US farmers may only harvest 67% of their winter wheat crop this year, which would be the lowest since 1917, according to the USDA. The Wheat Quality Council’s annual crop tour of Kansas fields wrapped Thursday, and the tour estimated wheat yield potential in Kansas at 30 bushels per acre, the lowest since 2000. The five-year average yield is 45.62.

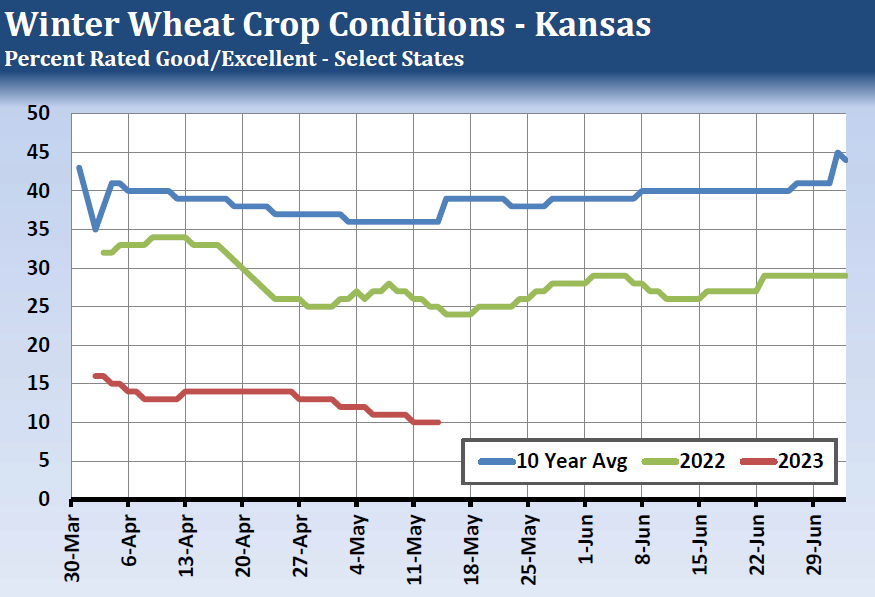

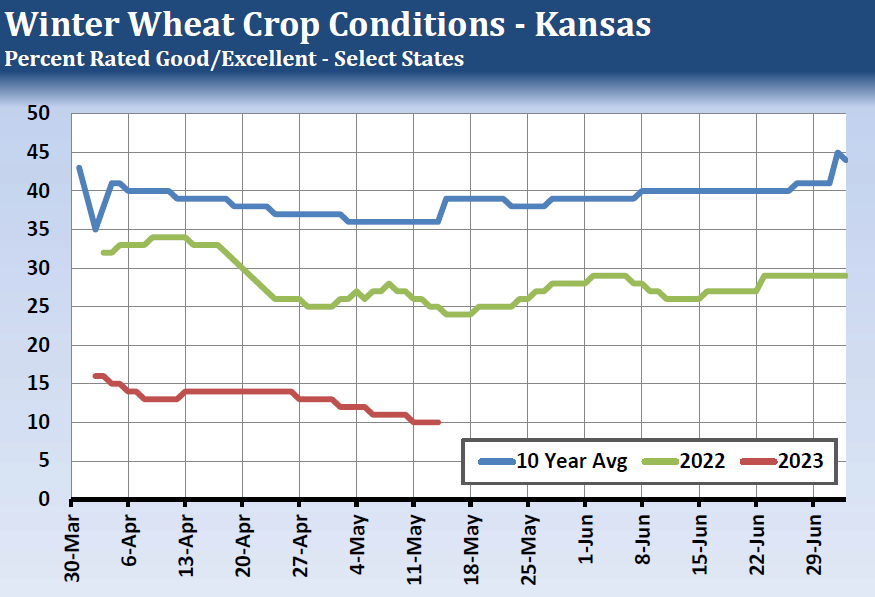

The Crop Progress report this week showed 29% of the winter wheat crop was rated good/excellent (G/E) as of May 14 versus a 10-year average of 45%. The poor/very rating was 41% versus 25% on average. Kansas was rated just 10% G/E versus 25% last year and 36% on average.

Source: USDA

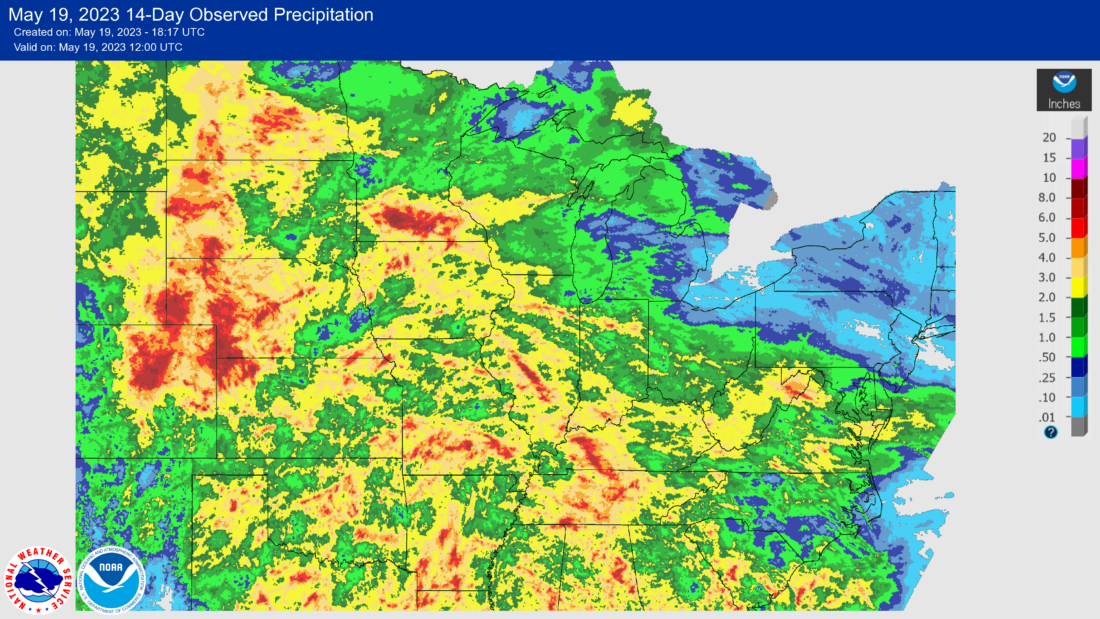

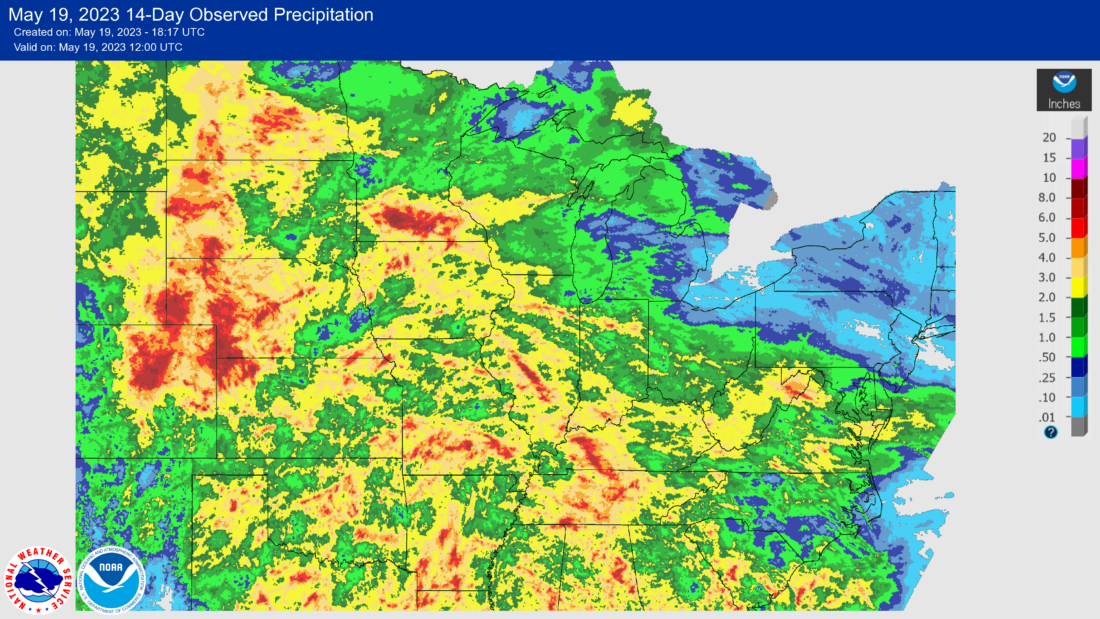

The weather forecast for the next two weeks shows above normal precipitation for the southern plains, but over the last seven days, very little rain was received in central Kansas, and less than an inch fell in many areas of western Kansas. There is still a question whether the recent rain or the rain in the forecast will have any significant impact on the production outlook. The wheat market has pulled back this past week on ideas the rain would bring some improvement in conditions.

Source: USDA

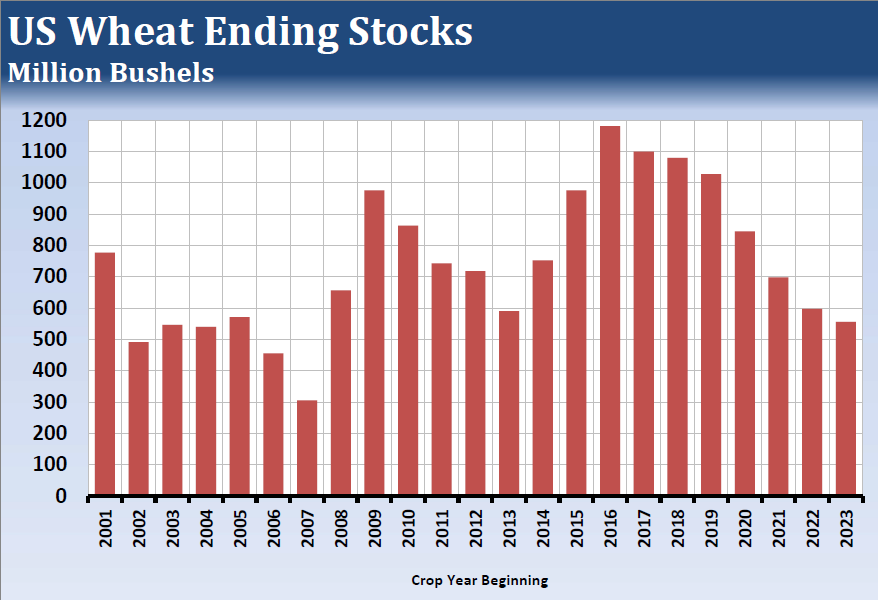

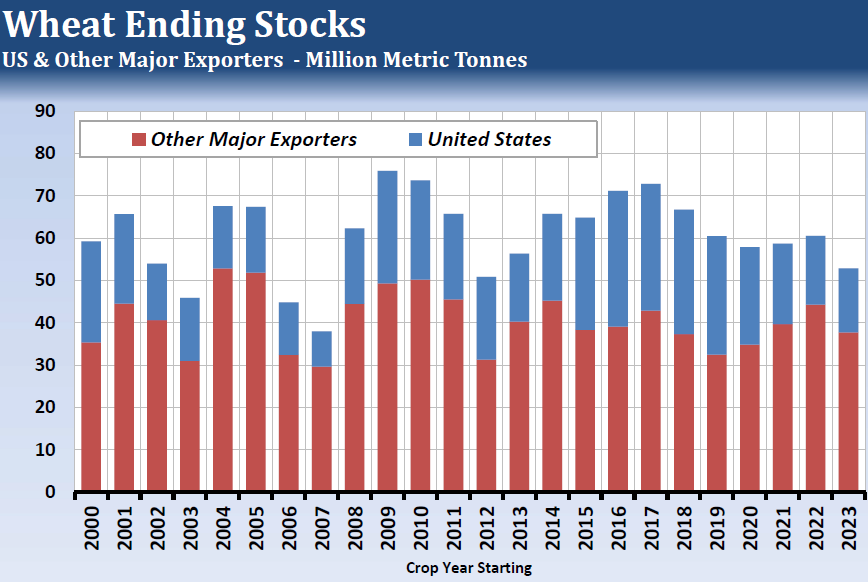

In the USDA update a week ago, US all wheat production for 2023/24 came in at 1.659 billion bushels versus an average expectation of 1.812. Hard red winter wheat production came in at 514 million bushels versus 594 million expected. US 2023/24 all wheat ending stocks came in at 556 million bushels versus 608 million expected. This would be the lowest ending stocks since the 2007/2008 season.

Global weather remains a concern with the potential for extreme heat in India and the possibility of El Niño bringing drought to Australia and India.

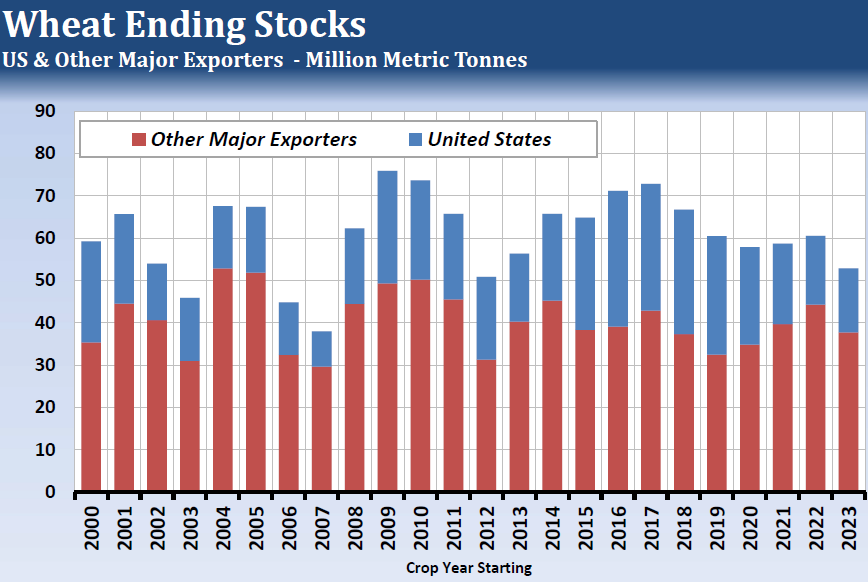

Even a minor reduction in a major world exporter’s production could have a significant impact on global wheat prices. Ending stocks for the US and other major wheat exporters are projected to come in at 52.85 million tonnes for 2023/24, which would be the tightest since 2012/13. This is a bullish set up.

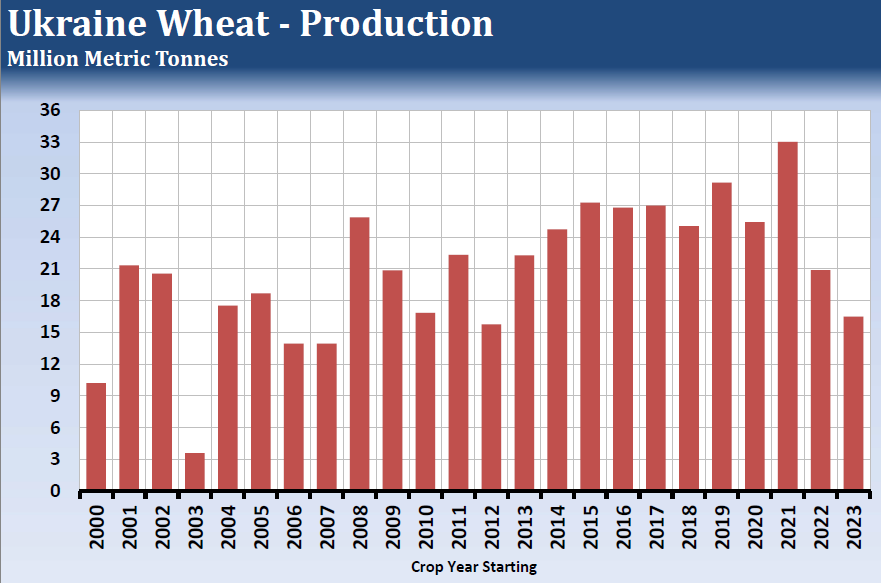

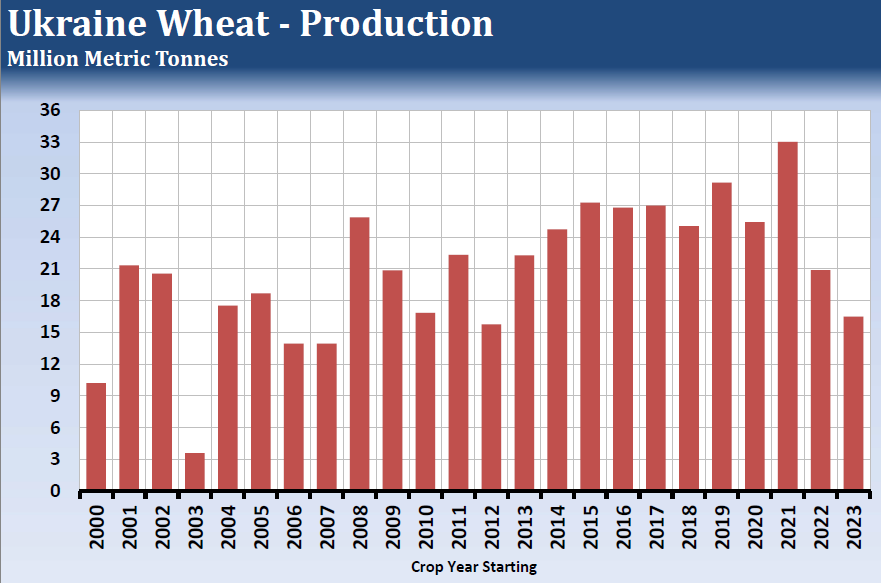

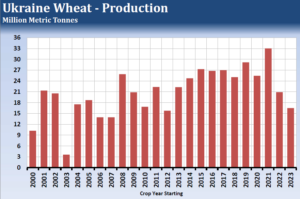

The Ukraine Grain Export Deal has been extended for two months. The agreement, brokered by Turkey and the United Nations, keeps open a major trade route amid Russia’s war in Ukraine. Moscow had threatened to withdraw from the deal if obstacles to shipments of its own crops and fertilizer weren’t removed. The news was seen as bearish to start, but with production declining, the bearish impact of the agreement has diminished. Ukraine’ production could reach an eleven-year low in 2023.

Source: USDA

China imported 1.68 million tonnes of wheat in April, a 141% increase from a year ago. Year to date imports have reached 6.03 million tonnes, up 60.9% from a year ago.

The market is in a short-term corrective mode, and December Chicago Wheat is testing the May 3 key reversal low. If this low gives way, 608 ¾ would become next downside target. The Commitments of Traders report for the week ending May 9 showed managed money traders were net buyers of 9,418 contracts of Chicago wheat, reducing their net short to 116,906. This short-covering trend is a bullish force.

Source: USDA

—

Originally Published May 19, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.