While 2022 was arguably one of the worst, if not actually the worst, years for the U.S. bond market in modern history, a silver lining has emerged. Indeed, with yield levels surging across the asset class spectrum, one could conclude that a semblance of ‘normalcy’ has returned to the fixed income arena.

Up until this year, the one major question I was always asked was: Where can I find yield in the bond market? To be sure, with U.S. rates being dragged down by zero interest rate (ZIRP) central bank policies, negative sovereign debt yields abroad and a lack of inflation, to name a few key factors, investors had been left with historically low yield levels, a new normal for the bond market.

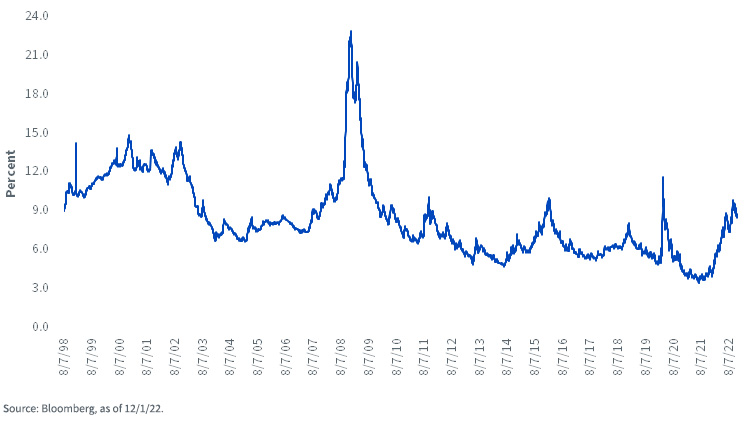

UST & U.S. IG Corporate: Yield to Worst

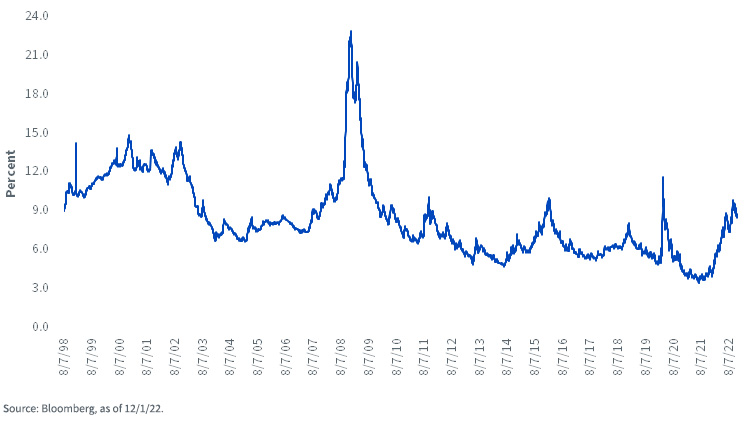

U.S. High Yield: Yield to Worst

As we are about to embark on a new calendar year, the fixed income landscape has changed dramatically. As I mentioned in a prior blog post, I would argue that the historically low yield levels of the last 10 to 15 years were “abby normal,” to quote the movie Young Frankenstein, and that investors are now witnessing what normal looks like when central banks are no longer pursuing ZIRP and are actually tightening monetary policy because of inflation.

This new rate regimen has brought Treasuries (UST), investment-grade (IG) corporates and high-yield (HY) corporates all back to familiar pre-global financial crisis territory, arguably the genesis of the abnormal yield structure for the last decade or so (see graphs). For Treasuries, that means a yield to worst reading at or around 4%, and for U.S. IG corps, levels over the 5% threshold. Perhaps one of the more intriguing developments has been the rise in HY into the 8%–9% range. Compare these readings to where they were just a year ago: UST 1.12%, U.S. IG corps 2.29% and HY 4.74%.

Conclusion

From an investment backdrop, investors now have some definitive options within the fixed income arena. In fact, even though Fed Chairman Powell has signaled the potential for some slowing in the pace of rate hikes, perhaps as soon as next week’s FOMC meeting, he also emphasized that rates could be heading higher for longer, with no apparent appetite to reverse course anytime soon. So, if I was asked the aforementioned question about where to find yield in the bond market now, my answer has now become a much easier one.

Indexes:

- Treasuries: Bloomberg U.S. AGG Treasury Yield to Worst

- IG Corps: Bloomberg U.S. AGG Corporate Yield to Worst

- High Yield: Bloomberg U.S. Corporate High Yield Yield to Worst

For more insights, please visit our Fixed Income Strategy page.

—

Originally Posted December 7, 2022 – Fixed Income: A Return to Normalcy

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.