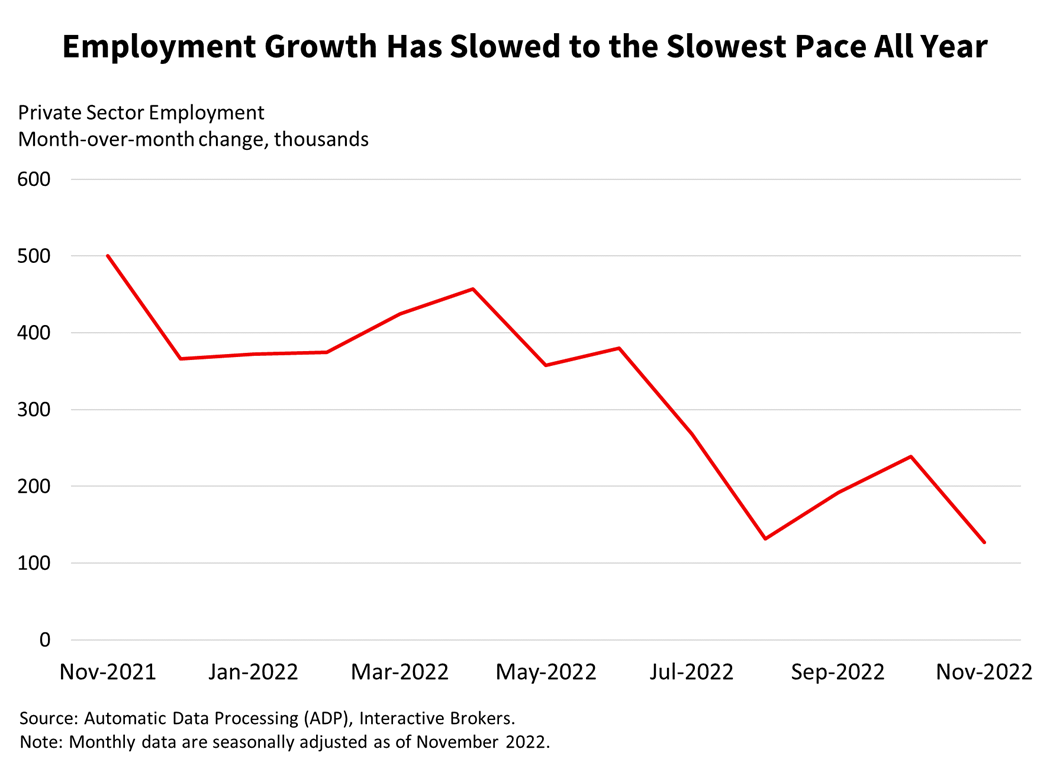

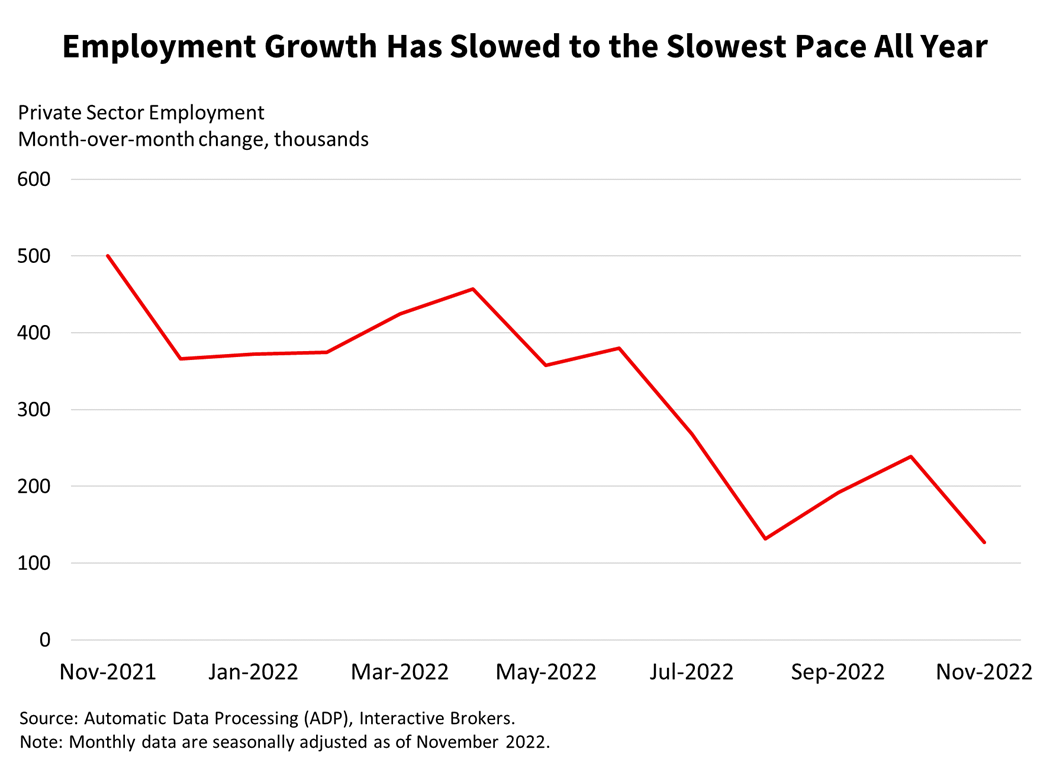

As high-profile layoffs surge through the U.S. tech industry, the broader private sector is still creating jobs, but at a slower pace, while job openings are still high. These factors imply that the Federal Reserve’s tightening campaign is helping to slow the economy and inflation, but the challenging war against increasing prices is far from over.

From an international perspective, the Harmonized Index of Consumer Prices show euro area inflation is easing. Despite the encouraging data, inflation is still a powerful foe, both internationally and domestically. In the U.S., wage pressure is persistent, with today’s ADP report showing a year-over-year wage increase of 7.7%, down only 10 basis points from October. In my view, labor market conditions imply that the Federal Reserve (the Fed) will need to continue its hawkish policies this year and throughout 2023. This opinion may be confirmed this afternoon when Fed Chairman Jerome Powell provides additional clarity on the Fed’s economic outlook at 1:30 pm.

Today’s ADP report shows the private sector added 127,000 jobs this month, trailing the 200,000 consensus expectation and the 239,000 notched in October by a wide margin. All employment gains were produced by mid-sized firms that employ between 50 and 499 workers. Small and large firms, below and above the mid-sized threshold, reported job losses during the period. The positive, but weakening job creation, comes just two days after Crunchbase reported that the tech sector, which among some investors has been viewed as being virtually infallible, has shed 85,000 workers year to date in mass layoffs. These include tech powerhouses such as Netflix, Meta (formerly Facebook) and Amazon.com, Inc.: https://news.crunchbase.com/startups/tech-layoffs-2022/.

At first blush, the massive layoffs are sobering, but I believe they result from the tech industry over hiring in 2021, a time when digital demand trends were difficult to forecast. At the same time, other sectors are still experiencing tight labor conditions. Within the ADP report, job creation was led by the following categories:

- Leisure and hospitality, which added 224,000 jobs

- Trade, transportation and utilities, which added 62,000 jobs

- Education and health services industries which collectively added 55,000 respectively jobs.

- The other services and the natural resources and mining sectors also contributed to gains, albeit less impactfully.

From an inflation perspective, it appears leisure and hospitality is still benefiting from pent-up demand for entertainment, dinning out and traveling that resulted from economic lockdowns and stay-at-home orders intended to slow the spread of COVID-19 pandemic. This implies that the impact of monetary tightening has yet to curtail demand and inflation within this sector.

Industries that shed jobs include the following:

- Manufacturing, which surrendered 100,000 positions

- Professional and business services, which shed 77,000 positions

- Financial activities, which lost 34,000 jobs

- Information, which gave up 25,000 positions

- Construction, which surrendered 2,000 positions

In another indication of a strong job market, today’s Job Openings and Labor Turnover Survey (JOLTS) from the U.S. Bureau of Labor Statistics showed that the economy had 10.3 million open jobs in October, meeting expectations and declining from September’s 10.7 million level. Job openings, however, are stubbornly high as they still remain above the level from last August. Professional business services, government, manufacturing, health care and construction saw the greatest declines in job openings. Other services, finance and trade, transportation and utilities experienced the greatest increases. On balance, employers continue to have difficulties filling positions needed as low labor force participation and demographics continue to weigh on hiring. The ADP and JOLTS reports confirm my comments during a recent Barron’s Streetwise podcast when I mentioned that a strong labor market is providing opportunities for laid off tech workers to find new positions in different industries.

Across the Atlantic, the Harmonized Index of Consumer Prices (HICP), also released today, shows an improving inflationary picture, which is welcome news for the European Central Bank and consumers. The HICP climbed 10% from the same month a year ago, better than the 10.4% consensus expectation and an improvement from last month’s 10.6% pace. Most importantly, prices fell 0.1% on a month-over-month (m/m) basis, driven by m/m cost reductions in energy, unprocessed foods and services of 1.9%, 0.7% and 0.3% respectively. A relief from inflationary pressures during the month also led to an improvement in economic sentiment which was released yesterday morning. Economic sentiment for November came in at 93.7, slightly better than the 93.5 expected and from October’s 92.7 level. Within the components, consumers reflected improved sentiment while industry sentiment deteriorated during the period, likely due to compressing margins against the backdrop of declining demand.

The two labor reports issued today appear to have had little influence on investors, who may instead be focused on Fed Chairman Powell’s comments scheduled for this afternoon. With that in mind, other factors may have a more significant impact on markets this Friday when the BLS Jobs Report is released as it’s more influential on the Street, while the correlation between the ADP and BLS reports is lackluster. Equities and the dollar are down modestly while yields are up as the market gears up for Fed Chair Powell’s comments. The labor market, while cooling, is not yet in-line with the central bank’s 2% inflation goal as job openings remain high and wage growth strong.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)