Having already been raised in December 2021 and again at each MPC meeting in 2022, Bank Rate is widely expected to be hiked for a tenth successive time on Thursday. However, the magnitude of Thursday’s move is much less certain. Splits on the MPC have become significant with the doves mainly focussed on slowing, if not declining, economic activity and the hawks more worried about strong wage growth in a still very tight labour market. Reflecting the high level of uncertainty about the economic outlook, disagreements at December’s deliberations were particularly marked. Voting ranged from no change at all to a hike of fully 75 basis points and another, sizeable, split is very probable this week. The market consensus is 50 basis points, which would match the December decision and lift Bank Rate to 4.0 percent, its highest level since October 2008 and boost the cumulative increase to date to some 390 basis points. However, a smaller, 25 basis point move is certainly a real possibility.

Meantime, having (largely) recovered from the fallout from September’s ill-received mini-budget, financial markets have performed well enough to allow the bank’s QT programme to run quite smoothly. Outright sales of corporate bonds from the Asset Purchase Facility (APF) began on 28 September and of gilts on 1 November. Since (passive) QT started in March 2021, total disposals have amounted to around £55 billion, reducing the stock of QE to just under £854.5 billion. For the fourth quarter, the bank decided to restrict APF gilt sales to the short and medium maturity sectors only but the schedule for the current quarter involves five auctions, each of £650 million, in short, medium, and long maturity buckets. Total planned gilt liquidations over the quarter are £9.75 billion. In addition, the bank indicated last month that it had unwound the emergency £19.3 billion of gilt purchases made in late-September/early October when the market was in freefall after the mini-budget.

Market expectations about where interest rates will peak this year have been trimmed in recent weeks. Just before the December MPC meeting, 3-month money rates were seen topping out at about 4.7 percent in September. However, helped by unexpectedly soft inflation news out of the U.S., financial markets are now pricing in a high of around 4.4 percent in June. This will have important implications for the bank’s new Monetary Policy Report (MPR), released alongside the Bank Rate announcement on Thursday. The MPR uses market pricing for its interest rate assumptions and, in the November edition, had Bank Rate as high as 5.2 percent in the third quarter of 2023. The updated version will show a significantly lower peak which should mean a higher longer-term inflation forecast.

Actual inflation looks to have reached its cyclical high last October when the revised energy price cap was instrumental in lifting the headline annual rate to 11.1 percent, a 41-year high. Since then, lower oil prices have helped to reduce overall inflation with December posting a 10.5 percent rate, a 3-month low albeit still a whopping 8.5 percentage points above the BoE’s target. However, the core rate is proving to be more of a problem and at 6.3 percent at year-end, was only unchanged from its November reading and just a couple of ticks short of the record high seen in September and October. Indeed, the risk of second-round effects from sustained high inflation remains a major worry for the MPC. Despite the monetary tightening already delivered, the latest BoE/Ipsos quarterly inflation attitudes survey released last month found households’ inflation expectations still well above the 2 percent target. At 4.8 percent, the 1-year ahead view was down only marginally from the 4.9 percent call in the previous report and expectations for the 2-years ahead (3.4 percent after 3.2 percent) and 5-years ahead (3.3 percent after 3.1 percent) were both higher. Such findings will strengthen concerns about a possible permanent shift in consumers’ view of inflation that could make workers’ calls for higher wages all the more vocal.

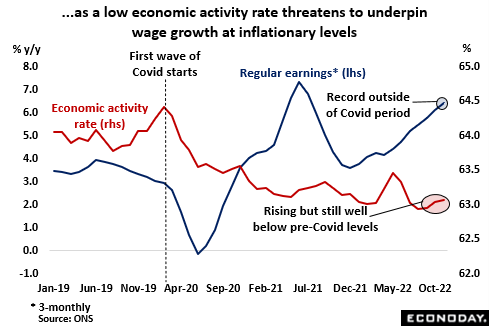

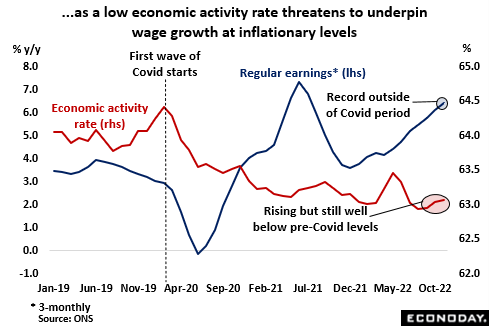

On the wages front, the bank is also having to confront the problems caused by declining labour force participation. The economic activity rate – the share of the population in work or actively seeking and able to work – hit a two-decade low in the third quarter of 2022 and, despite a modest improvement since, remains well short of its pre-Covid levels. More than half a million people have left the labour force since the start of the pandemic and the bank can do little about such structural changes that, by reducing the supply of workers available to businesses, increase competition and bid up pay rates. In terms of the demand for labour, vacancies have been falling consistently since the May-July quarter, largely in response to the BoE’s aggressive tightening. Even so, at 1.161 million in the fourth quarter, they were still more than 40 percent higher than just before the pandemic began. In other words, the labour market remains very tight, a characteristic reflected in annual regular wage growth of fully 6.4 percent in the three months to November, a record outside of the distorted Covid period.

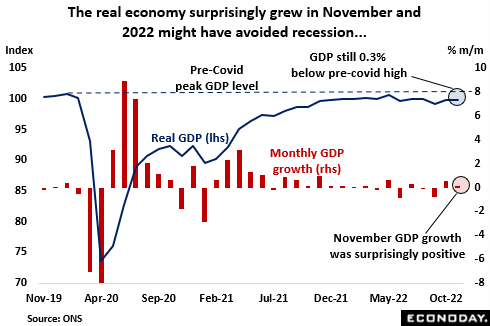

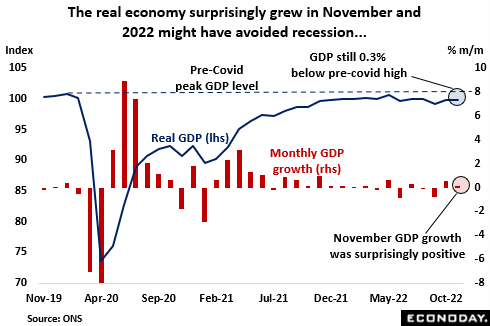

According to the early hard data, it looks as if the real economy held up rather better than anticipated last quarter. With many analysts expecting the period to confirm the arrival of recession, November’s GDP report actually showed total output expanding a monthly 0.1 percent. Absent any revisions, this left December requiring a contraction of at least 0.4 percent to ensure a second successive negative handle on quarterly economic growth. While such a decline is quite possible, there is now a real chance that recession was avoided in 2022 which, if true, would come as a surprise to the BoE MPC and potentially provide at least a psychological lift to UK financial markets. Nonetheless, as of November, the economy was still smaller than it was just before the pandemic struck and the goods producing sector has contracted every month since March. Similarly, retail sales remain very depressed. Volumes fell a further 1.0 percent last quarter and the sector faces a very testing 2023 as the damage from ongoing, near-nationwide, strikes is compounded by heavily squeezed real disposable incomes, rising unemployment, and falling house prices – already on some measures enduring their worst period since 2008. A 2-year low (47.8) on January’s flash PMI composite output index also warns of a weak start to 2023.

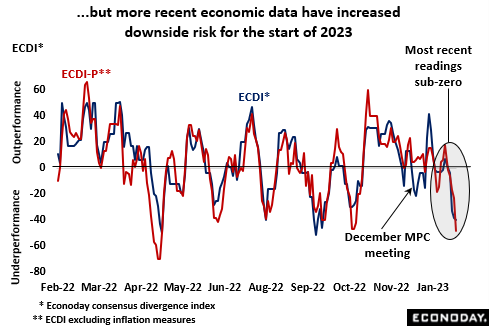

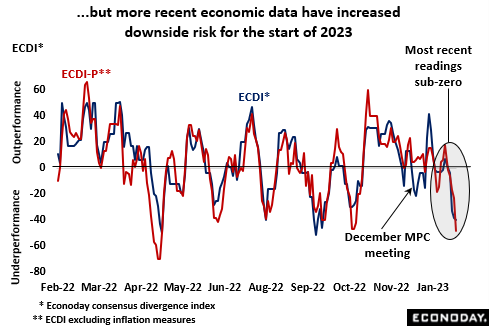

In fact, since the bank’s December meeting the majority of economic indicators have surprised on the downside. The UK’s ECDI and ECDI-P have been below zero for almost the entire period and recently fell quite deep into negative surprise territory. This offers early warning that a probable contraction in real GDP this quarter could be steeper than currently discounted, a possibility that will not be wasted on the MPC’s doves who seem all the more likely to renew their previous call for no more interest rate hikes.

In sum, with the BoE’s crystal ball as clouded as ever, Thursday will most likely see another split vote, albeit with the majority favouring another 50 basis point hike in Bank Rate to 4.0 percent. Such an outcome should not have a major impact on asset markets but any increase in the number of MPC members voting for no change (two in December), could well see peak interest rate expectations trimmed further and knock the pound.

—

Originally Posted January 30, 2023 – February BoE MPC Preview: The crystal ball is no clearer

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)