Russ Koesterich, CFA, JD, Managing Director and Portfolio Manager, of the Global Allocation team discusses whether markets have bottomed or not.

U.S. equities fell more than 9% in September, pushing year-to-date losses to roughly 24%. Only five calendar years have been worse, and three of those were during the Depression. Given the depth and breadth of the bear market, investors are asking a simple question: Have we bottomed? Last August, I suggested caution before chasing the summer really. At the time I cited three factors working against stocks: the Federal Reserve, the calendar, and the likelihood for softer earnings. Today I’d say the first issue is less of a threat, the second is turning positive and the third remains a question mark. The net effect is a still volatile market but one where downside and upside are becoming more balanced.

Valuations

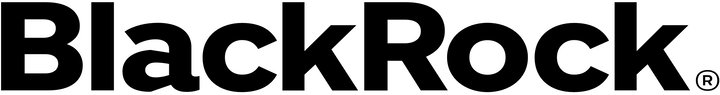

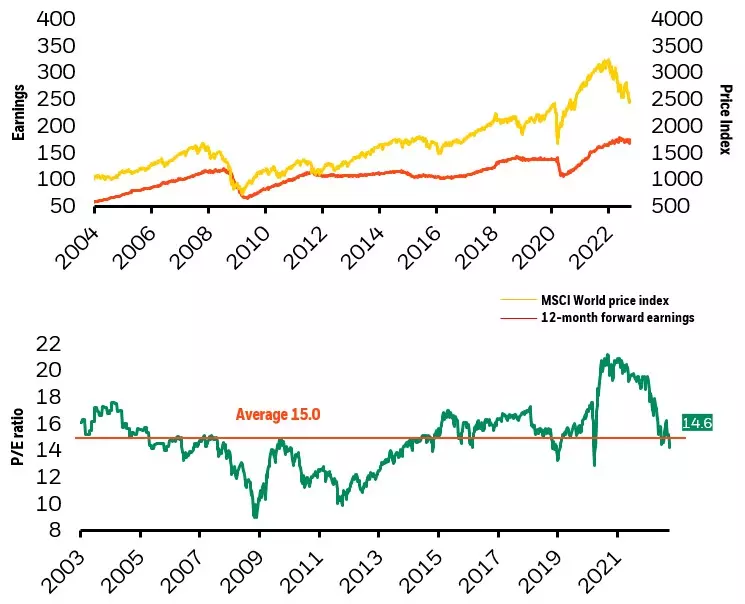

September’s losses brought stock valuations back to the year’s lows, with the S&P 500 trading down to approximately 15x next year’s earnings. While valuations dipped below these levels in early 2020 and late 2018, the post-COVID market premium has been eliminated. On a global basis, valuations have also mean-reverted and are now slightly below the long-term average (see Chart 1). Sticky inflation and an aggressive Fed can result in more multiple compression, but most of the adjustment has probably taken place.

Global equity price and earnings

Closer to restrictive territory

By the time the Fed completes its November meeting, monetary policy will be firmly in restrictive territory. In barely six months, real (i.e. inflation-adjusted) two-year yields have surged from -3% to 2%, the highest level since the 2008 financial crisis. The 500 bps swing represents one of the fastest tightening campaigns in history. While November is unlikely to be the last hike, nor will the central bank quickly pivot to lower rates, by year’s end much of the Fed’s work will be done.

Seasonality turning positive

Seasonality’s impact is often exaggerated but it is not irrelevant. This year September more than lived up to its poor reputation. While October can be volatile, the final quarter of the year is generally supportive for stocks. Since 1987 Q4 has been the best periods for equities, with the S&P 500 posting an average monthly price gain of approximately 1.5%.

Earnings will be key

With the calendar turning positive and rates having already staged a massive adjustment, the key for the market going forward will be earnings. Despite a historic tightening campaign and surging prices, the U.S. economy has proved remarkably resilient. While investors are realistic enough to discount some additional slowing, it’s not clear that earnings estimates reflect a full-blown recession. Under this scenario, even with steady valuations markets can move lower. To my mind, this is the big outstanding question. That said, assuming continued resilience and a modest slowdown or brief contraction, much of the carnage is probably behind us. This suggests more of a two-way market rather than a relentless grind lower. It’s probably too soon to aggressively add, but it’s also likely past the time to cut.

—

Originally Posted October 28, 2022 – Finding the market bottom: Why it’s a process, not a moment

© 2022 BlackRock, Inc. All rights reserved.

Investing involves risks including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of September 2022 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

The BlackRock Model Portfolios are provided for illustrative and educational purposes only, do not constitute research, investment advice or a fiduciary investment recommendation from BlackRock to any client of a third party financial advisor (each, a “Financial Advisor”), and are intended for use only by such Financial Advisor as a resource to help build a portfolio or as an input in the development of investment advice from such Financial Advisor to its own clients and shall not be the sole or primary basis for such Financial Advisor’s recommendation and/or decision. Such Financial Advisors are responsible for making their own independent fiduciary judgment as to how to use the BlackRock Model Portfolios and/or whether to implement any trades for their clients. BlackRock does not have investment discretion over, or place trade orders for, any portfolios or accounts derived from the BlackRock Model Portfolios. BlackRock is not responsible for determining the appropriateness or suitability of the BlackRock Model Portfolios or any of the securities included therein for any client of a Financial Advisor. Information and other marketing materials provided by BlackRock concerning the BlackRock Model Portfolios –including holdings, performance, and other characteristics –may vary materially from any portfolios or accounts derived from the BlackRock Model Portfolios. Any performance shown for the BlackRock Model Portfolios does not include brokerage fees, commissions, or any overlay fee for portfolio management, which would further reduce returns. There is no guarantee that any investment strategy will be successful or achieve any particular level of results. The BlackRock Model Portfolios themselves are not funds. The BlackRock Model Portfolios, allocations, and data are subject to change.

For financial professionals: BlackRock’s role is limited to providing you or your firm (collectively, the “Advisor”) with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of the Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for a client’s account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein for any of the Advisor’s clients. BlackRock does not place trade orders for any of the Advisor’s clients’ account(s). Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics–may not be indicative of a client’s actual experience from an account managed in accordance with the strategy.

For investors: BlackRock’s role is limited to providing your Advisor with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of your Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for your account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein. BlackRock does not place trade orders for any Managed Portfolio Strategy account. Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics—may not be indicative of a client’s actual experience from an account managed in accordance with the strategy. This material is subject to change.

Prepared by BlackRock Investments, LLC, member FINRA.

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRRMH1022U/S-2463987-1/4

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)