In part two of this interview, Steve Sosnick, Chief Strategist at IBKR speaks with Interactive Brokers Group’s founder Thomas Peterffy about the company’s past, crypto’s place in portfolios, and more!

Click here to listen to part one

Transcript – Traders’ Insight Radio Ep. 4: Mr. Sosnick, I Do Find You Increasingly Useless

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Steve

So, I want to relate a story to the listeners. One of my colleagues who just retired after almost 20 years with the firm, is he had been working in Europe came back to Greenwich his first day back on the desk.

We’re trading something, and so that the people know, you used to sit just off the trading desk so literally you would…

I’ll tell you the truth, I had a picture frame with a mirror in it so I could see when you’d come up behind me. So, I think the statute of limitations is over — I can tell that story — but I had a picture with a large, mirrored frame so I could see when you were coming.

And I don’t know what happened that day. But he was petrified because something happened and your comments to me was Mr. Sosnick, you’re becoming increasingly useless to me.

Now this is over 20 years ago. I don’t remember what the incident was. It was clearly minor because I’m still here, but you were known for having a bit of a temper in those days. Do you feel that you’ve mellowed over time without changing your intensity to the business?

Thomas

I certainly mellowed, and my intensity in the business has diminished somewhat also, but not my enjoyment.

Steve

Excellent. One thing that’s gotten a lot of press recently was the story that you’ve had a hands off embrace, let’s say, with cryptocurrencies.

Thomas

It was so misinterpreted. So when the Chicago Merc listed crypto futures I was lobbying for a high margin requirement.

I was all in favor of listing crypto futures, but I said to them that look nobody knows what this crypto is worth it. At that time, they were training at $10 or $12,000 a Bitcoin, right? So I said look, it can go up or down in any amount. Basically it could drop to zero and go to $100,000 only in one day.

So if you’re charging a $6000 margin requirement on the short…many clearing firms on the on the Merc are not very well capitalized.

So if they carry this, and they happen to be the [firms] who people with not much money go to trade with because they don’t charge much margin and they charge very little brokerage…

Say the cryptocurrency would triple overnight. They would all go bust, and then well-funded clearing members like Interactive Brokers then have to pick up the pieces. So that’s what I was worried about and that’s why I said that low margin requirement could destabilize the entire financial system.

The result was that they somewhat increased the margin requirement. But I still feel that you know a very, very large jump in the price could be a big problem.

Steve

Yeah, I think that’s something that most people don’t really grasp. It’s the idea that clearing firms there’s a mutual nature to them, and to a certain extent, the best managed firms are at the mercy of the worst managed firms in terms of thinking to kick in.

Thomas

Right

Steve

But the other part of the story that got a lot of press was that you’ve moved some of your money into crypto, and I know crypto resonates with people.

Thomas

It’s a small amount and but I think it’s the prudent thing to do. I mean, if you happen to be wealthy like I am, I can afford to put enough money into crypto on which I can survive, everything else becomes worthless.

Steve

I guess that was where I was going to go. This is in a sense your disaster put as well.

Thomas

Right. I always I make sure that I survive.

Steve

OK, so just to put it back into option terms… this is this is in effect your out of the money put on fiat currency I guess, or an inflationary hedge rather than an investment thesis per se.

Thomas

Right.

Steve

I don’t want to necessarily open this can of worms, but what do you think could put us into such a dire situation where that put comes into the money, so to speak?

Thomas

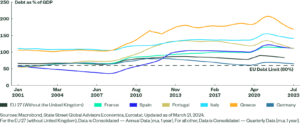

Well, it’s basically people losing faith in the currency. So the United States has always been the… not always, but say for the last 100 years or so, the strongest reserve currency all over the world. But we’re beginning to have issues because the deficit is accumulating at a very, very rapid pace.

At this time when the deficit is $29.3 trillion, the debt is $29.3 trillion. And just yesterday I read that the Fed had put out $8.6 trillion or something like that in in their bond purchases. So that’s all together. $38 trillion out there. It’s an awful lot of money circulating, and it’s given at the same time that we have supply issues.

There is a lot of money chasing a limited amount of goods, and that results in inflation. So now we have this situation where the Fed feels that they have to raise rates to slow the inflationary pressures. But as they raise rates on the debt, the debt service becomes more and more intolerable, and that just adds to the deficit.

So the higher the rates, the higher the deficit becomes, and the higher the deficit becomes, the more the inflationary pressures prevail. So I don’t see how we can get out of this. So the fact is that we have to get used to accumulating more and more and more debt every year and that will go with rising inflation.

Now, I’m not saying all the time, every year, but in most years, we will have substantial inflation and it will rise eventually to a level where it will hit double digits. And at one point people will begin to doubt the value of money, and at that time we’ll have a big problem.

Steve

So a scenario that you’ve described, it behooves you (A) to be a borrower because you’re paying back your loans with deflated currency and, (B) to have real assets.

Thomas

Yeah, absolutely. So, when you see the value of money deteriorating, what do you buy? You can basically buy real estate, or you can buy stocks, or you can buy art. The Fed is saying, OK, we raise the rates to 1%.

So Interactive Brokers currently lends at 1% at that time. If they raise it by up to 1%, we will end up at 2%. If inflation is still 5%, it pays everybody to borrow money from Interactive Brokers at 2% and put it into goods whose value is goes up by 5%, right? So I don’t know how to stop this.

Steve

Now, one thing you didn’t mention was gold, and we have started trading gold on behalf of customers. Do you feel that fits in with the thesis and it’s just out of favor? Or do you feel it’s been superseded by cryptocurrency in some way?

Thomas

So I’m stunned by the behavior of gold. I only have one explanation. That whenever people ask me about gold, I say OK, how much gold did you have in mind? And they say, well, maybe $1,000,000 worth. I say OK, so imagine yourself carrying $1,000,000 worth of gold. You can’t do it.

Yeah, so you know, as long as you have your gold somewhere in a vault that you trust that you can always get to. Gold is a very impractical store of value relative to digital assets, right?

Steve

The flip side being like in Kazakhstan where they shut down the internet and people couldn’t get to their cryptocurrency, but that’s probably less of a permanent scenario than a temporary one.

Thomas

Well, that’s the point, right? So some gold coins are enough in your pocket. Just what you can carry is not a bad idea. And as a matter of fact, when I realized this whole issue with this permanent looking inflationary pressures about three years ago, I bought an equivalent amount of gold and Bitcoin.

Steve

Oh, OK, so diversifying your disaster put as it were.

Thomas

Right.

Steve

We’ve been talking so much about, you know the past and the present … let’s talk about trading for a moment, and here’s a trading question. Would you rather catch a turning point or a trend?

Thomas

I don’t think people can reliably catch turning points. I think that’s impossible. Trends are easier, but of course it’s a… how do you know when the trend turns, right? So since you can’t catch the turning point you can’t catch the trend turns. But the fact is that the look in a rising market or a falling market the next day is more likely to be like the previous day was.

That’s also, markets have serial runs. Trend followers have made a lot of money. And, uh, I do not know too many people who have consistently made money catching turns, although some chartists are very good.

Steve

OK, so it goes back to the theory catch the trend but have a defined exit. Or be careful in case the trend turns against you.

Thomas

So I’ve never been very good as a trader. I’ve been very good as a market maker only because I was always focusing on low transaction cost.

Steve

What, if any, are your regrets? What do you regret over all these years in the business, either not doing or having done?

Thomas

Well, I think that whatever we did we never did it early enough, and never did it fast enough, and never did it with as much conviction as we should have.

Steve

OK.

Thomas

So I think we could have done everything we have done sooner and bigger. But I was half-chicken.

Steve

So I would say you’re right that measuring it would be more of opportunity costs than actual costs.

We’ve been talking for a long time. We’re probably going to end up splitting this into a couple of different podcasts. Is there anything else that you’d really want people to know about you or the firm or just something we haven’t touched on?

Thomas

Well, what I would like people to know is that we have been unable to convey how hard we are working to make the Interactive Brokers platform really much, much better than anything out there.

Because you know competition is very intense. But often our customers say, “How is it possible that your platform is so much better? It has so many more tools and so many facilities and your executions are so much better. Why isn’t everybody on your platform?” And I just don’t know what to say. That’s that …I don’t know. I’ve been trying to figure that out for the last 30 years and I don’t know the answer. We are failing somewhere. We are failing to convey the benefit that we can extend to our customers.

Steve

It’s tough. I mean, so much of it is perception. I do think some of it comes down to ease of use. I think there is a perception that because the platform is so encompassing it is therefore harder and that is a bit…

Thomas

Yeah, ease of ease of use is a problem, but it’s strangely enough I mean, the more capabilities you offer, the more confusing it becomes.

I mean I know my story with my own iPhone. There are so many things that I don’t know how to do on the iPhone. And as they make it easier, it crops up for me when it when I don’t want it to.

So there’s all kinds of things I didn’t want it to do. If somebody one day will figure out how to grow a platform’s capabilities without making it more complicated to use, that will be the ultimate winner.

Steve

So a UI engineer somewhere who’s listening to this please ring in.

Thomas

Really person help us.

Steve

Thomas, we’ve been talking for about 45 minutes. I think we’re going to wrap it up here. There’s plenty of information I think the listeners will love. I obviously really appreciate you taking the time to help make this podcast a success and I want to just thank you.

Thomas

Thank you very much and looking forward to future podcasts.

Steve

Absolutely, as am I.

Take care bye-bye.

Thomas

Bye, thank you.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)