By: subSPAC

EXECUTIVE SUMMARY

- Artificial Intelligence (AI) and Deep Learning Applications are all the rage, primarily thanks to the likes of OpenAI’s ChatGPT being used for text and Dall-E being used to generate digital images.

- ChatGPT’s popularity has soared, reaching a user base of 1 million users in 5 days, and OpenAI itself is benefiting from the surge in users, now valued at $29 Billion.

- Investors are already looking for the next wave of AI products that can make a big splash and potentially disrupt legacy industries.

DETAIL

Happy Sunday, Friends!

Artificial Intelligence (AI) and Deep Learning Applications are all the rage, primarily thanks to the likes of OpenAI’s ChatGPT being used for text and Dall-E being used to generate digital images. ChatGPT’s popularity has soared, reaching a user base of 1 million users in 5 days, and OpenAI itself is benefiting from the surge in users, now valued at $29 Billion. Investors are already looking for the next wave of AI products that can make a big splash and potentially disrupt legacy industries. Beauty and Fashion Tech Company Perfect Corp Aims to meld the growing trends of AI and Augmented Reality (AR) together to reinvent the in-store shopping experience. So is Perfect Corp all hype or the next big thing?

Personalized Fashion

As mentioned earlier, Perfect Corp plans to combine the two biggest (possibly?) trends of 2023, namely Artificial Intelligence (AI) and Augmented Reality (AR), to disrupt the beauty and fashion retail industry. The company has created applications that enable users to analyze the condition of their skin, recommending products/solutions from a catalog using AI.

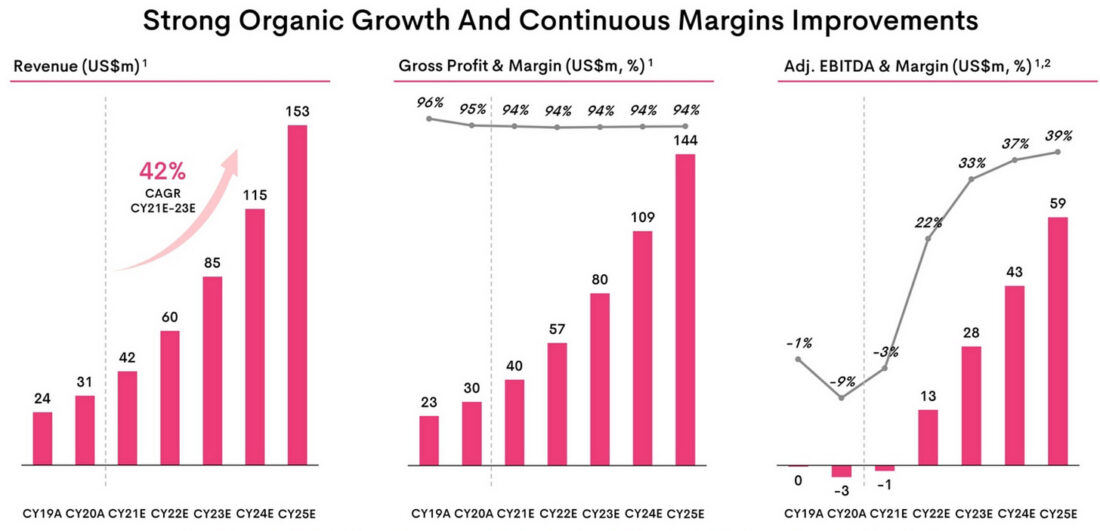

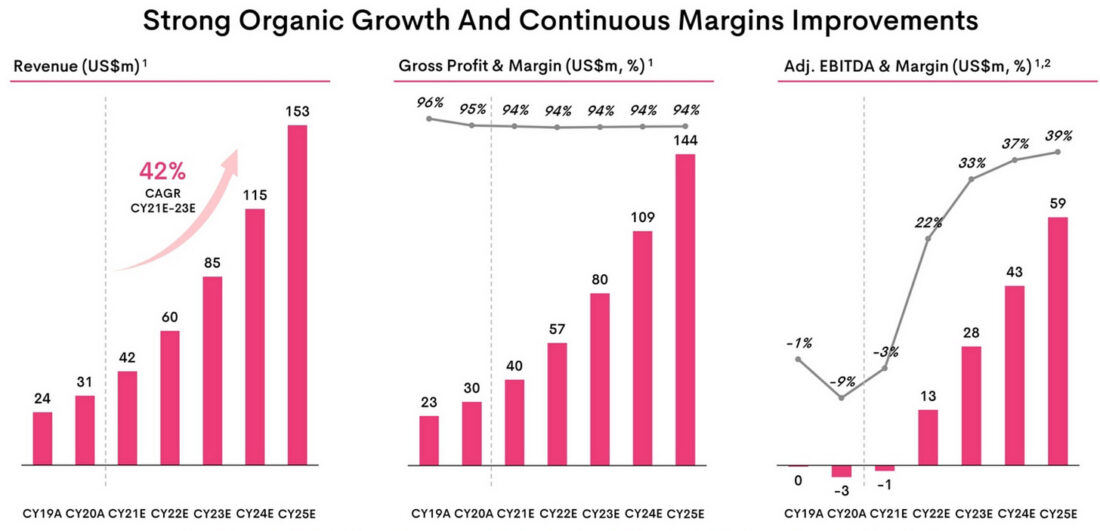

Furthermore, the company also uses AR to let users artificially try out different types of makeup, hair and nail colors, and other accessories. The company’s 44 issued and pending patents cover all this. It’s no surprise that Perfect has seen a meteoric rise in the past few years, seeing its revenues nearly double from $24 million to $42 million between 2019-21.

In the same period, the company has attracted the likes of L’Oréal, Chanel, Coty, and Estée Lauder in its clientele (the company has over 420+ clients across 80 countries). One of the reasons for the company’s staggering growth is the pandemic, which forced brands to re-examine the traditional brick-and-mortar shopping experience.

Despite reopening after shutting down for several months, consumers were reluctant to try on goods due to safety and hygiene concerns, prompting retailers to implement alternatives like Online stores with AR + AI suggestions. While many may be reluctant to change their shopping experience overnight, over 700 million consumers have already used a virtual try-on experience, suggesting a transformation of the industry is inevitable. In fact, the global Beauty AI + AR Market is projected to grow to $5.4 billion in 2025, presenting a sizeable opportunity for Perfect to capitalize on.

Disrupt or Be Disrupted

There’s good reason to be skeptical about Perfect’s recent success, questioning if the company’s current growth is a one-off or can be sustained over the long term. AR Based beauty solutions, filters, and try-on’s are not new; in fact, Snapchat popularised the trend over five years ago, which Instagram subsequently ripped off and popularised a few months later. The real question is the long-term viability of the business since such AI + AR solutions have been treated as gimmicks rather than full-blown SaaS solutions as Perfect is treating it to be. There are, of course, several catalysts for long-term growth that Perfect can capitalize on, including:

- Every retail beauty brand, from Sephora to L’Oréal, is investing in virtual stores and in-store AR + AI Experiences.

- Mixed Reality/AR is rapidly emerging as the next frontier in technology (with expected product/software stack releases from Amazon/Apple/Microsoft/Meta this year), and AR Glasses/Experiences could be as common as the smartphones of today.

- The fastest growing target market for beauty retail, namely GenZ/Millennials, is opting for alternative experiences digitally or by purchasing directly after looking at a product on social media.

The company has also partnered with 20 Beauty Groups, essentially becoming a monopoly in the industry, boasting a first movers advantage. However, there’s no guarantee that the company will be able to retain all of its customers since the technological moat is rapidly shrinking with the advancement in space.

Furthermore, some retailers like IKEA and Wayfair have developed their AR solutions (although these examples are in the furniture industry, where the tech won’t have as much trouble modeling subjects), essentially cutting out the middleman. While it will undoubtedly take tens of millions of dollars to develop, larger beauty retailers could still make the investments now to cut recurring costs while also emerging as digitally forward-thinking. This would force Perfect to only target smaller beauty-focused companies, vastly reducing the potential for future growth.

In addition to these challenges, Perfect has been downbeat in recent months, warning investors that immediate growth may be slow due to numerous factors, including brand customers taking longer or reconsidering investments, slower push into other segments like Jewellery and fashion, and forex headwinds impacting revenues. A prolonged recession could essentially bring the company’s growth to a screeching halt, putting it in line with SaaS peers that have seen their valuations crushed in recent months.

Financials and Valuation

Perfect expects its revenues to rapidly scale, from $42 million in 2021 to $153 million in 2025 through upselling, cross-selling, and upscaling into different SKUs, partner brands, and countries. The company has historically shown strong customer retention, with an average Net Dollar Retention Rate of 130% over the past four years. Like every other SaaS business, the low operating costs over time should result in robust margins.

As a result, Perfect is projecting Gross Margins of 94% and EBITDA margins of 39% by 2023, implying $59 million in operating profits. Considering the fact that Perfect also plans to expand into other avenues, including social AR + AI Experiences/integration, and international expansion, it will be important for investors to keep an eye on the company’s balance sheet. The SPAC transaction added $113 million to the $84 million cash on hand, bringing the total cash to $197 million.

Considering that growth may stall in the coming months and the company may lose some existing brand customers, it may report losses for a few more years until the macroeconomic situation improves. While the company’s revenue growth and margins may eventually recover, the biggest challenge for investors today is its valuation.

Perfect currently has a market cap of $870 million, implying a forward price/sales multiple of 17.4x (assuming the company generates revenues of $50 million in FY22, which seems challenging given the current scenario). SaaS multiples across the board have seen a compression over the last year, down 75% in the median from 17.3x in 2021 to 4.6x (Annual Recurring Revenue Multiple). With growth slowing and margins shrinking, Perfect could see a similar drop in valuation, bringing it in line with peers in the industry.

Bottom Line

Beauty Tech company Perfect Corp has emerged as one of the major beneficiaries of the pandemic. With AR + AI Solutions, Perfect aims to reinvent the beauty and fashion retail landscape. Investments from Big Tech to develop the next generation of Mixed Reality, growing interest from younger customers for differentiated retail experiences, and the willingness from retailers to rapidly adapt Perfect’s solutions to their digital/retail experiences remain the clear tailwinds for growth. However, increased competition and long-term business viability remain a concern over the long term. The biggest challenge for Perfect is its valuation, which is trading like the company is in a bull market when real revenue growth and margins are shrinking based on a worsening economic situation.

—

Originally Posted January 8, 2023 – Perfectly Imperfect

Disclosure: Smartkarma

Smartkarma posts and insights are provided for informational purposes only and shall not be construed as or relied upon in any circumstances as professional, targeted financial or investment advice or be considered to form part of any offer for sale, subscription, solicitation or invitation to buy or subscribe for any securities or financial products. Views expressed in third-party articles are those of the authors and do not necessarily represent the views or opinion of Smartkarma.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Smartkarma and is being posted with its permission. The views expressed in this material are solely those of the author and/or Smartkarma and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)