KEY TAKEAWAYS

- Robots have existed for decades; however recent technological breakthroughs across areas such as sensors, 5G connectivity, cloud computing and artificial intelligence are massively accelerating capabilities and adoption

- Industrial manufacturing and logistics have led the way in robotics adoption – we believe there could be room for continued growth here alongside more nascent applications in healthcare and services

- Wage inflation, labor shortages, demographic trends and supply chain transformation are game-changing catalysts that may accelerate demand for years to come

- Investors seeking exposure to robotics may want to consider ETFs that target the robotics value chain, from companies developing enabling technologies to those manufacturing robots themselves

EXPLORING DEVELOPMENTS IN THE ROBOTICS SPACE

“Come with me if you want to clean.”

The word robot can be traced back to 1920, when Czech playwright Karl Capek introduced it in his hit play, “Rossum’s Universal Robots”, a show that depicted robots taking over the world.1 Despite Capek’s chilling vision (and countless of our favorite films that have followed on the same theme – from Metropolis to The Matrix), robots have coexisted alongside humans for decades without a cinematic uprising.

The first industrial robot was rolled out by General Motors in 1959; the robot, called “The Unimate”, was a hydraulic arm that performed repetitive tasks such as welding.2 Seven years later, friendly robots entered pop culture when “The Unimate” appeared on The Tonight Show with Johnny Carson to play golf. (Check out the clip!)

As technology has become more powerful, efficient, and cheaper, robots have become more ubiquitous. In fact, North America robot sales have reached record highs for three straight quarters.3 We’ve also seen a range of robots enter our day to day lives: they vacuum floors, mow lawns, craft the perfect cup of coffee and even provide companionship. (This author’s vacuum and mop are named Rick and Rachael – after the protagonists of Blade Runner – they both clean and provide companionship, but no clarity yet as to whether they dream of electric sheep.) While fear of a robotic takeover is understandable, their ascension is anything but a zero-sum game. In fact, automation is combating supply chain disruption and inflation, allowing employees to move faster and focus on higher-value tasks.

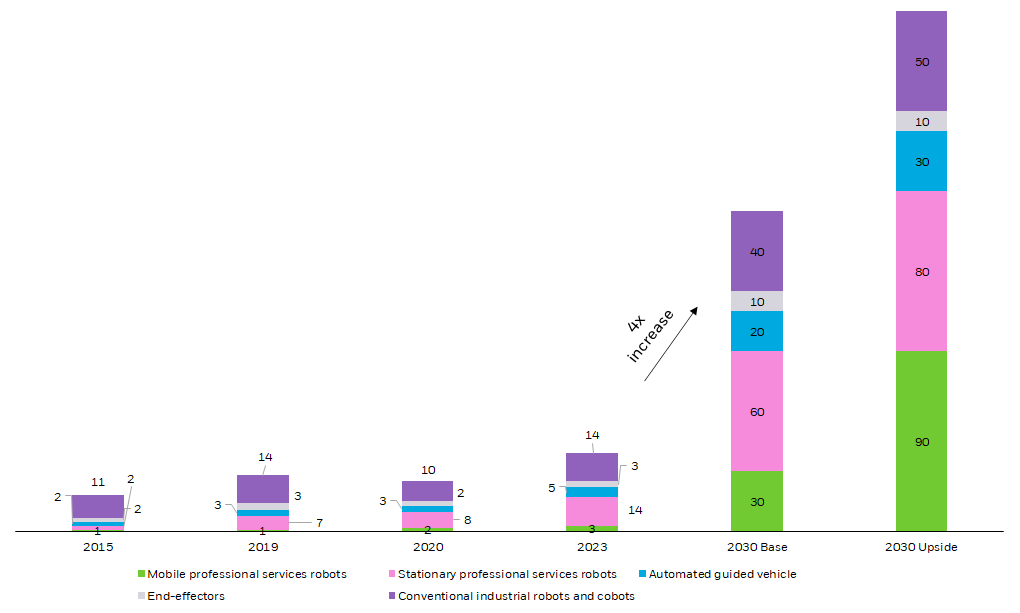

Global Robotics Market ($B)

Source: BCG Robotics Outlook 2030. Base case reflects BCG current assumptions. Upside case reflects accelerated adoption of robotics. There is no guarantee these forecasts come to pass.

Chart description: Chart showing size of the global robotics market. The chart breaks down the size of the market into five buckets: mobile professional service robots, automated guided vehicle, conventional industrial robots and cobots, stationary professional services robots and end-effectors.

We can already see four key factors driving robotics adoption:

• technological progress,

• demographic trends,

• economics, and

• geopolitics.

TECHNOLOGIES ENABLING THE ROBOTICS SPACE

Clear eyes, full hearts

Robotics sits at the intersection of several breakthrough technologies, such as sensors, 5G connectivity, cloud computing and artificial intelligence.

Sensors can be considered the eyes of robots, allowing them to assess the surrounding environment, including light, temperature, and proximity to other objects. As robots become more widely used outside of assembly lines, their ability to navigate unstructured, changing environments has become increasingly important. Lidar (light detection and ranging) technology, enabled by sensors, allows a robot to gather 3D imaging data for mapping and object classification purposes.4 Recently, we are seeing lidar systems with the capability to see more than 1000m into the distance, nearly 5x further than previous systems.5 This recent advancement has significant positive implications for autonomous robots, enhancing their ability to operate safely alongside humans.

Cloud computing and 5G connectivity are enabling robots to process and access more data. For robots to reach their full potential, they must be autonomous and able to be controlled from anywhere. The massive computing power required by sophisticated bots necessitates the cloud, as the physical hardware required to store data locally, inside the robot, would be impractical from a design and cost standpoint. The robot must then be able to “talk” with the cloud in real time, transferring large amounts of information with low latency, meaning 5G networks are enabling more data and capabilities.6 With 70% of warehouses constructed before the 21st century, warehouses must undertake significant spending on digital infrastructure to allow the fleets of robots to communicate. In fact, the industrial sector’s power use could grow more than 2x as fast as any other real estate sector in the coming decade.7

Finally, progress across three types of artificial intelligence: machine learning, natural language processing (NLP) and conversational AI are the keys to unlocking sensors and connectivity’s true potential.8 Machine learning enables robots to use data gleaned from previous experiences to develop new capabilities and solve unique problems. Take Rick, the robotic vacuum cleaner: when he maps the apartment, he identifies troublesome areas, such as stairs and furniture, and then avoids them in future cleanings. NLP enables robots to understand human language and is leveraged across industries such as retail via touchless check-out kiosks or smart speakers in the home. Conversational AI is the more advanced version of NLP and enables robots to interact in a more human like fashion. For example, fast-food restaurants have leveraged conversational AI to greet customers, take orders and make menu suggestions.9 All these technological advances are arguably having their biggest impact in two key segments driving adoption: logistics and healthcare.

DEMAND: HOW ROBOTICS USE CASES ARE GROWING ACROSS INDUSTRIES

Fewer accidents and better care

We see two key segments of the economy driving near-term robotics adoption: logistics and healthcare. As the expected wait time on e-commerce orders has shrunk from weeks to days to hours, companies must find safe, cost-effective ways to automate warehouses. 80% of warehouse operators agree they will have to rely upon more automation in the future.10 Today, robots are largely used to move inventory around the warehouse in an efficient and safe manner. These robots, known as AMRs (autonomous mobile robots), are like self-driving cars. Going forward, robots will be leveraged for “order picking,” which is the act of finding the item inside the warehouse and bringing it to the packing station. Humans are not particular good at order picking. Robots reduce warehouse error rates by up to 67%.11 Moreover, they help address warehouse injuries: today, over 200K non-fatal accidents per year in U.S warehouses cause pain and suffering for employees alongside financial costs for companies of over $84M per week.12,13

Healthcare similarly could see more robotics, with increasing usage in surgery and nursing. Robot-assisted surgical procedures offer benefits to doctors and patients and tend to improve outcomes. Typically, a surgical robot will have one arm with a camera, giving the surgeon a view of the affected area at up to 10x magnification versus the human eye. A second robotic arm will hold surgical instruments, allowing a degree of precision and steadiness not possible with human hands – the smaller resulting incisions improve outcomes and shorten recovery times – reducing pain, blood loss and scarring.14 Robotic surgery has become particularly important for urological and gynecological procedures, which make up about half of robotic procedures today. Globally, about 3% of surgeries are performed robotically, leaving tremendous runway for growth.15

Nursing robots are also seeing growing demand at a time when nursing shortages are dire, with 1.2m new registered nurses needed in the U.S. by 2030.16 Robots assist nurses by performing time-consuming tasks, such as medicine delivery, collecting lab samples and taking vital signs.17 The robotic nursing market is expected to grow more than 22% per year through 2026, reaching more than $2b in annual sales.18

LABOR, DEMOGRAPHICS, AND GEOPOLITICS

The robots are here to help

The average cost of an industrial robot has fallen by 50% over the past 30 years,19 increasing the affordability of adoption. With wage inflation at all-time highs,20 the break-even cost for new robotics installation has fallen dramatically. Contrary to popular concerns, robots are generally not being used to replace factory workers, but instead to free up those employees to focus on tasks where they add more value. A recent study from The Institute for Operations Research and the Management Sciences showed that “investments in robotics are associated with increases in total firm employment”.21

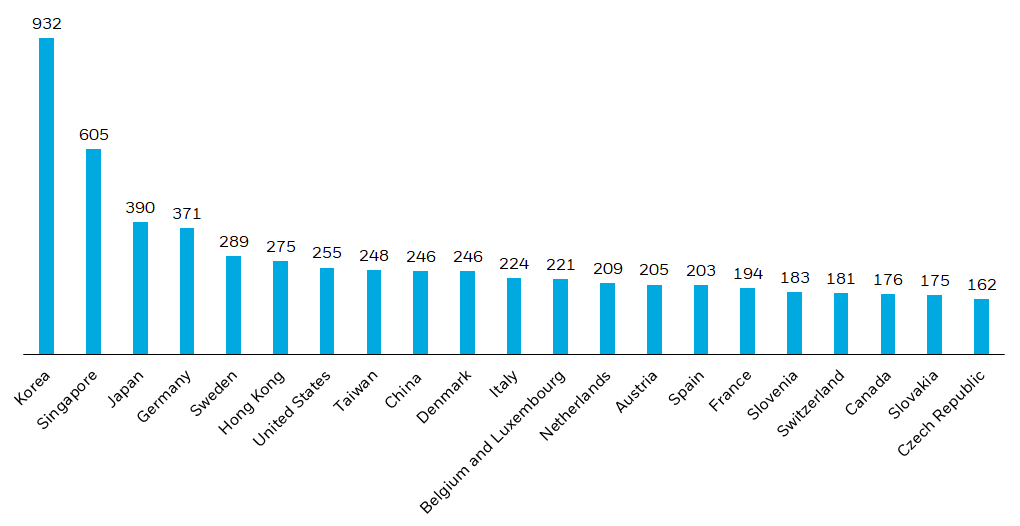

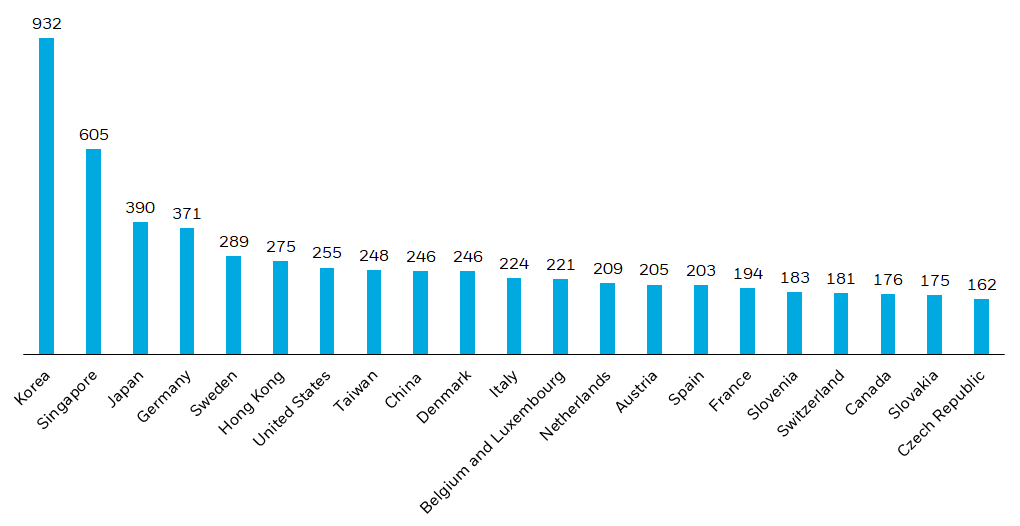

From a global demographic perspective, the percentage of people over 60 will nearly double between 2015 and 2050, from 12% to 22%.22 An aging global population means growing labor shortages, necessitating investments in robotics across a variety of industries. Perhaps unsurprisingly, countries such as Korea and Japan, both facing population declines, have some of the highest robot density in manufacturing.23,24 Other countries around the world face similar demographic challenges likely leading to more usage of automation.

Robot Density in the Manufacturing Industry

Source: International Federation of Robotics; 12/14/21. Robot density refers to the # of robots in factories per 10,000 employees.

Chart description: This chart shows the density of robots across 20+ geographies.

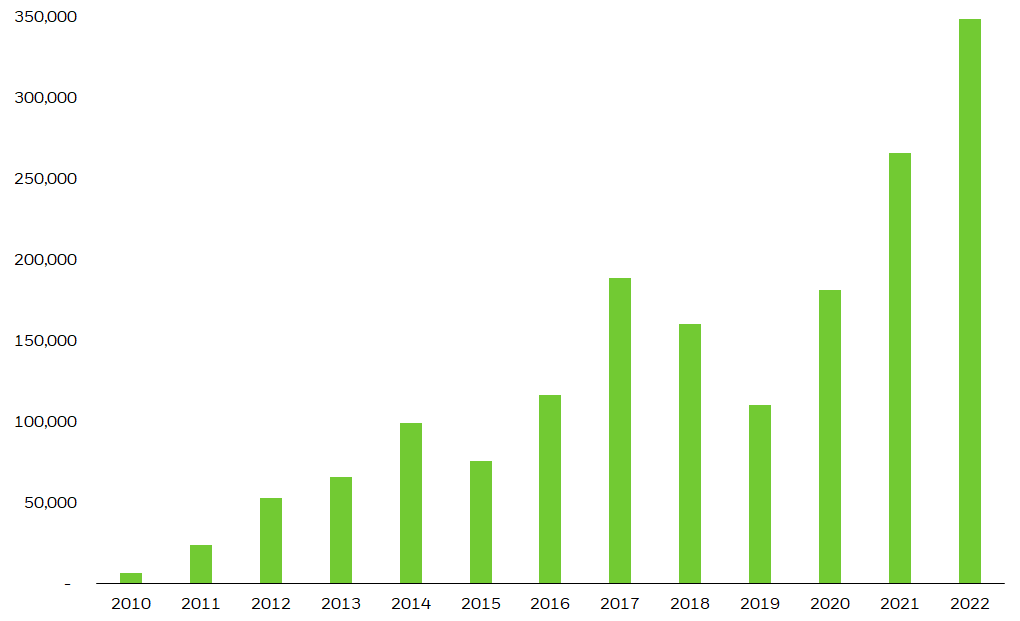

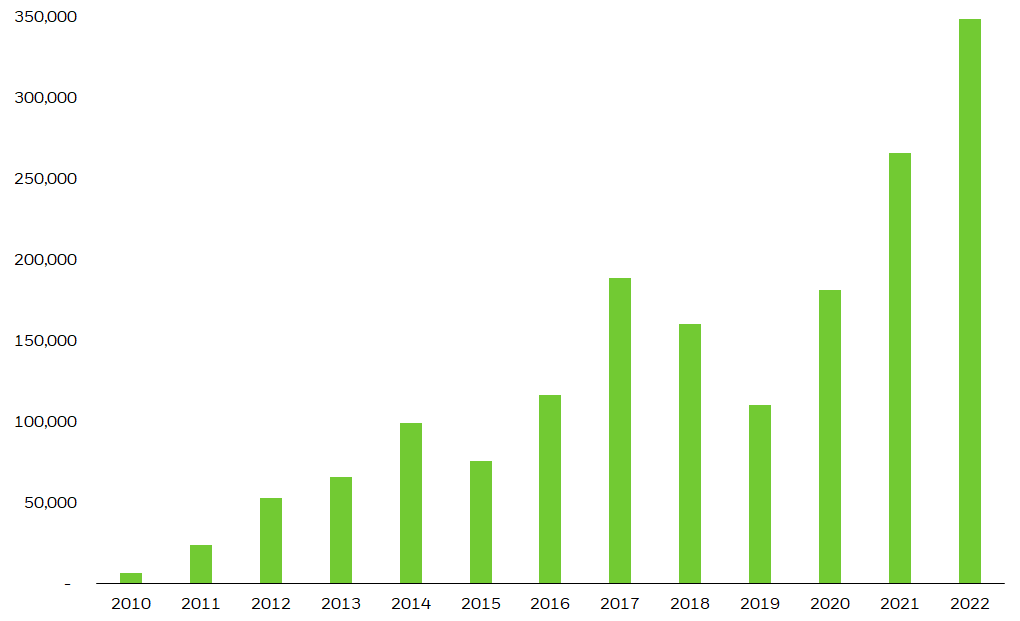

Finally, the pandemic and geopolitics have driven “onshoring.” A combination of supply chain disruptions, geopolitical conflict, and incentives for domestic manufacturing in the U.S., such as the Inflation Reduction Act and the Chips and Science Act, have made onshoring more attractive. In fact, in 2022 U.S. companies are on pace to bring home a record 350,000 jobs.25

Reshoring Job Announcements per Year

Source: Wall Street Journal, “U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs”. 8/23/22. 2022 number reflects full-year estimate.

Chart Description: This chart shows the # of reshoring job announcements per year since 2010.

In the U.S., the confluence of onshoring needs, an unemployment rate of 3.5%, and a labor shortage of nearly 4M people,26 is leading U.S. companies to turn to automation. In fact, North American companies ordered 11.5k robots in Q1’22, putting 2022 on pace to surpass last year’s record numbers.27

But onshoring is only a part of the story. From Latin America to Eastern Europe, investment is also being driven by near-shoring, with countries and firms investing in robotics to close production cost gaps versus lower cost labor further afield.

HOW TO INVEST IN ROBOTICS STOCKS

3 types of people – those who understand binary and those who don’t

Investors looking to access robotics companies may want to consider ETFs that hold pure-play firms across the full value-chain of robotics, targeting both the robotic developers as well as the technology enablers:

Robotics developers: Companies that manufacture robots across a variety of end-uses including household, healthcare, and industrial robots.

Robotics enablers: Companies that specialize in developing technologies such as 3D modeling, machine vision and motion control that enable increasingly sophisticated robots.

CONCLUSION

100 years after the coining of the term “robot,” technological breakthroughs, new use cases as well as economic and demographic forces are bringing science fiction more and more to life. In our view, people looking to invest in robotics may want to consider ETFs that provide exposure to pure-play stocks across the theme’s value chain.

—

Originally Posted December 2, 2022 – Investing in robotics: why now could be the right time

© 2022 BlackRock, Inc. All rights reserved.

1NPR, Science Diction, April 2011

2 Automate.org, “The First Industrial Robot”

3 TheRobotReport.com, “Robot Sales Hit Record High for 3rd Straight Quarter”. 8/29/22

4 Association for Advancing Automation, 7/19/21

5 Forbes, The LiDAR Range Wars, 5/27/21

6 Ericcson, Transforming Industry with 5G Robotics

7 NYT, Robots Aren’t Done Reshaping Warehouses, 7/12/22

8 Intel.com, Robotics and Artificial Intelligence Overview

9 Intel.com, Robotics and Artificial Intelligence Overview

10 FetchRobotics, July 2022

11 Robots 247, 8/14/21

12 Bureau of Labor Statistics, November 2021 “Employer Related Workplace Injuries and Illnesses”

13 Liberty Mutual Insurance Workplace Safety Index

14 Proliance Puyallup Surgeons, “How Robotic Surgery Improves Patient Outcomes”, 3/11/21

15 Medtronic Press Release, 10/11/21

16 University of St. Augustine for Health Sciences, “The 2021 American Nursing Shortage: A Data Study”, May 2021

17 Cedar-Sinai, “Robots Help Nurses Get the Job Done – With Smiles and Beeps”

18 Market Data Centre, 5/16/22

19 McKinsey, “Automation, Robotics and the Factory of the Future”

20 Atlanta Fed, Wage Growth Tracker

21 The Robot Revolution: Managerial and Employment Consequences for Firms, 3/31/21

22 World Health Organization, 11/4/21

23 World Economic Forum, 3/3/21

24 Council on Foreign Relations, 7/22/21

25 Wall Street Journal, “U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs”, 8/23/22

26 US Bureau of Labor Statistics, September 2022

27 Wall Street Journal, “U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs”

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Technology companies may be subject to severe competition and product obsolescence.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH1222U/S-2553643

Disclosure: iShares by BlackRock

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from iShares by BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or iShares by BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)