By J.C. Parets & All Star Charts

Saturday, 31st December, 2022

1/ Getting Ready for Expansion

2/ China Flips the Switch

3/ Dollar Remains Resilient Beneath the Surface

4/ Separating the Wheat from the Chaff

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

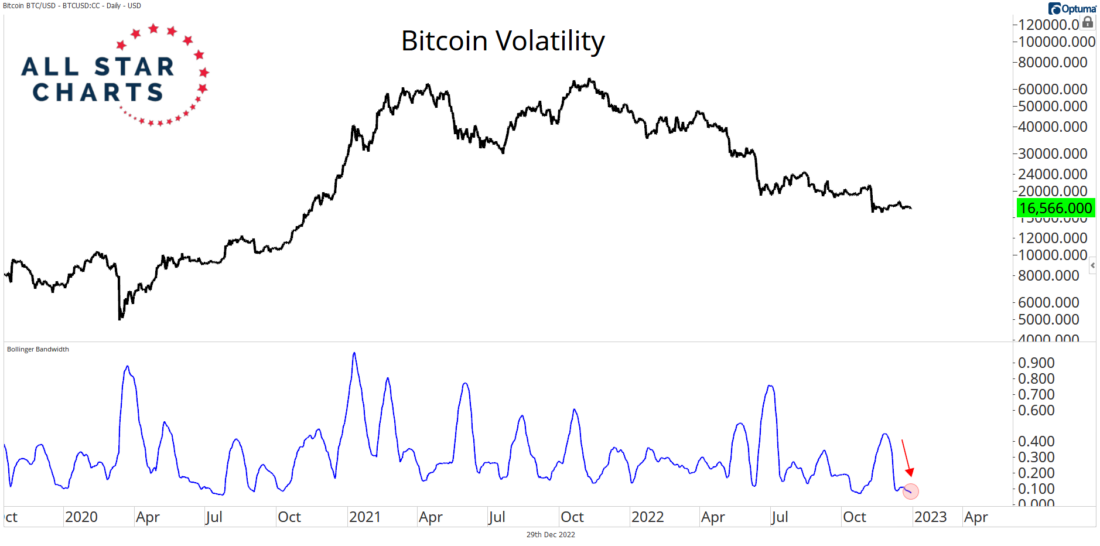

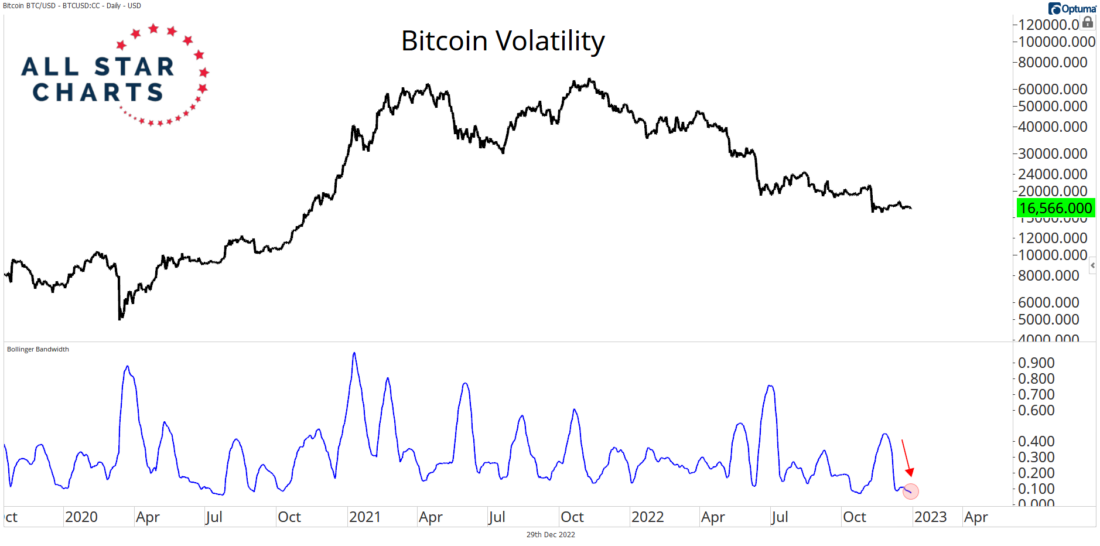

1/ Getting Ready for Expansion

Bitcoin’s volume and volatility have taken a holiday, with the biggest cryptocurrency’s monthly Bollinger bandwidth contracting to its third-lowest level in the last five years (highlighted by the blue line in the lower pane). While the lack of market action might seem appropriate this time of year, Bitcoin approaches an extreme.

As markets become more coiled and contracted, buyers or sellers are ultimately forced to step up to the line. A strong move in BTC could happen sooner rather than later as contractions in volatility on this scale often lead to expansions in price. While we don’t know what direction that will be, the resolution of this range could set the tone for the coming weeks and months.

2/ China Flips the Switch

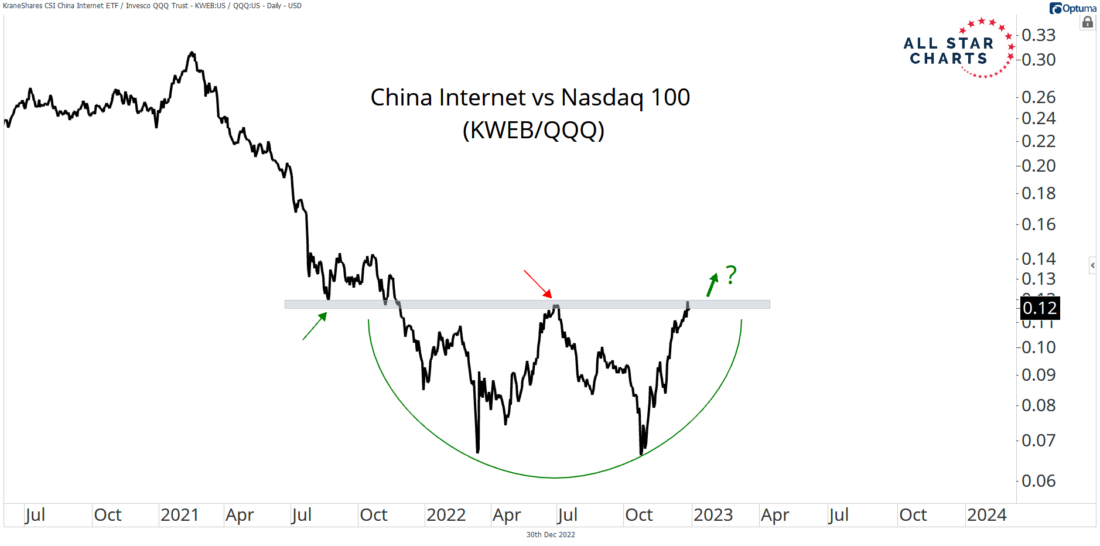

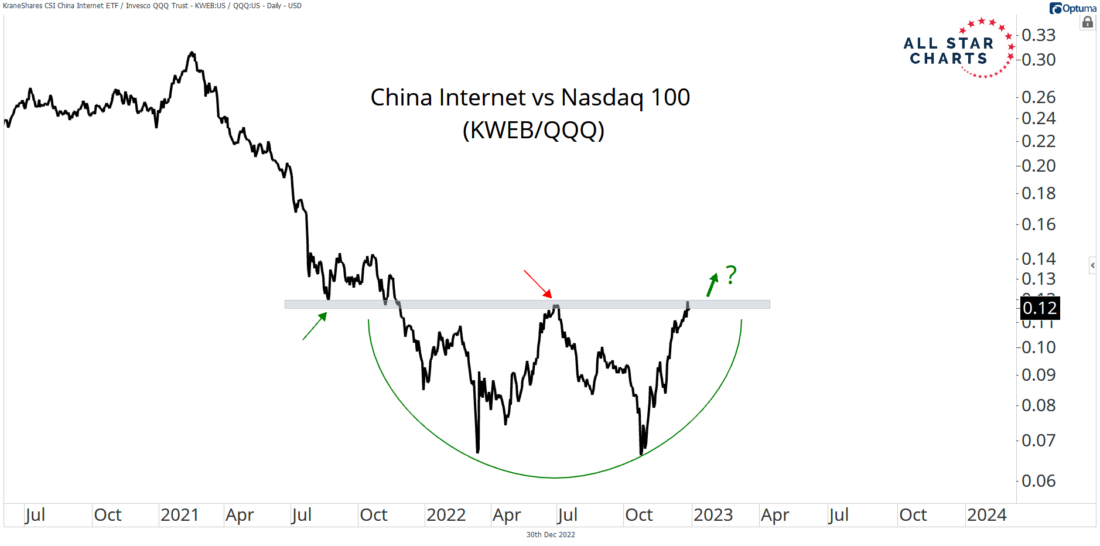

Chinese stocks have not only soared during Q4 but are becoming more attractive on relative terms. One way to look at this is by comparing Chinese tech to top U.S. tech stocks. Here’s a relative ratio of the China Internet ETF (KWEB) versus the Nasdaq 100 ETF (QQQ).

KWEB has been working on a major trend reversal against QQQ for over a year. As you can see, the ratio is pressing against the upper bounds of its range this week.

If and when we get an upside resolution, Chinese stocks would likely outperform. However, current levels could represent a logical place for U.S. growth stocks to reclaim their leadership role. For now, we’re focusing on those relative highs from earlier this summer for clear signs of leadership.

3/ Dollar Remains Resilient Beneath the Surface

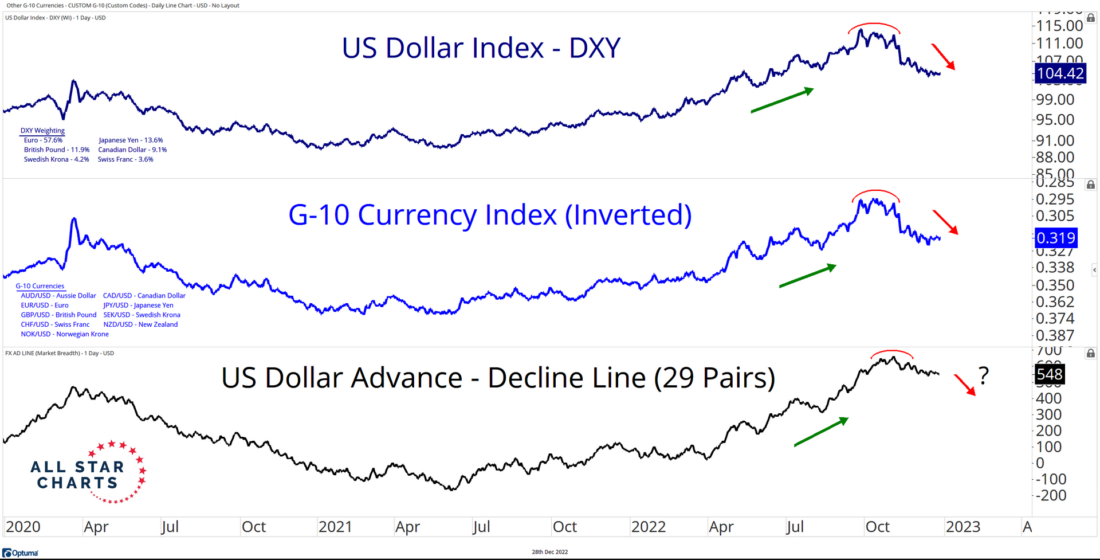

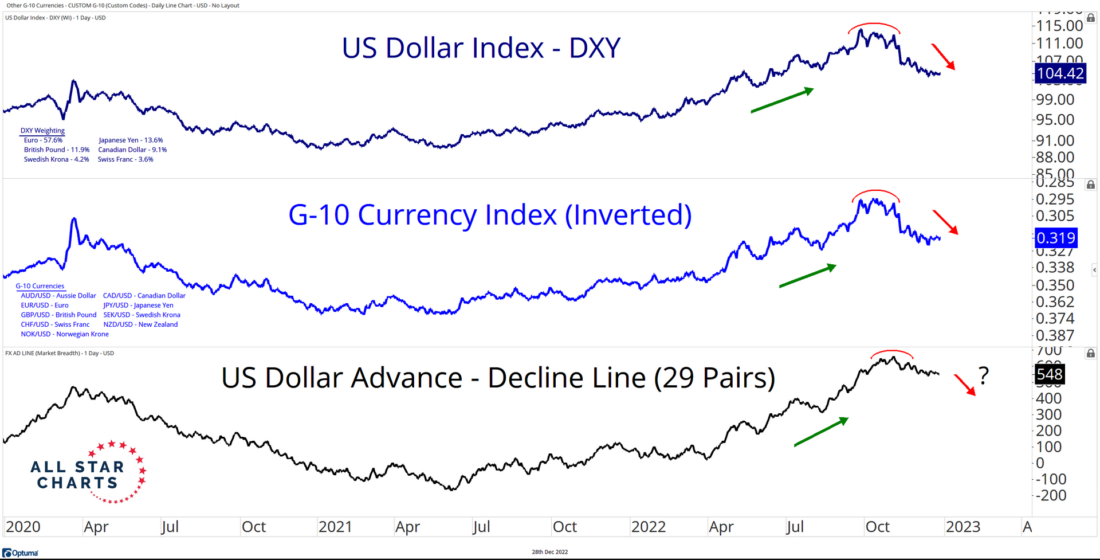

The U.S. Dollar Index (DXY) posted fresh six-month lows as the USD continues to slide. It’s a similar picture when we expand our universe to include Group of Ten (G-10) currencies. But when we look beneath the surface at our USD A/D line, it’s far more buoyant than the DXY and our G-10 currency index:

This disparity is likely due to the hardest-hit currencies—mainly in developed Europe—snapping back after steep selloffs earlier in the year. Remember, the pound retested its all-time lows! Our G-10 index and the DXY reflect those forceful mean reversions. However, more resilient currencies during this year’s USD rally, especially the commodity currencies, continue to chop sideways. If and when these currencies begin to catch higher, we could expect the dollar decline to intensify.

4/ Separating the Wheat from the Chaff

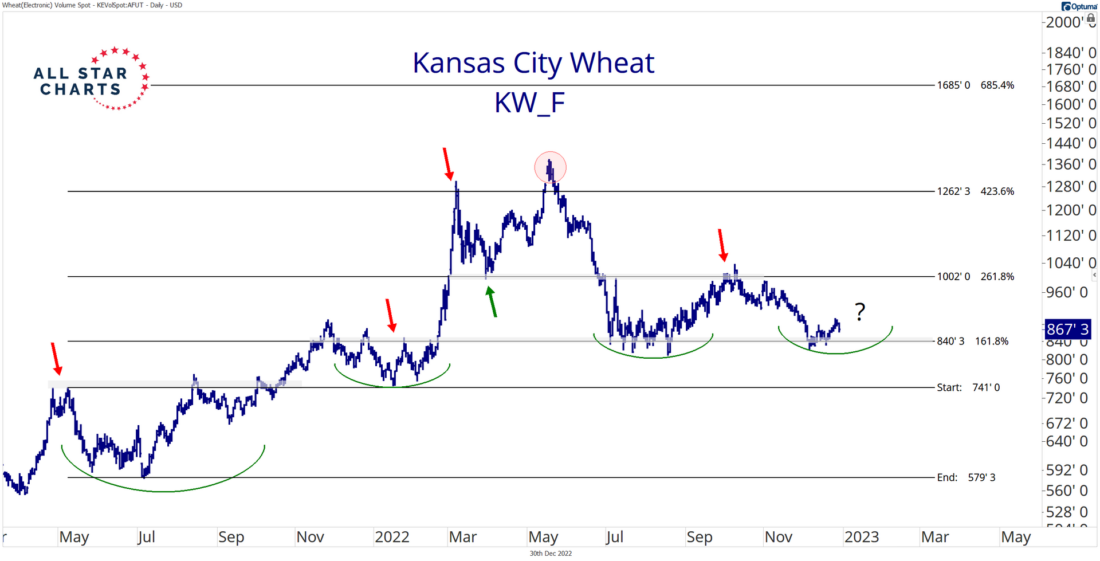

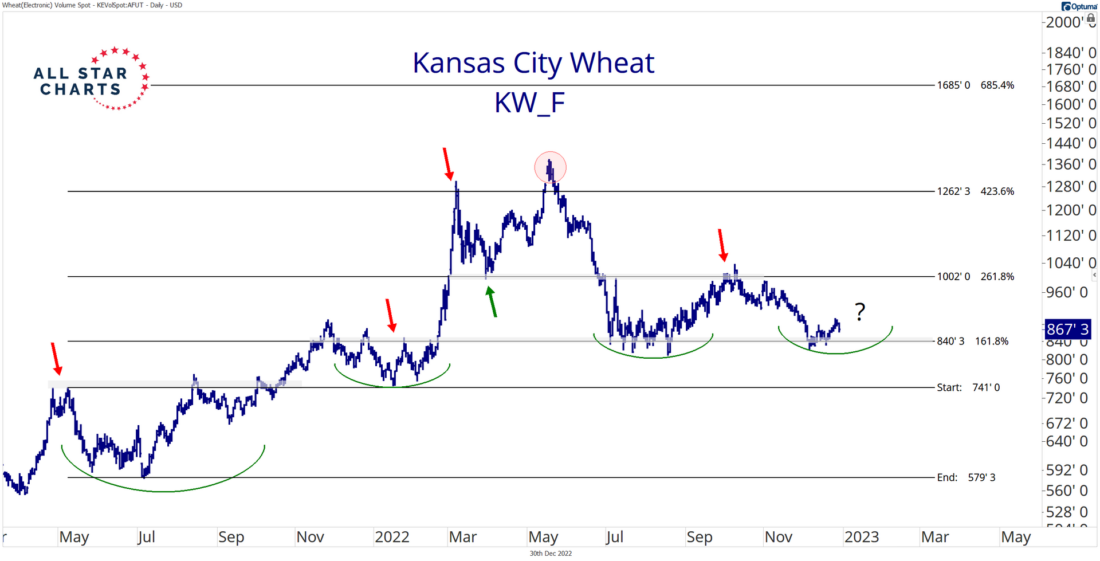

Defensive leadership is a key theme for commodities and stocks heading into the new year. When it comes to stocks, that means utilities, staples, and healthcare sectors. The corresponding groups for commodities include agriculture and precious metals. One of our favorite defensive contracts belongs to the wheat complex. Check out the continuation chart of Kansas City wheat:

It’s a clean chart, respecting key Fibonacci levels during the past 36 months. Plus, it’s a great representative of other wheat contracts, including Chicago and Minneapolis spring wheat. All three contracts currently carve out potential bottoms below their respective October pivot highs. If and when these commodities take out those former highs, we could be in store for some explosive rallies next spring.

—

Originally posted 31st December 2022

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.