The US dollar has seen a significant pullback since early November and has failed several attempts at recovery moves. With the CPI and December FOMC meeting coming next week, the dollar could have another rebound, particularly if the Fed’s post-meeting statements maintain a hawkish tone. If this happens, it may present an opportunity to approach the long side of the Canadian and Australian dollars, commonly known as the “Commodity Currencies.”

While the US employment situation remains strong, there has been a notable pullback in US inflation readings over the past few months. Friday’s US PPI and core PPI numbers were higher than trade forecasts but marked the fifth month in a row that their year-over-year rate of increase declined. While the jury is still out on whether the FOMC will hike rates 50 or 75 basis points on Wednesday, there is evidence to suggest that the Fed will have their final rate hike for this cycle early next year.

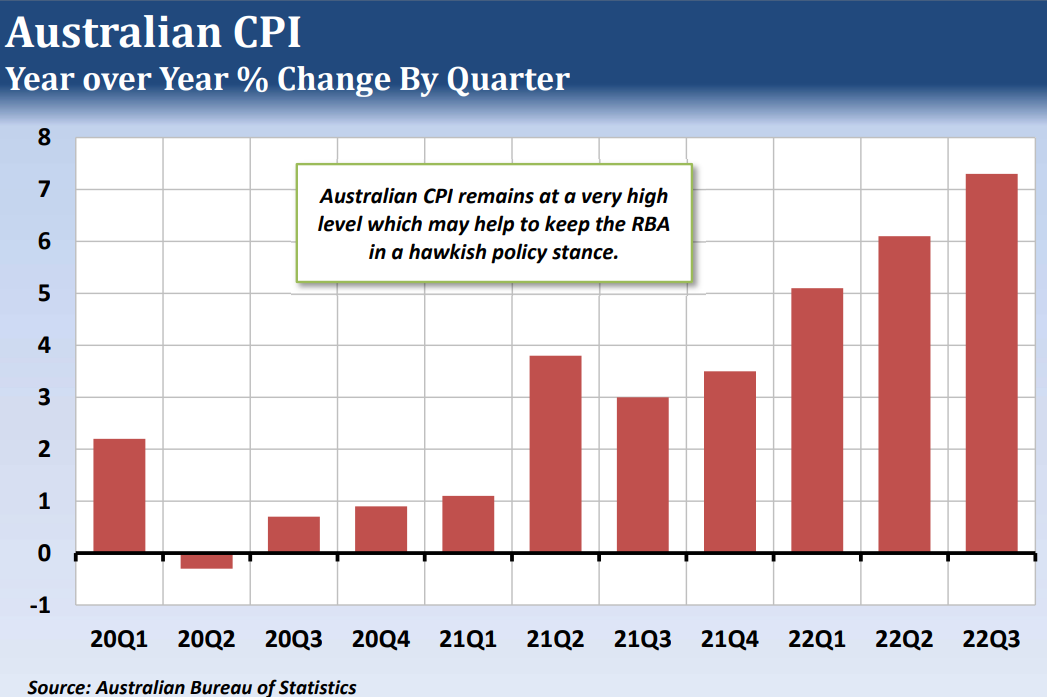

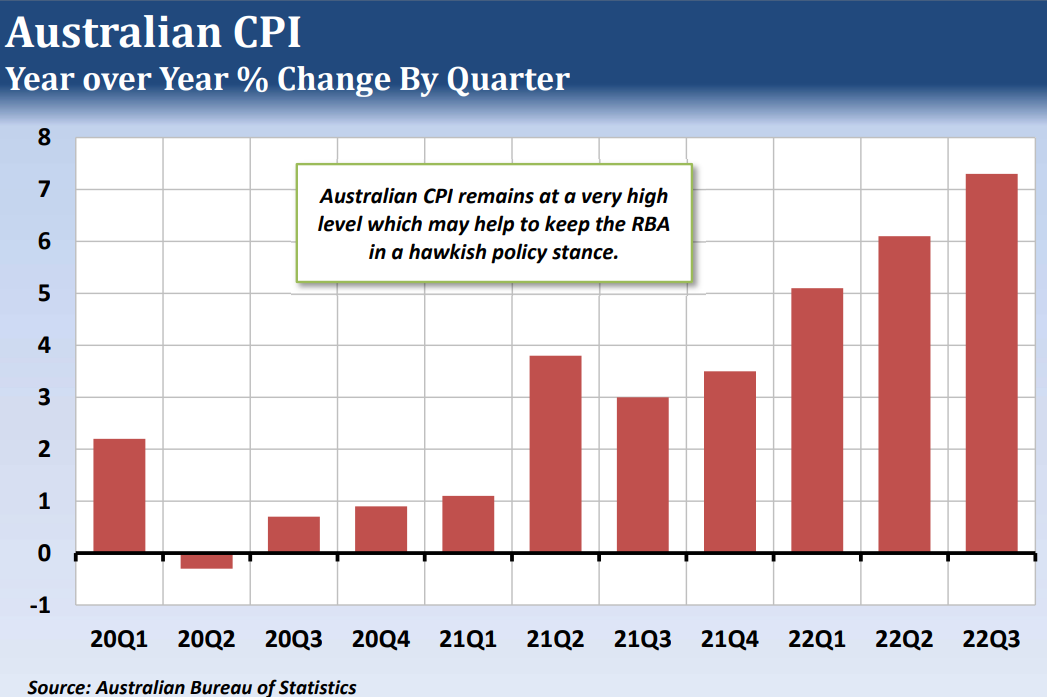

Although other major economies are starting to see their inflation readings fall as well, many are still close to multi-decade highs. This could keep those central banks in hawkish policy stances beyond any shift in the Fed’s policy to neutral. This would give those currencies an additional advantage over the Dollar.

This should benefit the commodity currencies, particularly if other factors come into play. China is showing signs that it will further relax its Covid Zero policies. This could strengthen the Australian dollar, as that nation is a major exporter of commodities to China. The Bank of Canada signaled that they are close to finishing their rate hikes at Wednesday’s meeting, but the Canadian dollar would also benefit from a broad-based rally in commodity prices.

—

Originally Published December 9, 2022

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.