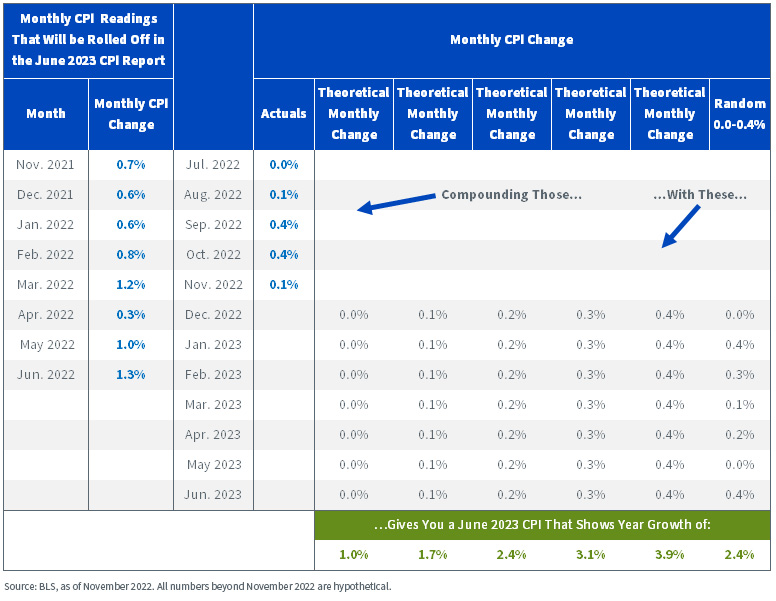

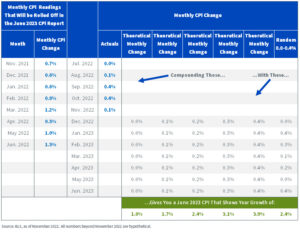

My mind is on July 12, 2023—the day next year’s CPI for the month of June will be released.

That month is my best guess for the one that is most likely to print a notably low year-over-year growth rate in inflation. It’s the first month to “roll off” all the ugly month-over-month readings that came in 2022’s first half. You can see them on the left side of figure 1.

I’m not sure many investors realize it, but the last half year or so hasn’t seen much inflation (over and above the spike into the summer). The last five monthly CPI growth rates were 0.0%, 0.1%, 0.4%, 0.4% and 0.1%.

If you look at the various scenarios for the months from now until summer 2023, a handful of “normal” reports can easily put YoY CPI in the 2%–3% area. We all talk about inflation coming down, but it’s my inkling that not many investors truly believe CPI’s first digit could be a “2” so soon.

Figure 1: YoY CPI Scenarios for June 2023

There is the real possibility all my scenarios could be wildly inaccurate. Between the war in Ukraine and persistent wage inflation manifesting in a surprise spending impulse by the consumer, maybe we will see some reports that resemble what we had to bear this past spring.

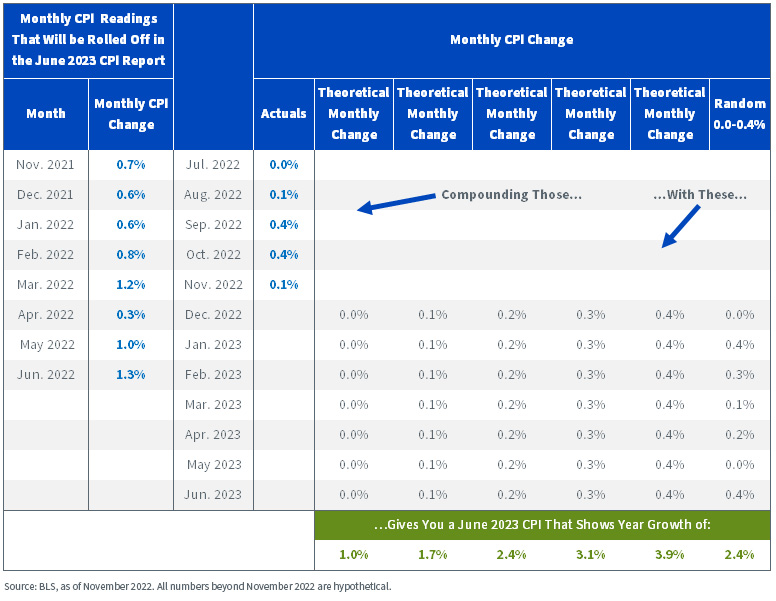

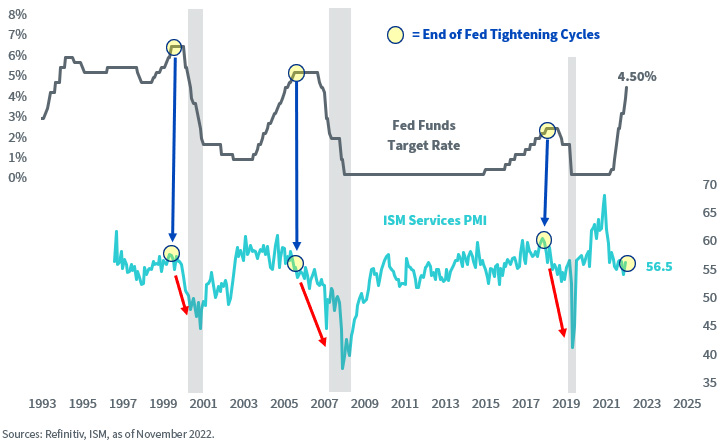

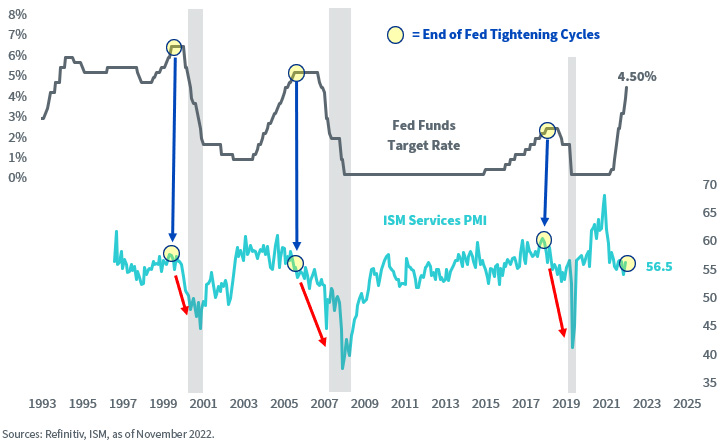

Nevertheless, I’m thinking disinflation for 2023’s first half. Consider the services sector, which has held up strongly. Strength in indexes such as the ISM Services PMI has been one of the core arguments for those who assert the economy will avoid a second dip into recession.

However, my worry is that the ends of Fed tightening cycles often break things (figure 2).

Figure 2: Fed Funds Points to Lower Services PMI

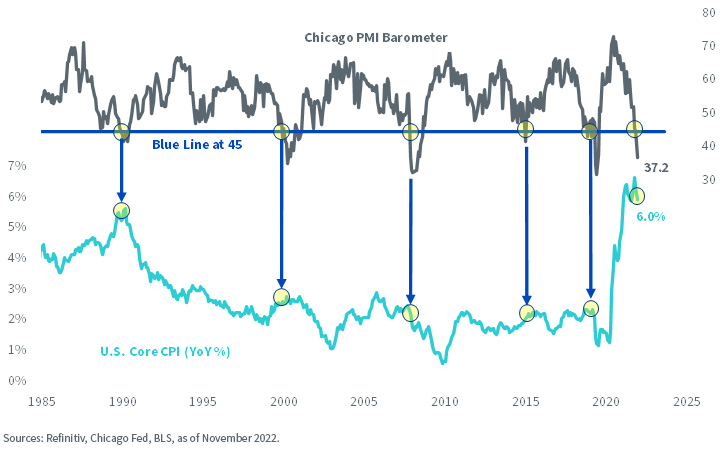

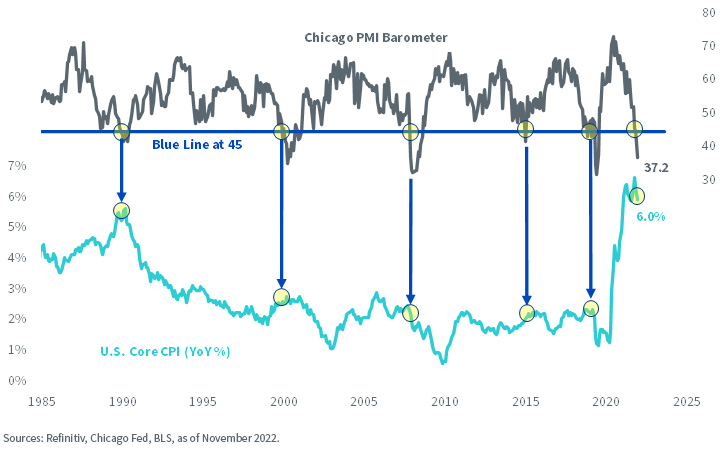

The Chicago PMI has already long since broken below the line of demarcation between expansion and contraction at the 50 mark; it came in at 37.2 in November.

In figure 3, I’ve added a line at 45 to show periods when most of us would conclude that conditions are recessionary. I think it puts a gravitational pull on core CPI, which excludes food and energy.

Figure 3: The Chicago PMI Is Indicating Acute Economic Contraction

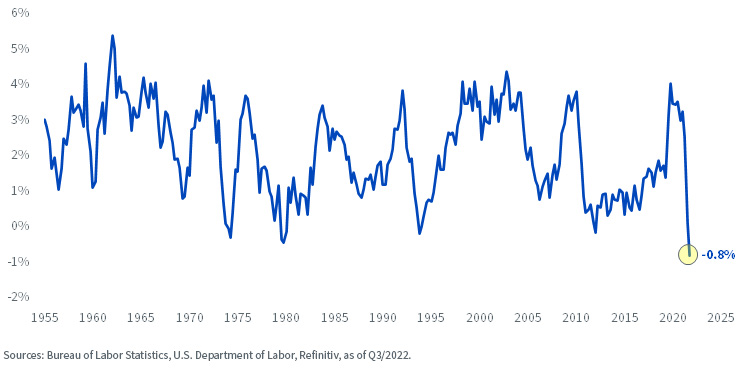

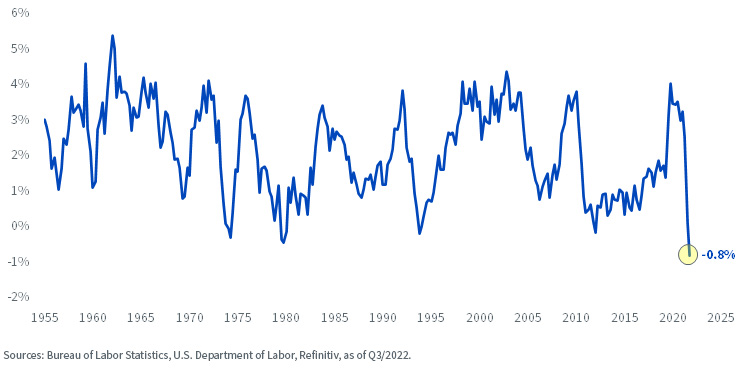

One of the key drivers of inflation this year has been robust wage growth. However, the U.S. has a productivity problem that is unprecedented (figure 4). It would be reasonable to anticipate hiring freezes and layoffs may be thematic in 2023.

Figure 4: 2-Year Annualized Growth Rate, U.S. Output per Hour, All Persons

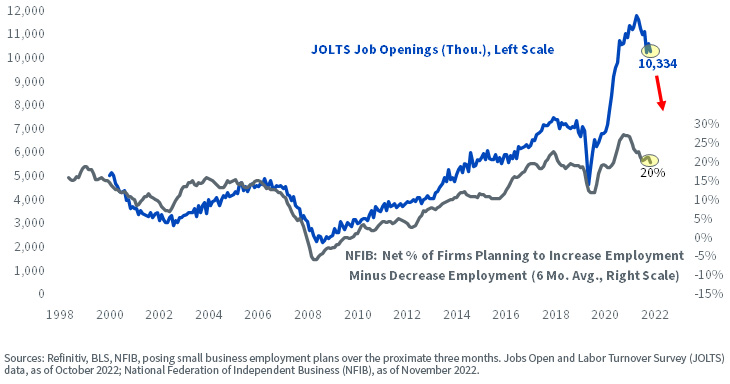

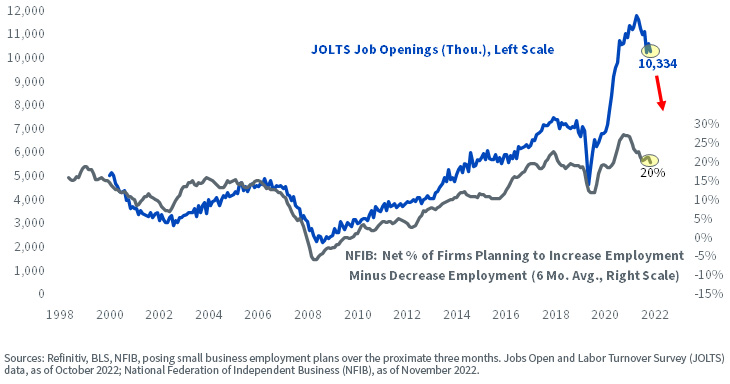

The NFIB survey of small businesses is moving in the wrong direction when it comes to hiring intentions. Because of a surplus of unproductive workers, I think the current 10.3 million job openings will decline (figure 5).

Figure 5: Small Business Hiring Plans Are Back to Pre-Covid Levels

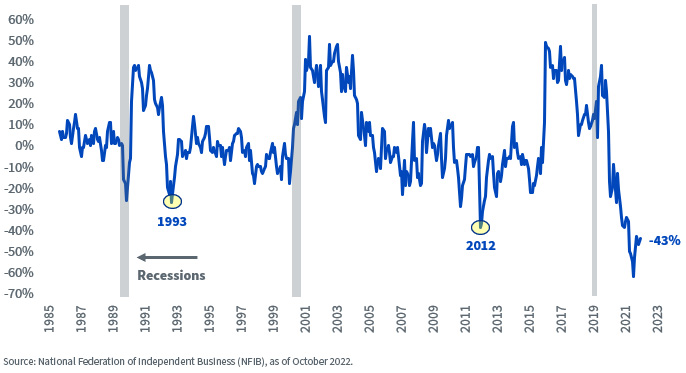

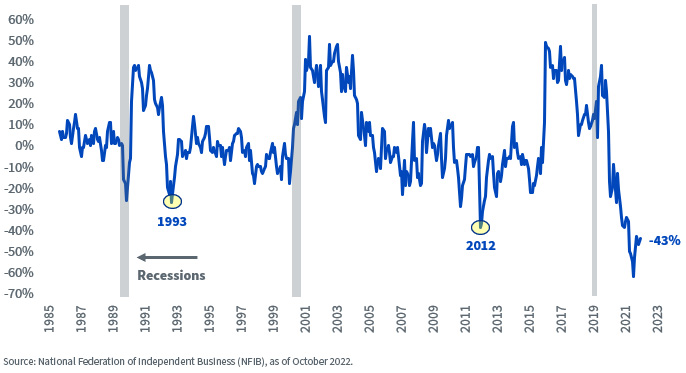

When it comes to the whole economy, the NFIB survey looks like a demand destruction situation (figure 6). I could easily see the unemployment rate heading above the Fed’s 4.4%–4.7% range that it is predicting for the end of 2023.

Figure 6: NFIB Survey, % Expecting Improved Economy Minus % Expecting Deteriorating Economy

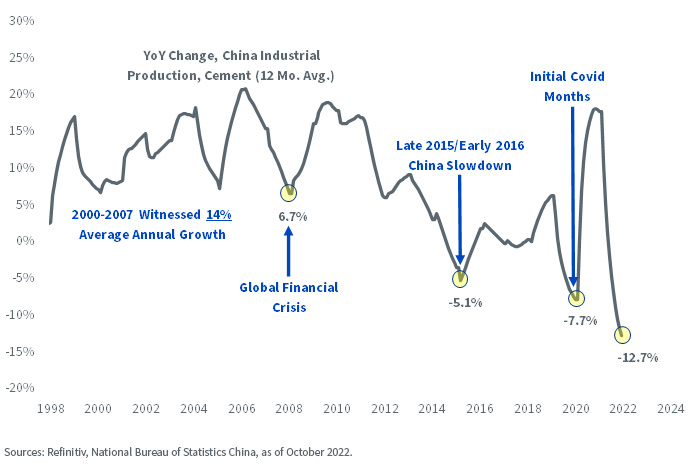

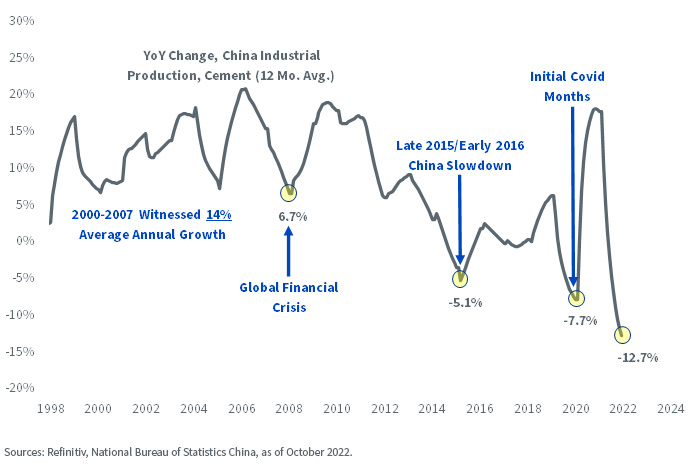

Another area of demand destruction is from the aftershocks of the burst in China’s property bubble. Figure 7 covers cement production. Normally, declining production of a good should be inflationary, but in this case, I worry that it’s declining because building activity has come to a standstill.

Figure 7: A Portrait of China’s Industrial Contraction: Cement Production

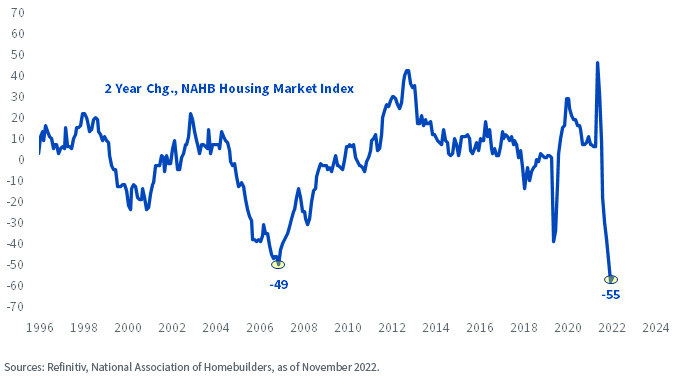

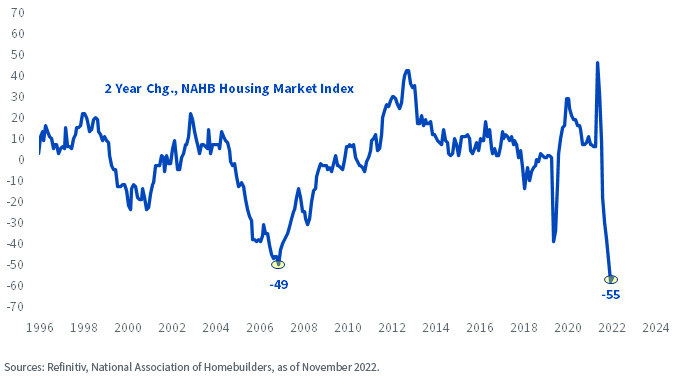

In the U.S., we also have an activity dilemma—in housing. Courtesy of a national average conforming mortgage rate of 6.27%, homebuilders are reporting a drying up in foot traffic (figure 8).

I’m hard pressed to see how we could get big inflation in things like refrigerators, landscaping equipment, paint and the hundred other things you spend money on when you move houses.

Figure 8: Homebuilder Sentiment Has Collapsed

When I look forward in 2023, I see a Federal Reserve that anticipates unemployment will only rise to a 4.4%–4.7% range, which I think is an underestimate. I see a Federal Reserve that is fighting early 2022’s inflation demons even as the clock ticks over to 2023.

A policy mistake.

—

Originally Posted January 4, 2023 – Next Summer’s CPI Reports May Be Lower than You Think

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-300x169.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-300x169.jpg)