Coinbase Global, Inc. (NASDAQ: COIN) is a cryptocurrency exchange operator, based in the United States. The platform facilitates trading of cryptocurrencies and digital assets. Coinbase went public via direct listing in April 2021 valued at $85 Billion. Since listing, volatility in the underlying crypto markets has impacted the company’s valuation. Per the Q3 2022 earnings report, Coinbase revenue is down 55% year-over-year, driven largely by a 44% drop in trading volume. The company is currently valued at $7.8 Billion.

On November 11, 2022, FTX Group, the world’s second-largest crypto exchange operator, filed for bankruptcy. The move sent shockwaves of uncertainty through digital asset markets and volatility in the crypto space increased.

IBKR’s Securities Lending desk has been monitoring how the FTX fallout is affecting the stock loan market. Concerns about FTX, along with fallen crypto firms Voyager and Celsius, have caused more market participants to search for shorting opportunities. The desk has seen increased short sale activity in crypto-related names.

Coinbase equity has returned -85% YTD, compared to -17% for the S&P 500 Index. Prior to the FTX bankruptcy, COIN shares had been trading “General Collateral” – defined as liquid assets in the securities lending market that are often interchangeable. But after the announcement, the COIN borrow fee jumped from 0.75% to 5.50%. Stock loan utilization (a measure of demand in securities lending) for Coinbase increased from 80% to 100% and the10-day Realized Volatility ranged from 67 to 155 in November. Traders on IBKR’s Trader Workstation were able to track borrow fees and short sale availability in real-time.

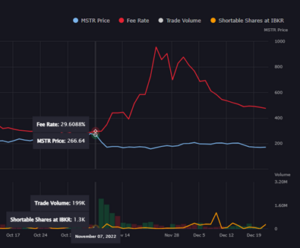

Short sellers who timed their trades correctly have generated alpha by shorting crypto proxies in the equity market as leverage unwinds from the underlying assets. Aside from well-known stocks like Coinbase, other crypto companies like MicroStrategy (NASDAQ: MSTR) and Marathon Digital Holdings (NASDAQ: MARA) have also seen a spike in Short Interest, borrow fees and short stock utilization in recent months. The borrow fees on MSTR and MARA are still elevated, hovering around 50% and 13% respectively.

Real-time and historical securities lending market data on these, and other stocks, is available on the new TWS Short Selling tab in Fundamentals Explorer. The example below shows the change in MSTR stock price and borrow fees following the FTX announcement. We have seen examples where borrow fees are affected by volatility.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.