Introducing New Crop Weekly options

New Crop Weekly options are a flexible tool with which participants can fine-tune their hedge or express a particular market view with precision at a lower cost relative to long term options. The new product complements the preexisting options suite that contains conventional long-dated options on futures, Short-Dated New Crop options, and Weekly options.

New Crop Weekly options merge the functionality of Weekly options and Short-Dated New Crop options by exercising into new crop futures (December for Corn futures and November for Soybean futures) and expiring weekly on Fridays from February through August.

The volatility of 2022, discussed here, demonstrates the utility of practicing precision in Corn and Soybean futures and options markets.

Two distinct crops

New crop and old crop instruments reflect different physical supplies and behave accordingly. For example, in June, the front-month Corn futures instrument expires in July, reflecting stores of corn harvested the prior autumn. On the other hand, the new crop Corn futures instrument at that time expires in December and reflects the anticipated supply resulting from the corn crop that is currently being grown. Extreme weather in June might affect new crop futures more than old crop futures because the new crop is more vulnerable to disruptions in its growing phase, whereas old crop supplies are already known at that time. Conversely, transitory supply chain issues, for example, may more distinctly affect old crop futures because logistic hurdles could hamper transport of the preexisting supply and would be expected to be resolved by the time the new crop is harvested.

New crop vs. old crop corn in 2022

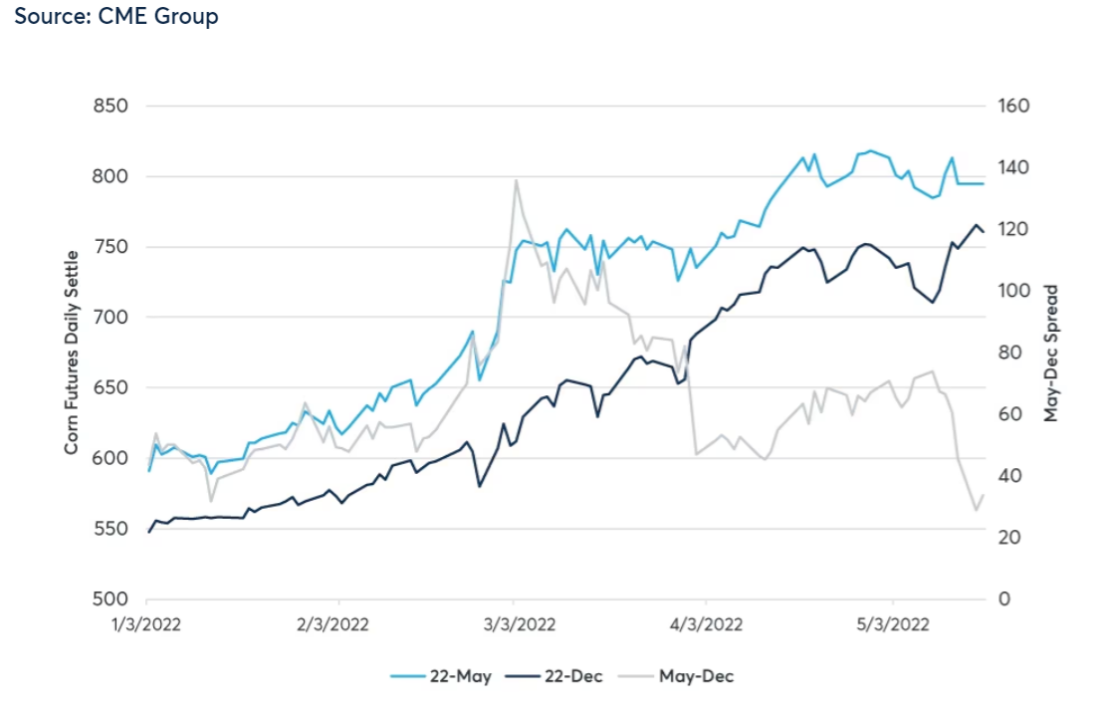

The dynamics between existing and future supplies played out boldly through the geopolitical and atmospheric tumult of 2022. The March 2022 spike in the May-December Corn futures spread demonstrates how the market prized nearer-term supply, more aggressively bidding up the May contract over the December contract given uncertainty of immediate Black Sea stocks after the onset of the Russo-Ukrainian War. Prices for both May and December Corn surged, though demand for front-month corn was so much stronger that the May-December spread increased 160% from mid-February to early-March 2022.

Figure 1: May vs. December Corn futures 2022

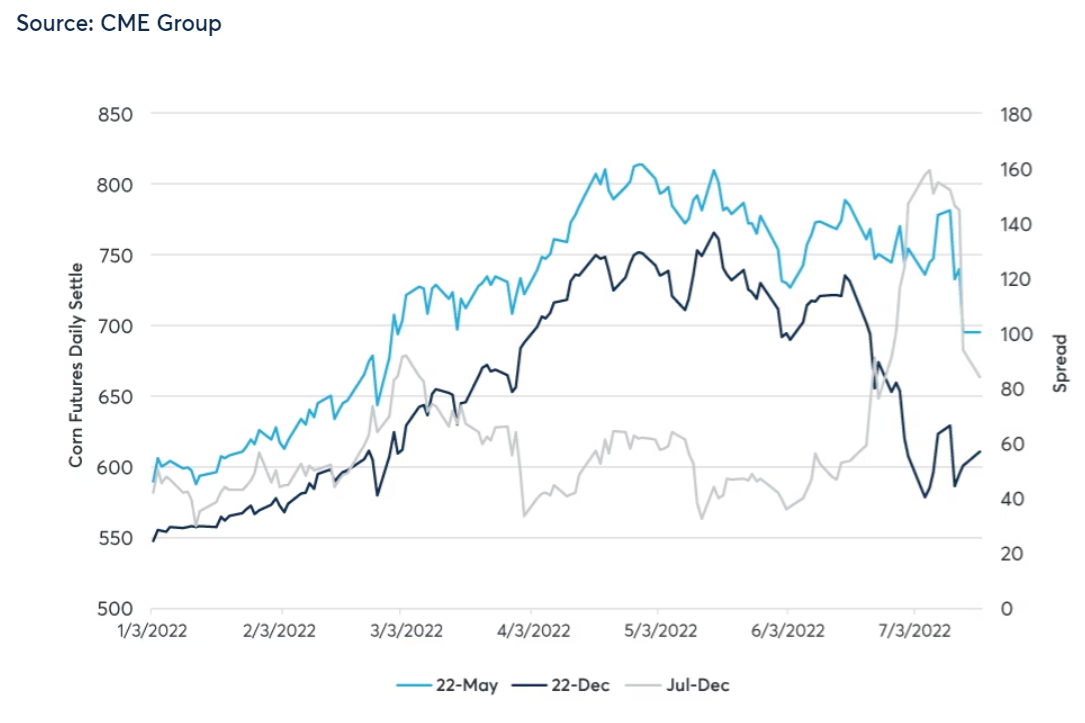

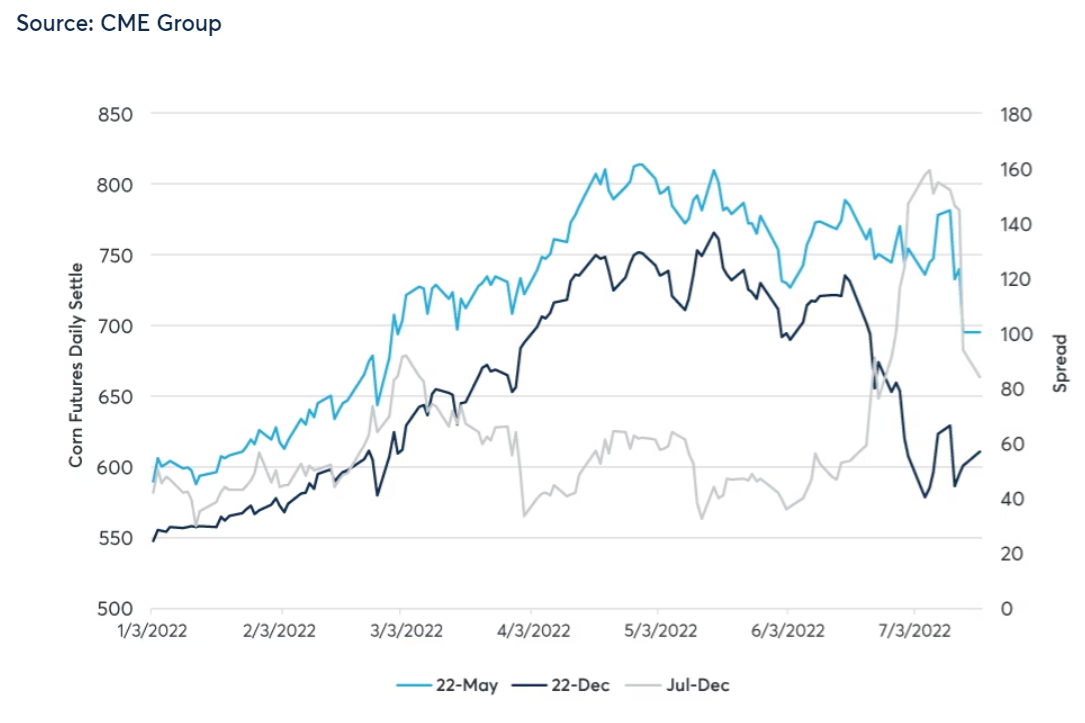

Spread volatility, however, is not always attributable to movement in the front-month instrument. In July 2022 for example, new crop Corn futures plunged upon favorable acreage and crop progress on top of a Black Sea grain corridor agreement that extinguished fears of a shortage of corn in the coming crop year. This sent the July-December spread soaring as the old crop instrument went unaffected by the news. On July 6, 2022, the July-December Corn spread exceeded $1.59, up from 43 cents one month prior.

Figure 2: July vs. December Corn futures 2022

How the crop year prices options

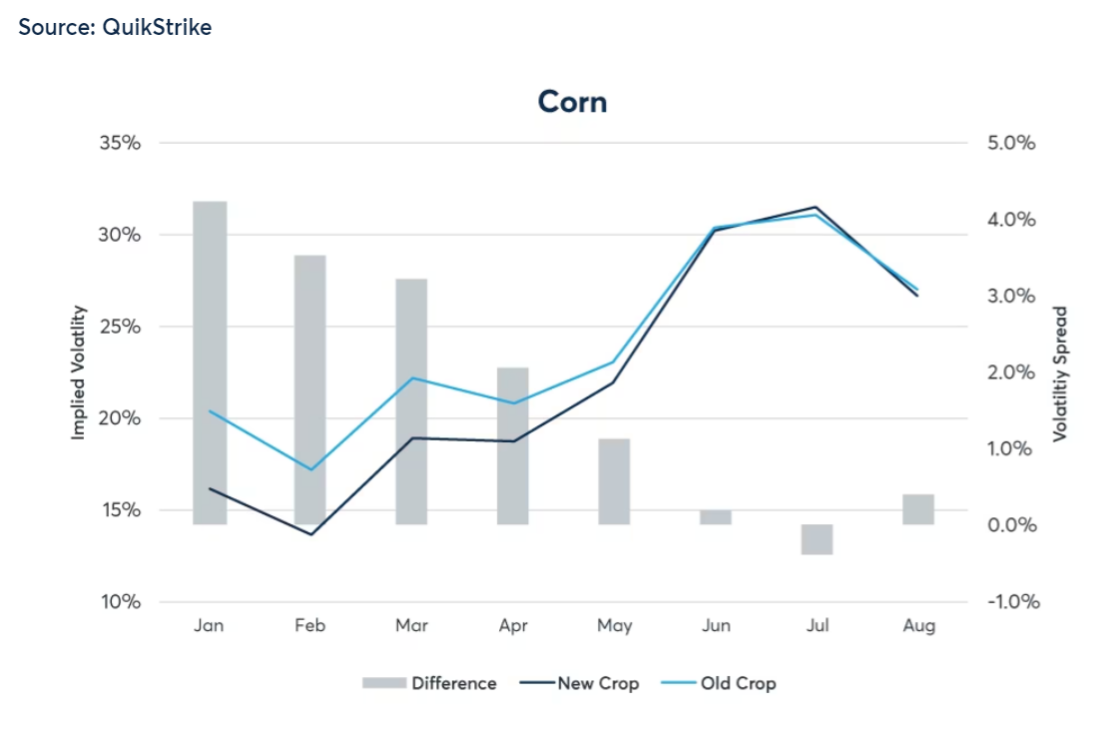

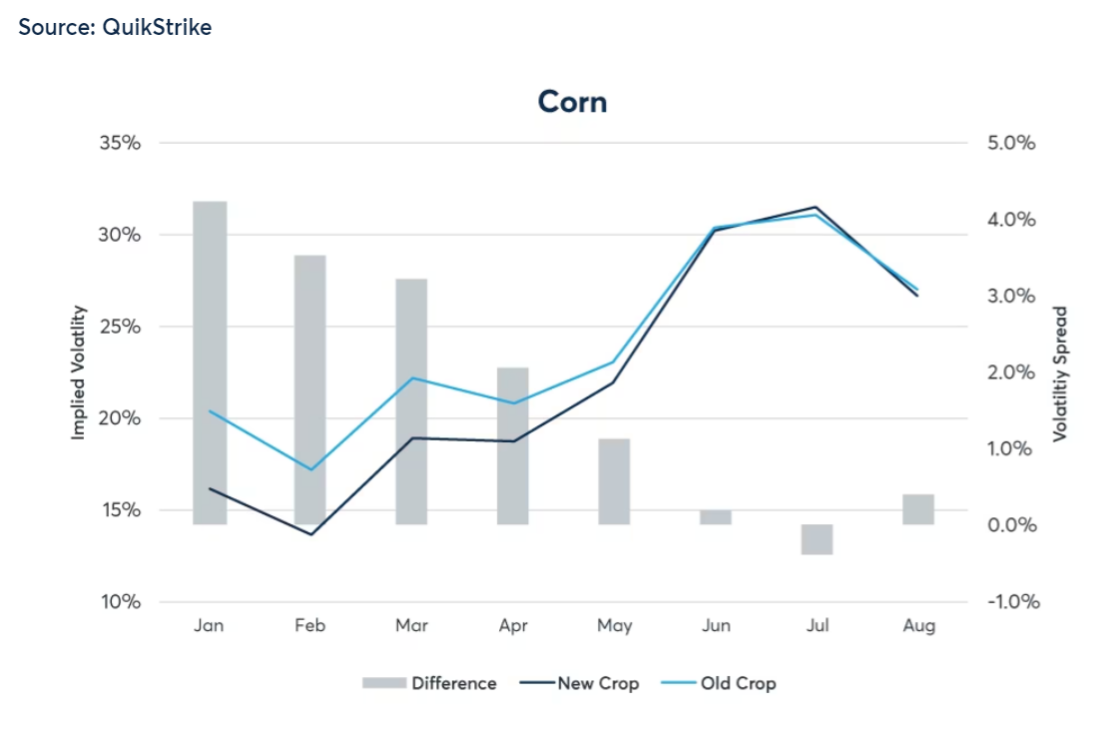

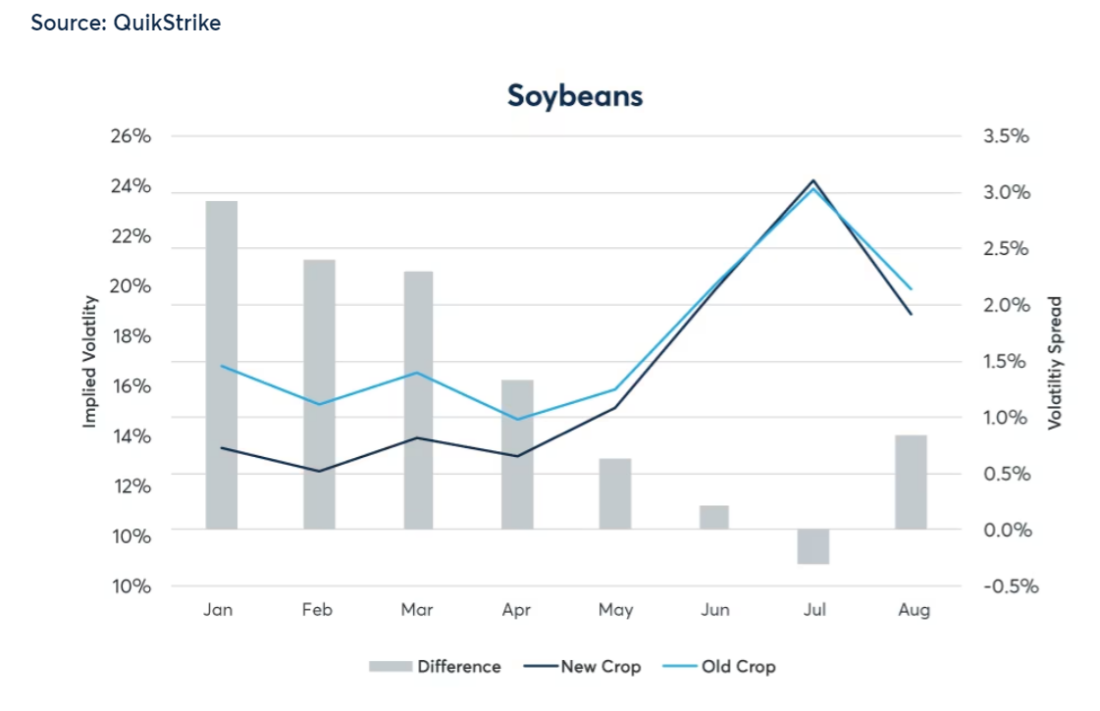

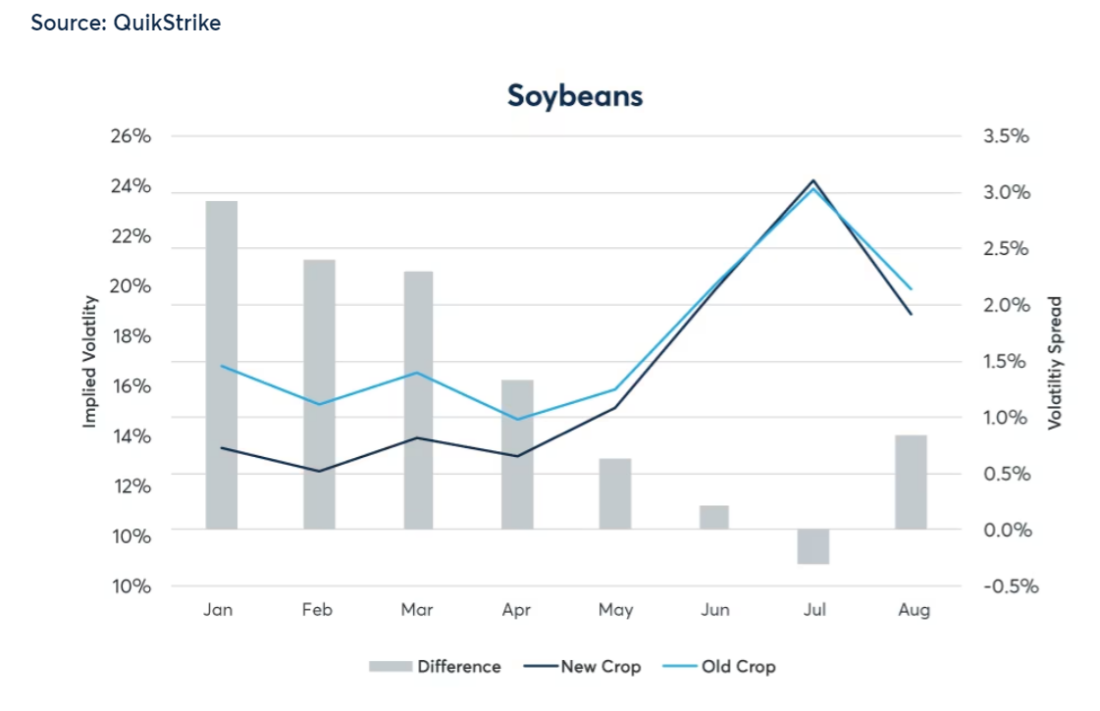

Fundamental differences between crops lead to very different volatility surfaces for Corn and Soybeans throughout the year. The figures below show Corn and Soybean one-week constant maturity volatility going back to 2015 for old crop and new crop contracts. Seasonal risks come into play during June, July, and August when new crops in North America are most vulnerable to weather. New crop volatility for Corn in February averaged only 15% but doubled in June and July during the summer “weather markets.”

Figure 3: Corn and Soybeans one-week volatility, averaged 2015-2022

Early in the calendar year, new crop Corn futures averaged lower volatility (3.7% on average for Q1) compared to the old crop, 2015-2022. New crop Soybeans historically trade at 2.5% lower volatility level in Q1 compared to old crop. As the year progresses, the average spread narrows as both contracts accumulate volatility going into the summer. Specific events, however, may disrupt this trend: South America weather issues, for example, may lead to a stronger reaction in the old crop, narrowing the volatility spread. On average, the July “weather market” sees an inverted volatility spread, with the implied volatility of new crop Corn and Soybeans exceeding the implied volatility of old crop Corn and Soybeans, respectively.

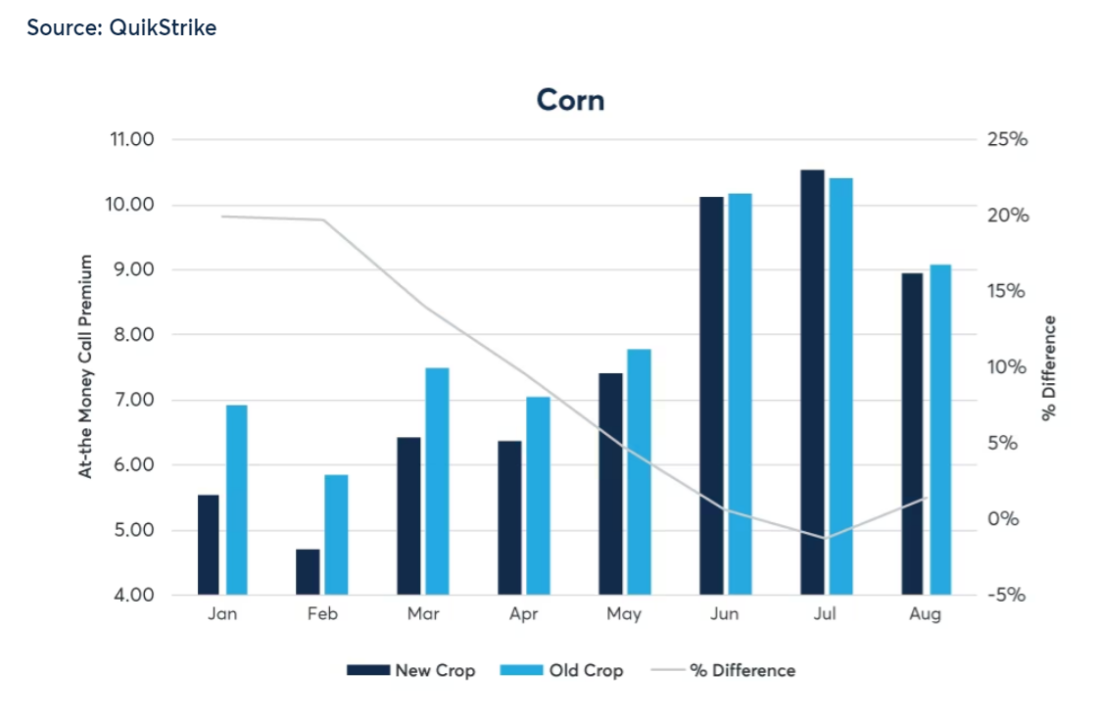

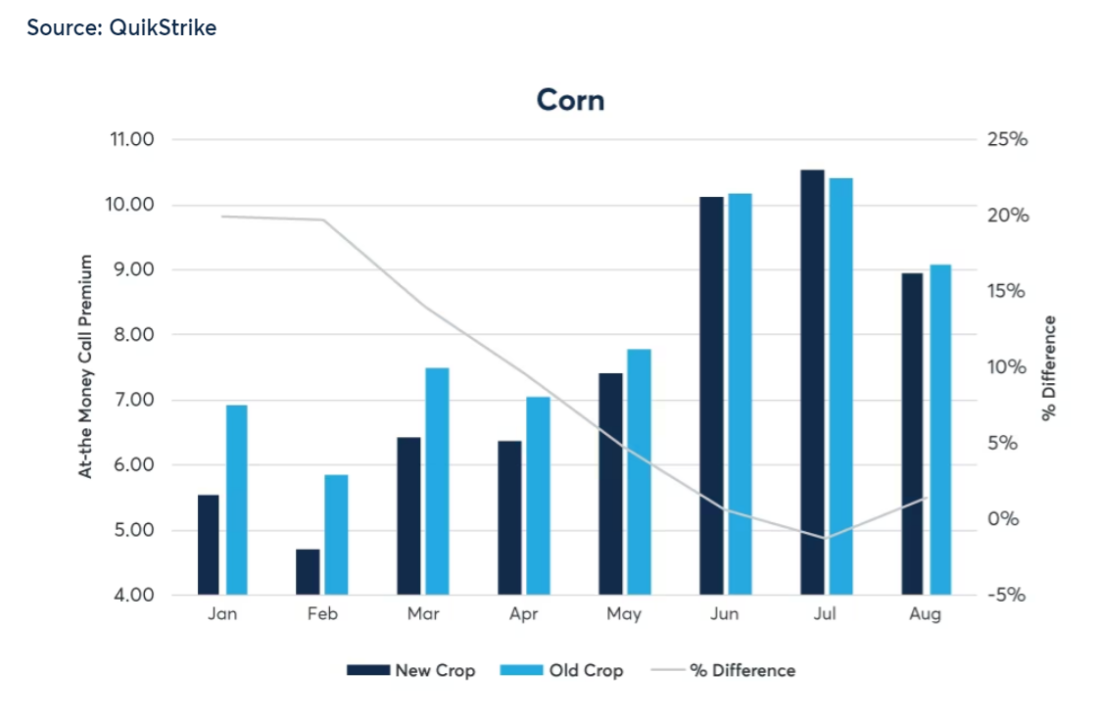

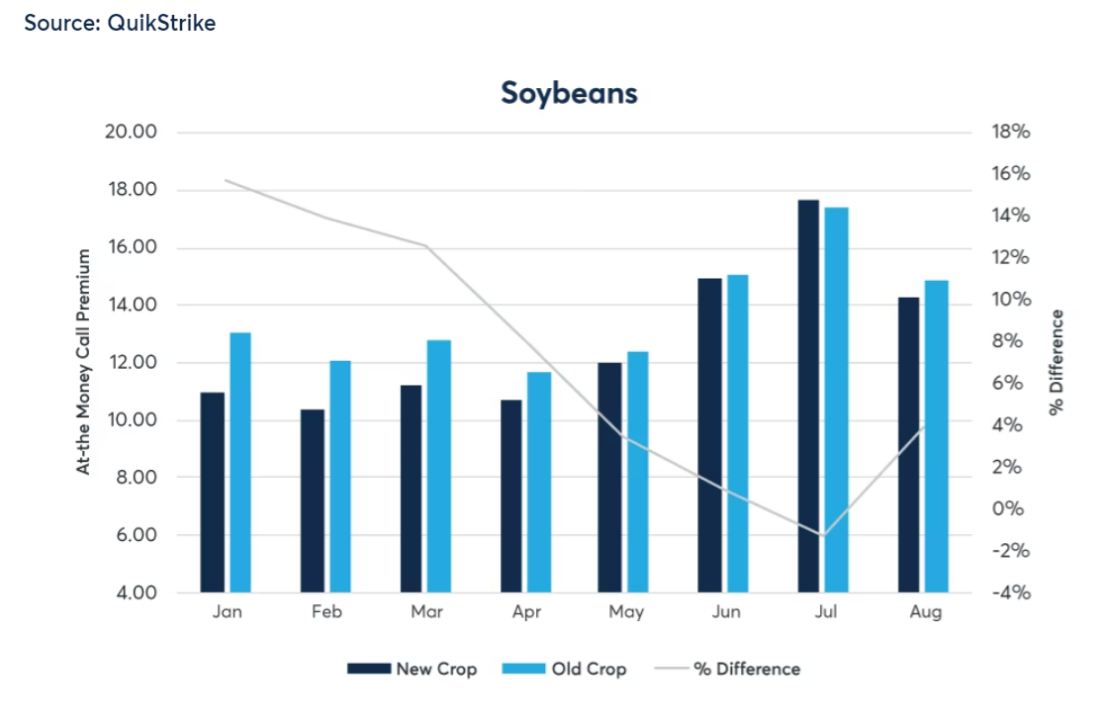

Converting the average historical implied volatility levels into premium terms: a one week, at-the-money call in New Crop Corn Weekly option will trade at a 20% lower premium compared to the old crop contract based on $7.00 Corn at the beginning of the year while New Crop Soybean Weekly option will trade at a 14% lower premium compared to the old crop contract based on $15 Soybeans at the beginning of the year.

Figure 4: Corn vs. Soybeans one-week ATM calls, averaged 2015-2022

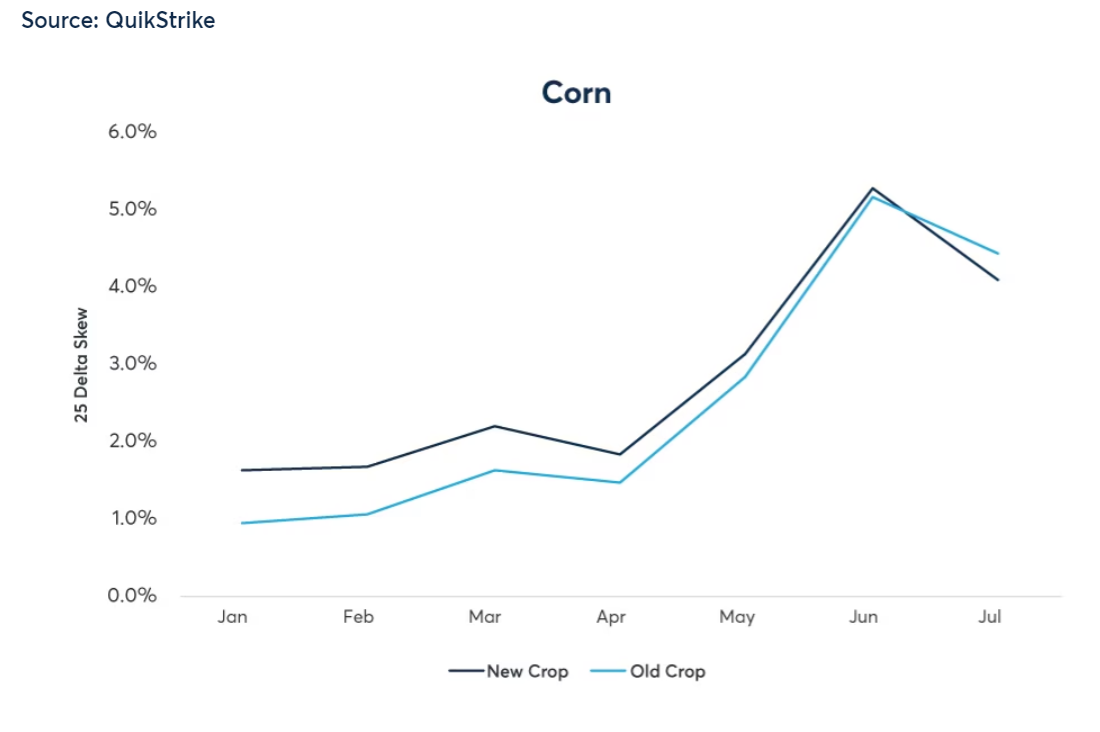

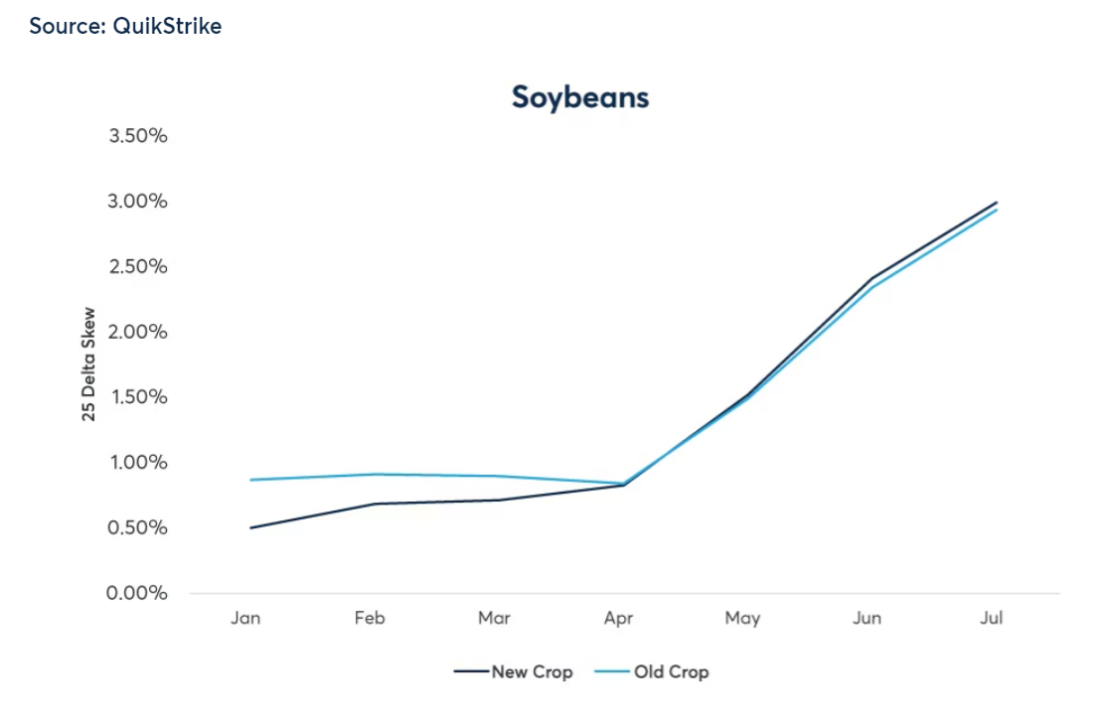

Skew

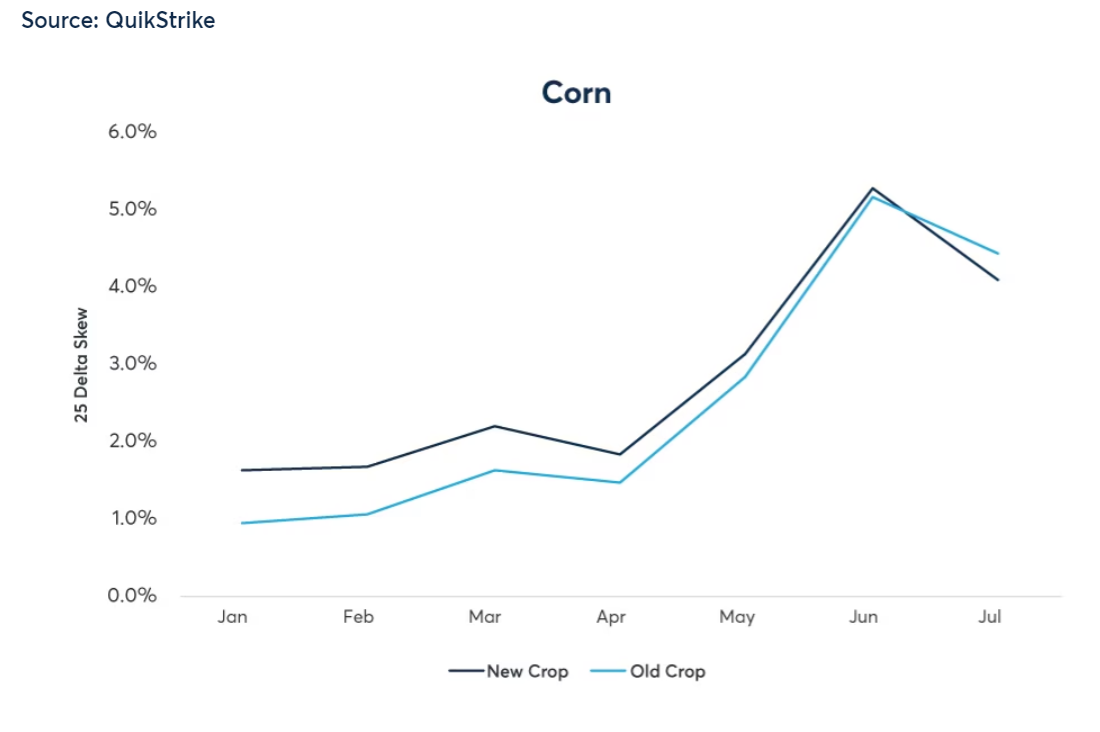

Skew is the price relationship between an equal distance call and put. The figures below show the difference between a 25-delta call minus a 25-delta put using a 30-day constant maturity. We again see a seasonal relationship between old and new crop with skews for both crops increasing from early through mid-summer given the weather risk to North American crops. Corn exhibits larger skew, peaking at 5% vs. 3% for Soybeans.

The old crop and new crop relationship is different for Corn when looking at skew vs. volatility levels. Historically, new crop exhibits higher call skew early in the season compared to the old crop. The overall volatility level is higher for old crop early in the calendar year, but calls are less expensive compared to puts when compared to the new crop contract.

Figure 5: Corn vs. Soybeans skew, averaged 2015-2022

New crop options

New Crop options, including Short-Dated New Crop and New Crop Weekly options, allow market participants to fine-tune their short-term exposure to the upcoming crop year, even as the current front-month instrument reflects the old crop year. Trading new crop instruments, such as December Corn futures, Short-Dated New Crop Corn options, and New Crop Weekly Corn options allow participants to express a view on the upcoming crop rather than the current old crop.

The past year has presented atmospheric and geopolitical events affecting old and new crop futures in distinct ways. Volatility may be the new normal, and the action of the past year shows no sign of slowing into 2023. News moves fast, and New Crop Weekly options allow market participants to express a precise and nuanced view on immediate issues affecting new crop Corn and Soybean futures, at a lower cost than conventional long-dated or Short-Dated New Crop options offer. Learn more at cmegroup.com/shortdatedoptions.

—

Originally Posted March 15, 2023 – New Crop vs. Old Crop Risk of the Past Year

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)