By: Jenna Barnard, CFA and John Pattullo

John Pattullo and Jenna Barnard, Co-Heads of Global Bonds, believe the confluence of attractive yields and an inflection point in rates should make 2023 an opportune year for high quality investment grade and government bonds.

Key takeaways:

- Yields on high quality government and investment grade corporate bonds have repriced to levels not seen in more than a decade.

- An inflection point in rates is expected as central banks shift their policy in response to declining inflation and an economic downturn.

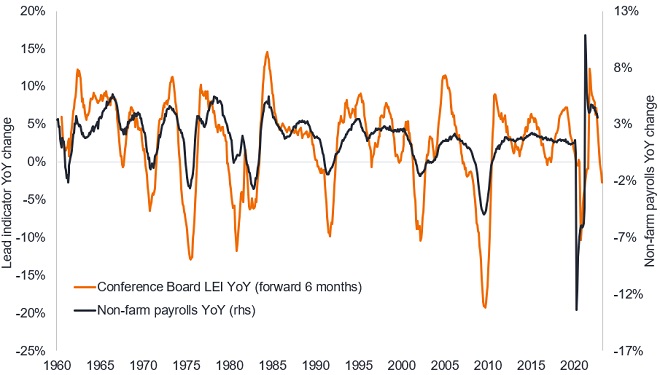

- A weakening in coincident employment indicators like non-farm payrolls in addition to declining inflation rates is required for a genuine shift in bias from the US Federal Reserve – something our lead indicators suggest is likely in 2023.

Every so often, ideal conditions present themselves. For the titan arum – the world’s largest unbranched flower – it can be anything between two to ten years between blooms, but when it flowers, the results are impressive. We think high quality investment grade bonds, especially government bonds, are in a similar sweet spot heading into 2023, as a confluence of attractive yields and an inflection point in rates opens up the potential for strong returns.

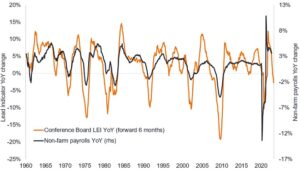

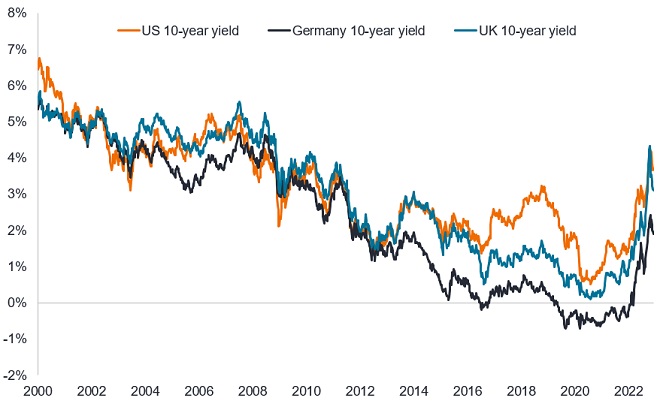

Attractive yields

For bond markets, policy tightening in 2022 to tackle inflation was painful as yields rose. Yet the price correction lifted government bond yields back to levels not seen in more than a decade. It was a similar story with investment grade corporate bonds where both credit spreads and yields moved higher.

Figure 1: Yields on government bonds

Source: Bloomberg, Generic US Government Bond 10-year yield, Generic UK Government Bond 10-year yield, Generic Germany Government Bond 10-year yield, 1 January 2020 to 29 November 2022. Yields may vary and are not guaranteed.

The rapidity and magnitude of central bank tightening caused yield curves to flatten and invert, meaning that shorter-dated bonds are paying similar (if not higher) yields than longer-dated bonds. This is creating a rare opportunity for investors to earn a higher income from holding shorter-dated bonds than longer-dated bonds, while also being exposed to less interest rate risk. For example, at the end of November 2022, yields would have to rise by a further 282 basis points (a so-called breakeven) to wipe out the positive total return from shorter-dated US 1-3 year investment grade corporate bonds. This compares with a breakeven rise of 78 basis points for US investment grade corporate bonds in general.1

2023 is an inflection point

Attractive income levels on bonds, however, are only half the picture. We think 2023 will also be an inflection point for the rates cycle – as central banks shift their policy in response to declining inflation and an economic downturn. This means that while we like short-dated bonds, there may be an opportunity cost to holding only short-dated bonds and that is potentially foregoing bigger capital gains from holding longer-dated bonds as rates decline.

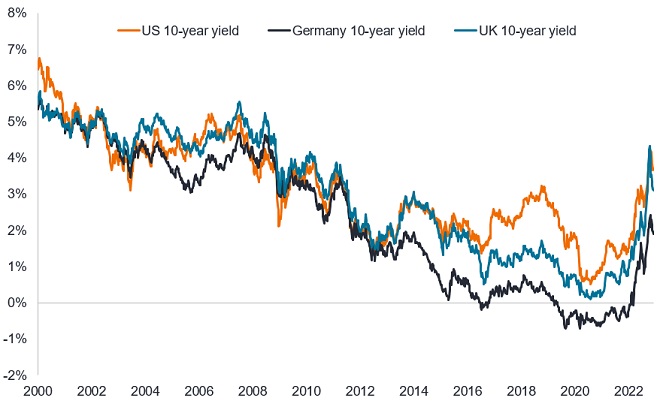

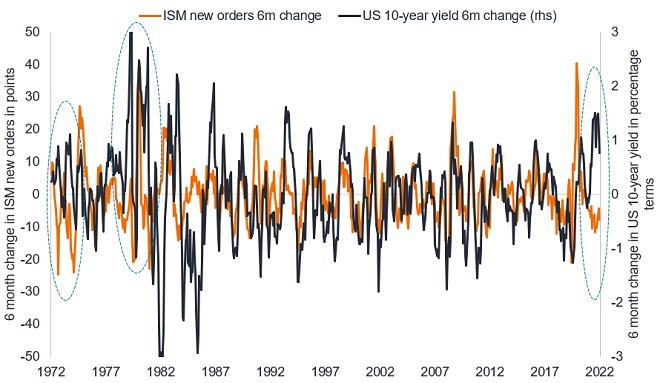

Bond yields have often overshot when core inflation spikes heading into an economic downturn. This decoupling of government bond yields from economic prospects occurred in late 2022 as bond yields rose despite manufacturing new orders declining (Figure 2). We expect government bond yields to recouple with the economic data. From above 4% in the fourth quarter of 2022, we think the US 10-year government bond yield could be close to 2% by the end of 2023. This could lead to strong capital gains on government bonds and should also have positive implications for better quality investment grade corporate bonds, since these bonds are typically sensitive to rate moves.

Figure 2: ISM new orders versus US 10-year government bond yield

Bond yields overshoot when core inflation spikes into growth downturns (circled)

Source: Bloomberg, Janus Henderson Investors, Institute for Supply Management (ISM) manufacturing new orders, US 10-year government bond yield, 30 November 1972 to 30 November 2022. Past performance does not predict future returns.

There is no guarantee that past trends will continue or forecasts will be realised.

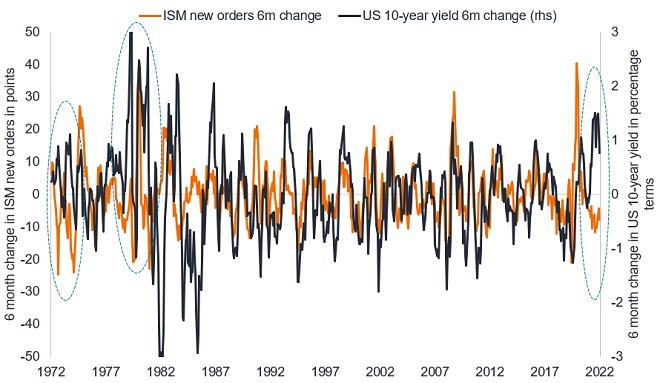

‘When’ not ‘if’ employment turns

We think we are progressing through a typical economic cycle, with the over-stimulus of the past couple of years giving way to a downturn and recession as policy tightening bites. Lead economic indicators are flashing red. Pain is already being felt in the housing market and corporate earnings appear to be peaking. We think it is only a matter of time (as soon as early 2023) before non-farm payrolls begin to reflect other employment data that companies are shedding jobs. In the US, the Household Survey is already registering job losses while data on withheld employment taxes appears to support the falls in employment seen in the survey.2 The Conference Board Leading Economic Index (LEI) – a highly reliable indicator on employment since the 1960s – suggests non-farm payrolls are set to tumble.

Figure 3: LEI leads employment by around six months

Source: Bloomberg, Janus Henderson Investors, Conference Board Leading Economic Index (LEI) for the US advanced by six months, US Bureau of Labor Statistics, non-farm payrolls. 30 November 1972 to 31 October 2022. Past performance does not predict future returns.

Plateau unlikely if payrolls tumble

Markets are pricing in a pause in rate hikes in early 2023 by the US Federal Reserve (Fed), followed by a plateau while it assesses the landscape, with a cut maybe coming in late 2023.3 We are not convinced this is how 2023 will unfold. More importantly, it is not how the Fed typically operates. The Fed rarely stands pat. Back in the 1970s and 1980s, it hiked rates until it had control of inflation and then immediately started cutting. Its tolerance of rising unemployment was low.

We think the Fed will take fright and start cutting rates after a few negative non-farm payroll prints – and this could come as early as the first half of 2023. Recessions kill inflation, so if unemployment is rising, we believe the Fed will look again at its dual mandate – stable prices and full employment – and switch to paying more attention to the second part.

Inflation on the turn

This shift in policy is reliant on inflation coming down but we already think inflation has peaked in the US and could come down rapidly in 2023 in Europe as well despite the distortions caused by the energy crisis. Commodity and freight prices have tumbled and this should help pull down inflation numbers. A collapse in broad money growth also suggests that the recent upsurge in inflation is set to wash out over the course of 2023. Even lagging measures, such as market rents, are now softening.

No need to be a hero – risk-reward favours investment grade

None of the key economic lead indicators we look at have even bottomed so we expect to see further economic deterioration and struggle to see the economy achieving a soft landing. In such an environment we think there is little to be gained from stretching too far in terms of credit risk, particularly as credit spreads on sub-investment grade high yield bonds are pricing in a soft landing and would be vulnerable to widening in a recession. A sell-off in high yield could potentially create a great buying opportunity for this asset class later in 2023 but we see no reason to be an early hero when the risk-adjusted reward potential is so appealing today in investment grade bonds.

The risk to our view is that data does not co-operate, with the jobs market remaining robust and inflation refusing to fall. If that is the case, however, then we would expect to see central bank policy being more restrictive and the economic downturn being even more severe – an outcome that would ultimately favour higher rated bonds, particularly sovereign bonds, as investors would seek relative ‘safe havens’. As we see it, we think there is simply too much data stacking up in favour of our view that we are in touching distance of investment grade government and corporate bonds putting on a strong display in 2023.

Footnotes and definitions

1Source: Bloomberg, Janus Henderson Investors, ICE BofA US Corporate Index, ICE BofA 1-3 Year US Corporate Index, at 30 November 2022. Note. The calculation of the breakeven is the yield to worst divided by the modified duration. Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%. Yields may vary and are not guaranteed.

2Source: US Bureau of Labor Statistics, Current Population (Household) Survey employment level, Refinitiv Datastream, US Withheld Income and Employment Tax, at 30 November 2022.

3Source: Bloomberg, Fed Funds Futures, 6 December 2022.

ICE BofA US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.

ICE BofA 1-3 year US Corporate Index is a subset of the ICE BofA US Corporate Index including all securities with a remaining term to final maturity less than 3 years.

Broad money: The stock of physical cash, bank deposits, money market funds, and other monetary instruments held by the private sector.

Credit ratings: A score given by a credit rating agency such as S&P Global Ratings, Moody’s and Fitch on the creditworthiness of a borrower. For example, S&P ranks high yields bonds from BB through B down to CCC in terms of declining quality and greater risk, i.e. CCC rated borrowers carry a greater risk of default.

Credit risk: The risk that a borrower will default on its contractual obligations, by failing to meet the required debt payments.

Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Cyclical: Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due. The default rate is typically expressed as a percentage rate reflecting the face value of bonds in an index defaulting over a 12-month period compared with the total face value of bonds in the index at the start of the period.

Financial conditions: The ease with which finance can be accessed by companies and households. When financial conditions are tighter it is harder or more costly for people and businesses to access finance.

High yield bond: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub- or below investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon (regular interest payment) to compensate for the additional risk.

Inflation: The annual rate of change in prices, typically expressed as a percentage rate. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Interest rate risk: The risk to bond prices caused by changes in interest rates. Bond prices move in the opposite direction to their yields, so a rise in rates and yields causes bond prices to fall and vice versa.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Lead indicator: A piece or set of economic data that can help provide an early signal of where we are in an economic cycle.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Easing refers to a central bank increasing the supply of money and lowering borrowing costs. Tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Recession: A significant decline in economic activity lasting longer than a few months. A soft landing is a slowdown in economic growth that avoids a recession. A hard landing is a deep recession.

Volatility: The rate and extent at which the price of a portfolio, security or index moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility means the higher the risk of the investment.

Yield: The level of income on a security, typically expressed as a percentage rate.

—

Originally Posted December 14, 2022 – High quality bonds are primed to bloom in 2023

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.