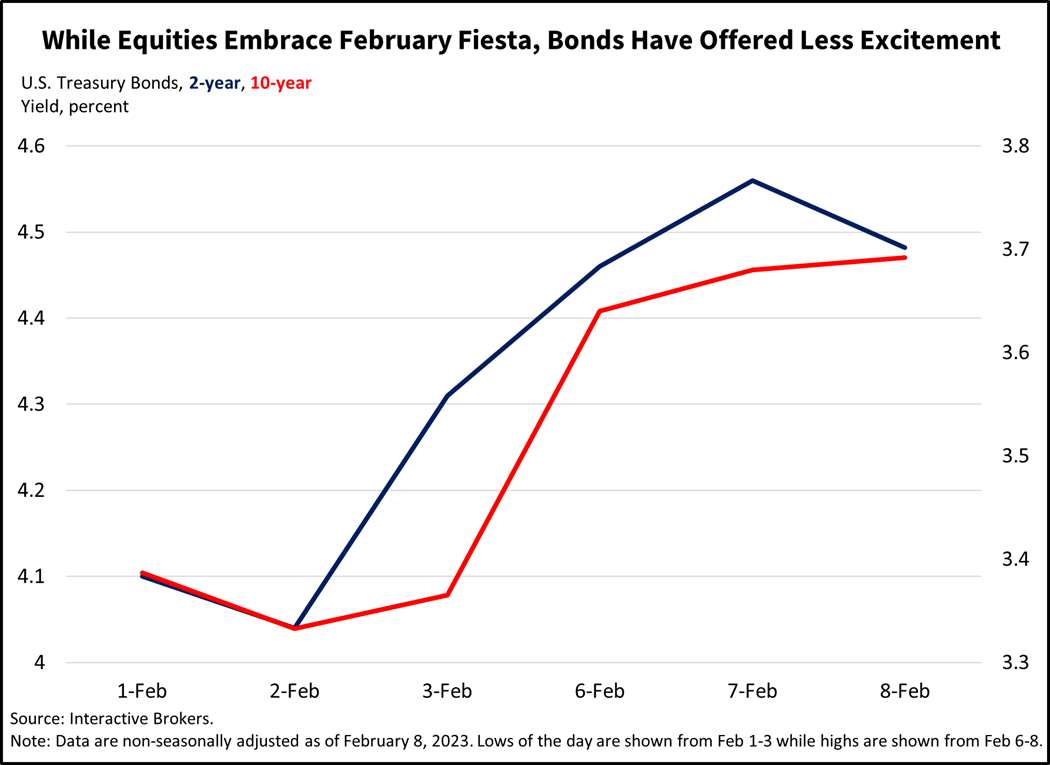

Bond yields have surged higher in recent days as hot economic data and disciplined Federal Reserve commentary have supported the need for higher borrowing costs to contain inflation. While Federal Reserve (Fed) Chairman Jerome Powell appeared nonchalant, friendly and at times humorous during his speeches this week and last, he nonetheless reiterated the need for ongoing rate hikes and balance sheet reduction. He also left the door open for raising the pace of rate hikes if hot data calls for it. Last week’s job number was a scorcher and reignited worries that inflation may tilt to the upside in the coming months.

The dramatic loosening of financial conditions since October has fueled inflationary pressures in the short term. This Valentines Day’s CPI report is likely to show broad based price pressures across most of the economy, with the following examples recently exhibiting price increases:

- Food at home and at dining establishments.

- Oil and gasoline.

- Used and new cars, with price increases supported by the decline in financing costs during the past few months.

- Services, which have experienced price increases. The labor-intensive nature of this sector is sensitive to higher labor costs and has become increasingly problematic in the battle to curtail inflation.

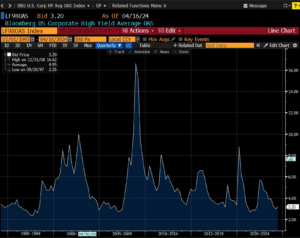

The risk of Chair Powell not quelling animal spirits, or the emotional bidding up of securities prices, during his public speaking engagements are literally contributing to more inflation as borrowing costs over the past few months have dropped, supporting more consumption against the backdrop of an easy-going Fed Chairman. Even with the recent surge in yields, borrowing costs are still considerably below highs that occurred in late 2022.

Powell’s appearances on the mound this week and last, when he appeared to throw underarm to appease batters at the plate, occurred as corporate earnings releases confirm strong trends: Inflation and higher interest rates are weakening consumer demand, travel services continue to grow, energy is generating blockbuster profits and social media is experiencing weakening advertising revenue growth.

- Tyson Foods and Chipotle Mexican Grill both disclosed disappointing results earlier this week. Tyson reported fiscal first quarter revenues of $13.26 billion, missing expected revenues of $13.52 billion. Its year-over-year (y/y) earnings per share of $0.85 fell 70% y/y. Tyson said the average sale price for its products dropped 8.5% due largely to declining demand for beef while cattle costs increased $350 million. Chipotle also disappointed with fourth quarter revenues of $2.18 billion compared to the $2.23 billion expected by a Refinitiv survey of analysts. Chipotle’s same store sales grew 5.6% while analysts anticipated 6.9% and the company’s guidance called for mid-to-high single-digit growth. It was the company’s first combined earnings and revenue miss since 2017 and perhaps more importantly, signaled a change in management’s outlook for consumers. In October, Chipotle management said it was receiving little consumer pushback after raising its prices to offset higher dairy and tortillas costs. The fourth quarter results imply that the price increases may be turning away certain consumers.

- Hertz’s results, meanwhile, illustrate how travel and other services are experiencing growing usage with pent up demand resulting from prior COVID-19 restrictions being unleashed. For the fourth quarter, Hertz generated $2.035 billion in revenue compared to the $2.033 billion that was expected. In January, corporate travel increased 28% y/y. Hertz didn’t provide guidance.

- BP on Monday joined the list of oil majors generating record profits, a result of soaring energy prices following the Russian invasion of Ukraine and capital spending discipline within the energy industry. BP said its underlying replacement cost profit, a proxy for net profits, hit $27.7 billion in 2022, up from $12.8 billion in 2021 and exceeding the Refinitiv analyst consensus expectation of $27.6 billion. BP’s fourth quarter profits of $4.8 billion also sailed past analysts’ expectations of $4.7 billion. Shell, Exxon Mobil and Chevron have also reported generating record profits.

- Pinterest on Monday joined a handful of social media companies with weak results. Its fourth quarter revenue of $877 million missed expected revenues of $886.3 million and the company said it expects revenue for the current quarter to grow in the low single digits y/y while analysts were expecting growth guidance of 6.9%. The S&P 500 Communication Services sector has been the worst quarter to date for earnings and revenues falling below expectations, with 55% of companies’ missing earnings estimates and 73% of companies missing revenues estimates.

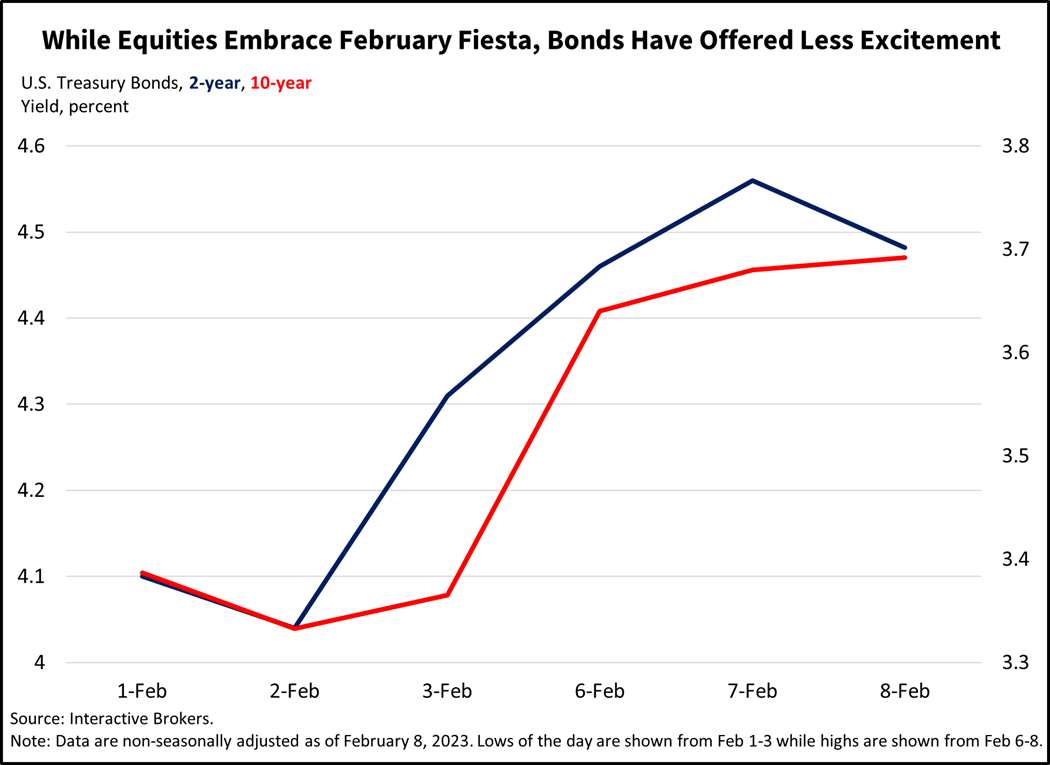

The market has worked to catch up to the Fed’s most recent summary of economic projections released last December. Bond pricing implies a terminal rate of 5.17% this summer with one or two 25 basis point (bps) cuts by year-end while the Fed expects 5.13% with no cuts. While the market is still off from the Fed by 23 basis points for the end of this year, at the beginning of February, the discrepancy was more than double, closer to 60 bps. As the gap between the Fed and the market narrowed, yields leaped significantly across the curve, with the 2-year Treasury and the 10-year Treasury rising over 50 and 30 bps from their respective lows last week.

Anticipating a hot CPI this Valentine’s Day, spectators have whispered of the starved bears quietly lining up in a wildcat offense in an effort to compress the bull’s lead with an unpleasant surprise midway through the first quarter.

Against the backdrop of recently rising yields, lackluster earnings and higher expectations of Fed tightening, the equity market has been rallying indecisively, gaining 8.3% year to date. Equities are taking a break this morning, however, lingering below some indefinite resistance for the S&P 500 at 4150, with the index down 0.7%. The dollar and bond yields are also taking breathers this morning, roughly unchanged after big moves to the upside in recent days. Crude oil is up 1% to $78 per barrel. Anticipating a hot CPI this Valentine’s Day, spectators have whispered of the starved bears quietly lining up in a wildcat offense in an effort to compress the bull’s lead with an unpleasant surprise midway through the first quarter. On the political front, yesterday evening’s State of the Union address featured President Biden pleading for unity and reiterating his efforts to strengthen American industry against the backdrop of the looming debt ceiling, macroeconomic uncertainty and geopolitical tensions from Russia, China and others.

Visit Traders’ Academy to Learn More about the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.