By J.C. Parets & All Star Charts

Thursday, 25th May, 2023

1/ Nvidia Soars to New Highs

2/ Nasdaq Reacts Higher

3/ Bitcoin Forms a Top

4/ The Pound Breaks Down

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

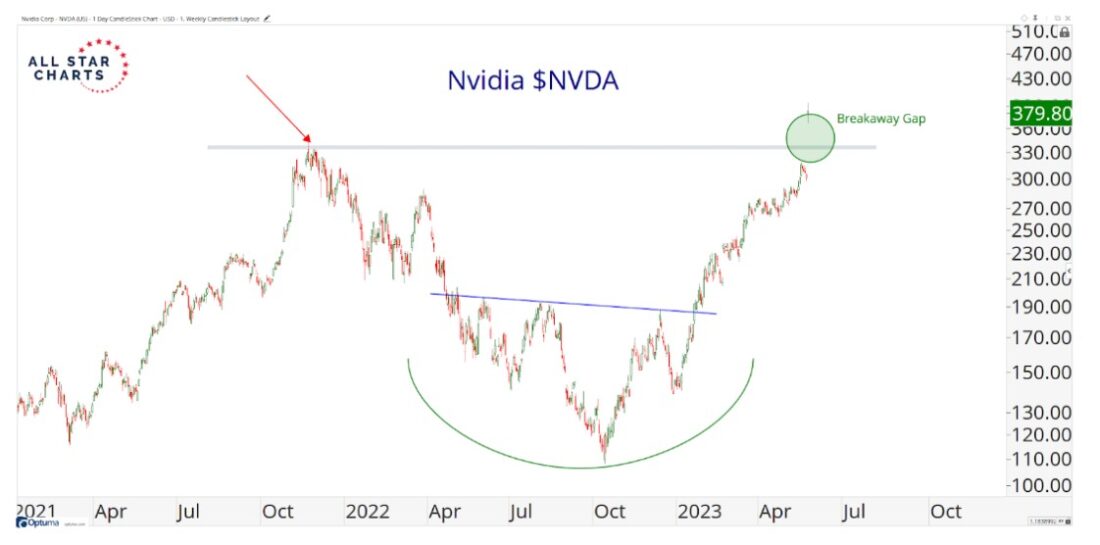

1/ Nvidia Soars to New Highs

Nvidia (NVDA) just became the first mega-cap tech stock to make new all-time highs, rallying 24% today on the heels of a historic earnings report.

The company’s guidance and artificial intelligence (AI) business resulted in a massive sympathy bid that dragged the entire technology sector and Nasdaq 100 higher today.

Nvidia stock is up about 250% from its October lows, making it the best performer in the S&P 500 since equity markets bottomed last year.

Not only is NVDA at fresh all-time highs on absolute terms, but it is also making new record highs versus every benchmark under the sun. This stock is the definition of secular leadership. And based on today’s earnings reaction, it appears to have the fundamentals to back it up.

As long as this breakaway gap holds in the coming days, there is potential for a fresh leg higher for this stock.

2/ Nasdaq Reacts Higher

The Nasdaq 100 (QQQ) was up about 2.5% today, primarily due to Nvidia’s earnings, which propelled the entire growth complex higher.

As shown below, after a pullback to the August highs, buyers jumped in, causing the price to rebound to fresh 52-week highs.

Notice that momentum is in a bullish regime and the 200-day moving average is turning higher. All this evidence reinforces a shift in the trend in favor of the bulls.

As long as this breakout remains intact, the path of least resistance is to the upside for tech and growth stocks.

3/ Bitcoin Forms a Top

The sideways action in Bitcoin (BTC/USD) that has taken place this quarter has resulted in a potential distribution pattern.

As you can see in the chart below, the price is threatening to violate the lower bounds of a head and shoulders formation.

The question we’re asking now is whether this topping formation resolves lower or if it could result in a failed pattern, like what happened in Q1, and result in a price reaction to the upside.

If it’s the former, the bias is lower, which could lead to further downside. However, if buyers can quickly reclaim the $26,500 level, we could see a swift reaction back to this year’s highs.

4/ The Pound Breaks Down

The U.S. Dollar Index (DXY) booked another day in the green. Volatility is hitting the FX markets as major global currencies fall against King Dollar amid a growing list of failed breakouts.

The euro has fallen below its breakout level. The USD/JPY pair has reached its highest level since November last year. And now the British pound has undercut a critical shelf of former highs.

Here’s the British Pound Sterling Trust ETF (FXB):

With the path of least resistance pointing lower for the top components of the dollar index, few obstacles stand in the way of a USD uptrend.

Bulls must step in and support major global currencies like the pound to stave off a stronger USD. If they fail, stiff headwinds will likely impede global risk assets in the near term.

—

Originally posted 25th May 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.