Key takeaways

Thinking about a recovery

While it doesn’t appear that a US equity recovery has started yet, I believe it’s time to start thinking about how to position for one.

Inflation watch

Inflation has a way to go before reaching the Federal Reserve’s “comfort zone.” But “better-than-expected” readings may be all the market needs to stage a recovery.

What I’m thankful for

The US midterm elections went off without much of a hitch. That’s just one of the things I’m grateful for in this month of Thanksgiving.

Like the rest of the investing world, I’m anxiously awaiting a “pause that refreshes” from the US Federal Reserve. Coca-Cola originally ran that campaign in 1929, on the eve of the Great Depression, in an effort to make the product appealing during a time when people were struggling financially. This time, what would appeal to investors is a pause in Fed tightening that reinvigorates the stock market. We’ll assess the prospects of that pause, the potential for a recovery, and as always try to rise above the noise and put everything into perspective.

A ‘keep it simple’ strategy

1) Where are we in the cycle?

The market indicators say recession.1 The hard economic data largely disagree.2 When in doubt, I go with the market. To that point, I expect the market to recover before the economy. In fact, stocks were positive during four of the last nine recessions.3

2) What’s the direction of the economy?

The economy is still in contraction, with leading indicators suggesting that growth is below trend and declining. The duration of the contraction will likely depend on what the Fed does next. A recovery could be forthcoming. Speaking of which…

3) What’s the expected policy response?

Typically, the Fed is easing by the time we are in the contraction phase of the cycle. That’s not yet the case. But, given the likely improvements in inflation, a pause could be forthcoming. The markets are pricing in a 5% terminal fed funds rate by March 2023.4 If that’s the case, then a recovery could be in the offing.

While it doesn’t appear that a recovery has started yet, we nonetheless believe it’s time to start thinking about how to position for a recovery. We would favor allocating toward riskier credit and the more cyclical and value-oriented parts of the equity market.

‘Tis the season

Even in a tough year — or maybe especially so — it’s worth identifying things for which we are thankful. Here’s my top 5 list, financial market edition.

- The US stock market was up 49% from March 13, 2020 (the day the world essentially shut down for COVID) to Nov. 16, 2022.5 I would have absolutely signed up for that at the start of the pandemic.

- The 1-year inflation breakeven is well below 2.5%,6 which indicates that the bond market believes inflation is set to decline rapidly.

- There appears to be little excess in the economy. Businesses do not appear to be over-levered,7 the banking system is well-capitalized,8 and US households are still sitting on excess savings.9

- There is finally income to be had in fixed income.10

- The US midterm elections went off without much of a hitch, as the losing candidates generally conceded. Rumors of American democracy’s demise may be overstated.

Stop me if I’ve told you this

Investors are likely tired of being told that missing the best days and months in the market can meaningfully erode returns. I suppose I’ll stop saying it when investors stop selling at inopportune times.

According to the Investment Company Institute, investors pulled $27 billion out of equity mutual funds and exchange-traded funds in September.11 No surprise then that October (+8.1%) was the 11th best month for the S&P 500 Index in 35 years!12 Not to be outdone, Nov. 10 (+5.5%) was the 15th best day for the index since 1957!13

Allow me to repeat myself: If you invested $100,000 in the S&P 500 Index in 1988 and left it alone, you would currently have over $3.2 million. Missing the top 1, 3, 5, and 10 months would have cut that total to $2.8 million, $2.3 million, $1.9 million, and $1.2 million, respectively.14

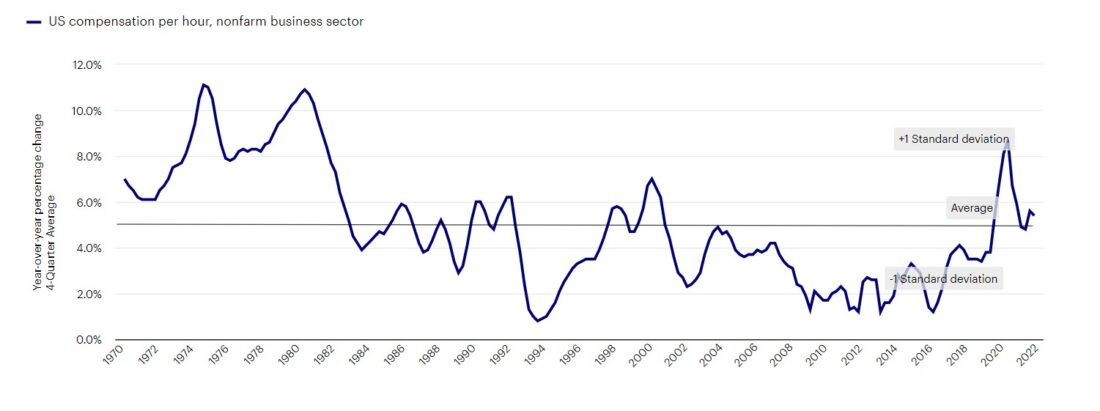

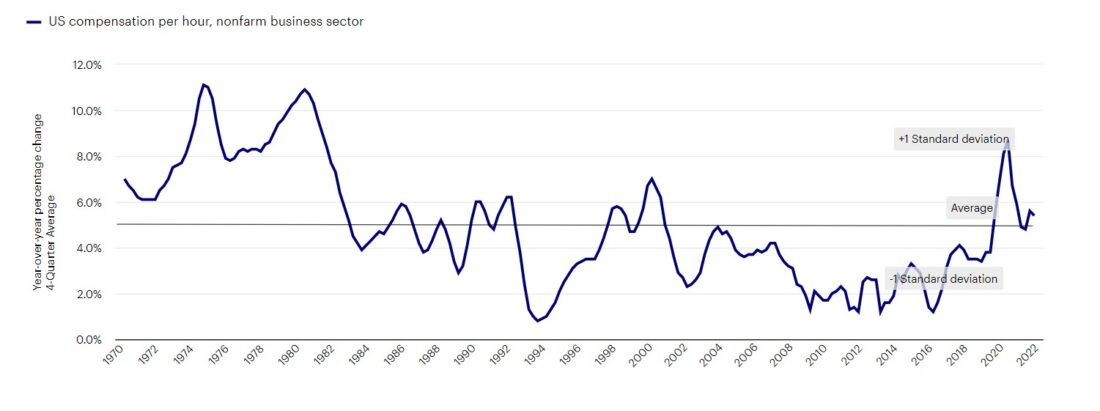

It may be confirmation bias, but …

… we’re not experiencing the wage-price spirals of the 1970s. In fact, current compensation growth in the US is now close to its long-term average.15

US compensation per hour, nonfarm business sector

Source: US Bureau of Labor Statistics, 10/31/22. Standard deviation measures the dispersion of a dataset relative to its mean.

Since you asked

What does it mean that the spread between the 10-year and 2-year US Treasury rates is as inverted now as it has been in 40+ years?

In short, it likely means that the Fed is tightening policy by too much. Short rates have been pushed higher, while the 10-year Treasury appears to be crying uncle, or more specifically signaling lower future nominal growth. The last time the yield curve was this inverted was in 1981. Yes, it portended a recession but also turned out to be a very attractive buying opportunity for equity and credit investors.

Song of the month

In response to October’s better-than-expected inflation reading, let’s go with Timber by Pitbull.

US economic history suggests that high inflation tends to come down rapidly, which explains why “Timber!” has been on repeat in my mind this month. As the saying goes: “The bigger they are, the harder they fall.” Remember, markets likely won’t wait to recover until inflation is back in the perceived “comfort zone.” “Better-than-expected” may be all the market needs.

Phone a friend

I once again dialed Ashley Oerth, an investment strategist and Invesco’s resident crypto expert to help me to understand what is transpiring with the crypto exchanges and what the implications, if any, could be for the global financial system. Here’s what Ashley had to say:

Following the implosion of the FTX crypto exchange and its related businesses, questions are swirling over what contagion we may see in decentralized and traditional markets. In crypto, Bitcoin and Ethereum fell sharply along with other big-name cryptos, and crypto-linked trading firms and services are facing serious hardship; Alameda Research, a quantitative crypto-trading firm (also run by Sam Bankman-Fried) was wound down, and lending services BlockFi and Genesis have halted withdrawals, with possible bankruptcy in the cards. Complicating the situation is that there are currently more rumors than facts, which has only helped stoke concerns. Despite all this, this crisis appears so far to be contained within the crypto sphere, which remains largely unregulated, leveraged, and without any institutional backstops (such as a central bank) — all factors that help enable crises like we’ve seen with FTX and Terra Luna.

In the longer term, I suspect that these events may help further the distinction between cryptocurrencies, as embodied by coins and tokens, and the underlying use cases that are found in decentralized ledger technology, which is ultimately a new spin on database technology. Without meaningful, international, cooperative regulation, the crypto world will probably continue to be something of a wild west.

On the road again

My travels in early November took me to the City of Brotherly Love, a city electrified by their professional sports franchises. At the time, the Philadelphia Phillies were leading the World Series by two games to one. More than a few optimistic fans prepared me for what victory might mean — each time Philadelphia had won a World Series, the economy had fallen into recession (1929, 1930, 1980, 2008). Does their loss mean we’re now in the clear?

I was in Philly to speak at a conference for investment professionals, where I was on an agenda with Mike Quick, the former Philadelphia Eagles wide receiver. Quick told his story of what it took to rise from a small town in North Carolina to the heights of the National Football League. He also was sure to note that he is currently the radio announcer for the (then) undefeated Eagles. Quick was asked, “Who hit you the hardest?”

Me (thinking): I bet he gets asked this all the time.

Quick: “I get that question all the time.”

Me (thinking): I bet he’s going to say Lawrence Taylor.

Quick: “You all think I’m going to say LT. Well, it was my sister Linda.”

Me (thinking): That’s hilarious. I may be a lifelong Giants fan, but this guy is ok.

See you in December. I think most of us are ready to put 2022 to rest. Here’s to a less volatile and more fruitful 2023!

Footnotes

- Source: Bloomberg, 11/18/22. Based on the shape of the US Treasury yield curve (the difference between the 10-year US Treasury rate and the 2-year US Treasury rate) and the strength of the US dollar versus a trade-weighted basket of currencies. The U.S. Dollar Index (USDX) indicates the general international value of the US dollar by averaging the exchange rates between the US dollar and major world currencies.

- Sources: Bureau of Labor Statistics and US Census Bureau, 10/31/22. Based on US jobless claims and US retail sales.

- Source: Bloomberg, 9/22. Based on the S&P 500 Index and on recession dates defined by the National Bureau of Economic Research: Aug. 1957 – Apr. 1958, Apr. 1960 – Feb. 1961, Dec. 1969 – Nov. 1970, Nov. 1973 – Mar. 1975, Jan. 1980 – Jul. 1980, Jul. 1981 – Nov. 1982, Jul. 1990 – Mar. 1991, Mar. 2001 – Nov. 2001, Dec. 2007 – Jun. 2009 and Feb. 2020 – Apr. 2020.

- Source: Bloomberg, 11/18/22. Based on Fed Funds Implied Futures. The terminal rate is the anticipated level that the federal funds rate will reach before the Federal Reserve stops its tightening policy. The federal funds rate (or fed funds rate) is the rate at which banks lend balances to each other overnight.

- Source: Bloomberg, 11/16/22. As represented by the S&P 500 Index.

- Source: Bloomberg, 11/18/22. The breakeven inflation rate is calculated by subtracting the yield of an inflation-protected bond from the yield of a nominal bond during the same period.

- Source: US Federal Reserve. Based on Nonfinancial corporate business: Debt to profits after tax

- Source: US Federal Reserve, 10/31/22. Based on the Tier 1 capital ratios of the nation’s banks. Tier 1 capital ratios compare a bank’s equity capital with its total risk-weighted assets

- Source: US Federal Reserve, 10/31/22.

- Source: Bloomberg, 11/18/22. Based on the yield to worst of the Bloomberg US Corporate Bond Index. The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility, and financial issuers. Yield to worst is the lowest potential yield an investor can receive on a bond without the issuer actually defaulting.

- Source: Investment Company Institute, 10/31/22.

- Source: Bloomberg, 11/16/22. As represented by the S&P 500 Index.

- Source: Bloomberg, 11/16/22. As represented by the S&P 500 Index.

- Source: Bloomberg, 11/16/22. The analysis is based on a hypothetical and is for illustrative purposes only. As represented by the S&P 500 Index.

- Source: US Bureau of Labor Statistics, 10/31/22.

—

Originally Posted November 29, 2022

Above the Noise: Is there cause for a pause? by Invesco US

NA2605473

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

Past performance does not guarantee future results.

Investments cannot be made directly in an index.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

Cryptocurrencies such as Bitcoins are considered a highly speculative investment due to their lack of guaranteed value and limited track record. Because of their digital nature, they pose risk from hackers, malware, fraud, and operational glitches. Cryptocurrencies are not legal tender and are operated by a decentralized authority, unlike government-issued currencies. Cryptocurrency exchanges and cryptocurrency accounts are not backed or insured by any type of federal or government program or bank.

Yield spread is the difference between yields on differing debt instruments, calculated by deducting the yield of one instrument from another.

The yield curve plots interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates to project future interest rate changes and economic activity. An inverted yield curve is one in which shorter-term bonds have a higher yield than longer-term bonds of the same credit quality. In a normal yield curve, longer-term bonds have a higher yield.

Tightening is a monetary policy used by central banks to normalize balance sheets.

The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic US stocks.

The opinions referenced above are those of the author as of Nov. 21, 2022. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)