In sharp contrast to the severe winter conditions seen in many areas of the US and Canada, there have been record high temperatures in many parts of Europe the past few weeks. Some major European cities saw conditions more typical of late spring and early summer and several ski resorts had to shut down due to a lack of snow. This follows a very hot European summer during 2022 with average temperatures during June through August the highest on record.

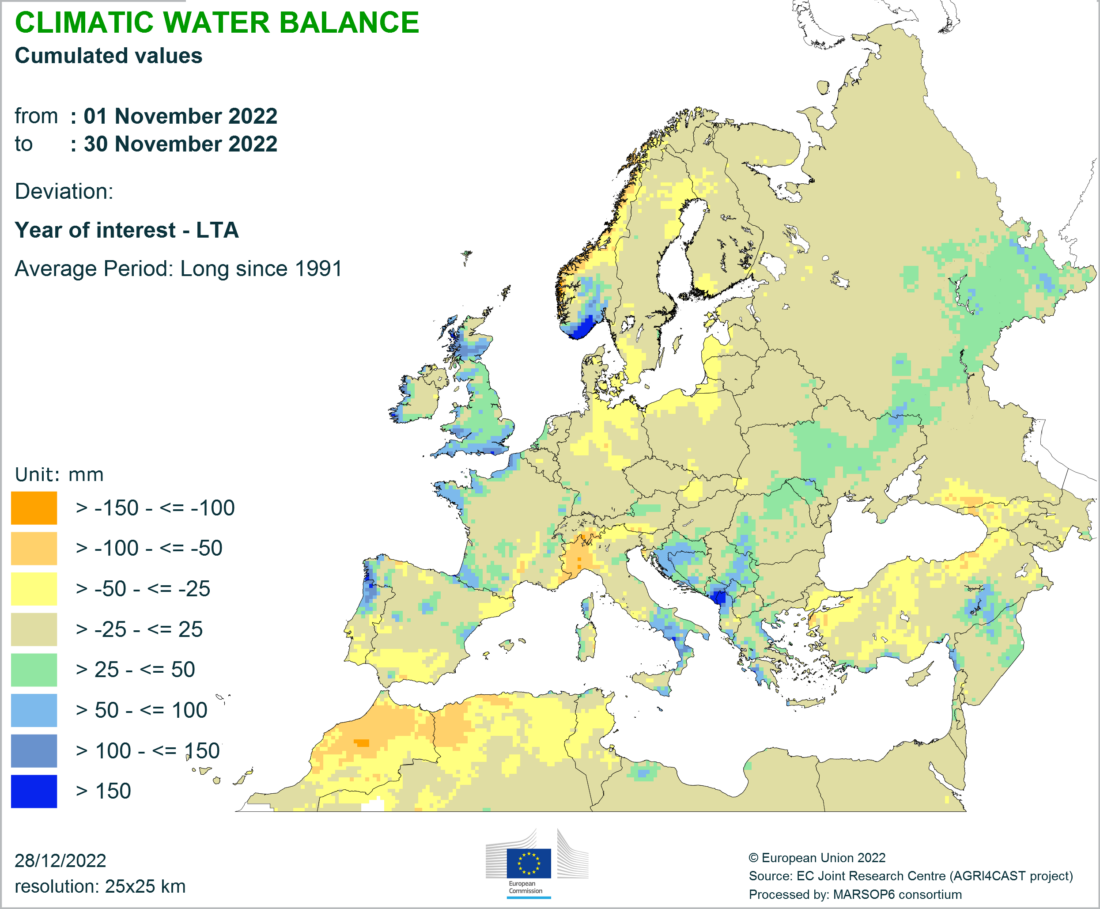

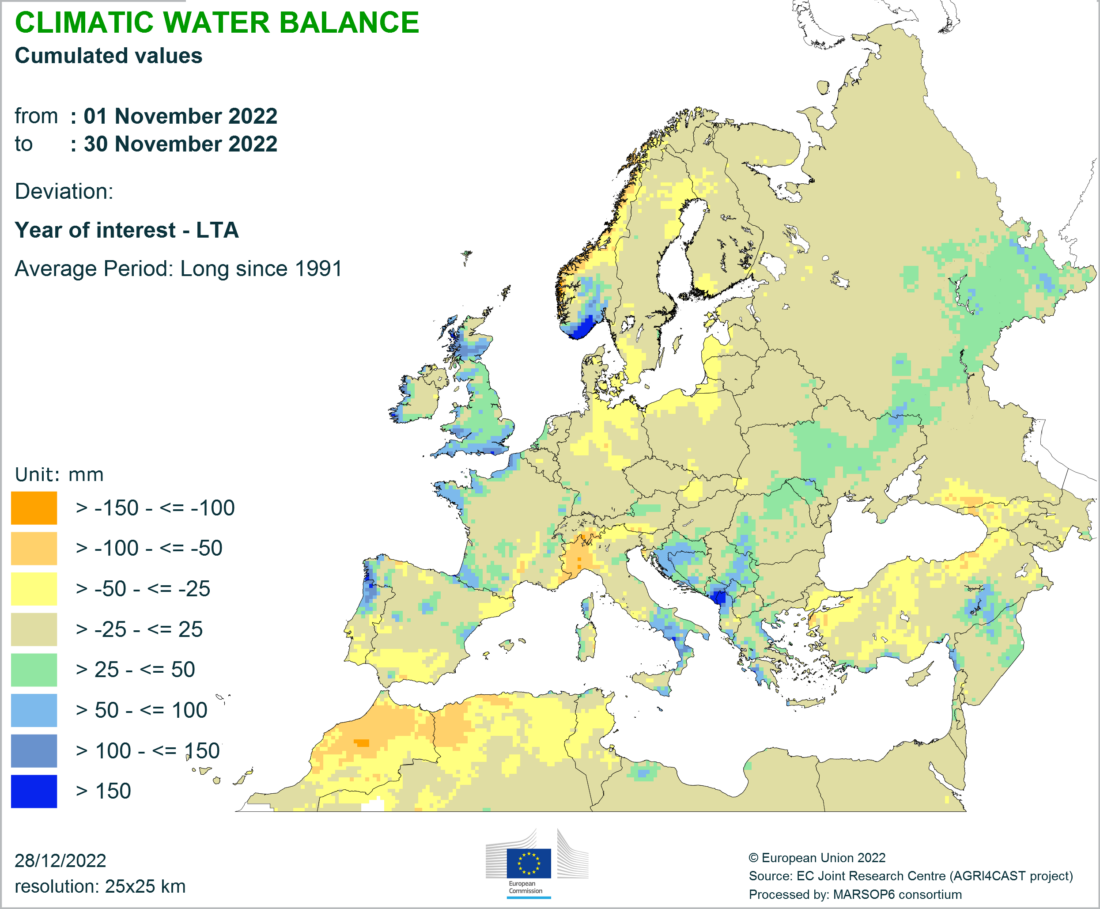

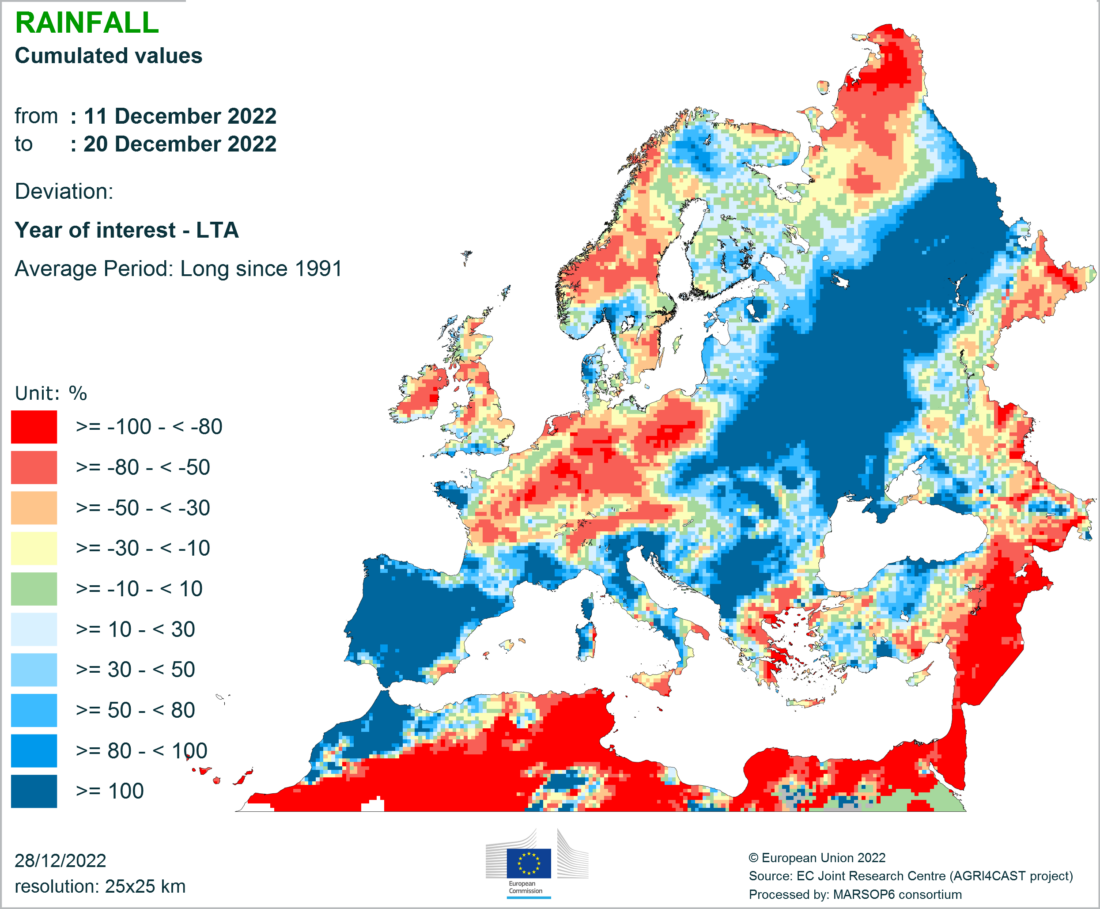

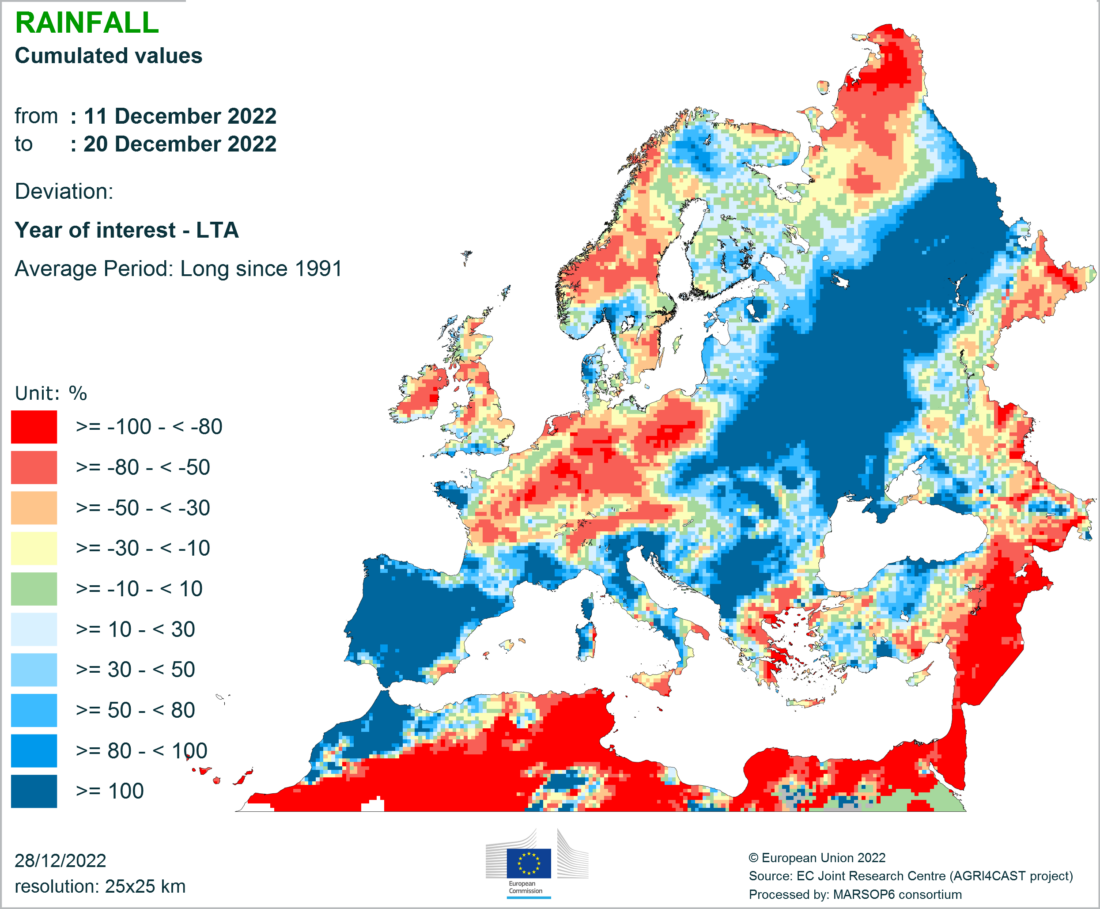

As a result, many areas of Europe were drier than normal at the start of the current winter season. When looking at Climatic Water Balance (which takes into account both precipitation and evaporation), there were significant regions of France, Germany and Poland already in deficit. While pre-holiday rainfall was heavier than normal in some areas of southern Europe, western and northern Europe rainfall was well below normal and is likely to increase the climatic water deficit.

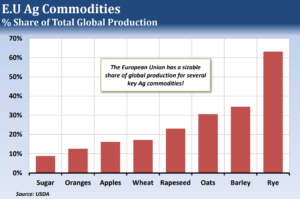

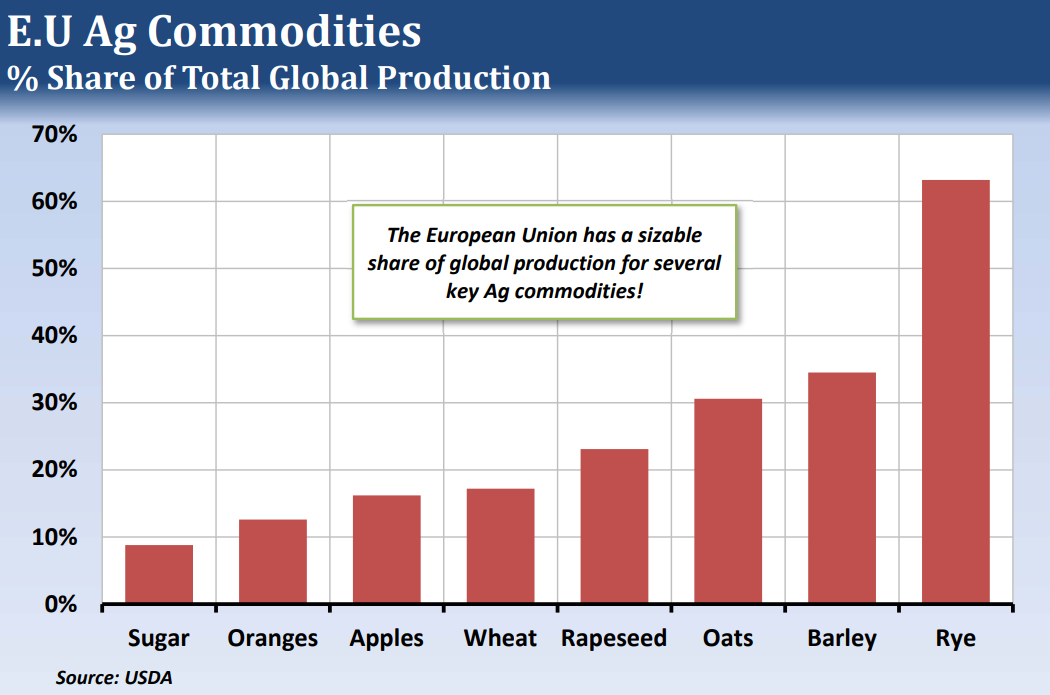

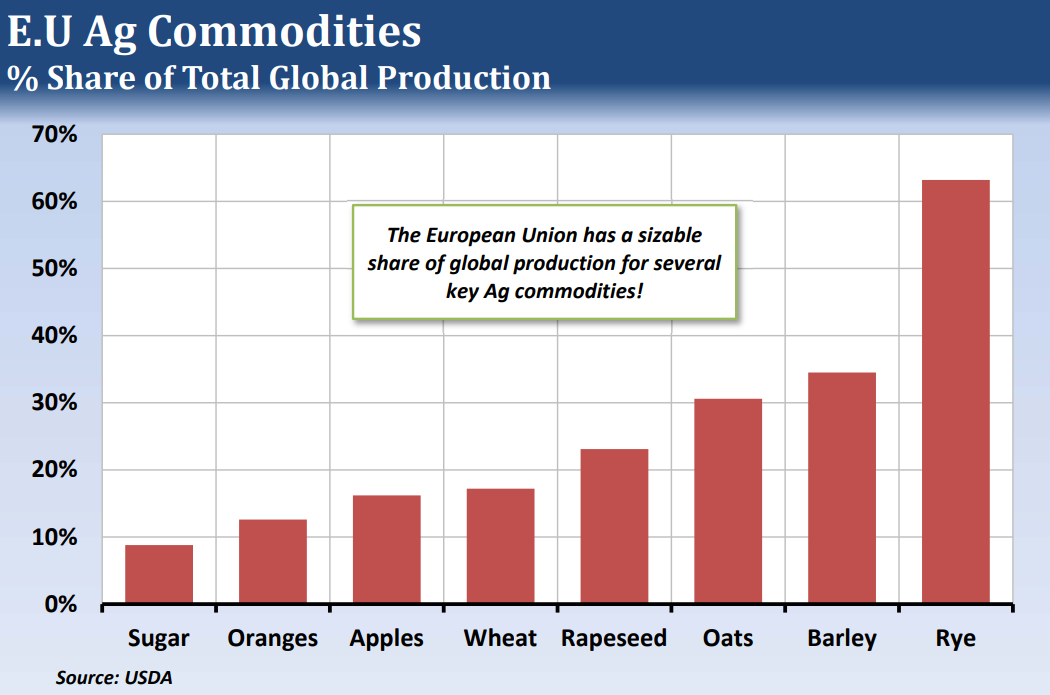

The European Union (the EU) is composed of 27 nations who have Common Agricultural Policy (the CAP). This is why they are viewed as one entity in global production terms. The EU has a large share of global production in several Ag commodities. It produces 63% of the world’s rye, 34% of the barley, and 30% of the oats.

Even though Europe is located at higher latitudes, the EU is the world’s third largest producer of sugar as they are far and away the world largest beet sugar producer.

The EU also accounts for 23% of global rapeseed production which is comparable with Canada. Recent dry conditions in the EU may have their largest impact on the wheat market where the EU has a 17% share of global production. Russia’s invasion of Ukraine will restrict their wheat exports, potentially leaving the EU as the world’s largest wheat exporter. With drier than normal conditions since last summer, EU wheat supplies available for exports could be negatively impacted both this season and next.

—

Originally Published January 6, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)