With an almost 60 trillion-dollar sovereign debt market, the case for ESG integration remains unclear. According to the World Bank’s 2021 paper A New Dawn – Rethinking Sovereign ESG, Sovereign ESG investing suffers from a lack of clarity over investment objectives. Limited to its use as a risk-adjustment tool, Sovereign ESG data has not been explored for its impact-investing potential. Can ESG data thus drive better investing and contribute to improved sustainability outcomes?

Today’s sovereign ESG scores are primarily used as a supplementary tool to evaluate a country’s creditworthiness or for reporting on the sustainability characteristics of fixed income portfolios. In other words, Sovereign ESG has been dominated by a risk-management focus where ESG factors are used as an input in the investment process to reduce risks and enhance financial performance. But this ignores potential non-financial benefits in terms of contributing to sustainability outcomes (i.e., as an output).

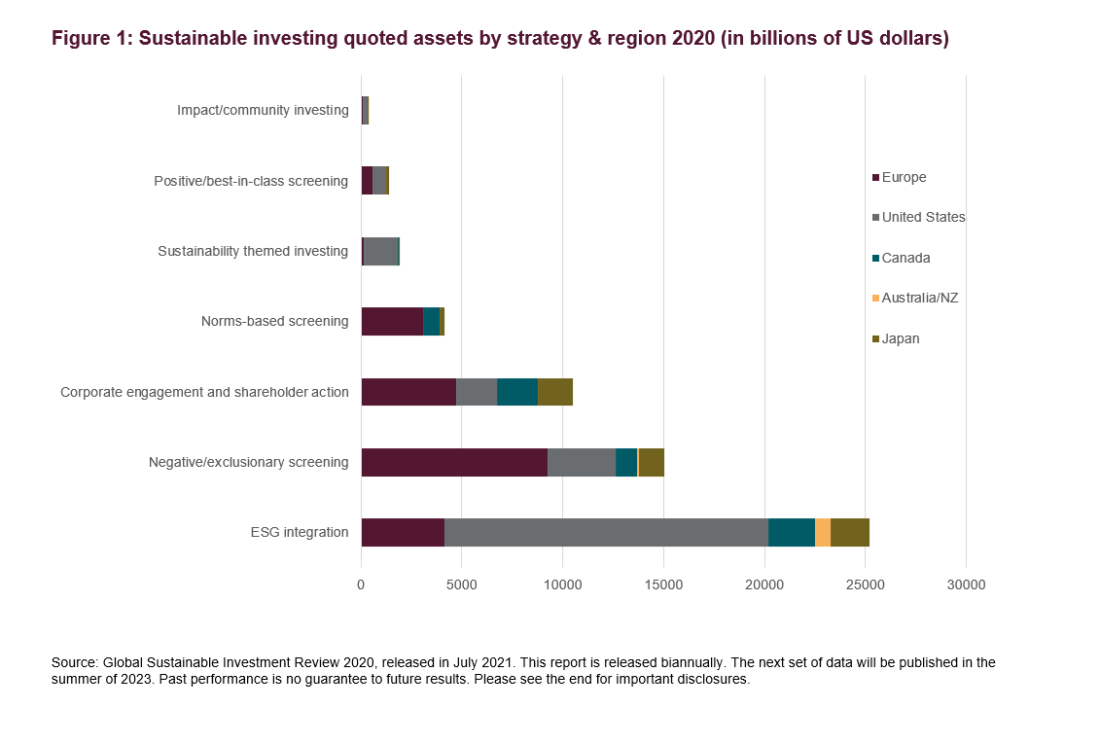

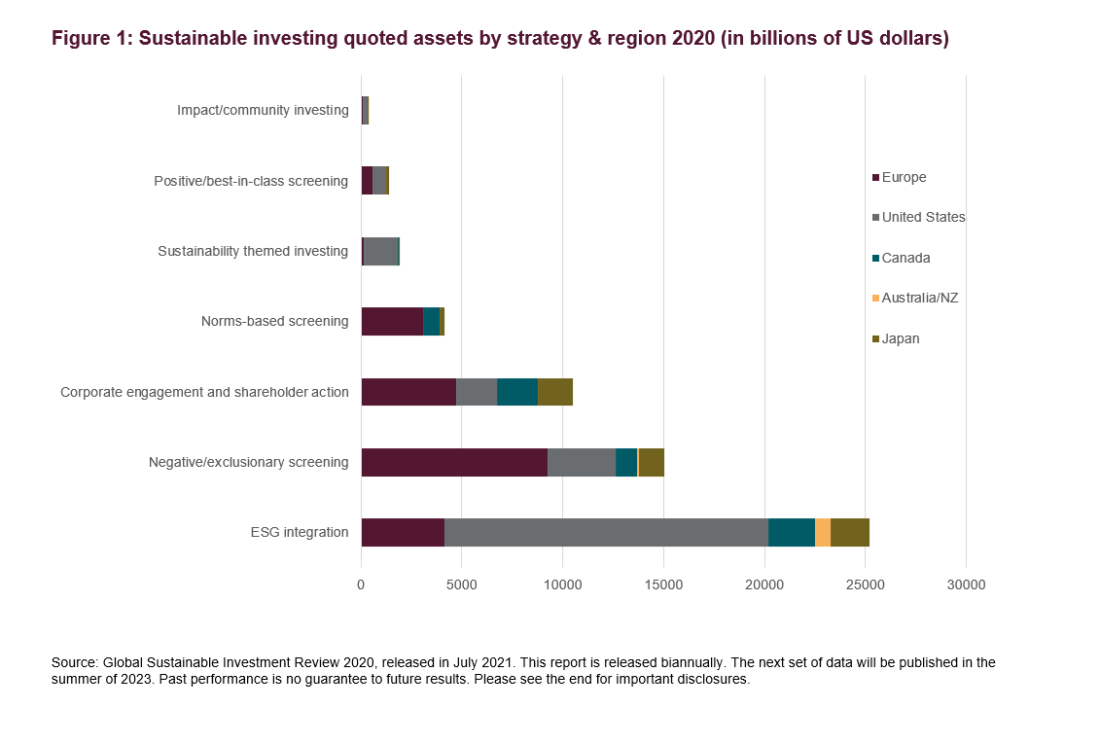

ESG investing can inform financial decision-making in three main paradigms: (1) using ESG as an input; (2) or as an output; (3) or as a combination of both. The latter impact-driven paradigms are less common, and would, in addition to financial objectives pursue wider non-financial performance factors. This could include for example investing in a manner that contributes to greater energy efficiency, higher school attainment or lower corruption, with targets often being linked to the United Nations Sustainable Development Goals (SDGs). Using ESG as both an input and output could offer a sweet spot, with Sovereign ESG scores serving as a tool to identify risks more efficiently but also to assess the impacts of regional, corporate and project-level financing.

However, getting sustainability right in the sovereign ESG investing space isn’t straightforward.

The scalability versus effectiveness trade-off for Sovereign ESG products

Where investors pursue sustainability objectives through their investment strategies, they often encounter a trade-off between scalability and effectiveness for the asset at hand. The Sovereign Debt market has great potential for scalability; it is large and liquid with an outstanding debt of US$58.9 trillion [1], yet it proves challenging when trying to pursue or measure specific sustainable outcomes.

Market practices that target the reduction of aggregate ESG risk may have the perverse impact of increasing funding gaps and thus decreasing the effectiveness and impact of sovereign ESG investment. For example, ESG-adjusted benchmark indices can be tilted to boost the aggregate ESG score relative to its traditional benchmark, resulting in portfolios of only strong ESG-performing developed market issuers. Emerging markets – with larger room for ESG improvement and where fruitful sustainable outcomes are often greatest – are thus disadvantaged and make up a very small part of the financing pie. This is a consequence of the Income-Bias inherent to sovereign ESG scores.

Additionally, the prevalence of benchmark investing in sovereign emerging markets (EM) universe and the relatively lower level of capital market development mean a few emerging issuers can attract meaningful flows to their local currency sovereign debt market. According to the World Bank, only 11% of local currency sovereign bonds outstanding are included in the main EM sovereign bond indices on average, compared to 84% for equivalent hard currency debt[2].

However, better data and the steady growth of Sovereign ESG investing can generate indirect positive effects. For example, more granular ESG scores at the sub-national level create greater impact investment opportunities. Also, as the sovereign debt market is often the entry point for foreign investors, large, targeted investments can trigger or amplify development responses from emerging economies’ financial markets. Therefore, an ESG-conscious investor’s decision could help foster a more effective and sustainable allocation of capital at the global level.

Government bonds, such as Green, Social or Sustainability-Linked bonds, are another effective and more direct alternative: they have been created to be impactful. They incorporate clear ESG targets and are designed to finance climate, social or environmental-related projects and activities. However, being relatively recent, they have not reached scale yet: for OECD countries, sovereign green bonds currently only account for around 0.2% of all government debt securities (OECD, 2021), while the issuance of Social and Sustainability-linked bonds has only started recently (cf. our recent analysis).

For more on sustainable investment strategies, subscribe to the blog.

[1] According to the Bank for International Settlements in 2021.

[2] For more details, please refer to the World Bank’s A New Dawn : Rethinking Sovereign ESG

—

Originally Posted February 7, 2023 – Beyond risk management: can Sovereign ESG data drive impact investing?

Disclosure: FTSE Russell

Interactive Advisors, a division of Interactive Brokers Group, offers FTSE Russell Index Tracker portfolios on its online investing marketplace. Learn more about the Diversified Portfolios.

This material is not intended as investment advice. Interactive Advisors or portfolio managers on its marketplace may hold long or short positions in the companies mentioned through stocks, options or other securities.

© 2023 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®“ and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of the FTSE Russell products, including but not limited to indexes, data and analytics or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained herein or accessible through FTSE Russell products, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB, BR and/or their respective licensors.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from FTSE Russell and is being posted with its permission. The views expressed in this material are solely those of the author and/or FTSE Russell and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.