Although they finished this week with a sharp pullback, gold prices remain at historically high levels. There is a saying among commodity traders that “the cure for high prices is high prices.” The idea is that high prices will encourage producers to increase output, which in turn will lead to an increase in supply that will ultimately result in lower prices. The gold market could be an exception.

The World Gold Council (WGC) released their Gold Demand Update for 2022 earlier this week, and in it they reported that overall gold demand reached an 11-year high. A large portion of that surge came from central banks, whose purchases of 1,136 tonnes reached a 55-year high. Official gold coin demand increased by 13% as well. This helped offset a 2% decline in gold jewelry demand and a 7% decline in gold technology demand.

Unlike many commodities, a portion of metals demand can be met by recycling. Over the past decade, gold recycling has accounted for 23% to 28% of the WGC’s estimated supply. The 2022 recycling total came in at 1,144.1 tonnes, which was 7.9 tonnes above 2021. However, this was 148.9 tonnes below 2020 and 482.2 tonnes below 2011, which was when gold demand reached a record high.

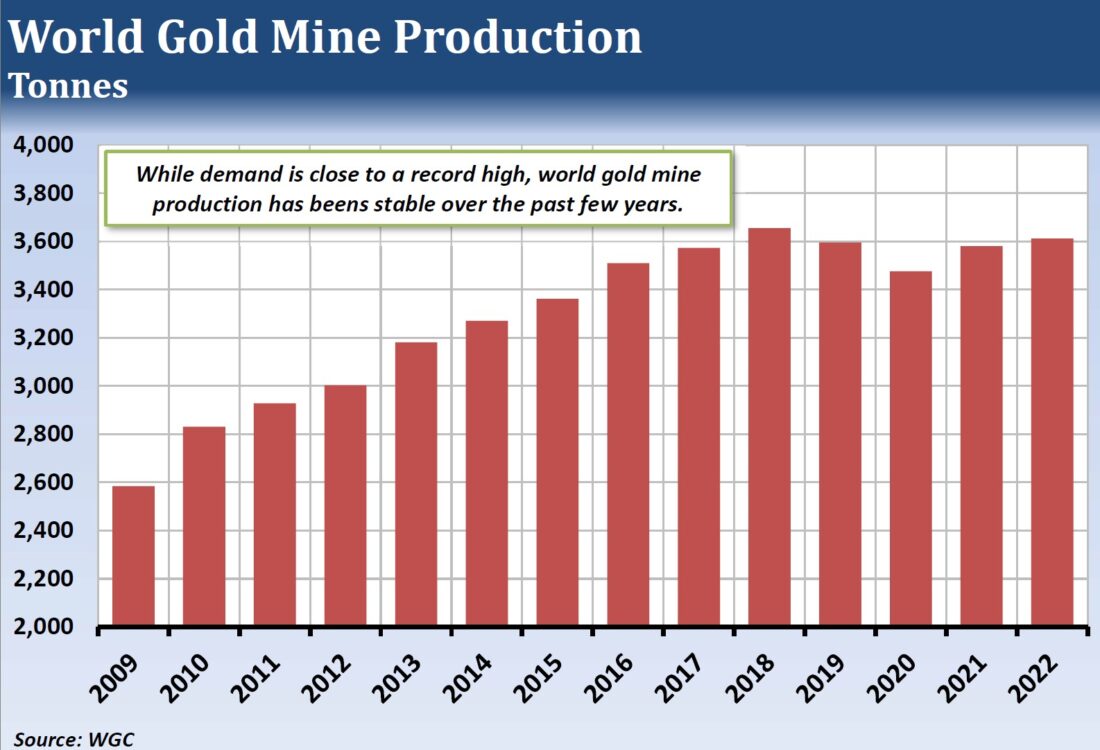

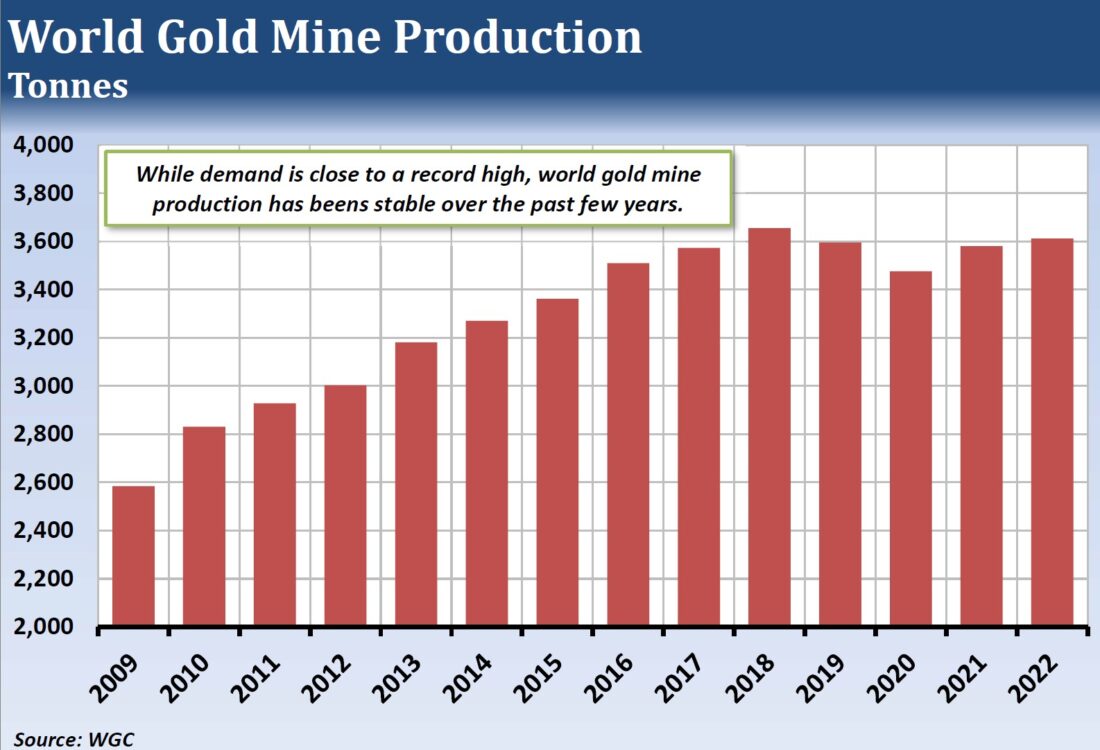

The largest share of gold supply comes from mine production. The WGC forecast 2022 gold mine production at 3,611.9 tonnes, up from 3,568.9 in 2021. This is far above mine output during the record high demand year of 2011 (2,876.9 tonnes), but it is 43.4 tonnes below the record production from 2018. Since seeing a 48% increase from 2008 to 2016, annual mine production has held within a relatively tight range.

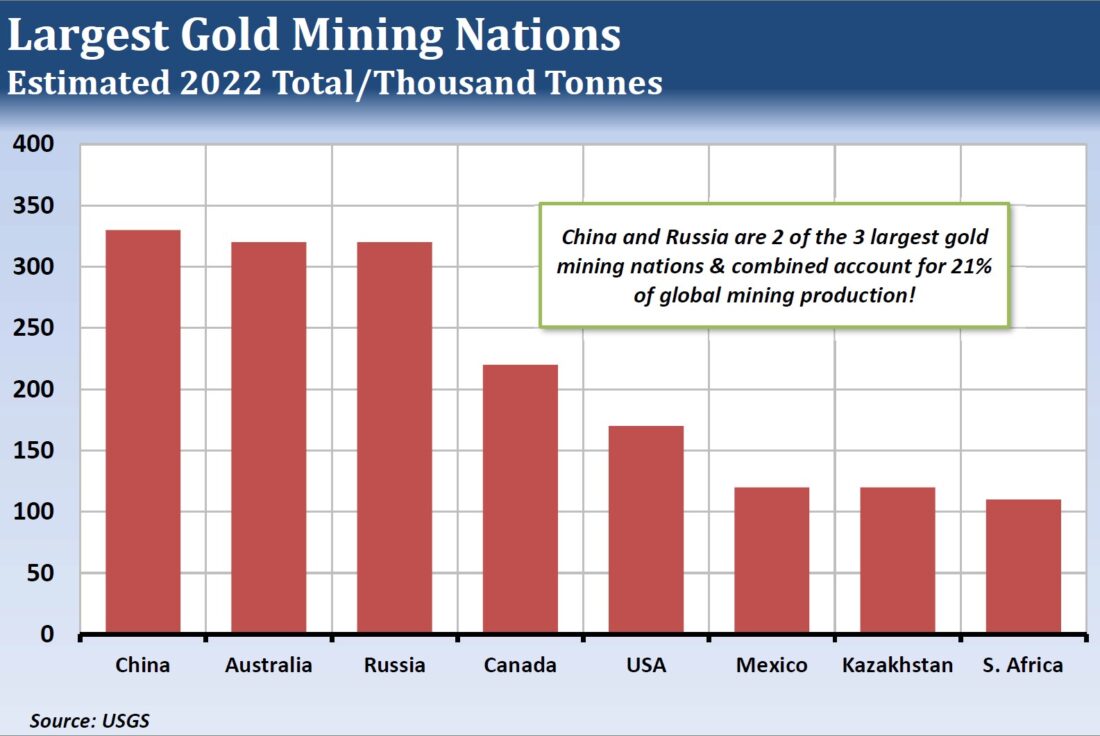

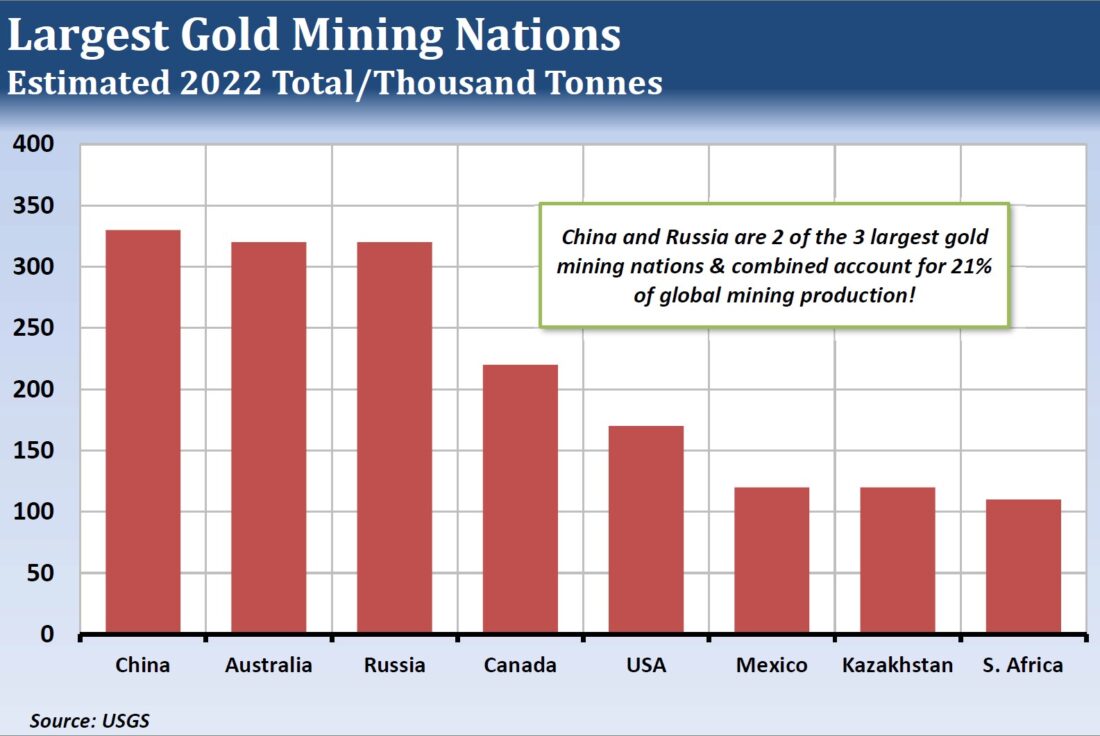

While gold prices reached a record high during the first quarter of 2022, average All-In Sustaining Costs (AISC) for gold mining reached a record $1,289 during the third quarter. Of the world’s largest gold producing nations, China is still vulnerable to fresh outbreaks of COVID. Imports of Russian gold have been banned by several nations. Thus, it could be difficult for global gold mine production to increase by any significant amount over the next few years.

—

Originally Published February 3, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)