Here are three blue chip stocks to watch in the stock market this week.

Blue chip stocks are highly respected and established companies that have a strong reputation for stability and steady growth. Blue chip companies are typically leaders in their respective industries and have a long history of profitability, making them potentially attractive to both individual and institutional investors.

Examples of blue chip stocks include large multinational corporations such as Apple (NASDAQ: AAPL), Johnson & Johnson (NYSE: JNJ), and Microsoft (NASDAQ: MSFT). These companies have proven track records of success, with a long history of consistently high earnings and steady growth. Their financial stability and reputation for reliability make them a popular choice among investors looking to build a balanced and diversified portfolio.

In addition, blue chip stocks often pay dividends to shareholders, providing a steady source of income in addition to any potential capital gains. Investing in blue chip stocks can provide a solid foundation for your investment portfolio and offer peace of mind in knowing that you are investing in well-established companies with a long history of success. It’s important to note that, while these stocks are generally considered to be low-risk, no investment is completely risk-free, so it’s important to conduct your own research and due diligence. Accordingly, let’s look at three blue-chip stocks for you to watch in the stock market today.

Blue Chip Stocks To Watch Today

- JP Morgan Chase & Co. (NYSE: JPM)

- The Procter & Gamble Company (NYSE: PG)

- The Coca-Cola Company (NYSE: KO)

JP Morgan Chase & Co. (JPM Stock)

To kick off this list let’s turn our attention to JP Morgan Chase & Co. (JPM). In brief, the company is one of the largest financial institutions in the United States. What’s more, JPM is organized into four major segments. These are consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

Moving along, just last month, JPM reported its Q4 2022 financial and operating results. In the report, the company reported earnings per share of $3.57, along with $47.4 billion. For context, these numbers came in better than what analysts estimated, which was earnings of $3.11 per share and $34.2 billion in revenue. Moreover, JP Morgan Chase & Co also reported a 54.6% increase in revenue on a year-over-year basis.

Looking since the beginning of 2023, shares of JPM stock have increased by 6.05%. Meanwhile, on Wednesday morning, JPM stock opened down by 0.26% and is currently trading at $143.29 a share.

Source: TD Ameritrade TOS

Procter & Gamble (PG Stock)

Next, let’s look at consumer giant The Procter & Gamble Company (PG). This consumer goods behemoth owns popular brands like Tide, Crest, and Pampers. Additionally, PG currently operates in multiple business segments. These include Beauty, Grooming, Health Care, Fabric & Home Care, among others.

In January, Procter & Gamble released its Q2 2023 financial results. Diving in, the company posted 2nd quarter 2023 earnings of $1.59 per share, with revenue of $20.8 billion. Wall Street consensus estimates were an EPS of $1.58 per share, along with revenue estimates of $20.6 billion. Meanwhile, PG said it continues to estimate fiscal 2023 earnings in the range of $5.81 to $6.04 per share.

Year-to-date so far, shares of Procter & Gamble stock have dropped by 8.33%. While, during Wednesday morning’s trading action, PG stock opened the day lower by 0.75% at $138.95 per share.

Source: TD Ameritrade TOS

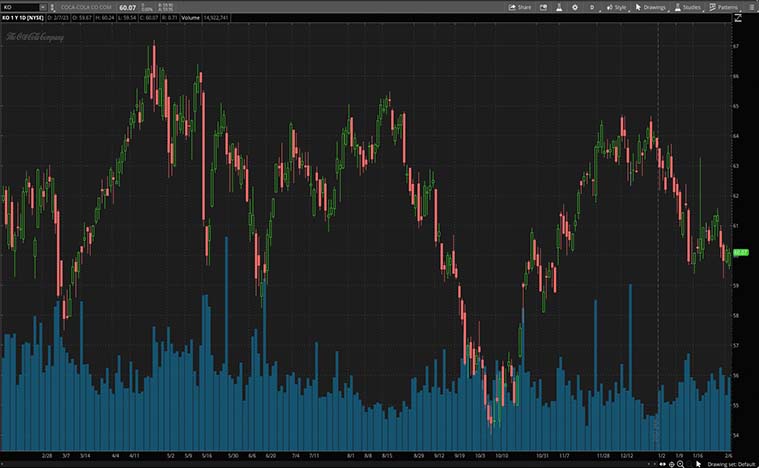

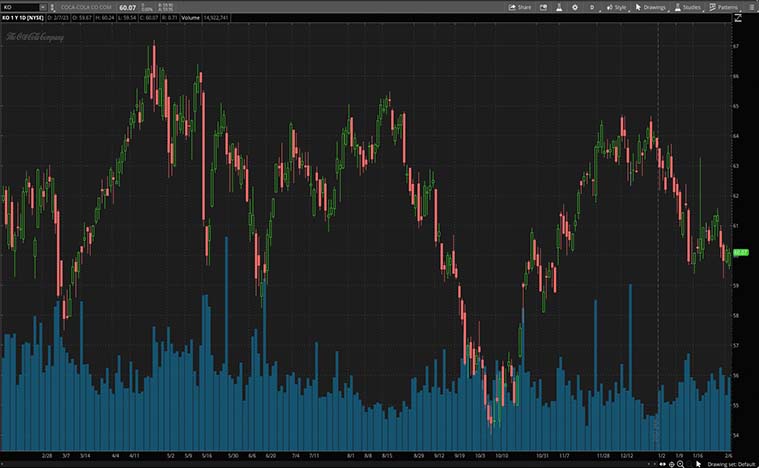

Coca-Cola (KO Stock)

Last but not least, we have The Coca-Cola Company (KO). To start, Coca-Cola is the largest nonalcoholic beverage company in the world. Notably, the company has a strong portfolio of 200 brands covering key categories. These include carbonated soft drinks, water, sports, energy, juice, and coffee.

In January, The Coca-Cola Company reported that it will announce its fourth-quarter and full-year 2022 financial results. In detail, the company will announce the results Tuesday, February 14, 2023, before the stock market opens. For a brief refresher, in Q3 2022, KO reported better-than-expected earnings of $0.69 per share, with revenue of $11.1 billion.

In 2023 so far, shares of Coca-Cola stock have fallen by 5.13% year-to-date. With that, during Monday morning’s trading session, KO stock is trading lower by 0.52% at $59.76 a share.

Source: TD Ameritrade TOS

—

Originally Posted February 8, 2023 – 3 Blue Chip Stocks To Watch In February 2023

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from StockMarket.com and is being posted with its permission. The views expressed in this material are solely those of the author and/or StockMarket.com and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)