AT A GLANCE

- China’s lifting of EV subsidies this year has had a chilling effect on lithium markets

- Supply constraints in the Democratic Republic of Congo – a major producer of Cobalt – are presenting short-term risks

The uncertain price outlook for lithium and cobalt poses challenges to market participants. At the same time, futures markets for battery metals are growing in liquidity, enabling firms to manage their exposure to these price movements with tools previously unavailable.

China, which accounts for more than half of global electric vehicles (EVs) sold, decided to eliminate EV subsidies at the beginning of 2023. This has had a chilling effect on the lithium market, with CATL, the world’s largest lithium-ion battery manufacturer, reportedly offering discounted batteries to its main buyers in order to preserve market share.

Further worries about a depressed property sector and overall bearish mood have not helped the local market. On the supply side, lithium production is expected to grow in the years to come, with Goldman Sachs calling 33% annual growth from 2022-2025 and Bank of America estimating 38% growth from 2022 to 2023. Lithium bulls are looking past China and at longer-term trends. They argue that fundamentals remain strong: producer Albermarle says that continuously high prices will be required to incentivize new production in order to meet burgeoning demand. They forecast demand to grow from 800,000 metric tons (MT) in 2022 to 3.7m MT globally in 2030.

Pressure on Cobalt Prices

In the cobalt market, it is the supply picture that has recently dampened the market mood. Chinese producer CMOC, which competes with Glencore for the title of the world’s largest producer, has had to stockpile cobalt in the Democratic Republic of Congo (DRC) since last July. This was due to a tax dispute with the Congolese authorities. With an agreement now reached, the stockpiled cobalt will soon be able to enter the market and may put pressure on short-term prices.

Longer term, it is changes in battery chemistry that may have an even larger impact. Lithium-iron-phosphate (LFP) batteries consume less cobalt than those using nickel-cobalt-manganese (NMC) chemistry. Consultant Rho Motion estimated that LFP captures around 34% of the global EV battery market, with that share to rise to 39% by 2024. In response, cobalt bulls can argue that capturing a smaller portion of a much larger EV battery pie is still a positive development. In addition, the market is expected to remain heavily reliant on DRC production – a jurisdiction which presents risks.

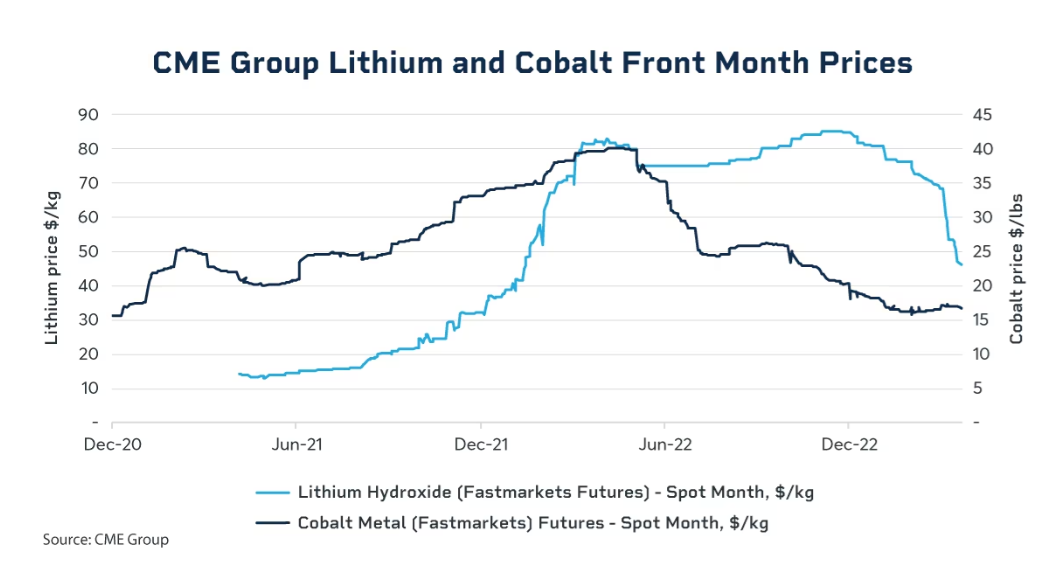

The metals’ recent performance may appear lacking, but it’s worth looking at a longer time horizon – while lithium has now fallen by about 50% from its peak, prices are still three times higher than when CME Group first launched a lithium contract in May 2021. As for cobalt, the prices are right back where they were in early 2021 at levels at just below $20/lbs.

For customers, producers and financial investors, the increase in futures markets liquidity at CME Group means that there are now derivate instruments to protect against price swings – something that was previously only limitedly available in cobalt, and not available at all for the lithium market.

Cobalt open interest – or the number of unsettled futures contracts – set a record at above 20,000 metric tons in April 2023, or about $700 million notional at current prices and extends out to December 2025. While smaller, lithium open interest is now at over 1,500 metric tons, equivalent to $70m notional value and going out to September 2024.

Both metals have now lost about half their value since their respective peak prices in 2021/2022. For lithium, it is mostly Chinese demand that has chilled the market; for cobalt, the explanation most likely lies in DRC-specific issues. Yet the fundamental picture may not have changed much. Both metals remain key to the energy transition and are expected to continue growing in importance globally.

—

Originally Posted May 4, 2023 – Cobalt and Lithium – a Tale of Two Battery Metals

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.