Key takeaways

What’s different about EM today?

The large emerging market (EM) economies of Asia and Latin America have become more resilient, but slower growing, economies.

Why bother with EM equities?

Why would investors consider EM if economies are slower growing? We highlight four reasons: stock valuations, central bank policy, a strong US dollar, and competitive companies.

2022 is a year that most investors want to see in the rearview mirror, thanks to inflation and monetary tightening in the US, the energy crisis in Europe, and a host of issues in China that are inhibiting medium-term growth. It’s hard to imagine that the cyclical funk in the global economy is going to get substantially better in 2023. However, there are some unpredictable events that could potentially improve that outlook:

- A negotiated peace in Ukraine could lead to lower energy prices in Europe.

- An effort to secure boundaries of geopolitical competition between China and the United States could dial down the tensions.

- A gradual unwinding of elevated inflation, which would be aided by both of the above, would create space for central banks to ease monetary policy.

What’s more, as emerging market investors, we must note that EM equities have not been disproportionally hammered in 2022 as they have been during past crises (which we will explore more below.) This is a result of the relatively staid growth across the developing world over the past decade. The large EM economies of Asia and Latin America have become more resilient, but slower growing, economies. And in our view, they represent attractive opportunities for investors.

Below, we dig into the details of the EM story today.

Almost no place to hide in 2022

There has been almost no place to hide for investors this year.1

- US bond markets are down 16% year-to-date, based on the Bloomberg US Aggregate Bond Index.

- US equities are worse: The S&P 500 Index declined 19% and the NASDAQ Composite lost more than 30% year-to-date.

- International equities have performed better in local currency terms, but the dollar strength has impaired this for dollar investors. Year-to-date, the MSCI EAFE index is down 25% and the MSCI Emerging Market Index is down 31%.

Resiliency in challenging times

As noted above, it is interesting to highlight the relative performance of emerging market equities today compared to other troubled times over the past 40 years. EM equities are generally viewed as a beta5 play, or proxy, on global economic cycles. As such, the asset class has historically been absolutely flattened in environments like we’re experiencing today.

- EM-specific crises of the early 1980s (the Latin American debt crisis), 1994 (the “tequila crisis”) and 1997-1998 (the Asian financial crisis) were all birthed in an environment where the US Federal Reserve was aggressively hiking rates. These were very, very dark times for EM investors.

- Even in periods when the busts were created in developed markets, EM equities were hammered disproportionately. The dot-com bust of 2000-2002 and the Global Financial Crisis of 2007-2008 did not wreck EM economies, but the beta wrecked EM equities’ relative performance.

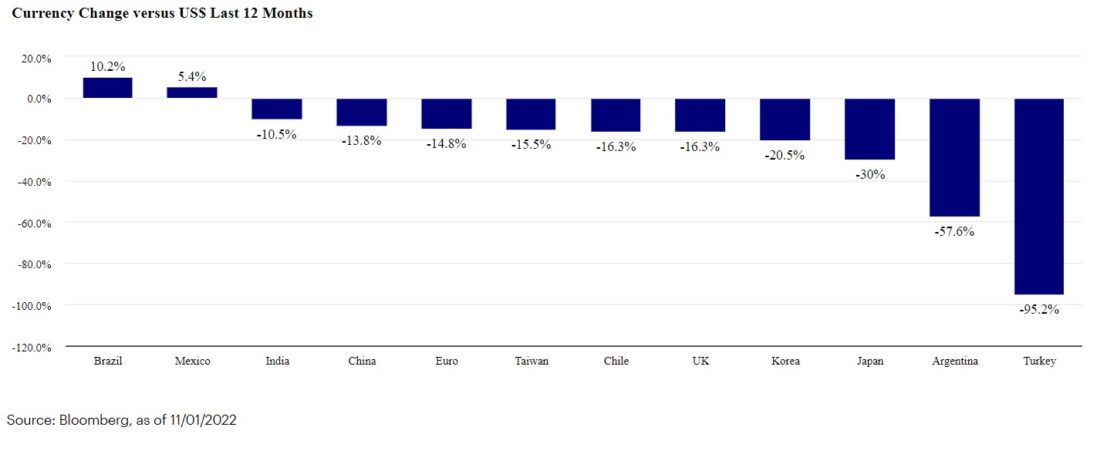

Today we have the combination of aggressive US Fed rate hikes, a very strong US dollar, and the prospects for significant global recession in the near future. Yet, EM currencies have outperformed their non-dollar developed peers, while EM equity markets have not experienced the dramatic underperformance that they did in those past crises.

EM currencies have outperformed their non-dollar developed peers

What’s different this time?

The simple answer is that there are no major excesses across the EM landscape with the possible exception of China. This is a result of the relatively staid growth of much of the past decade across the developing world. In essence, the large EM economies of Asia and Latin America are no longer global beta plays. They are no longer growth markets addicted to the vagaries of foreign capital (in hard currency). Nor are they, broadly speaking, enjoying the tailwinds of global trade growth, which has slipped considerably in the past decade. Instead, they have become resilient, but slower growing, economies.

With rare exceptions, for example Turkey, none of the large EM economies have any external imbalances. Current account balances are healthy relative to the developed world – the US current account deficit of 3.5% of gross domestic product compares to deficits of less than 2% for Brazil, India, and Mexico, and current account surpluses for Taiwan, Russia, South Korea, and China.4 Foreign exchange reserves are very high. This contrasts with bygone periods where EM markets exhibited “global beta” characteristics — lots of external, hard currency debt; high current account deficits and shock when USD rates increased.

And the large EM economies have no material internal imbalances. Credit growth has been subdued for much of the past decade, and banks are well-capitalized and liquid. Fiscal balances are generally healthy, with arguable exceptions in South Africa and Brazil. There have been no notable asset price bubbles of the post-Global Financial Crisis world to speak of, which is why EM equity returns have been so unexciting for the past eight years. As an aside, one might speculate that the only real asset bubble of significance in the world is the US, but that’s for another blog.

Why bother with EM equities?

If emerging markets are no longer ‘global beta’, and they are delivering slower, albeit more resilient, growth, what’s the attraction for equity investors? We see four main reasons.

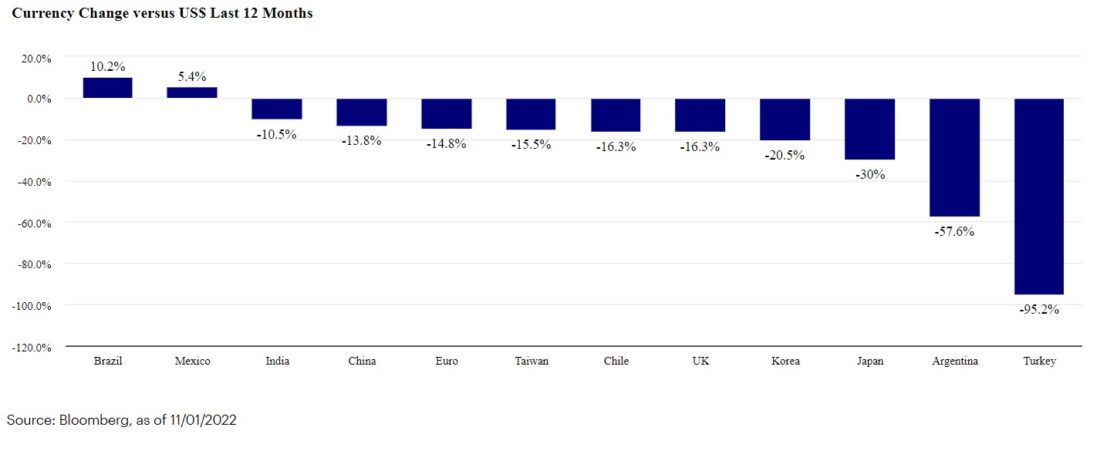

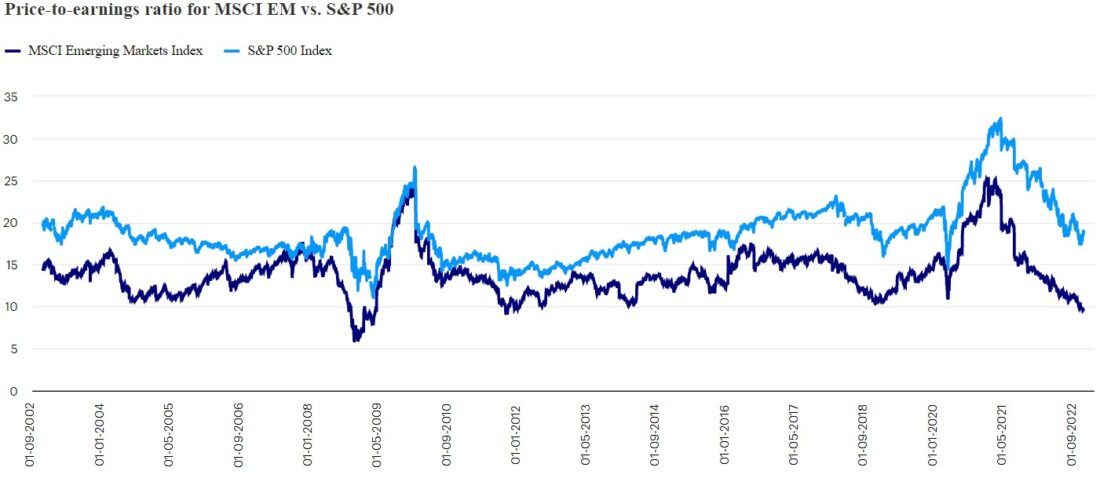

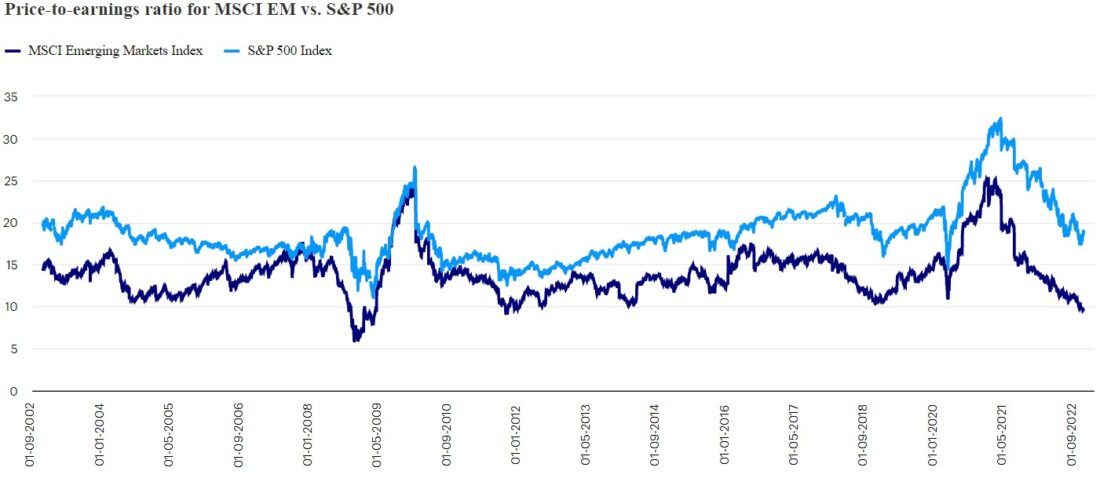

1. Value. We believe there is tremendous value in EM equities, even in a slower growth world. EM stocks are cheap in both absolute and relative terms. Though lower EM macro growth is likely, we do not expect to see the same magnitude of cyclical earnings risk broadly across EM that is likely to be observed in US equities after the last 10 years of stunning profit growth and multiple expansion.

EM stocks are cheap compared with US equities

Source: Bloomberg, as of 11/1/2022

Past performance does not guarantee future results. An investment cannot be made directly into an index.

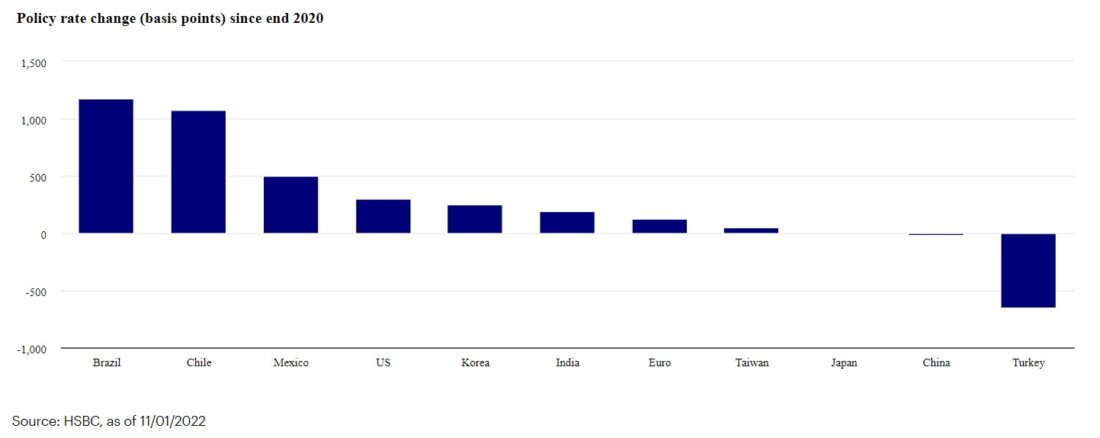

2. Central bank policy. As we have stressed before, EM central banks are significantly ahead of their developed markets peers in addressing recent inflation. Rates have moved up dramatically across much of EM. Inflation is already rolling over in some of these economies given the growth-sapping nature of these hikes. We believe EM central banks are in a position to cut rates significantly over the next 12 months, which should serve to boost real economic growth and lift valuation from very low levels.

EM rate hikes have given them a head start in fighting inflation

3. The US dollar. The US dollar is richly valued. In our view, this is unsustainable and, as we are witnessing, destructive to US corporate earnings. And, as mentioned earlier, US asset prices are also relatively expensive. In our view, the next few years are going to be much more favorable to international equity investors on a relative basis than the past decade.

4. Competitive companies. Finally, the real reason to invest in EM equities, in our view, is the same as the motivation to invest in developed market equities – seeking out extraordinary companies with sustainable competitive advantages that lead to market share gains in their core businesses and create real options in adjacent businesses.

- These can be globally advantaged companies with strong long-term growth prospects. In our view, these companies exist in industries like beverages (Pernod, Ambev), IT services (Tata Consultancy Services, Infosys), semiconductors (TSMC) or luxury (Richemont), where the combination of recent rate hikes and cyclical slowdowns have led to valuation de-ratings.2

- These can also be domestic winners. In our view, this category includes resilient businesses in China’s hotel (H World), restaurant (Yum China) and logistics (ZTO) industries, which we expect to eventually see a sharp recovery in near-term growth from less draconian mobility restrictions.3 Even in the resource space, we see companies with strong capital discipline, great free cash flow, and dividend yields that we expect to benefit from structural supply constraints.

Conclusion

For most investors, the steep decline in global equity markets this year has certainly been discouraging. However, crisis often births unique opportunities for experienced investors who remain focused on long-term prospects. We, as most investors, have been humbled by the challenges of this year but we expect the tailwinds we’ve identified for emerging market equities to we expect that the tailwinds we’ve identified for emerging markets equities could result in outperformance for the category.

Footnotes

- 1Source for performance data in this section: Bloomberg, L.P., as of 11/1/22.

- 2As of 9/30/22, Invesco Developing Markets Fund held the following companies: Pernod (4.0% of assets under management), Ambev (1.6%), Tata Consultancy Services (4.7%), Infosys (2.2%), TSMC (6.6%) and Richemont (1.8%).

- 3As of 9/30/22, Invesco Developing Markets Fund held the following companies: H World (3.6% of assets under management), Yum China (5.8%), ZTO (3.6%), Grupo Mexico (3.9%) and Vale (1.7%).

- 4Bloomberg as of 12/31/2021.

- 5Beta is a concept that measures the expected move in a stock relative to movements in the overall market.

—

Originally Posted November 9, 2022 – Emerging from crisis: The case for developing markets in 2023

Important information

NA2571503

Past performance is not a guarantee of future results.

An investment cannot be made directly in an index.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

An investment in emerging market countries carries greater risks compared to more developed economies.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The Bloomberg US Aggregate Bond Index is an unmanaged index considered representative of the US investment-grade, fixed-rate bond market.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The NASDAQ Composite Index is the market capitalization-weighted index of approximately 3,000 common equities listed on the Nasdaq stock exchange.

The MSCI EAFE Index is an unmanaged index designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the US and Canada.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 26 Emerging Markets (EM) countries.

Gross domestic product is a broad indicator of a region’s economic activity, measuring the monetary value of all the finished goods and services produced in that region over a specified period of time.

The price-to-earnings (P/E) ratio measures a stock’s valuation by dividing its share price by its earnings per share.

A basis point is one hundredth of a percentage point.

The opinions referenced above are those of the author as of Nov. 2, 2022. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.