The crude oil market is well into a significant, well-deserved correction, and the July peak just below $75 might be a major top until later in the year. In addition to the uptrend in the dollar, the energy markets are facing frequent evidence of a slower economy that is likely to translate into softer consumption.

Source: EIA

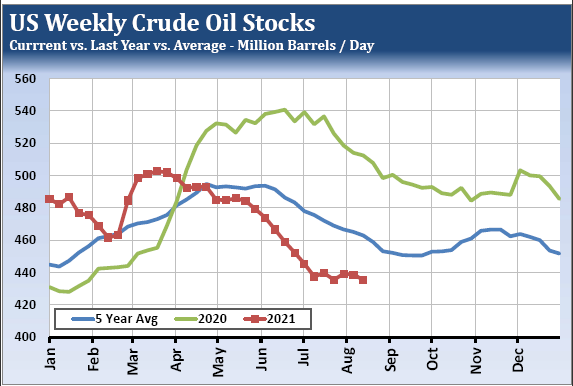

Global oil supply is rising modestly, and the US crude oil inventory deficit to year ago levels has narrowed by more than 20% over the last month. The rise in global energy production has been led by the OPEC-plus agreement to bring back 400,000 barrels per day of idled production per month until the entire hold-back is eliminated. Even the US is showing signs of increasing production, with the most recent estimates putting output to 11.4 million barrels per day, the highest since May 2020. The US drilling rig count has doubled over the last year, which should add to US supply.

From the demand front, the Delta variant infection wave appears to have stymied the recovery of air travel, and after the upcoming holiday weekend, seasonal demand for gasoline and jet fuel is expected to moderate. After a record implied gasoline demand figure of 10.043 million barrels per day earlier this summer, weekly readings have not advanced, and we suspect they will taper off in September. There are also signs that Chinese demand is softening, with the trade anticipating a reduction in Chinese crude oil imports and refinery runs in September as well.

Source: Bloomberg

Technical Signals

With a precipitous decline in October Crude Oil over the past two weeks and a moderately large spec and fund net long position, we anticipate additional, follow-through selling and a possible return to $60.00. The most recent spec and fund net long was still in the upper portion of the range of the past 25 months, and while the $6 price slide this week likely pulled that position lower, we believe more liquidation is possible. Declining open interest is another sign that long-held bulls have stepped aside. Until prices fall to a low enough level to bring in some bargain-hunting, we suggest selling rallies.

—

Originally Published on August 20, 2021

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.