With most of the bad news seemingly already priced in on the interest rate front, can markets deliver positive returns for investors in 2023? Paul O’Connor, Head of the UK-based Multi-Asset Team, gives his view on the prospects for equity and fixed income in the year ahead.

Key takeaways:

- While the prospect of easing interest rate pressures should be a constructive theme for markets in the first half of 2023, the associated weakening of growth remains a challenge.

- A reasonable central scenario is one in which investors can expect to achieve solid returns from high quality assets, albeit probably having to ride out plenty of turbulence along the way.

- With most of the rate hiking cycle now behind us and with asset valuations notably more attractive than they were at the end of 2021, 2023 should be a better year for investment returns than 2022.

2022 was a challenging year for most investors, as they struggled to price in the impact of some exceptional global developments, such as the war in Ukraine, the lingering effects of the pandemic and dramatic shifts in global monetary and fiscal policy. It was a year of surging interest rates in many economies and persistent growth downgrades in most. Investors had nowhere to hide among mainstream financial assets, with most of the world’s major equity, credit, and government bond indices registering losses close to or above 20% at some stage in the year.

Rate peaks and recession

Market regimes rarely change on the turn of the calendar. The headwinds on both the interest rate and growth fronts are likely to persist well into 2023. However, after 2022’s aggressive repricing, the upside to rate expectations now looks fairly limited, suggesting that most of the difficult news has probably been priced into financial assets. Although we expect central banks in the major economies to continue to push through a number of rate hikes in the next few months, policy rates should peak in Q1 in the US, and in Q2 in the eurozone and the UK. Even though inflation seems likely to remain uncomfortably high for these economies well into 2023, central bank concerns should be somewhat offset by slowing growth and the recognition that the full restrictive impact of previous rate hikes will still be working through the economic system, with the usual long and variable lags.

While the prospect of easing interest rate pressures should be constructive for markets in the first half of 2023, the associated weakening of growth remains a challenge. Consensus predictions of real GDP growth for 2023 now stand at 0.4% for US, -0.1% for eurozone and -0.8% for the UK. These forecasts envision a slowdown in the US and eurozone that will be the gentlest and the shortest that could be called a recession. The health of private sector balance sheets should be a source of resilience in the major economies, but housing markets are likely to be a big drag, now that surging mortgage rates globally have pushed housing affordability to an all-time low. With many reliable economic frameworks pointing to recession in the major economies in 2023, the risks to economists’ forecasts seem skewed to the downside.

China is the wildcard

Beyond these cyclical dynamics in the developed economies, China remains a potential wildcard for the world economic outlook. Economists are expecting a significant rebound in Chinese growth in 2023, on the view that the government will eventually abandon its “zero-COVID” policy. Although an orderly reopening of the Chinese economy is a plausible bull scenario for investors to embrace, even the most successful version seems unlikely to lift the economy before the middle of the year. More progress on the development of Chinese mRNA COVID vaccines could boost confidence in this outcome, but the pandemic is nevertheless likely to continue causing significant economic disruption in the early months of the year. Given these uncertainties and the continuing economic and financial threats from the unfolding property correction, the outlook for the Chinese economy remains unusually unpredictable, with scope for positive and negative surprises of a scale that could alter the trajectory of the global economy in 2023.

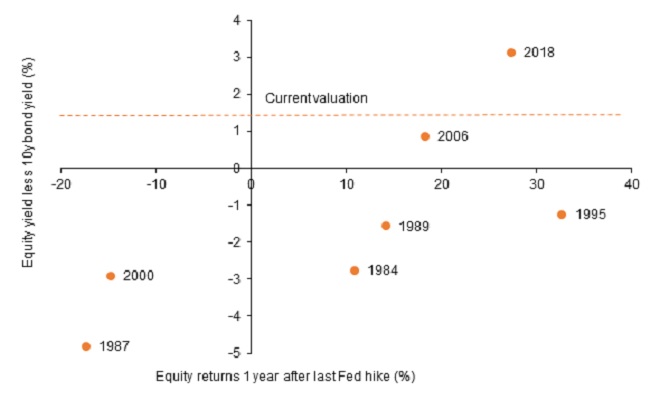

While economists’ growth projections look fairly optimistic, analysts’ earnings estimates look highly optimistic. For financial markets, this means that the first half of the year is likely to be an environment of persistent earnings downgrades, which will probably present a continued challenge to investor sentiment. Still, even if growth dynamics do turn out to be problematic for risk assets, the prospect of interest rates peaking offers some cause for optimism. During the current hiking cycle, equities have tracked interest rate volatility inversely and closely. From here, interest rate volatility should subside, as the US central bank slows the speed of hiking, helping stocks and other risk assets to regain composure after 2022’s monetary shifts and shocks. Indeed, history shows that equities usually perform well after the last US Federal Reserve (Fed) hike in each cycle, except when they were unusually expensive (Figure 1).

Figure 1: US equity returns one year after the last US interest rate hike vs starting valuations

Source: Janus Henderson, Bloomberg. Data as at 30 November 2022. Note: equity returns and valuations based on S&P Composite Index. ‘Last interest rate’ here refers to the final interest rate hike in each rate hiking cycle. Past performance does not predict future returns.

Better investment returns in 2023

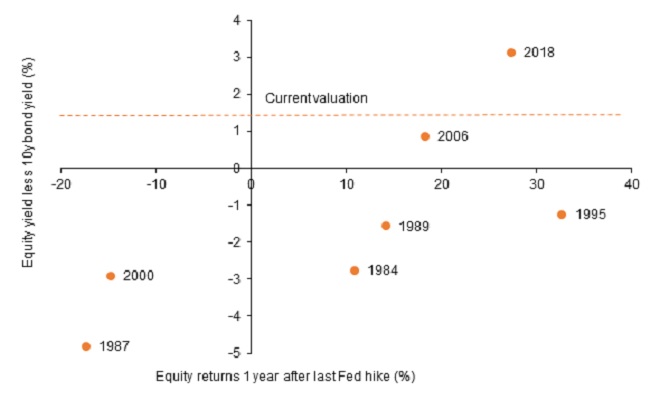

With the big picture remaining so complicated, and the global economy exhibiting so many cyclical and structural frailties, it is hard to build a strong fundamental case for risk assets swinging from 2022’s bear market into a new bull market in 2023. Instead, we feel a reasonable central scenario is one in which investors can expect to achieve solid returns from high quality assets, albeit probably having to ride out plenty of turbulence along the way. A multi-asset income perspective shows how the investor opportunity set has changed over the past year. While multi-asset income portfolios began 2022 with yields at historic lows, they now offer the most attractive income prospects and expected returns since the global financial crisis (Figure 2).

Figure 2: Indicative yield on a multi-asset income portfolio

Source: Janus Henderson, Bloomberg. Data 1 August 2008 to 30 November 2022. Index composition: MSCI World High Dividend Yield Index (40%), Bloomberg Global Aggregate Index (40%), Bloomberg Corporate High Yield Index (10%), Bloomberg Emerging Markets Hard Currency Index (10%). Past performance does not predict future returns.

Note: Hypothetical performance shown in this model is for illustrative purposes only and does not represent actual performance of any client account. No accounts were managed using the portfolio composition for the periods shown and no representation is made that the hypothetical returns would be similar to actual performance.

In both equities and credit, we start the year with a modestly defensive view, tilting towards quality rather than cyclicality and leverage, and keeping some power dry to buy the seemingly inevitable market dips. Regionally, US equities look less attractive than eurozone, Japanese and UK stocks, given their relative valuations, earnings risk and sector composition. European IG investment grade bonds appeal most in the credit space.

250 years of history says buy bonds

The area where we shifted our asset allocation views most in 2022 was government bonds. We ended our longstanding underweight stance and now regard the asset as a core holding for multi-asset portfolios in 2023. While the prospect of peaking interest rates and negative growth surprises is an ambiguous combination for risk assets, both trends would be positive for bond duration. Another cyclical consideration is that government bonds typically outperform equities and other risk assets when unemployment rises, which we expect to happen in the quarters ahead. Although quantitative tightening is likely to provide some headwinds, the overall demand/supply picture looks fairly supportive, now that an unprecedented reduction in investor positioning has wiped out 14 years of fixed income overweights among multi-asset portfolios and helped create a $67tn global investor cash pile. US government bonds have delivered negative returns for the past two calendar years. In 250 years of history, we have not seen this happen three years in a row.

On balance, it is hard to avoid the conclusion that the early months of 2023 present a complicated backdrop for risk assets, with central banks still tightening, global growth slowing and the Chinese economy facing multiple frictions. Markets seems likely to remain choppy, until developments on the monetary policy side or in China become encouraging enough to compensate for the inevitable bad news on the corporate earnings front. Nevertheless, with most of the rate hiking cycle now behind us and with asset valuations notably more attractive that where they were a year ago, 2023 should be a better year for investment returns than 2022.

The most important assumption in our base case is the view that interest rates peak in first half of 2023, giving markets the confidence to look through the slowdown we expect in the eurozone, the UK and US. Stubbornly high inflation would probably be the biggest risk to this scenario, threatening an outcome in which 2022’s market performance trends persist for longer than we expect. Upside risk scenarios could involve the major central banks delivering rare soft landings, in which inflation cools and recessions can be avoided. Positive developments in the war in Ukraine or on the health front in China offer other potential paths to more constructive economic and market outcomes.

Footnotes and definitions

Bond duration: How far a fixed income security is sensitive to a change in interest rates, measured in terms of the weighted average of all the security/portfolio’s remaining cash flows (both coupons and principal). It is expressed as a number of years. The larger the figure, the more sensitive it is to a movement in interest rates.

Cyclical: Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Bear market/bull market: A bear market is a financial market in which the prices of securities are falling. A generally accepted definition is a fall of 20% or more in an index over at least a two-month period. A bull market is a financial market in which the prices of securities are rising, especially over a long time.

GDP (Gross Domestic Product): The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is usually expressed as a percentage comparison to a previous time period and is a broad measure of a country’s overall economic activity.

Inflation: The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures.

Interest rate volatility: This refers to the variability of interest rates on loans and savings over time. Businesses are affected by volatile interest rates because they impact borrowing costs and investment account earnings.

Investment grade (IG) bonds: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

Leverage: An interchangeable term for gearing: the ratio of a company’s loan capital (debt) to the value of its ordinary shares (equity); it can also be expressed in other ways such as net debt as a multiple of earnings, typically net debt/EBITDA (earnings before interest, tax, depreciation and amortisation). Higher leverage equates to higher debt levels.

Monetary and fiscal policy: Monetary policy is the behaviour of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Fiscal policy relates to government policy relating to setting tax rates and spending levels.

Quantitative tightening: Quantitative easing was an unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system. Quantitative tightening is the removal of that stimulus.

Rate expectations: Expectations for interest rate changes.

Risk assets: Financial securities that can have significant price movements (hence carry a greater degree of risk). Examples include equities, commodities, property and bonds.

Yields: The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

—

Originally Posted December 6, 2022 – Multi-asset outlook for 2023 – light at the end of the tunnel

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)