The January 23 week encompasses the communications blackout period around the January 31-February 1 FOMC meeting. This starts at midnight on Saturday, January 21 and runs through midnight on Thursday, January 26. Fed officials will make no public comment about monetary policy during this time. Note that the Fed has announced that Chair Jerome Powell has tested positive for and is symptomatic for Covid-19. His case is said to be mild. In all likelihood he will be able to attend the FOMC meeting – either remotely or in person.

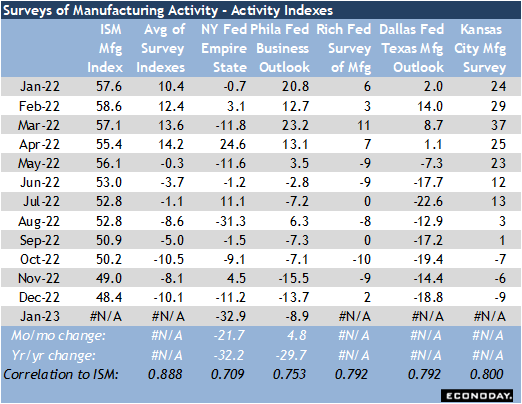

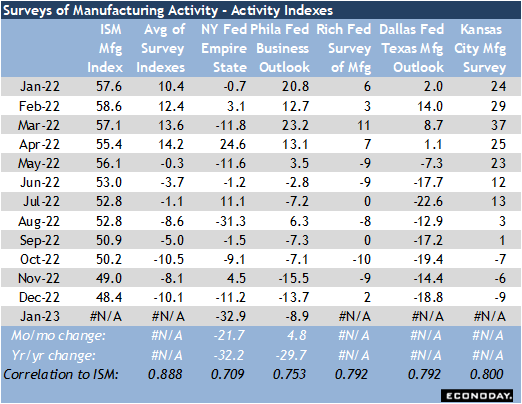

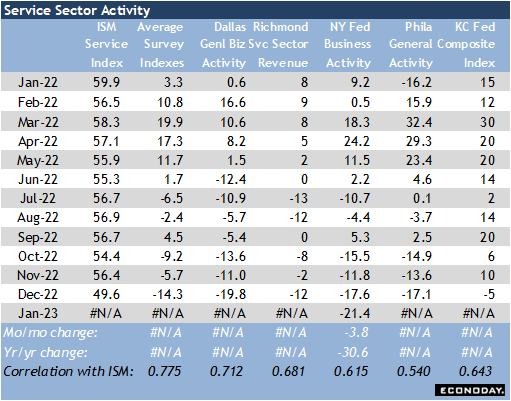

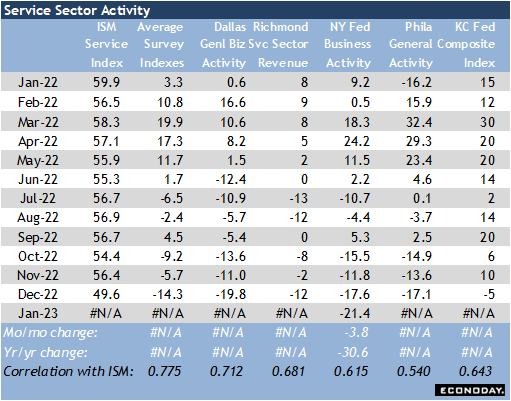

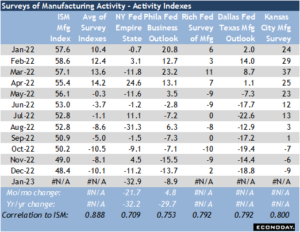

In any case, most of the data that will substantially influence the outcome of the FOMC decision have already been published. The only new reports that might have an impact are the regional Fed surveys of manufacturing and services for January. Already reported was the New York survey for manufacturing (Empire State) which showed an outsized drop while service sector data remain in contraction. Then the Philadelphia Fed survey for manufacturing told a more positive story, although its factory sector is slowing. In the coming week, the Philadelphia Fed will release its survey of the service sector at 8:30 EST on Tuesday. The Richmond Fed’s surveys of manufacturing and services will be reported at 10:00 EST on Tuesday. The Kansas City Fed’s manufacturing survey will be at 11:00 EST on Thursday and service sector survey at 11:00 EST on Friday. If these back up the data that the factory sector is moving into recession and that activity in services is continuing to slow, it might give Fed policymakers another reason to reduce the size of the next rate hike to 25 basis points after the 50 basis points in December. The FOMC will have evidence that inflation is improving – if still too high – and incorporate lagged effects of previous rate hikes into their policy outlook.

The report that is most anticipated is the advance estimate of fourth quarter GDP at 8:30 EST on Thursday. The Atlanta Fed’s GDPNow looks for an increase of 3.5 percent in the final quarter of 2022, similar to the 3.2 percent rise in the third quarter. While this makes the second half of 2022 one of solid growth, indications are that first-quarter 2023 is going to reflect subpar activity, at best.

—

Originally Posted January 22, 2023 – High points for economic data scheduled for January 23 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)