TLDR: Hedge funds are buying. And I mean REALLY buying, like their existence depended on it (frankly, it probably does after a mediocre showing last year). The 3.3% rally in Nasdaq on Thursday was greatly helped by short covering that actually eclipsed the GameStop episodes in January 2021. What’s going on?

Tech stocks have surged out of the gate, staging the kind rally that brings back memories of the market’s Covid-era surge. There are plenty of tech tickers with year-to-date gains of more than 50%. Some have already doubled.

It ain’t because the earnings results were so stellar. Combined revenue at the five giants – AAPL, AMZN, GOOGL, META, MSFT – rose just 1% in the recent quarter. Yup, a single meager percent.

META’s top line fell 4% and its guidance was downbeat. Of course, after the word “buyback” investors stopped listening and started buying. GOOGL managed a small gain but reported a drop in ad revenue. MSFT did grow its sales – 2%ish – but disclosed an almost 20% drop in the PC segment. AMZN did the best: solid 9% gain in sales albeit the company is increasingly now a cloud platform.

If it’s not about the micro, it must be the macro.

Traders have concluded that the Fed’s aggressive rate hiking campaign is close enough to the end to warrant a low in the market. The pendulum has swung back to greed.

The resulting flurry of short covering was the largest since November 2015, according to a Goldman Sachs note. Carvana, which fell 98% in 2022 is already up 200% this year. Short interest was at 30 per cent as of Thursday, up from less than 5 per cent a year ago.

AMC Entertainment is a similar story. Its shares fell 76% last year but have now risen 49%so far this year. AMC short interest is running at 29 per cent.

Markets will need some further confirmation from inflation data but – as discussed in these pages a few issues back – it’s pretty clear Powell and Co. think a soft landing is possible.

Back to the good old (bull market) days?

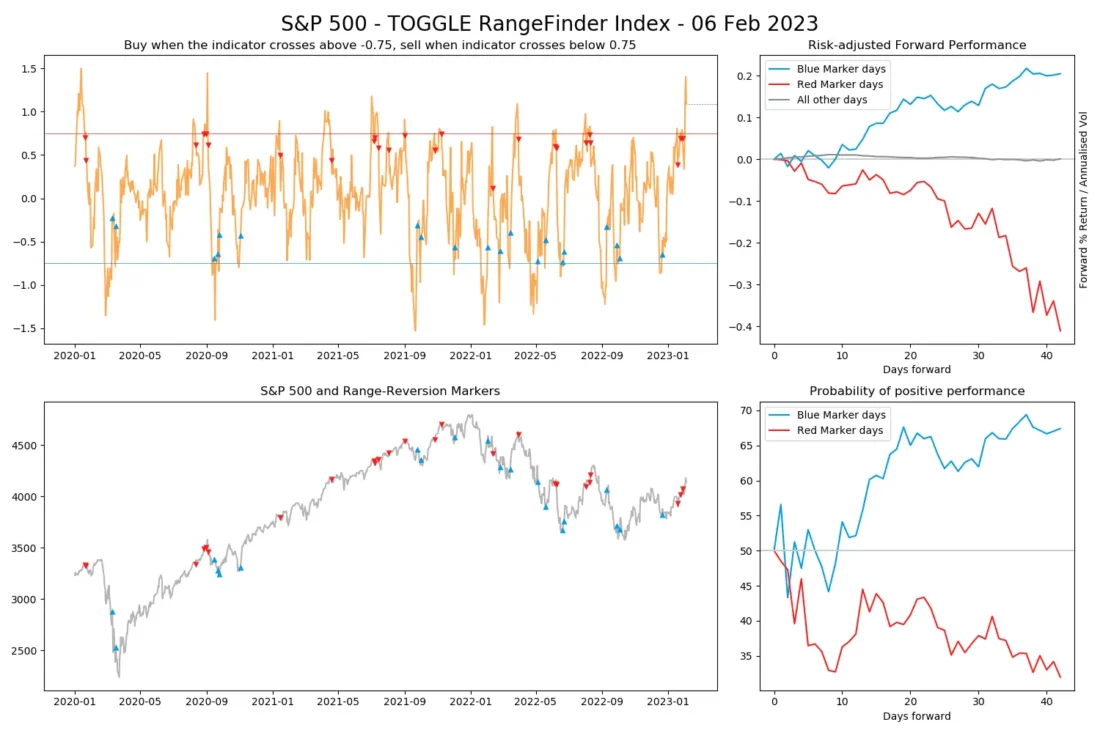

TOGGLE Leading Indicators: Indicators tilt bearish

After the last rally, all our indicators are pointing bearish

- TLI: began flashing red two weeks ago now, now it retraced into neutral

- Rangefinder Index: reached the highest level it ever attained at ~1.5

- Peak Probability Indicator: still not active, nearing the 95% threshold

- Candle Breadth: reached the bearish threshold last week

- Market Phase Shift Indicator: still not active, this is a longer-term indicator

Learn more about the Leading Indicators in the Learn Center!

Upcoming Earnings: Chipotle releases tomorrow

Click here to test what to expect when CMG releases earnings tomorrow.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Netflix MACD suggests potential upside

TOGGLE analyzed 5 similar occasions in the past where technical indicators for NFLX rose and and historically this led to a median increase in the stock price over the following 3M. Check it out!

General Interest: New Yorkers Never Came ‘Flooding Back.’ Why Did Rents Go Up So Much?

An interesting article in Curbed explores the flight from the city during lockdown, the return of occupants and the discrepancy between inflows and rent rises.

See read more here.

Originally Posted February 6, 2023 – Cover, cover!

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: TOGGLE Relationship with IBKR

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)