Concert-goers know that opening acts can sometimes set the tone for a great show, but are often irrelevant. On the plus side, we can get an opener that fits perfectly, like when I was fortunate to see the classic bluesman Buddy Guy open for the recently departed virtuoso Jeff Beck. But the tone was set at my first major concert, when James Montgomery (who?) opened at one of the shows that was used for Foghat Live. Bank earnings are the opening act for earnings season, but we really can’t know whether they will be setting the correct tone for the main event.

Faithful readers know that I wish we didn’t have to open earnings season with the banks. I wrote about it at length in July and discussed on TV this morning. My rationale is that their dependence upon interest rates and trading profits makes them far too idiosyncratic to make banks a foolproof indicator for what will follow during the rest of earnings season. Because of trading profits, the market’s reaction to a beat or a miss can be quite different than a normal company. We can see a major bank beat but decline if it was too reliant on “fluky” trading profits. As a trader at a publicly traded firm, it infuriated me. Our profits were real, but analysts acted otherwise.

The key to bank earnings instead is qualitative – what do CEOs like Dimon, Moynihan, Fraser, and their peers have to say about their companies’ trends in consumer and business lending, and credit quality. That has a huge bearing upon what we might hear from the rest of the companies scheduled to report over the coming weeks. If we can glean some clues from bankers whose companies touch almost every sector of the global economy, that can give us a sense of what to expect.

What we learned today was that there is a broad consensus that the economy will slow over the coming months, but that we are likely to avoid the direst outcomes. This is even as charge-offs grew in many cases. JPMorgan’s Dimon seems to have mellowed his views somewhat, which might explain why JPM is now a leading gainer among bank shares after leading to the downside earlier today. This is a notable turnaround for JPM; not only have its shares bounced over $6 in morning trade, but it could portend a change in pattern for JPM’s post-earnings reactions. Prior to last quarter, JPM fell 8 straight times after earnings. Two bounces in a row could put a definitive end to an ignominious streak.

As we look to next week, the most prominent bank names are Goldman Sachs (GS) and Morgan Stanley (MS). Of the two, I see MS as more broadly significant. We already know that GS is in the midst of a large round of layoffs. While there is much that we might want to learn about the state of the various businesses that are shrinking, that is largely company-specific. Charge offs should be the key item to watch at MS. They are the largest holder of Twitter debt, so it will be useful to know whether they mark it down in a manner that portends negatively for all sorts of holders of lower-rated debt.

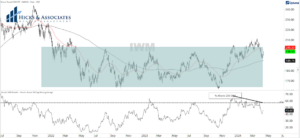

As of now, options markets are relatively sanguine about both companies’ results. While we see the usual volume in protective puts, in both stocks the most active lines in options expiring next Friday are upside calls – specifically $375 and $380 calls in GS and $96 calls in MS. This fits with the largely sanguine views about volatility that are being expressed in VIX and similar measures.

Finally, a word of caution about using XLF, the Financial Sector SPDR, as a hedge for bank earnings. It seems like the obvious choice, but there are problems. First, it is heavily weighted with insurance companies, especially Berkshire Hathaway (BRK.B) at almost 15%. Contrast that with JPM at 10.5% and Bank of America (BAC) at 6.1%. Second, it is not abnormal for one bank to go up while the another goes down, meaning that the ETFs move is muted. That is the case today, where XLF is essentially unchanged as I write this.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)