A “trap” is generally defined as a dangerous and/or unpleasant situation which you have gotten into, and from which it is difficult or impossible to escape. A “bull trap” is a version of said situation but applicable to equity markets. There is a real possibility that we might be headed for such a trap now. A few data points are sounding an alarm, and inevitably some investors will escape it in time.

A bull trap is a way to describe a seemingly convincing rally that appears to be signaling the end of a bear market by breaking all sorts of prior support levels – but proves to be a false signal and eventually reverts back to the bear trend.

So why bring up a bull trap now?

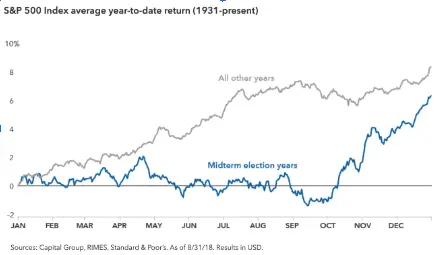

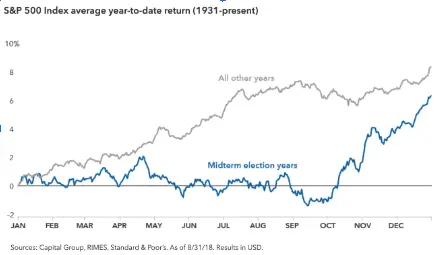

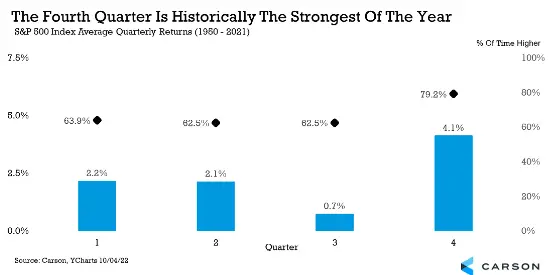

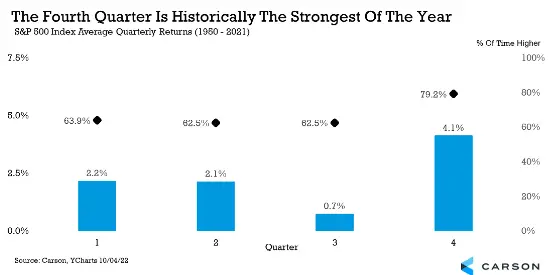

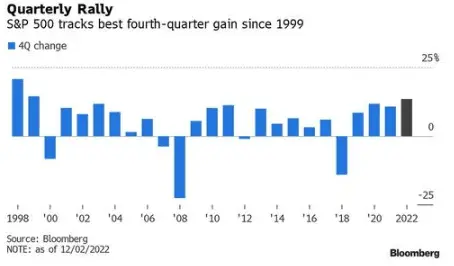

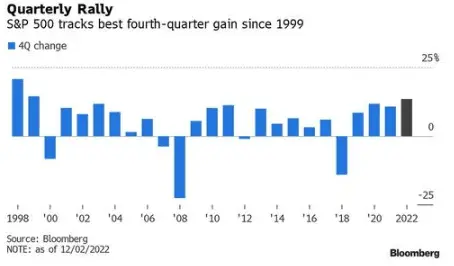

The rally in the quarter has been the best since 1998. It’s gone on longer than hoped. Some of this is not unexpected. Right before the election in November we featured the chart below that showed how strong the last quarter tends to be in midterm years. This is more or less what happened.

Chairman Powell then added fuel to this proverbial fire by opening to door to a reduced pace of hikes as early as December.

Ok, some of you are scratching your heads at the narrative so far: “Just because the market may not go up much further doesn’t make it a bull trap. That is a poorly constructed argument.”

True enough.

But here is why the rally may have been overdone – the trap bit – and a meaningful drop is a distinct possibility.

First of all, history suggested S&P500 would rally 6% or so into the close of a midterm year. Even outside of midterms, the fourth quarter is historically the strongest: a typical rally amounts to 4.1%, almost double the next best quarter.

But the benchmark index broke through all those levels to sit at an astounding 11.5% up on the quarter, the best quarter since 1998.

History rhymes. Why can’t we rhyme with 1998?

Yes, we could. Except in 1998, the Fed was CUTTING rates. Three times in that quarter, actually because of the LTCM debacle and the Russian financial crisis (the two were related because the former was betting heavily on spreads that blew out when Russia defaulted on its debt.)

Chairman Greenspan aka The Maestro was warning everyone that the US can’t stay an oasis in global turmoil and economic predictions – incorrectly, as it turns out – became dire for 1999.

Needless to say, the Fed is in a very different mood this time around.

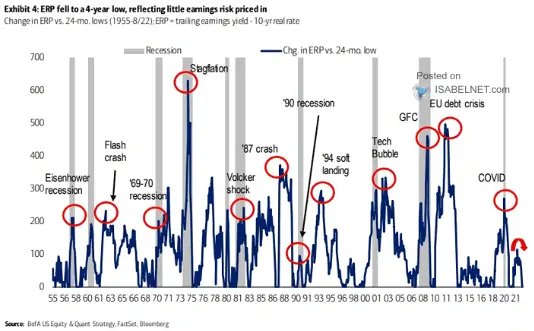

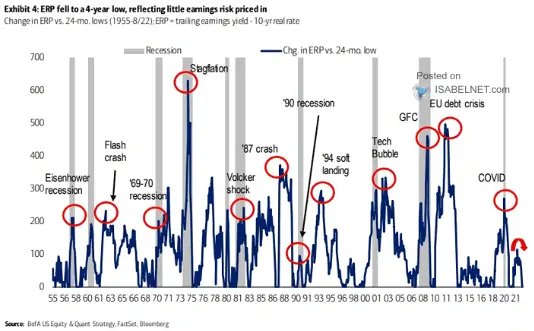

Second, in 1998 there was at least a little bit of risk premium built into stocks. This time, there is virtually zero. Markets are providing no reward for taking on the additional risk of equities over fixed income.

Nothing in life is certain but there is definitely relatively compelling evidence that stocks may be ready to trap a lot of bulls into an “unpleasant situation” if there is a meaningful drop from here.

Idea Spotlight: Chewy

TOGGLE analyzed 5 similar occasions in the past where analyst revision indicators for CHWY:NYSE were moving up and historically, this led to a median increase in price.

The company is scheduled to release its quarterly earnings data after the market closes on Thursday. Analysts expect the company to announce earnings of ($0.08) per share for the quarter.

Learn more about TOGGLE AI and its awesome arsenal of tools at our weekly orientation sessions or reach out at support@toggle.ai.

—

Originally Posted December 7, 2022 – A mega Bull Trap in the making?

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.