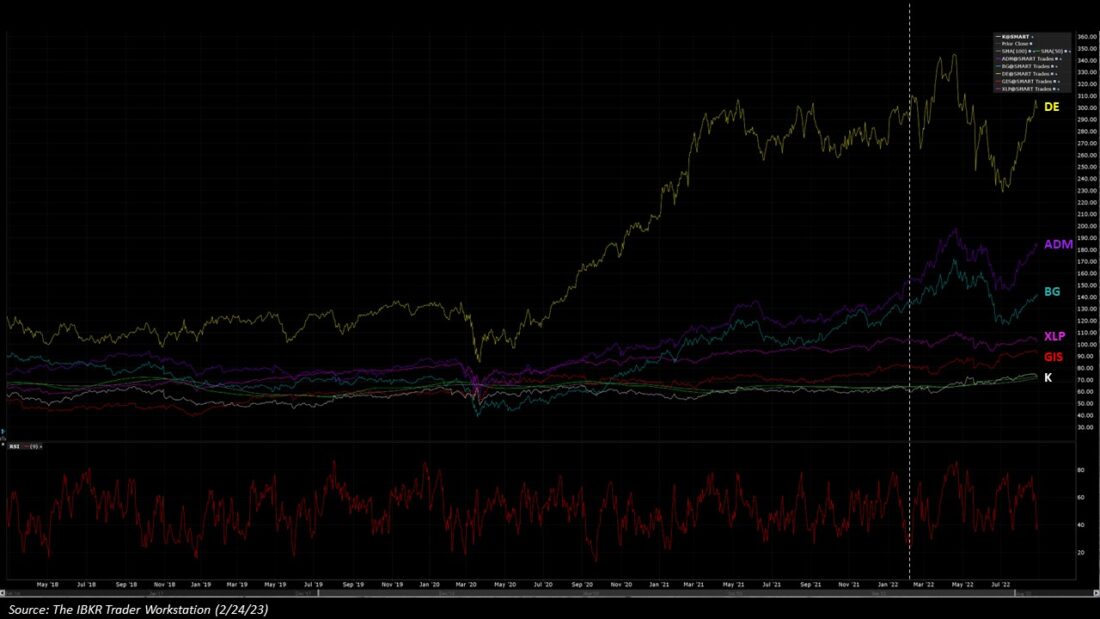

Energy is certainly a factor when you consider the transport. I can understand that. So, let’s switch gears a bit here and talk about some of the companies that are beholden to, say, wheat prices. And these can be all sorts of companies in the ecosystem, like Archer Daniels Midland, ADM … Bunge, Bunge is a food processor … it does grain trading … and it’s a fertilizer company out of Saint Louis. They each released their [earnings] results pretty recently. ADM’s stock is down year-to-date. At the time of this recording, it’s down about 9% year-to-date; Bunge’s up about 4% over the same period. So, do you have an outlook on say these companies, or any companies in the ecosystem, that may be wheat-related? [They] could be consumer staples companies as well … or Kellogg’s … General Mills … I mean all sorts of different companies I suppose.

Sean McGovern

Sure. Among these enterprises … ADM, Bunge … these kinds of guys, they specifically are major grain traders and derive a lot of their revenues from that line of business. And they’ve certainly benefited from a lot of the factors that we’ve already discussed: shipments of wheat out of Ukraine choked by blockading and then suppressed even once they were able to get that grain to the market; North American grain shipments definitely had to go and fill in that gap, and obviously that helped traders based in this region benefit from those higher prices. Even though wheat futures, and contracts for soybeans and corn and other commodities, did come off the boil later, in the second-half of the year, you zoom out a little bit more, look at the two to five year chart on these futures, and that shows the rise in pricing we’ve seen has been occurring gradually, and they remain stronger today than they were at the start of the 2020s. Sure, you saw a really aggressive spiking of those prices in 2022, but the reality is that the more long-term uptrend remains intact. And that has helped farmers and crop traders continue to grow their revenues in the grain business year after year. There’s definitely risk on the demand side for these firms – recession fears still looming, but the Fed’s rate hikes slowing down, getting smaller. You’ve got Chinese demand coming back onto the scene. That’s going to mitigate some of those worries. Supply disruptions may play the larger role in defining the direction of prices moving forward. Whatever happens in that realm will flow downstream to the bottom line of middlemen like some of the firms you mentioned.

Steven Levine

I can’t imagine the demand would wane too much for Wheaties, right? I mean, that’s like the ‘Breakfast of Champions’. Wheaties and All Bran. These are really iconic products in the cereal aisle. I wonder about shrinkflation with respect to these kinds of items as well. I haven’t tested it, I don’t know. I imagine there would be. But I mean, I haven’t heard stories. Have you heard anything?

Sean McGovern

Well, there is a little bit of an interesting dynamic going on with name brands versus private labels. So, name brands … things like Kellogg’s and General Mills … they gained market share during the pandemic due to stimulus checks, generous unemployment benefits, all this money that was floating around during that time. But that trend reversed course as savings have gotten tighter for Americans. However, recently, because of that, private label prices – this is the store brand – have been rising quicker than name brands, which could start to shift the balance back toward those name brands, potentially.

Will GMO Wheat Disrupt the Industry?

Steven Levine

This brings us to our very last question … very last point. I know I mentioned it earlier, and I’d like to talk about it, because I think it’s a fairly interesting concept. It’s a little bit like the concept that we brought up about the coffee being made without coffee. This is genetically modified wheat. So, I understand that Brazil has fairly recently taken some steps to import genetically modified wheat flour from Argentina. So, genetically modified wheat, I understand, appears to be about combating inflation, dealing with weather … like droughts. It seems to appeal to environmentalists. So, it’s supposed to help reduce prices of bread and pasta and breakfast cereal and so on. And, so, do you think, Sean, in your view, is it … or will it be a disruptor for the wheat industry as we know it? Do you think it will? Do you think it might be a necessity to have to do this at some point if things get too tight in supply?

Sean McGovern

I’ve been looking into the research on GMOs for my own edification, nutritional planning, for years now. I went through a period where I was doing mostly organic food. Sounded nice and kind of gave you that feeling that you are healthier and better than everyone. But it just doesn’t bear out in the research. We’ve been genetically editing crops for thousands of years through selective breeding. And sure, that wasn’t done in a laboratory like it is today, but it’s not far off from the same thing. If you really look into the data we have on the GMOs, which you can easily do through meta-analyses and similarly packaged research, most of the modifications humans have made have been focused on reducing the use of pesticides and herbicides, which are really what hurt people in the past. In fact, you could argue that we need to utilize modification to increase the yield of these crops, reduce the frequency of tilling, which keeps the soil from becoming exhausted, and expand profit margins for farmers. GMOs have been shown to do all that. At one point, organic was supposed to be this disruptor in foods. Not just for wheat, but for agriculture as a whole, and it probably would have been great for General Mills, Kellogg’s – all of these guys – to get on top of that and capitalize. But you actually see profit margins are larger on organic foods than they are for non-organic. At the end of the day, I feel like companies are selling a lifestyle with organic, right? It’s a feeling, and I don’t know how much it really adds as far as utility, or your health, or anything like that. And I also think it’s falling out of fashion due to the rise of inflation. The next disruptor that we’re really looking at is going to be gene editing technologies like CRISPR, if you’re familiar with that. Those methods which allow scientists to target specific genes for removal will make safer genetic engineering of food, more efficient. The data I’ve seen show crops can become much more plentiful and healthy from this kind of intervention. Just last week, new research showed scientists can knock out what’s called an asparagine gene from wheat, which is associated with higher risk for certain kinds of cancer. So, you’re creating foods that might have a risk factor, might not understand it, and might not really know that, but we can knock those things out without destroying the integrity of the food or really even changing the appearance or anything like that because it’s so specific. It’s one little gene you can knock out, and we can do that with CRISPR now.

Steven Levine

Wow, so, it’s like a bespoke manufacturing for all sorts of different ailments or reasons.

Sean McGovern

Exactly.

Steven Levine

I’ve heard of different like bioengineered foods that will inject certain chemicals to combat certain diseases, for example. Really interesting. Jeff, Cassidy, would you all switch to something that had a label that was ‘GMO’ on it … if you were paying, say, less … and the taste was the same?

Jeff Praissman

I’ll start. I’d say, and maybe I have a little bit of the old-school blinders on, I think if I was consuming it, I’d be okay with it. I have children, and I’m not so sure – although maybe it may be safer in the end. At this point in time, I’d probably not switch over – for them. You know, and again, I’m not really putting any scientific proof behind this. I’m just…. It’s sort of like a parental gut feeling of, you know, I don’t really want to kind of take that chance with them.

Steven Levine

Yes, consumer choice. I think that makes a lot of sense. Cassidy, would you do it?

Cassidy Clement

I think, given the option, I’d probably stick more with what I’m used to, but I can understand from the perspective of if supply gets that tight, and there’s not many options on the shelf, I think for myself, yes. As a grown woman, I think I I’d kind of go for it, but I actually completely understand what Jeff is saying. Coming from a big family, I have a lot of very young cousins. I could totally see their parents, or my grandparents, saying, ‘No, no, no, no. We’ll make you something instead.’ But I think for myself, to save some money, maybe. But in the grand scheme, if you’re feeding a family, I could totally sympathize with a couple of dollars is worth it instead of, you know, hopefully not waking up to a child who’s having an allergic reaction or something like that. But I’m not a scientist either. I’m just a gal who likes bagels, so I get it.

Steven Levine

Expensive bagels.

Cassidy Clement

Yes. Unfortunately.

Steven Levine

I think we know Sean’s answer. I think Sean wouldn’t have a problem with it.

Sean McGovern

I wouldn’t. I haven’t. A lot of the food you’re eating are GMO, and you might not even know it.

Steven Levine

There’s supposed to be labeled. There’s supposed to be a label now.

Sean McGovern

I think they are now. But, you know, the labels sometimes are so small with certain things that you don’t even notice them.

Steven Levine

I think they modify the labels as well. There are different languages. I buy my blackberries – you can’t really tell, but the organic ones are labeled in French for some reason. I don’t know where they come from. Probably Canada. But they’re very good. And I think the psychological effects really outweigh everything else.

Anyway, this was all really, really, really, really great. I think we’ve got a lot of really great insights in terms of why wheat futures are priced the way that they are, what kind of knock-on effects they have to companies in the ecosystem that depend on wheat, where they could go, and whether genetically modified wheat could be a disruptor or help to offset supply shortages if that should happen, and we all hope that doesn’t happen.

So, as always, Sean, thank you so much. Thanks for coming back. I hope you’ll come back with us again. Jeff, Cassidy. Thank you both as well. Thank you all for your time.

For our listeners out there, you can read more commentary and market analysis at IBKR Traders’ Insight. You can keep abreast about topics we’ve discussed here, as well as a wide range of other news critical to your investment decisions. McAlinden Research Partners has a host of articles on several different themes – from central banks and gold buying to issues involving cybersecurity. And for a full list of financial educational offerings, visit the IBKR Campus at ibkr.com, where as always, all of our educational material is provided to the public at no cost.

And until next time, I’m Steven Levine with Interactive Brokers.

—

THE IBKR CAMPUS

Interactive Brokers has relaunched IBKR Campus. Access a suite of free education offerings about trading, financial markets, AI and more – from a single source. Visit ibkrcampus.com and start exploring!

LEARN MORE

WHAT’S FOR BREAKFAST – PODCAST SERIES

RELATED IBKR PODCASTS

- From Singapore-on-Thames to Broadgate: A Brief Tour of the British Economy

- Inflation, Rates, and Recession – The Worsening Inversion Version

- Cooking it Up in a Lab – Investing in the Future of Bioengineered Food

IBKR TRADERS’ ACADEMY

- Courses On Futures

- Introduction to Futures

- Futures Fundamental Analysis

- CME Micro WTI Crude Oil Futures

- Understanding South American Soybean Futures

- Introduction to Grains and Oilseeds

- Hedging with Grain and Oilseed Futures and Options

MORE FROM McALINDEN RESEARCH PARTNERS

- CRISPR Closing In On First US Product Launch, Latest Data Shows Treatment 100% Effective After Three Years (7/11/22)

- Russia-Ukraine Tensions Put Global Food Trade at Risk, Mounting Headwinds Face Agriculture Industry (1/26/22)

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.