We will not discount the potential for further significant declines in platinum and palladium, especially given a strengthening dollar and renewed recession concerns in the US. However, we suspect a significant amount of selling has been the result of fears that China’s infection bulge is derailing the world’s most important vehicle market. Palladium began a five-month, $935 decline (40%) shortly after an explosion in Chinese infections began last September. However, a sharp jump in traffic congestion in 15 major cities in China suggests their economy is well on its way to recovery. Talk over the last several quarters that platinum would steal market share from high-priced palladium has allowed platinum to narrow its gap with palladium from as much as $1400 to $526.

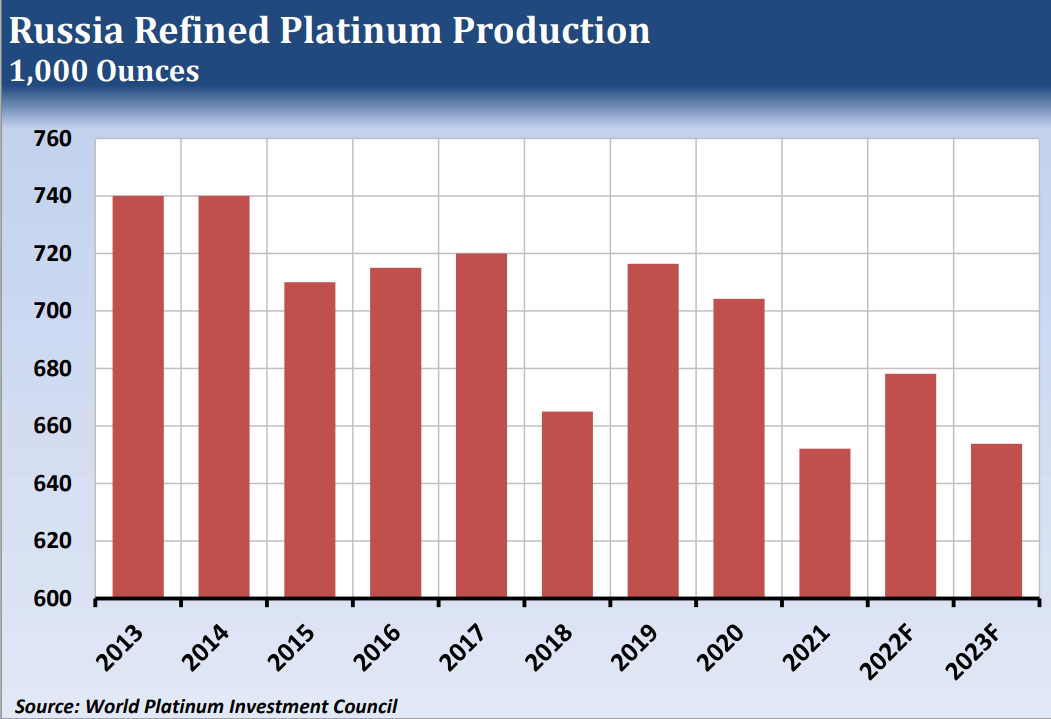

Even though classic supply and demand fundamentals appear more supportive of palladium than platinum, platinum could face significant supply disruptions from falling South African production. This could attract speculative buying, especially if Chinese economic headlines continue to flow positive. So far in 2023, ETF holdings have increased 1.9% for platinum and 4.1% for palladium. The potential for improving industrial, investment, and jewelry demand presents an upbeat view for both markets.

The most recent Commitments of Traders report showed the spec and fund position in palladium had shifted to moderately short by January 24. Given the selloff since then, the net short may have reached a new record by the time it put in a low on February 15. Platinum was still holding a significant net long as of January 24 but was in the process of turning lower. With prices having fallen by $322 since that data was collected, we expect that the spec and fund net long has plummeted as well. (The COT data has been delayed for three weeks because of problems collecting the data. The CFTC has not announced a date when reports will resume.)

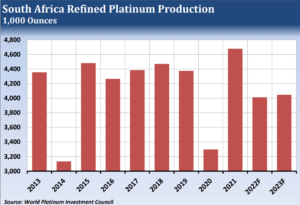

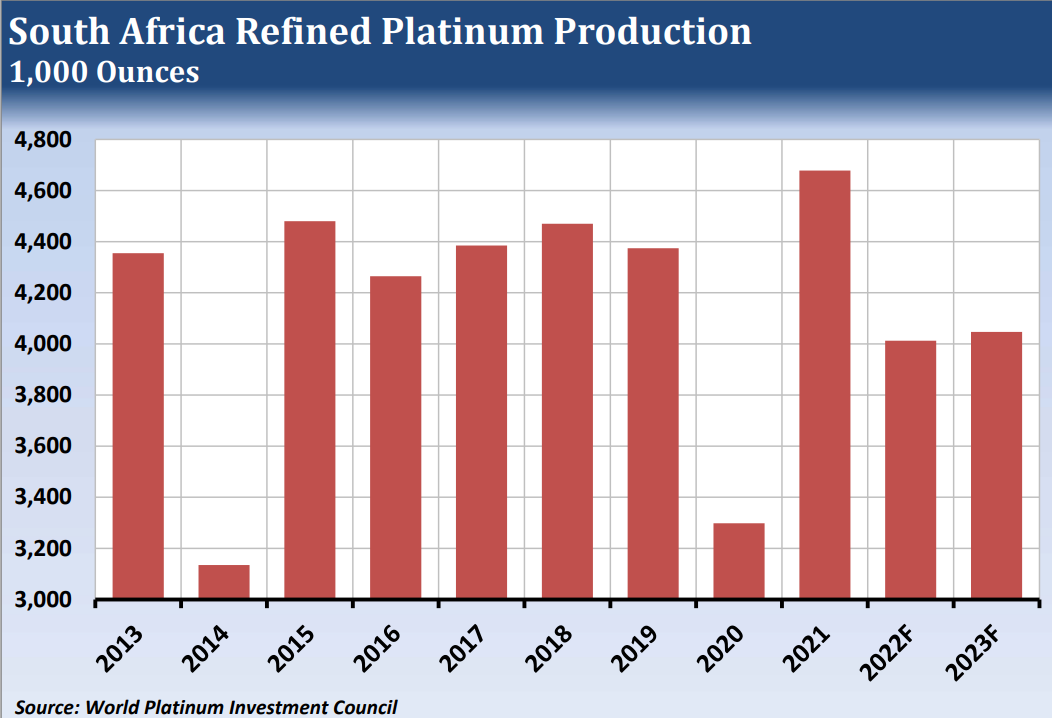

Our primary interest in platinum is the possibility that South African production will continues to decline due to trouble at the national electricity company, Eskom. Severe power disruptions in South Africa are not a recent development, and the CEO of Implats has warned that there would be significant losses in production unless the utility is overhauled. There are reports that there were 200 days of power outages in 2022, and the disruptions have recently caused trouble for food makers. This puts the crisis front-and-center. The utility already faces a massive debt load, and engineers are warning that the grid could collapse.

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.