By J.C. Parets & All Star Charts

Thursday, 22nd December, 2022

1/ Dollar Digs In

2/ Risk-On Pairs Look Flat

3/ Rates Catch Support

4/ Precious Metals Shine

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Dollar Digs In

The U.S. Dollar Index (DXY) is finding its footing after experiencing significant downside pressure in recent weeks. Price is currently testing a critical level of former resistance marked by a shelf of former highs.

With so much price memory here, this area represents a logical level for demand to absorb supply. So far, that’s the case as former resistance has become support.

If DXY begins to mean revert in the coming days, we could expect risk assets to come under increased selling pressure.

On the other hand, a downside violation of this critical level would likely result in a tailwind for stocks and risk assets alike.

2/ Risk-On Pairs Look Flat

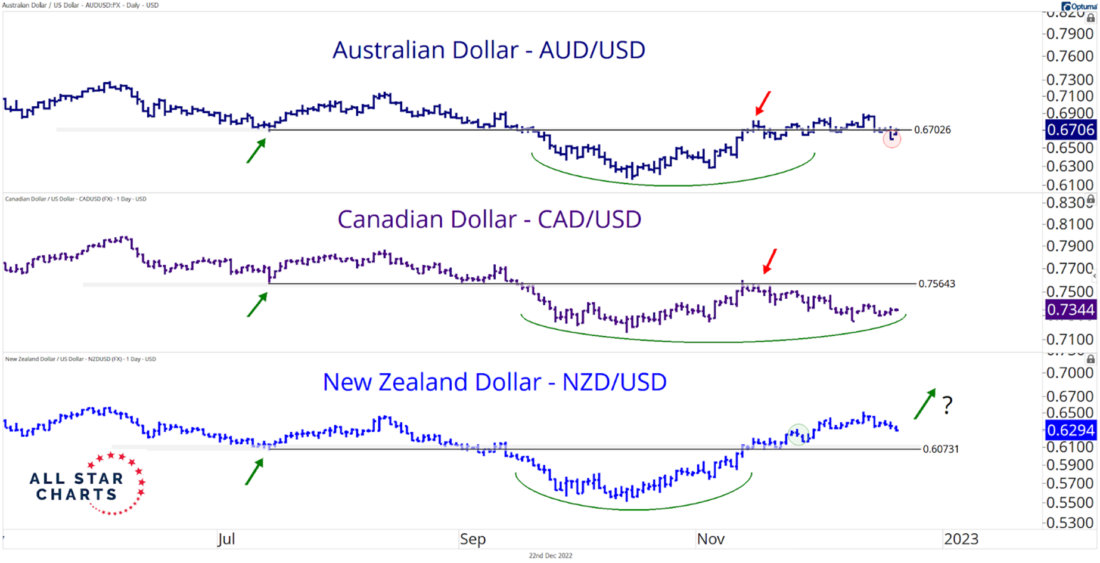

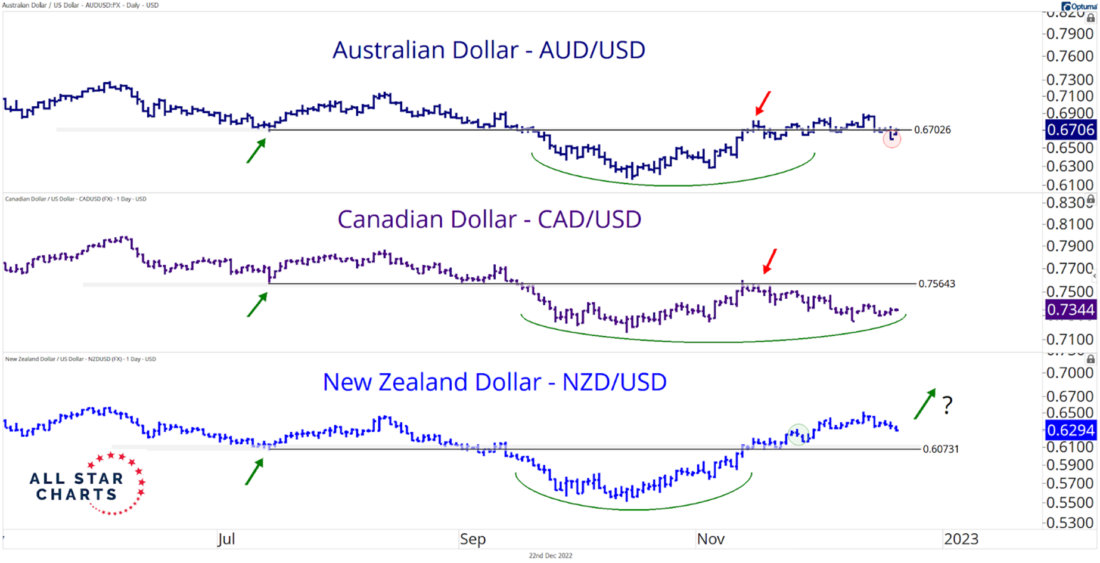

When we think of DXY catching higher, we have to consider how it is performing against its alternatives. The lack of expanding participation beyond the DXY components, especially risk-on currencies, suggests near-term dollar strength.

The triple pane chart of the Australian (AUD), Canadian (CAD), and New Zealand (NZD) dollars against the U.S. dollar below highlights what we already know. It’s messy out there. At the same time, these currencies provide key levels for measuring the dollar more broadly.

All three pairs have so far challenged their July pivot lows to varying degrees of success. The NZD holds above its respective lows, while the AUD straddles its level, and the CAD retreats lower.

A sustained downtrend in the dollar might not come to fruition until these three commodity currencies reclaim their summer pivot lows. And with the Aussie and Kiwi losing ground today, a near-term bounce in King Dollar could be likely.

3/ Rates Catch Support

When it comes to U.S. Treasury yields, we see a similar behavior as in the U.S. dollar.

Below is the 30-year Treasury yield (TYX) testing a critical polarity level. This support zone not only represents the summer highs from earlier this year, but the highs of the previous cycle from 2018.

So far, this trend is intact, and as long as we’re above these old highs, we’re looking for a presumption of the rising rate environment we’ve been in since 2020. However, a break below this level would indicate damage to the primary trend as well as a relief in selling pressure for long-duration assets.

4/ Precious Metals Shine

Precious metals have all rallied considerably in recent weeks. While gold and silver have reclaimed critical levels of interest, platinum isn’t far behind.

The chart below shows our equal-weight precious metals index hooking back above its prior cycle highs from 2008 and the 1970s.

As long as we’re above that shelf of former highs, our bias would remain to the upside.

—

Originally posted 22nd December 2022

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.