Any way you slice it, 2022 was a turbulent year, from Russia’s invasion of Ukraine to historic inflation and jumbo rate hikes to multiple failures in the digital asset space. These have had wide-ranging implications for the world of finance that are sure to carry over into next year.

Through it all, gold managed to help investors limit their losses. The yellow metal was one of the very best assets of 2022, down just 1.5%, compared to a loss of more than 19% for the S&P 500 and around a 10% loss for U.S. government bonds.

Not uncoincidentally, the most popular stories of 2022 that were published on usfunds.com all had to do in some way with gold, gold mining stocks or other hard assets. Below are recaps of the five most popular stories in descending order by pageviews.

5. For The First Time In 20 Years, 1 Dollar = 1 Euro. What This Means For Gold (July 2022)

For frugal travelers, there was no better time to visit Europe than in September of this year. That’s when the euro/dollar exchange rate hit its most favorable level in 20 years, fueled by the Federal Reserve’s aggressive tightening cycle.

But a strong dollar, as you know, can also be kryptonite to gold. The yellow metal declined more than 20% from its 2022 peak in March to the trough in late September, when the exchange rate also found a bottom.

Since then, gold has climbed around 10%, making it one of the most resilient assets of the year. Meanwhile, gold miners, as measured by the NYSE Arca Gold Miners Index, have jumped more than 32% since the late-September bottom.

4. $2.8 Billion Lithium Investment Expected To Jumpstart The “White Gold” Rush (October 2022)

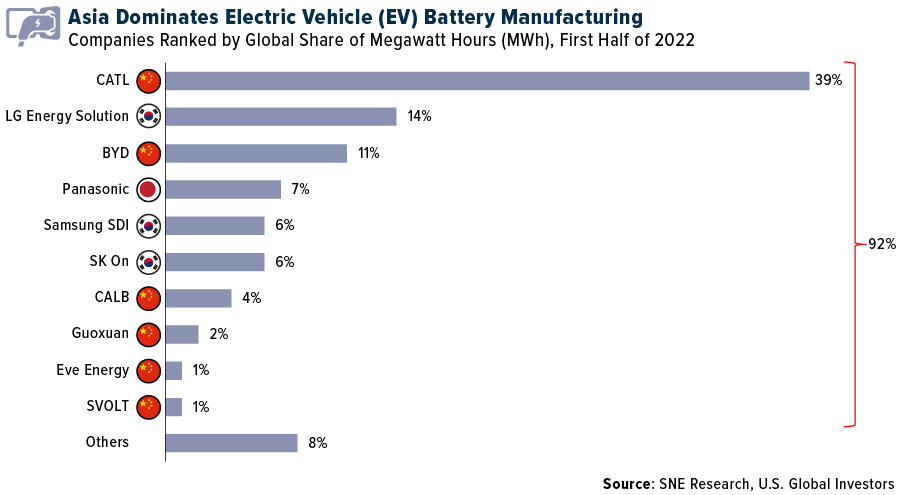

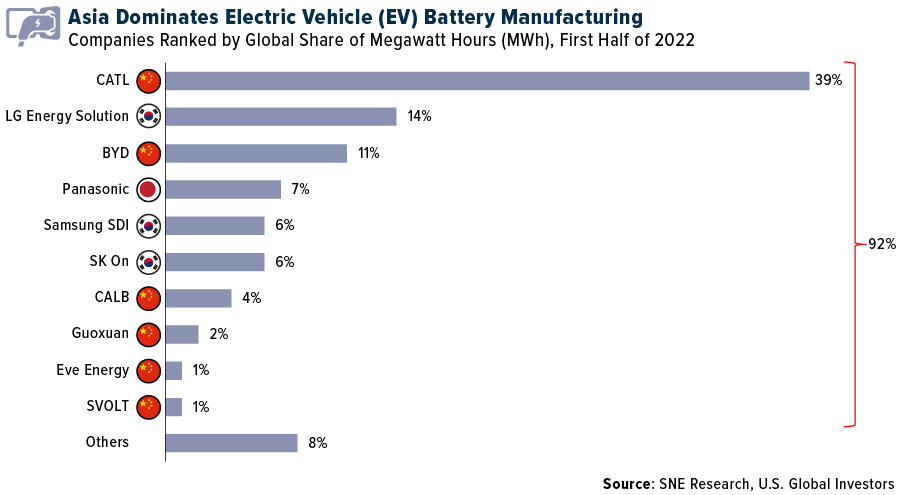

Lithium stocks continue to look interesting as demand for energy storage technology increases. Asia, and specifically China, has long had an advantage over the rest of the world in producing “white gold” products, but that may be set to change.

In October, the Biden Administration announced it would be awarding nearly $3 billion in grants to some 20 U.S. companies to “expand domestic manufacturing of batteries for electric vehicles and the electrical grid.” The lion’s share of the investment went to three companies—Talon Metals, Piedmont Lithium and Albemarle—all of which are in the process of building new lithium projects here in the U.S.

3. Gold Has The Potential To Hit $3,000 Or $4,000 An Ounce In 2023 (December 2022)

In his outlook for 2023, respected commodities strategist Ole Hansen said he believes gold could hit $3,000 an ounce once the market realizes that inflation will remain high despite historically aggressive monetary tightening.

I believe it’s entirely possible that the metal could hit $4,000, a price I’ve been forecasting since 2020.

Technically, gold is setting up for a monster rally. Its 50-day moving average has crossed above the 100-day, while gold itself is trading above its 200-day average.

The fundamentals look strong too. Inflation remains stubbornly high, and the U.S. dollar is on the decline. A recession looks all but guaranteed with the yield curve at its most inverted in over 40 years.

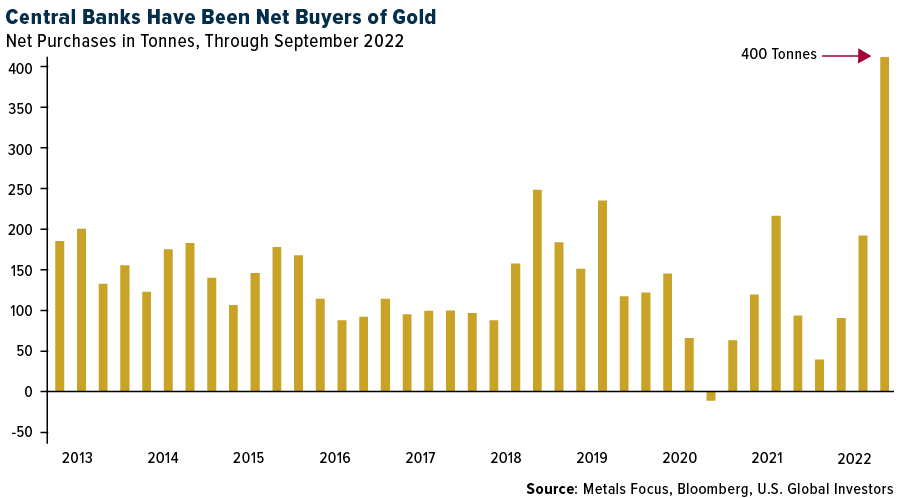

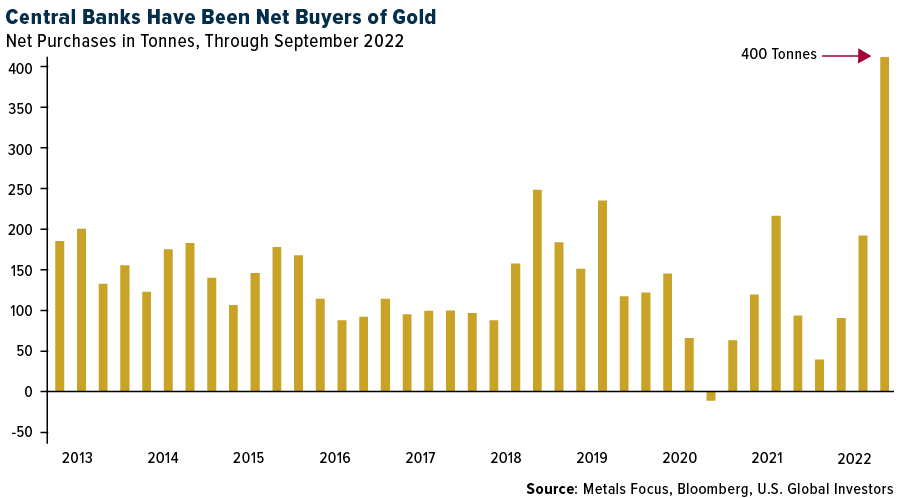

Most importantly, central banks can’t get enough of the metal. In the third quarter, official net gold purchases were approximately 400 tonnes, around $20 billion, the most in over a half-century.

2. Worried About Inflation? Here’s What Investments Worked In The 1970s(May 2022)

Scorching inflation this year recalled similarly high consumer prices in the 1970s. So what investments worked during that decade?

You might not be surprised to learn that gold was the best asset to own in the 70s. The metal went from $35 an ounce at the beginning of the decade to as high as $850 by 1980. Investors sought a hard asset that could go toe-to-toe with inflation and hold its value over time, and gold fit the bill.

But does the thesis still hold up?

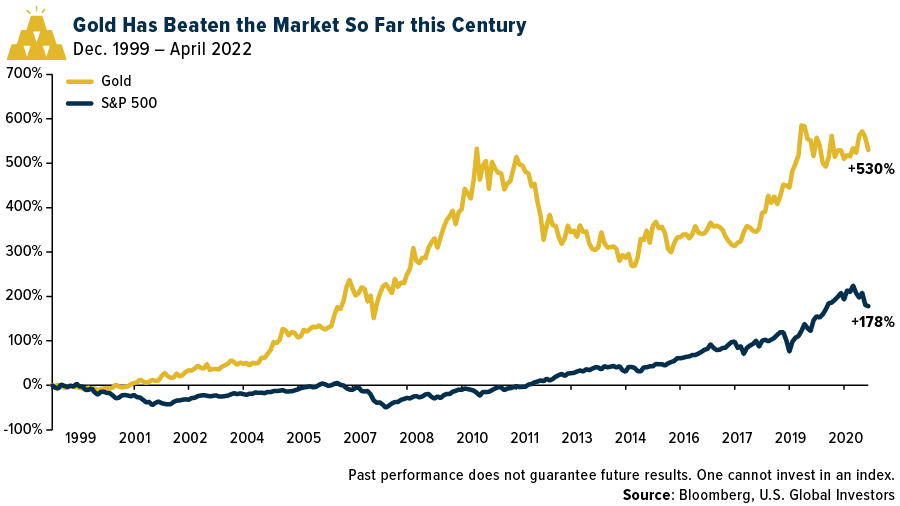

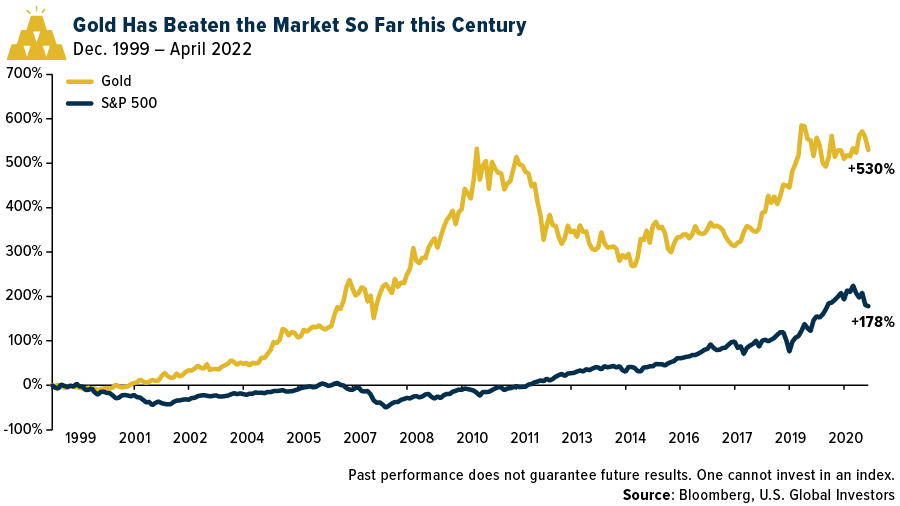

So far this century, gold has outperformed the S&P 500 by a factor of three. Not bad for a “barbarous relic” that generates no income.

This brings us to the most popular story of 2022…

1. Unloved And Overlooked, Gold Mining Stocks Could Be The Ultimate Contrarian Play (August 2022)

On August 10, I made the case that gold miners, among the most heavily battered stocks of 2022, were starting to look interesting. Since then, the NYSE Arca Gold Miners Index has increased around 7%, beating the S&P 500, which was down around 9% over the same period.

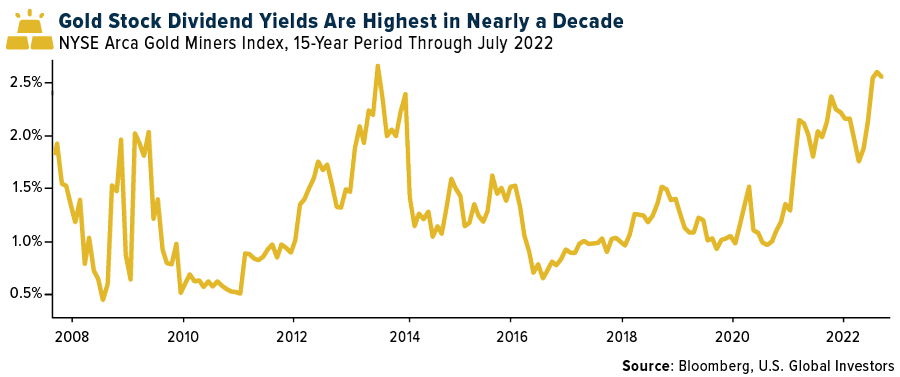

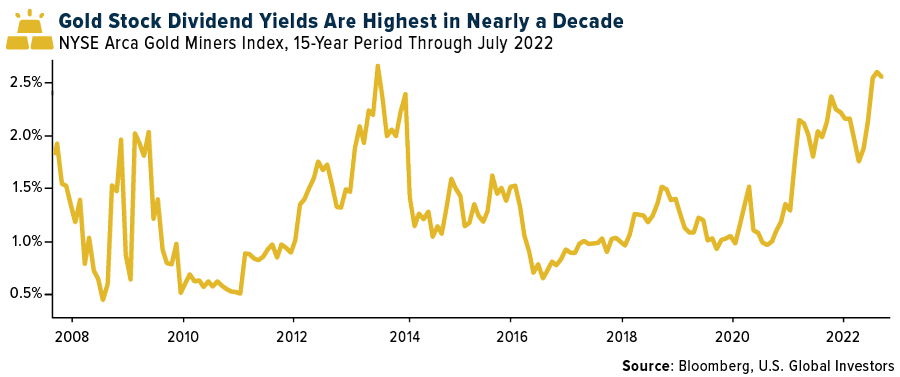

It isn’t just gold miners’ performance that makes them attractive. As I pointed out to you, dividend yields were the highest I’d seen in nearly a decade.

Add to that the fact that many producers are starting to generate impressive free cash flow, and this often maligned and ignored industry may be worth your consideration. That’s especially true if you believe a Fed pivot could be in the cards in 2023.

—

Originally Posted December 27, 2022 – Gold Was The Most Popular Asset Of 2022

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)