The global economy is expected to slow materially in 2023 to a growth rate of 1.8%. Tighter financial conditions and stubborn inflationary pressures will continue to weigh on economic performance. Geopolitical pressures are likely to continue weighing on GDP growth as well, with the Russia-Ukraine conflict underpinning energy prices while Chinese COVID-19 uncertainties continuously shift risks back and forth from supply chain operations to global health conditions.

The U.S. economy is expected to enter recession in 2023, driven by aggressive shifts in fiscal and monetary policies. Unprecedented levels of fiscal and monetary support have led to significant excesses in asset valuations and consumption patterns that cannot be sustained as monetary policy shifts to significant restraint. Fiscal policy provides a silver lining, however, because while it’s pulled back significantly, it’s arguably still accommodative.

After a difficult year in which the Federal Reserve (the Fed) underestimated inflation and aggressively tightened monetary policy in order to catch up, investors are likely to spend 2023 dealing with declining business performance and dwindling valuations. Declining business performance will be driven by slowing revenue growth as customers curtail spending, while costs remain under pressure due to structurally higher inflation. This inflation is being driven by an incredibly tight labor market, a shift from globalization toward regionalization, geopolitical tensions, relative inefficiencies regarding supply chains, climbing commodity prices and continued deficit spending. Taken together, slower revenues and higher costs point to margin compression and earnings coming under pressure as a result.

On the valuation side, the equity risk premium isn’t properly pricing earnings softness alongside the higher yields that are driven by structurally higher inflation. At a price-to-earnings (P/E) multiple of roughly 17, the equity market competes with “risk free” government bond multiples as low as 21 based on a yield of 4.74%. Investment grade credits, furthermore, offer multiples as low as 19 based on a yield of 5.26%. High yield credits rival equity returns for those who like to parse through the distressed areas of the fixed income market. As a result, the equity market is currently not a good value proposition unless you believe yields will decline dramatically and earnings will hold up, both of which are significantly unlikely in my view. The S&P 500 is likely to reach a low of around 3,100 as earnings per share (EPS) sink to $206 and the P/E drops to 15.

The potential light at the end of the tunnel may be a Fed pivot to a more dovish stance in response to higher unemployment and cratering inflation. While inflation may settle at 3.5%, and not the Fed’s 2% target, economic turmoil, higher joblessness and political pressure may lead the Fed to soften its hawkishness. The Fed’s focus may shift from inflation to the central bank’s second mandate: maximum employment. A shifting Fed and lower yields at the short-end may drive equities higher in the second half of the year because equity prices and earnings will respond well to higher inflation alongside an easing Fed. Higher inflation would make year-over-year revenue and earnings results more manageable and support investor sentiment by masking the true characteristics of organic growth. This potential Fed pivot could drive the S&P 500 to 4,100 at year-end with EPS growing slightly to $228 while a potential boost to investor sentiment could drive the P/E to 18.

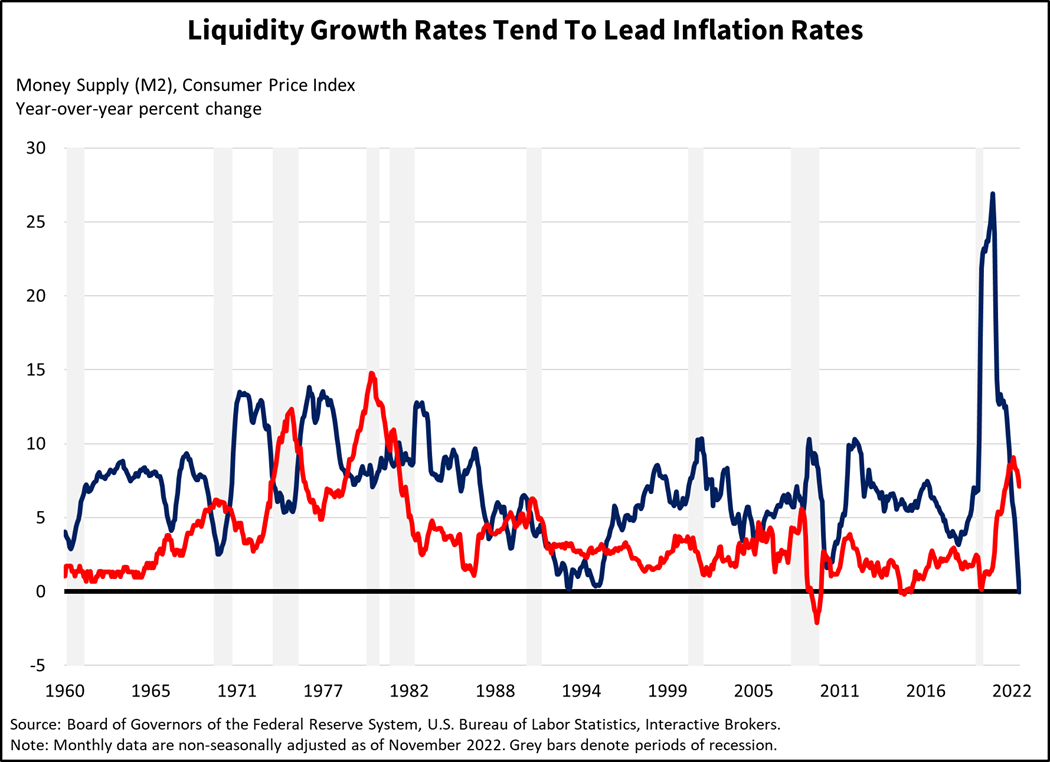

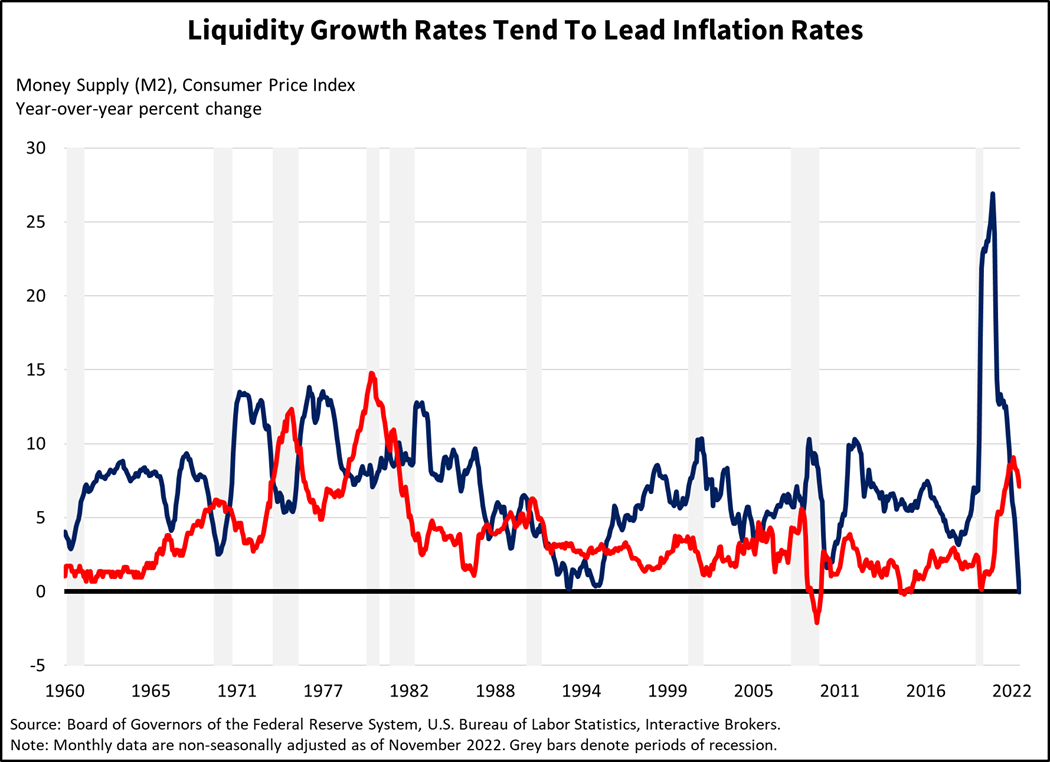

Liquidity Contracts

Concerns that the Fed’s aggressive tightening of monetary policy may trigger a recession have caused lenders to steepen loan standards, challenging consumers and businesses alike. In addition to raising the fed funds rate to a midpoint of 4.38%, the Fed has accelerated the drawdown of its balance sheet from $47 billion a month to as much as $95 billion a month after the account hit an all-time high of $8.96 trillion in April of this year. So far, the Fed has reduced the balance sheet by $401 billion to $8.56 trillion. The M2 money supply is also contracting, dropping from approximately $21.74 trillion in March to $21.35 trillion in November. While inflation has been moderating as the Fed tightens, the core PCE was 4.7% in November, more than twice the Fed’s target inflation rate of 2%. With that number in mind, Fed Chairman Jerome Powell earlier this month said he anticipates the central bank raising the fed funds rate to 5.1% in 2023 and not reducing the rate until 2024. In comparison, 12 months ago, the Fed anticipated that the fed funds rate would reach 2.1% but not until 2024 and it could reach 2.5% longer term.

Earlier this month, Powell also explained the Fed expects 2023 GDP growth of only 0.5% and that inflation (core PCE) will slow to 3.5% during the same year. The Fed’s latest Summary of Economic Projections acknowledges a challenging inflationary landscape going forward, anticipating core inflation to average 2.5% and 2.1% in 2024 and 2025. Banks have taken notice of a difficult economy, with many institutions planning to increase their lending standards for businesses and individuals if they haven’t already done so, according the Fed’s October 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices.

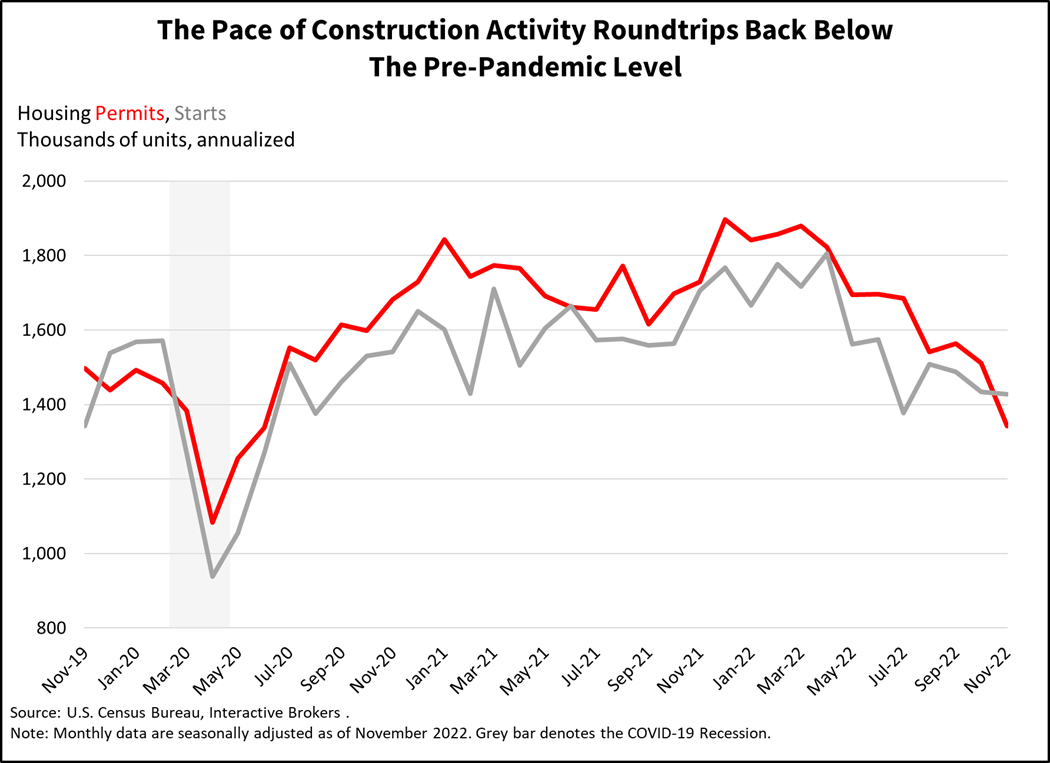

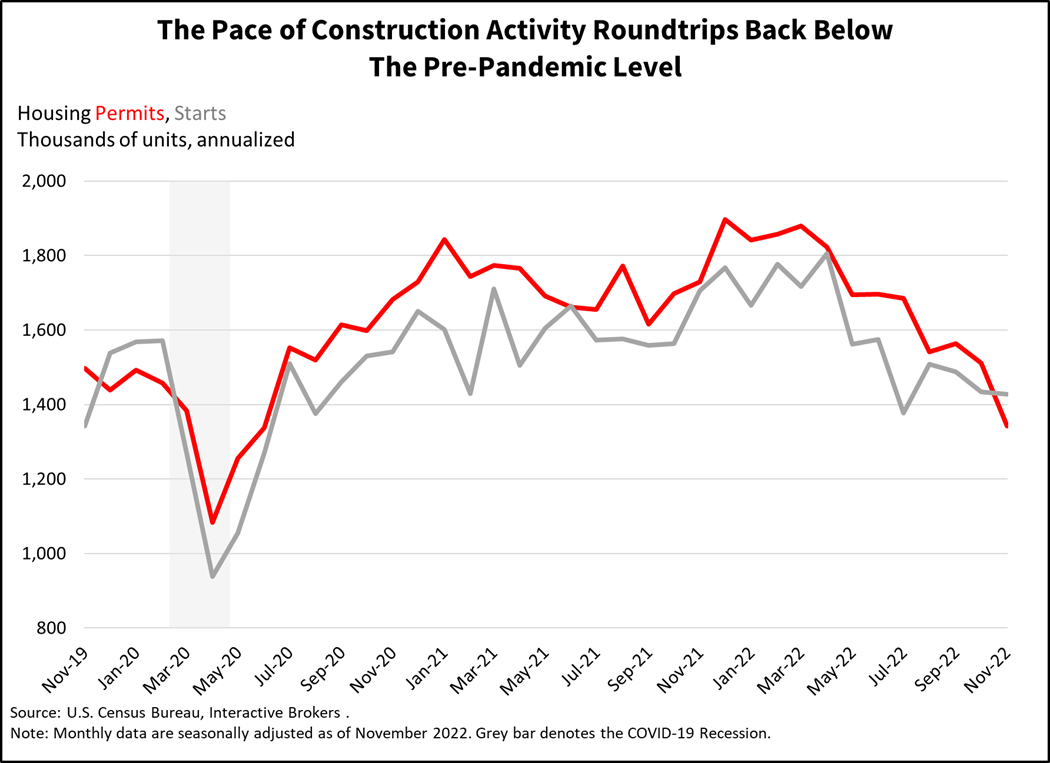

Real Estate Hits the Skids

Interest rates for 30-year fixed mortgages have climbed to above 6% from a previously unheard of 2.70% low in 2020. The higher rates and the rally in home prices during the past 10 years has resulted in home affordability plummeting to an approximately 34-year low, sparking a significant slide in the market. October was the fourth consecutive month of price declines, according to the S&P CoreLogic Case-Shiller National Home Price Index and November was the 10th straight month of declining sales of existing homes. Building permits data, which is a leading indicator of real estate activity, has also weakened with October and November producing month-over-month declines.

Real estate is closely tied to business and economic cycles. Real estate construction is a strong job creator and when consumers buy homes they often splurge on furnishings, tools and other items, which creates demand for manufacturing. In many instances, this demand causes manufacturers to hire additional employees who then use their new income to purchase goods and services, further stimulating economic growth. The weakness in the real estate market is having the opposite effect as home builders shy away from new projects due to recession fears and potential property buyers don’t require new home furnishings. The weakness in the real estate market, therefore, underscores the reversal of economic excesses and implies that the medicine (tighter financial conditions) is working. The medicine works with long and variable lags and hits the economically cyclical, interest rate sensitive sectors first before making its way to the overall economy. In my view, real estate’s 2022 weakness points to a recession in 2023.

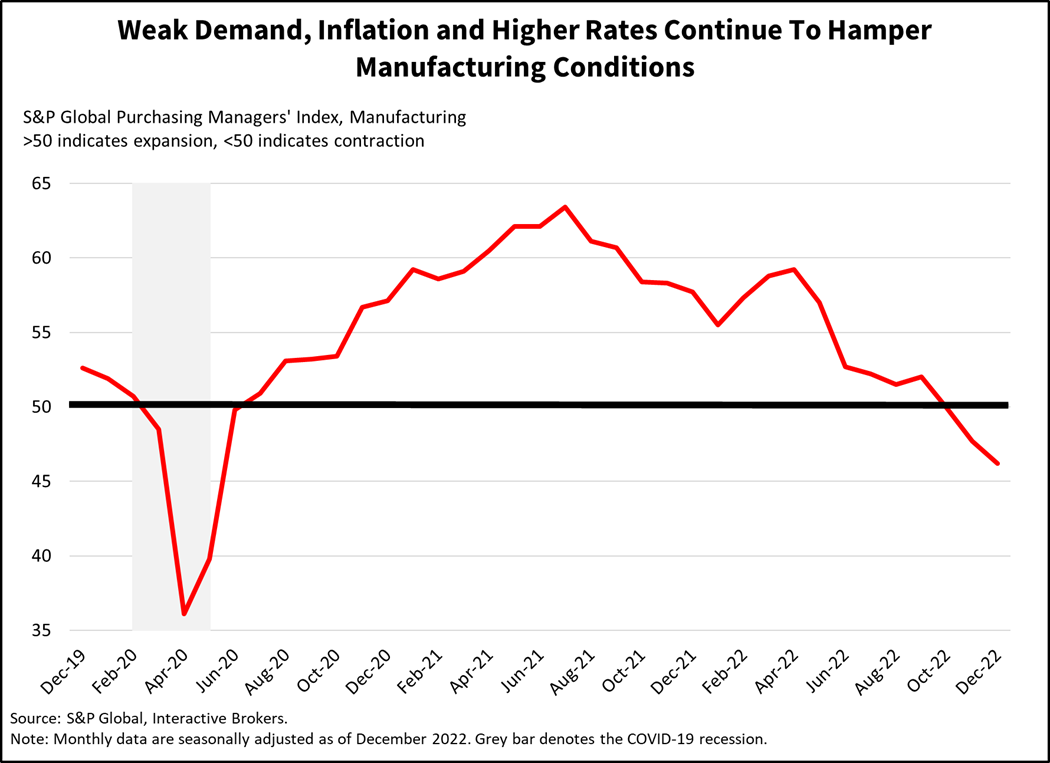

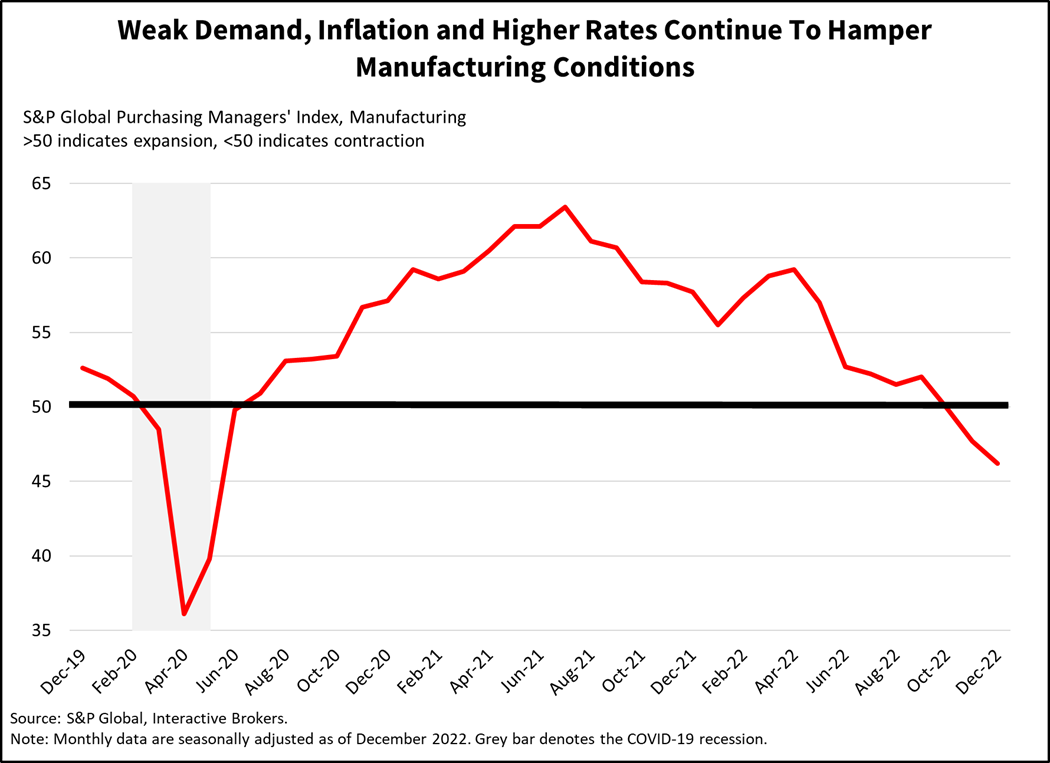

Manufacturing Contracts

The manufacturing sector is facing the full-force blow of the Fed’s monetary policy tightening and the shift from goods spending to services as the COVID-19 pandemic winds down in the states. Higher interest rates and tighter financing requirements are making it more expensive for companies in this capital-intensive industry to manufacture goods. In November, the S&P Global US Manufacturing PMI fell to 47.7, significantly below the contraction/expansion number of 50. The gauge, which measures overall manufacturing conditions, fell even further to 46.2 in December and is expected to drop even lower in future readings. The U.S. Census Bureau durable goods data also shows manufacturing contracting, a result of higher costs of capital, slower demand and persistent inflation. November new orders contracted the most since the depth of the COVID-19 pandemic in April 2020. The 2.1% November month-over-month (m/m) headline decline was much worse than expectations of a 0.6% contraction and the previous month’s 0.7% gain. November’s loss follows three consecutive months of gains. Slowing demand and improved supply chains, furthermore, are helping manufacturers trim their backlogs, with unfilled orders declining for the first time in over two years, breaking a streak of 26 consecutive months of increases.

2023 could likely become the year of manufacturers cutting their workforces and scaling back capital expenditures as they work through back orders and face a decline in new orders. In one highly visible example, chip manufacturer Micron Technology has already announced that it will slash capital expenditures a whopping 40% year over year (y/y) in 2023 and make additional cuts in 2024. It is also cutting its workforce by 10% to lower expenses.

While a strong job market is essential for economic growth, a reduction in manufacturing jobs could potentially ease inflation by easing a labor shortage that is currently creating wage pressures. Similar to real estate, however, the medicine’s effect on manufacturing points to a weaker consumer and higher unemployment in 2023 as pressures spread from the interest rate sensitive sectors to consumer spending and job creation.

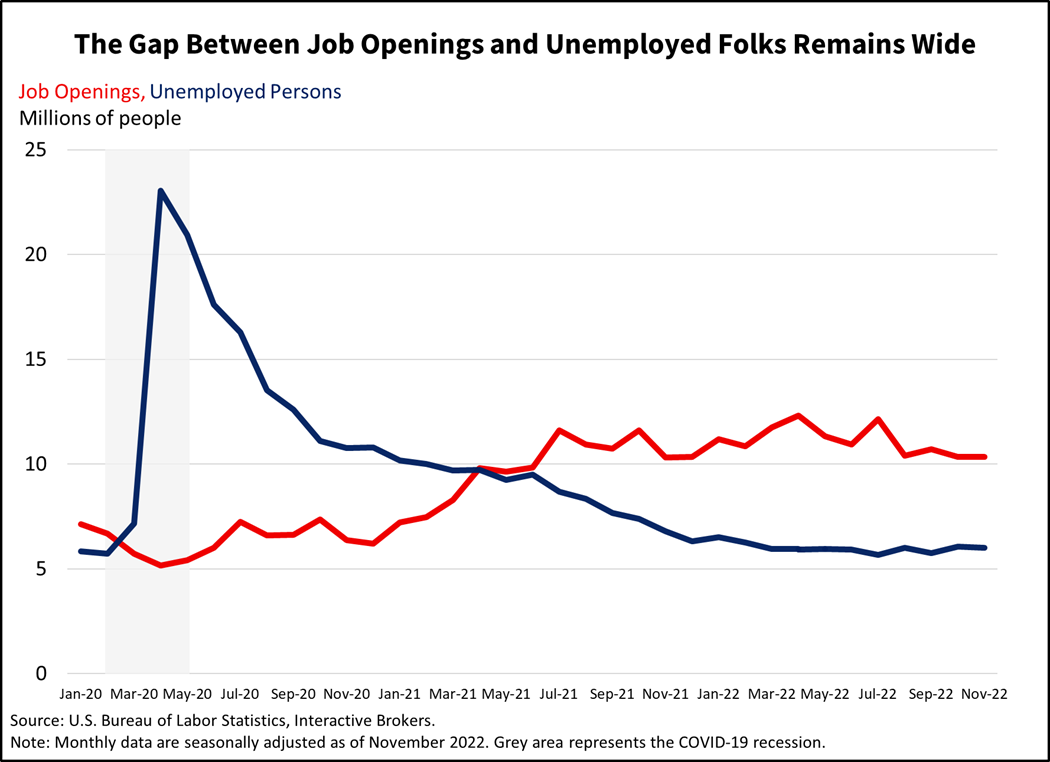

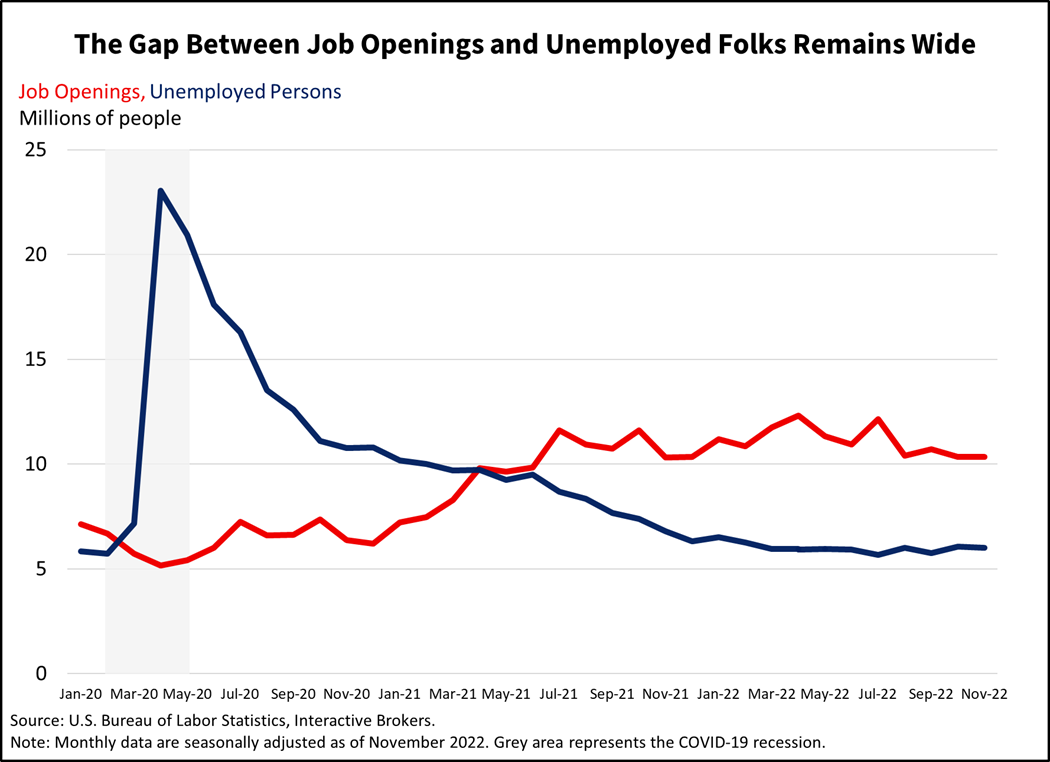

Labor Market Expected to Weaken

In a recent press conference, Fed Chair Jerome Powell said that as the central bank continues to raise the fed funds rate, unemployment could climb to 4.6% in 2023, up from the current rate of 3.7%. Job market weakness would be a considerable shift from the current tight labor conditions and could help ease wage pressures and inflation. A severe mismatch occurs in today’s labor market, with job openings outnumbering unemployed folks 1.7 to 1. There are 10.3 million job openings in America, but only 6 million unemployed folks looking for work. In November, wages were up 5.1% year over year and the economy added 263,000 jobs, exceeding the 200,000 consensus forecast but trailing the 284,000 jobs created in October. The job creation occurs as the portion of working age Americans, or the labor participation rate, bounces along low levels, hitting 62.1% in November, its third consecutive monthly decline. The low participation rate results in large part from Americans retiring early during the depths of COVID-19 pandemic, discouraged workers upset about income and growth prospects, a skills mismatch as companies struggle to match job openings with job applicants and to a lesser extent from working age Americans on the sidelines due to long Covid. Wage pressure is a persistent component of inflation as companies must choose between having higher labor costs eroding earnings or passing the increased costs on to consumers by raising prices. Another problematic consideration for companies amidst labor shortages and declining demand is to accept margin compression or shrink their footprint. Despite remaining strong in 2022, the labor market is poised to weaken in 2023 as it’s a lagging indicator of which the medicine takes the longest to cure.

Consumer Spending

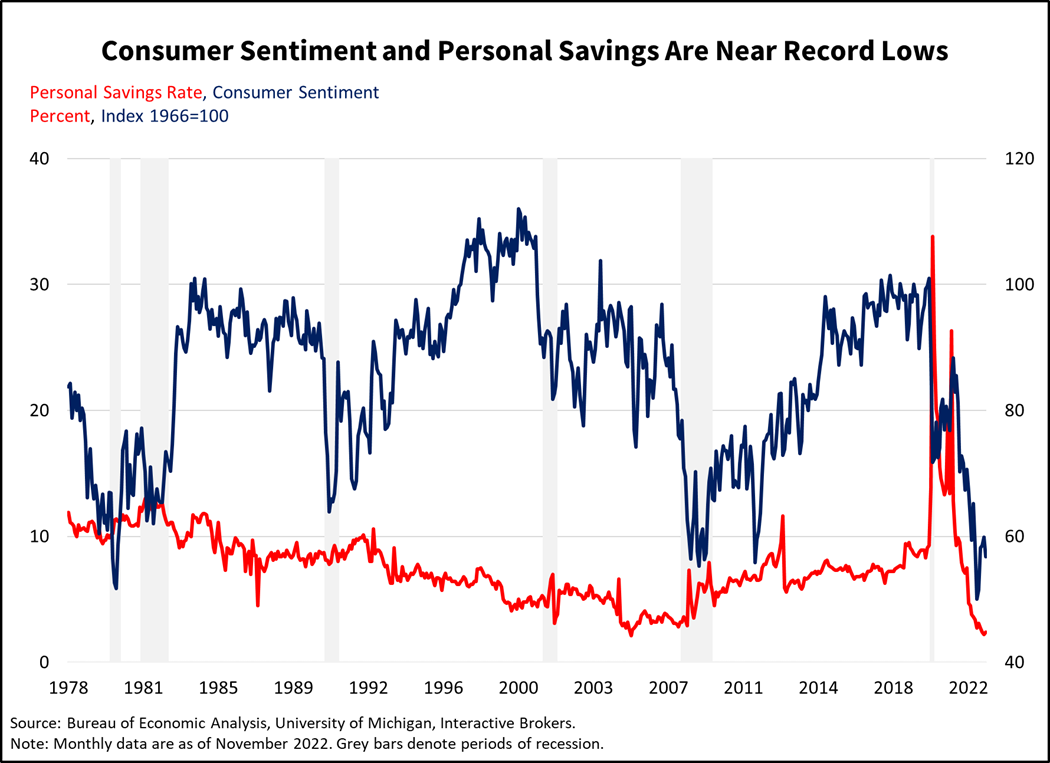

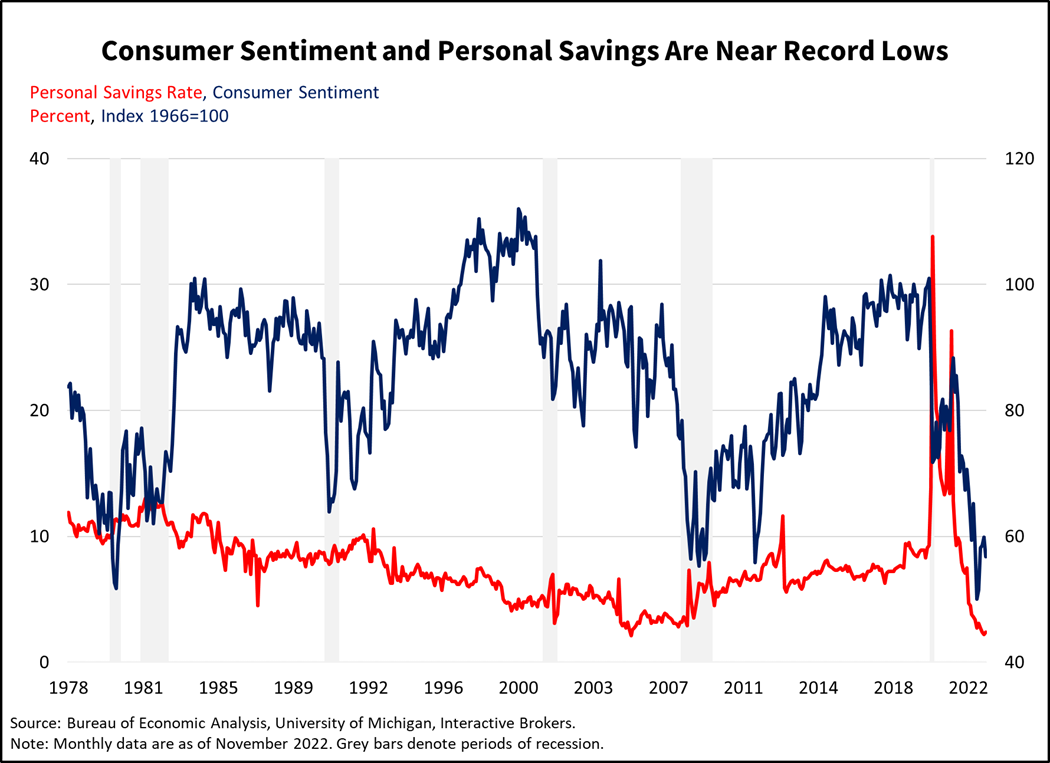

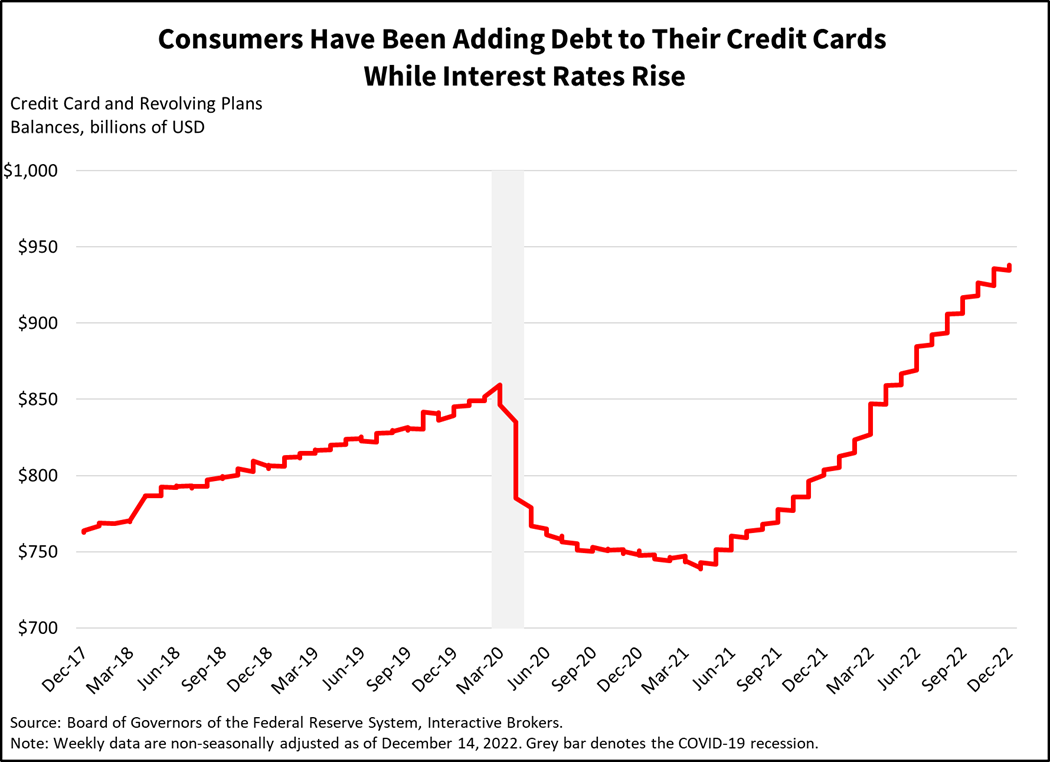

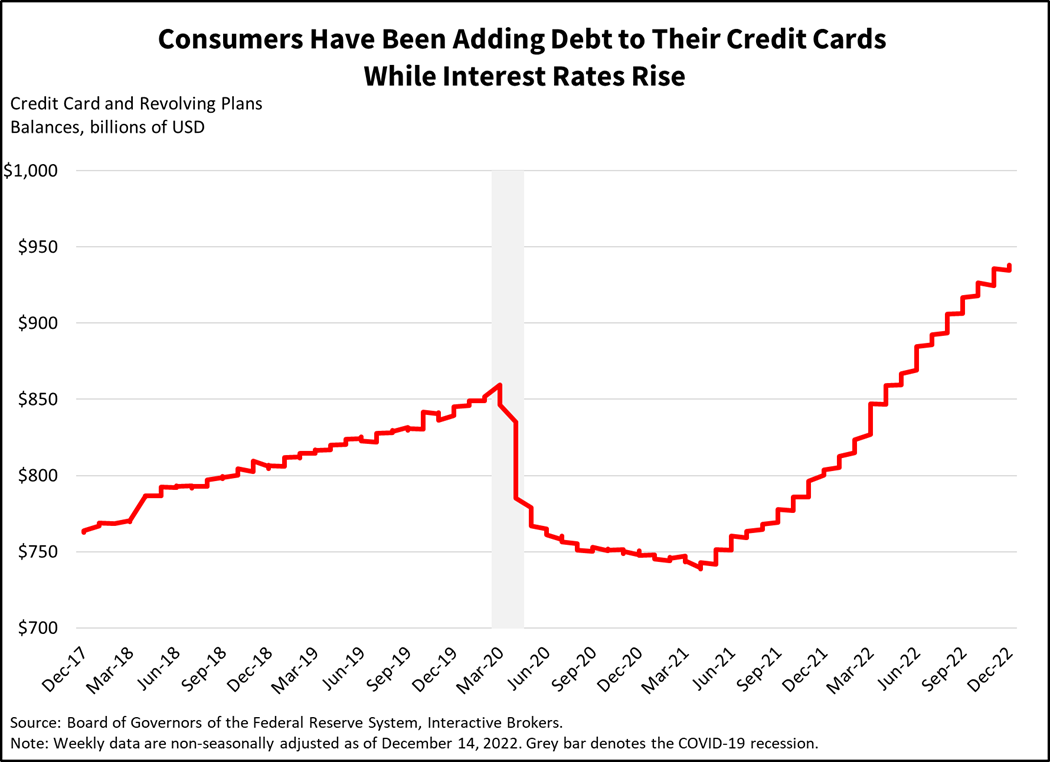

Consumers in 2023 are likely to be in the middle of economic crosscurrents. For most of the period following the March 2020 COVID-19 recession, wage increases have trailed inflation, but that changed last July, with wage gains exceeding price gains for five months in a row. With a strong job market, consumers may feel comfortable with splurging, but tightening credit conditions, higher interest rates, price increases and a lack of fiscal stimulus are major headwinds to sentiment, which although climbing from 56.8 in November to 59.7 in December is significantly below the year-ago reading of 70.6, according to the University of Michigan’s Consumer Sentiment Survey.

Consumer sentiment, at least among homeowners and financial asset owners, is influenced by real estate, equity, bond and crypto values. When Americans’ portfolios increase, Americans feel richer and they spend more, but the ongoing decline in asset valuations is likely to be another headwind for consumer sentiment. The shocks from lower asset values, the winding down of pandemic era savings and a weaker labor market are likely to lead to contracting consumer spending as the U.S. enters recession in 2023.

Despite a bearish 2023 economic outlook, we hope you have a wonderful new year and experience comfort and support as you spend time with your friends and families.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.