Ahead of Thursday’s BoE MPC announcement the only question troubling investors is, once again, the size of the seemingly inevitable hike in Bank Rate. The benchmark rate has already been raised at each of the previous eight MPC meetings but such is the size of the current inflation overshoot that a ninth consecutive increase is widely anticipated. However, the majority view is that this week will not see a repeat of November’s 75 basis point move, but a smaller, though still historically large, 50 basis points. If correct, Bank Rate would stand at 3.5 percent, its highest level since October 2008.

Speculation about where Bank Rate might end the year has been slashed since the government’s massive U-turn on fiscal policy and subsequent hefty downward revisions to UK growth and inflation forecasts. Consequently, while a 3.75 percent level remains possible, the economic justification for what would be a very aggressive 75 basis point increase is now much less obvious. Indeed, recall that even at the last meeting MPC member Silvana Tenreyro wanted only a 50 basis point rise and her fellow voter, Swati Dhingra, just 25 basis points. Another split vote is very likely again this week – and it could easily be even wider given the high level of uncertainty about the economic outlook.

The bank should also update the progress made to date on reducing its bloated balance sheet. Disposals of corporate bonds began on 28 September and outright sales of gilts on 1 November, the latter a month late due to enforced emergency purchases used to support a collapsing bond market in late September/early October. As of 7 December, the overall quantity of assets financed by the creation of central bank reserves (QE) stood at £845.9 billion, down from a peak of just under £895 billion earlier in the year. The bank’s QT policy involves selling £10 billion of the gilts every quarter which, with around £40 billion of redemptions also falling due, would shrink the balance sheet by £80 billion over the year. The BoE will also look to offload its £19.3 billion of emergency purchases but sales here will be demand-led, with no fixed timetable so as not to unduly impact the market. To date, the introduction of QT seems to have had only a limited effect on bond yields.

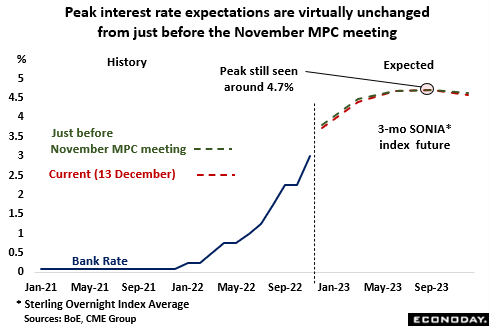

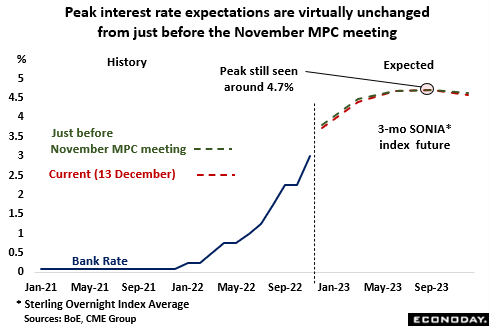

However, alongside the shift in fiscal policy, QT has helped to reduce market expectations for interest rates over the medium-term. Just after the previous administration’s disastrous mini-budget in September, 3-month money rates were seen peaking as high as 6 percent in June 2023. However, the change of leadership and return to fiscal orthodoxy has lowered the discounted peak and at about 4.7 percent, market expectations are currently much the same as just before the November MPC meeting. Last month the MPC made it very clear that it thought financial markets had been far too aggressive in their future interest rate pricing and BoE Governor Bailey is on record saying that it was “blindingly obvious” that rates would probably end up closer to their current 3 percent rate than the 5.25 percent contained in the then new Monetary Policy Report.

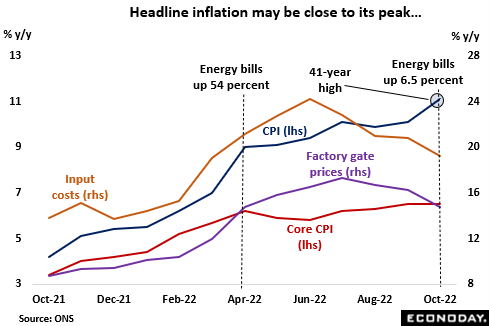

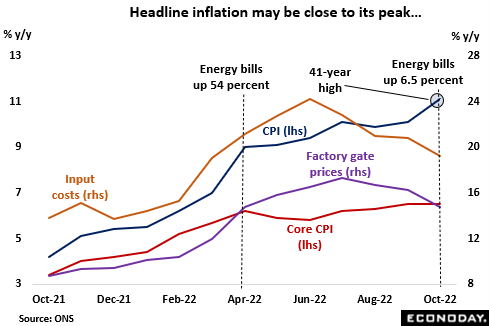

Meantime, the bank’s target indicator, CPI inflation, has continued to accelerate, reaching a 41-year high of 11.1 percent in October. However, the core rate (6.5 percent) at least stabilised and if only through the base effects of sharply rising energy prices over the latter half of 2020 and the first half of this year, there is reason for supposing that the headline print is close to peaking. The government’s Energy Price Guarantee (EPG) shaved several percentage points off the October outturn and its extension, albeit in more modest form, from April next year should subtract around 3 percentage points from the 2023 high. Factory gate inflation (14.8 percent) has been falling for three months now and while still historically very high, October’s rate was the lowest since March. Non-labour input cost inflation (19.2 percent) has also declined every month since June. Against this backdrop, there is hope that inflation has peaked or is at least close to doing so. Even so, the BoE’s new survey of inflation expectations released last Friday found households’ 2-year ahead expectations rising from 3.2 percent in August to 3.4 percent, matching its highest mark since November 2013. Looking out five years, expectations were up 0.2 percentage points at 3.3 percent, although this was at least short of May’s two-and-a-half year peak of 3.5 percent. Gains in both these measures will not sit at all well with the MPC’s hawks.

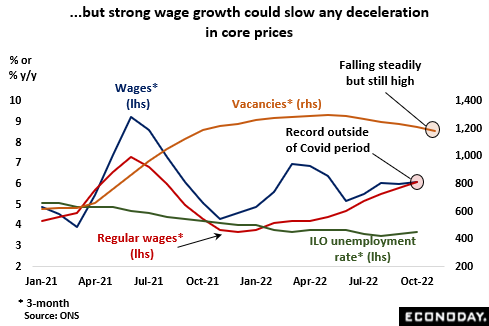

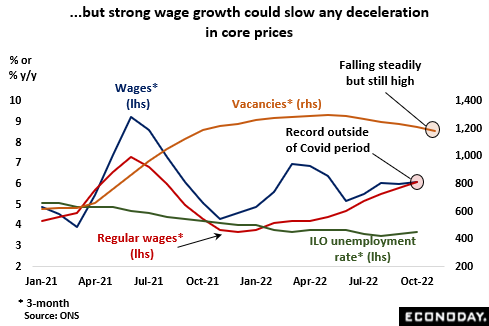

Nonetheless, key to the underlying trend – which will become increasingly important next year as base effects automatically weigh on headline inflation – will be wages. Although the demand for labour has eased recently, the level of vacancies remains more than 26 percent above its pre-Covid level and payroll employment is at an all-time high. Businesses continue to report significant difficulties with hiring while the BoE bemoans a stubbornly low participation rate. Indeed, without a recovery here, wage growth may be sticky at higher rates than normally expected for any given rate of unemployment, making the BoE’s job all the more complicated. As it is, regular wages in the three months to November were rising at their fastest rate on record outside of the pandemic period.

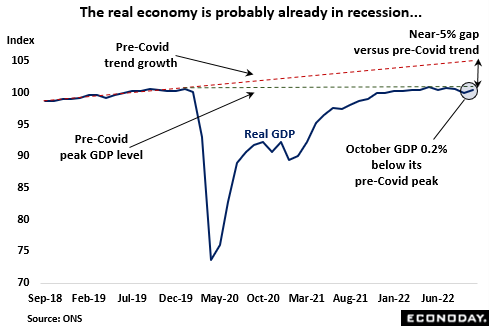

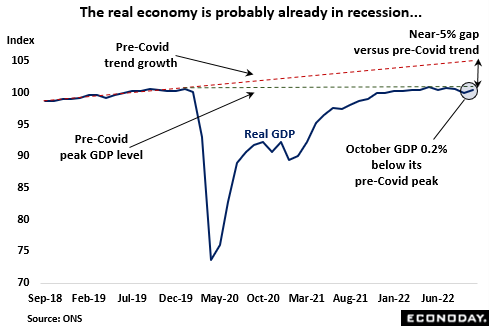

The real economy is almost certainly already in recession and, making matters worse, the downturn has begun with the economy still smaller than its pre-Covid peak in January 2020. October real GDP rose a respectable 0.5 percent on the month but that failed to reverse a 0.6 percent drop in September. The latter print was the worst since the 3.0 percent slump prompted by the Omicron lockdown back in January, albeit biased down by the holiday linked to the funeral of Queen Elizabeth II. October’s gain was only the second in the last five months and with 3-monthly growth at minus 0.3 percent, leaves intact a clear downward trend. In fact, compared with its trend growth rate before Covid, total output was short by almost 5 percent. The fourth quarter will also be hit by wide-ranging strikes, thought likely to cost the economy more lost working days than any time since 1989. Indicators of both business and consumer sentiment are at levels normally associated with contraction and with ongoing Brexit problems exacerbating a slowdown in overseas trade, avoiding negative growth this quarter will be very difficult.

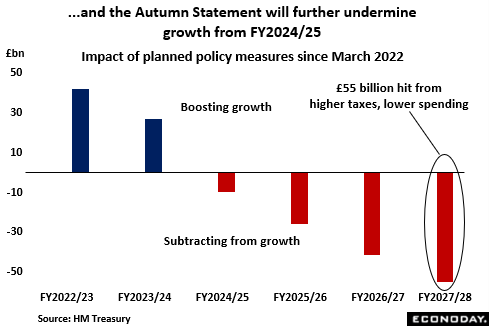

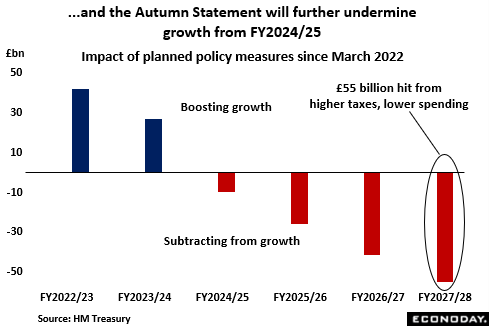

Meantime, even the government admits that the fiscal tightening contained in its new Autumn Statement will put significant additional downside pressure on economic activity and that with the independent Office for Budgetary Responsibility (OBR) already expecting GDP to shrink 1.4 percent in 2023. Planned net tax increases of some £54 billion by FY2027/28 should fill the hole in the financial accounts left by a combination of Covid, the war in Ukraine and rising inflation but it will also weigh heavily on spending and investment. Against this backdrop and compared with the March Budget, fiscal policy will actually be more supportive through FY2023/24 but beyond that, the hit to growth will build steadily as the UK’s tax burden reaches its highest level since 1948. As it is, the next couple of years are likely to be especially grim with real household disposable income seen slumping a record 7.1 percent to its lowest level since 2013. The OBR at least expects inflation to decline but the 9.1 percent and 7.4 percent rates projected for 2023 and 2024 respectively remain well above target.

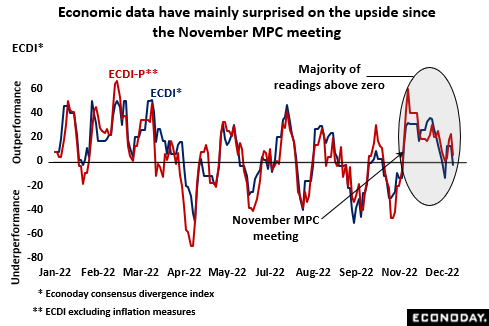

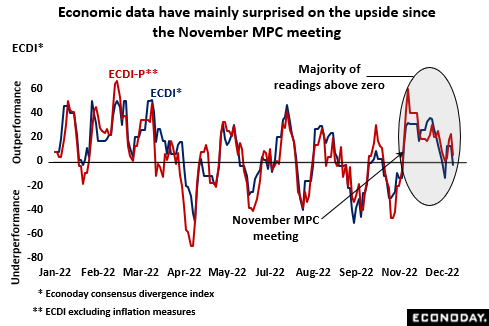

All that said, in the main the hard data have held up surprisingly well since the November MPC meeting. The UK’s ECDI and ECDI-P have been above zero for most of the period, clearly indicating a month of solid outperformance versus market expectations. This will play into the hands of the MPC’s hawks who may well see this relative buoyancy as a sign that the pace of tightening should not be reduced.

In sum, a near-certain split vote on Thursday will probably push Bank Rate up to 3.5 percent. However, with so much uncertainty surrounding the economic outlook in general and, crucially, the likely disinflationary impact of the economic downturn in particular, another 75 basis point hike cannot be ruled out. Either move would bring the terminal rate closer and the latter would probably lower it too. However, if the economy is as weak as many expect in 2023, it may soon be time to let recession do most of the work bringing inflation back to target.

—

Originally Posted December 13, 2022 – December BoE MPC Preview: Policy splits to underline economic uncertainty

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.